Global Market Comments

March 16, 2015

Fiat Lux

Featured Trade:

(FRIDAY, APRIL 3 HONOLULU, HAWAII STRATEGY LUNCHEON)

(THE CRASH COMING TO A MARKET NEAR YOU),

?(TLT), (TBT),

(A TOUCHDOWN FOR USC), (INTC)

iShares 20+ Year Treasury Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

Intel Corporation (INTC)

I?m sure that most of you are spending your free time devouring the utterly fascinating pages of Fifty Shades of Gray these days. I, however, am reading slightly different subject matter.

As obscure, academic and abstruse the ?Global Dollar Credit: Links to US Monetary Policy and Leverage? may sound, published by the Bank for International Settlements, it has been an absolute blockbuster among strategists at the major hedge funds.

And given the apocalyptic conclusions of the report, it might well rank as one of the best horror stories of the year, worthy of the bloodiest zombie flic.

I?ll give it to you it a nutshell.

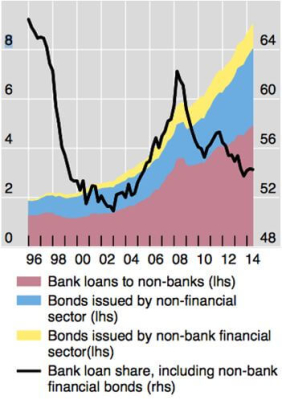

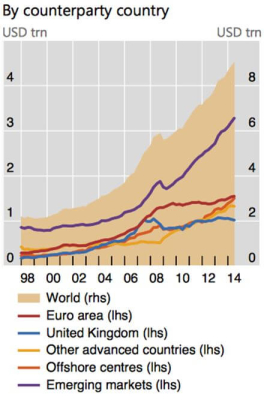

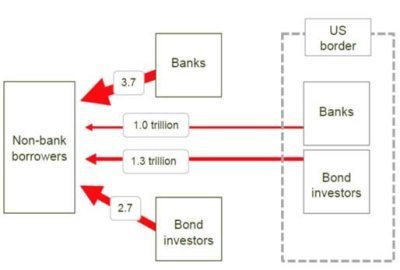

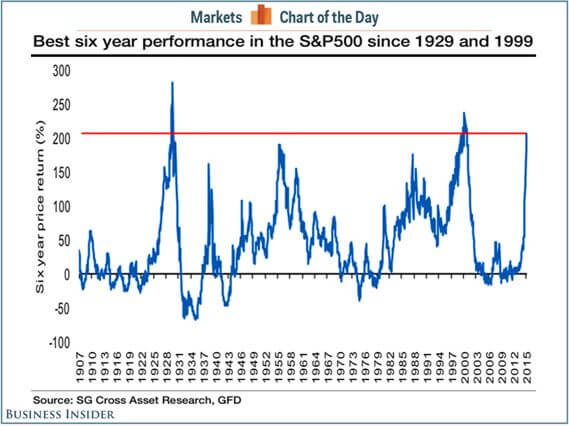

Corporate borrowers outside the US have ramped up their borrowing astronomically over the past 15 years, from $2 trillion to $9 trillion. This makes them extraordinarily sensitive to any rise in US interest rates and the dollar. Emerging market debt alone has doubled to $4.5 trillion.

Easy money has encouraged mal investment and overinvestment in projects that would have never seen the light of day if financing were not available at 1%. In other words, it is all a giant house of cards ready to collapse.

That could happen as soon as Wednesday, if the Federal Reserve removes the word ?patient? from its forward guidance.

I know a lot of you thrive on folk based economic theories you picked on the Internet based on monetarism, Austrian economics and the theories of Friedrich von Hayek, that all have the dollar collapsing under a mountain of debt.

In fact, the complete opposite has come true. The global economy has become ?dollarized,? with companies and governments in almost all nations relying on the buck as their principal means of financing.

The end result of all this has been to vastly expand the power of the Federal Reserve far beyond America?s borders. Even the smallest rise in US interest rates, like the ?% hike mooted for June, could trigger a cascade of corporate defaults around the world. Think of subprime, with a turbocharger.

