Location, location, location.

Those are the three most important elements of a successful real estate transaction.

A glut of $2 million plus mansions has suddenly hit the market in the posh Berkeley Hills, with dozens of signs for weekend open houses congesting every corner.

However, in nearby West Oakland a mere few miles away the market is on fire, a gritty, but rapidly gentrifying area near San Francisco Bay.

There you can pick up a fixer upper Victorian for as little as $400,000 walking distance from the BART station, and a mere five minute commute from pricey downtown San Francisco.

So is the residential real estate market going up, down or sideways? Which neighborhood has it right?

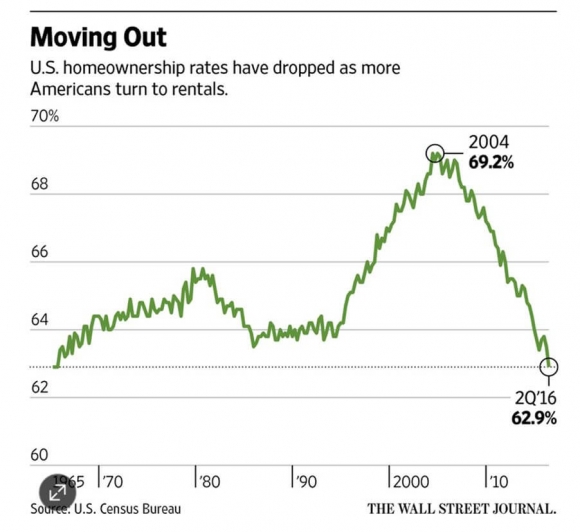

There is no doubt that this is not our father?s real estate market.

Nationwide, luxury homes are in recession. Some of this reflects profit taking by the smart money that got in at the 2011 bottom.

Prices in key markets like San Francisco, Seattle, and Portland have nearly doubled in five years.

New York penthouses listed for tens of millions of dollars, heavily dependent on the Russian and Chinese buyers, are going begging.

Multifamily dwellings, that have been on a tear, have also gone soft.

However, it is still early days for new entry-level homes.

While Millennials thought it was cool to live with significant others in postage-stamp-sized inner city apartments, throw a couple of kids into the mix, and the picture changes completely.

The US birthrate, falling for the past decade, has taken off like a rocket. The birthrate among woman over 25 is suddenly exploding, while for those over 35 it is rising at an even faster rate.

As with the original Great Depression, the 2008 Great Recession ended up pushing out the demographic curve by five years, delaying new family formation.

Yes, I know what you are going to call it. This is nothing less than the start of a millennial baby boom which will power our economy for the next 20 years.

The biggest demand is now in starter single-family homes with 3-4 bedrooms, modern kitchens, and generous backyards in leafy suburbs.

The math here is very simple.

Why face an onslaught of 4%-12% annual rent increases, when you can build equity, install your own solar panels, and harvest great tax breaks through home ownership?

A silent revolution in home finance is making all the difference.

You hear a lot about the difficulty in getting home loans from traditional brick and mortar banks these days.

Tales are legion of mountainous paperwork requirements, low loan to values, second signers, ridiculous appraisals, and stringent FICO standards.

Blame The Dodd-Frank financial regulation act. Some eight years after all the big banks required bailouts, the government still has them on a short leash.

But guess what? Banks aren?t the main players in the market anymore.

Non-bank lenders now account for 56% of the residential real estate market.

Firms like Quicken Loans, Stearns Mortgage, and Freedom Mortgage have moved aggressively to offer streamlined online applications and instant approvals.

Just for fun, I called Quicken Loans in Detroit, Michigan to get a refinancing offer on my San Francisco Bay Area home.

Within a minute, the agent was looking at my house from Google Earth, and had obtained an appraisal from Zillow.com.

I only needed a FICO score of 700. Within three minutes, he received approval to refinance 70% of the appraised value with a 5/1 ARM at a 2.87% interest rate. The closing would be in 30-40 days.

If you want to go through this exercise yourself, please visit

http://www.quickenloans.com.

Banks are now responding by attempting to claw back lost market share. Wells Fargo recently announced a first time buyers program with only 3% down. Other banks are rolling out similar programs.

?What about rising interest rates?? you may ask.

My bet is that interest rates will rise so slowly that the impact on monthly mortgage rates will be negligible.

The great thing for stock investors is that the demographics are ramping up just when housing inventories are at 30 year lows.

New home construction in recent years by risk averse builders is proceeding at less than half the frenetic rate we saw during the 2000s. And this is an industry where it takes two years or more to ramp up production.

This all shines a great spotlight on the home construction industry.

In the sweet spot are Lennar (LEN), DR Horton (DHI), Home Deport (HD), and Tripointe Group (TPH).

The performance of these shares has been lackluster for a couple of years. They have additionally been hammered by the recent selloff in interest-rate-sensitive asset classes and fixed income surrogates.

They are about to play catch up with a vengeance.