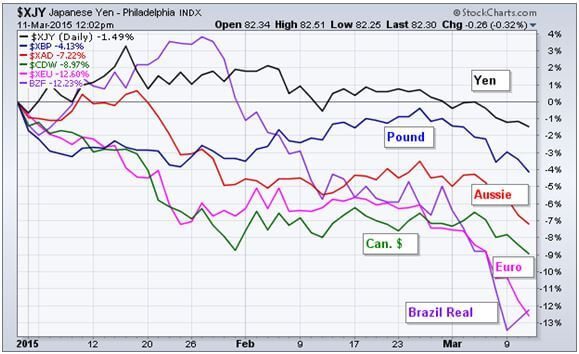

We are already starting to see some cracks. The complete collapse of a number of emerging market currencies, like the Brazilian Real, Turkish Lira, South African Rand, Malaysian Ringgit and the Russian Ruble, has been accelerated by local borrowers rushing to buy back dollar before it appreciates further.

This is having a huge deflationary effect on the economies of many emerging nations.

Malaysia?s sovereign wealth fund has almost gone under after a series of bad bets against the dollar. There is thought to be another troubled dollar short coming out of Hong Kong worth $900 million.

This is forcing countries to liquidate their US Treasury Bonds to cover local losses.

Further exacerbating the situation has been the crash of the price of oil, which has turned producing countries from suppliers to takers of liquidity to the global credit markets. Russia alone sold $19 billion in the Treasury bond market in February, and is partially responsible for the sudden and dramatic rise in yields there.

The net net of all of this is to increase the risk of surprise blowups overseas, both by banks and the private borrowers. This will increase the volatility of financial instruments everywhere.

The Bank for International Settlements is an exclusive club of the world?s central banks. It is based in Basel, Switzerland, with further offices in Hong Kong and Mexico City. Its goal is it to coordinate policies among different nations.

The BIS was originally founded in 1930 to facilitate payment of German reparations following the Versailles Treaty ending WWI. As a regular groupie on the central banking scene, I have been reading the research publications for many decades.

The BIS Has Some Scary Ideas

The BIS Has Some Scary Ideas

Global Market Comments

March 13, 2015

Fiat Lux

Featured Trade:

(MARCH 18 GLOBAL STRATEGY WEBINAR),

(TAKING PROFITS ON MY EURO SHORTS),

(FXE), (EUO), (DXGE), (HEDGE)

(ARE JUNK BONDS PEAKING?),

?(JNK), (HYG)

CurrencyShares Euro ETF (FXE)

ProShares UltraShort Euro (EUO)

WisdomTree Germany Hedged Equity ETF (DXGE)

Hedge Inversiones SICAV (HEDGE)

SPDR Barclays High Yield Bond ETF (JNK)

iShares iBoxx $ High Yield Corporate Bd (HYG)

Occasionally the consensus is right.

Since the start of the year, it seems that everyone and his brother, sister and cleaning lady has been selling short the euro.

As a result, the beleaguered continental currency has suffered one of the sharpest falls in the history of the foreign exchange markets.

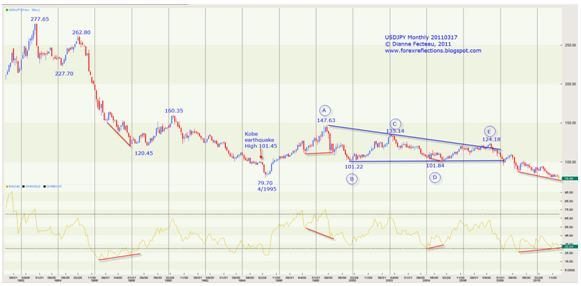

I have to think back three decades to recall something similar, when the Plaza Accord ignited a dramatic collapse in the US dollar against the Japanese yen, then trading at Y270.

Or you can recall back to January, when my friends at the Swiss National Bank engineered an overnight depreciation of the euro against the Swiss franc of 20%.

Those who followed my advice to sell short the euro last July have profited mightily. The (FXE) has plunged by 26% since then. Those who picked up the ProShares Ultra Short Euro 2X bear ETF (EUO) that I pleaded with you to buy did even better, capturing an eye popping 75% profit.

To read my prescient predictions about the imminent demise of the European currency, please click here for my 2015 Annual Asset Class Review.

With spectacular results like this, one has to ask whether we are seeing too much of a good thing, if this trade is getting rather long in the tooth, and if it is time to get while the getting is good.

The technical analysts certainly think so. The greenback is currently overbought and the euro oversold in the extreme, with RSI?s and momentum indicators off the charts.

For the statisticians out there, the euro?s move is 3.5 standard deviations away from the mean, something that is only supposed to happen every 100 years. And as we all know, mean reversion can be a real bitch.

On top of that, long-term market veterans will tell you that markets of all kinds naturally gravitate towards large round numbers. With the euro trading yesterday at the $1.03 handle, spitting distance from parity at $1.00, this is about as large of a round number that you will find anywhere.

So trying to catch the last three cents of a move from $1.40 to $1.00 is an awful trading idea, as the risk/reward is so poor.

My guess is that we will take a brief, peripatetic run at the $1.01 handle, and then develop a sudden case of acrophobia, or fear of heights. There will just be too many traders out there with enormous unrealized gains, begging to be exited.

I have not suddenly fallen in love with the euro. The pit from which its economy must extricate itself is deep, foreboding, and structural. But it is time to face facts. The only reason to add new euro positions here is to believe that it is going to 88 cents to the US dollar, and fast.

It could well do that. But the probability is much lower than we saw with the moves from $1.60 to $1.40 or from $1.40 to $1.03.

However, get me a decent price to sell at, like $1.08 or $1.10, and I?ll be back there again on the short side in a heartbeat.

You also must understand that the cure for a cheap euro is a cheap euro. Big continental exporters, like Daimler Benz, BMW and Volkswagen, are licking their chops at the prospects of booming sales, thanks to a newly devalued currency. Sooner or later, this will turn into robust economic growth.

If nothing else, you need to look at the Wisdom Tree Germany Hedged Equity Fund (DXGE), which will profit from this new business activity, and has already tacked on an impressive 24% in 2015. The Wisdom Tree International Hedged Equity Fund (HEDG) also looks pretty good.

As for me, I have already started planning my discount summer vacation in Europe in earnest.

Cappuccino, please!

I Remember it like it was Yesterday

I Remember it like it was Yesterday

The Cheap Euro Works for Me

The Cheap Euro Works for Me

Global Market Comments

March 12, 2015

Fiat Lux

Featured Trade:

(MAD DAY TRADER JIM PARKER IS UP 39% IN 2015),

(ZIOP), (THRX), (ZTS), (DXJ), (USO), (SPY), (IWM),

(FRIDAY, MAY 15 SAN FRANCISCO STRATEGY LUNCHEON)

(DIAMONDS ARE STILL AN INVESTOR?S BEST FRIEND)

ZIOPHARM Oncology, Inc. (ZIOP)

Theravance Inc. (THRX)

Zoetis Inc. (ZTS)

WisdomTree Japan Hedged Equity ETF (DXJ)

United States Oil ETF (USO)

SPDR S&P 500 ETF (SPY)

iShares Russell 2000 (IWM)

Mad Day Trader Jim Parker has been absolutely knocking the cover off the ball this year, delivering a blistering 39% profit so far for followers.

He was in and out of the Apple (AAPL) melt up twice. He was early and big in the biotechnology sector, trading around ZIOPHARM Oncology (ZIOP), Therevance (THRX), and Zoetis (ZTS).

He played the Japanese economic recovery through the Wisdom Tree Japan Hedged Equity ETF (DXJ). And for good measure, he was playing oil (USO) from the short side.

The current rapid ?RISK ON/RISK OFF? environment is tailor made for Jim?s disciplined, quantitative approach to the markets. In other words, Jim thrives on volatility.

And the best is yet to come. Jim is expecting the rest of 2015 to offer plenty of volatility and loads of great trading opportunities. He thinks the scariest moves may be yet to come.

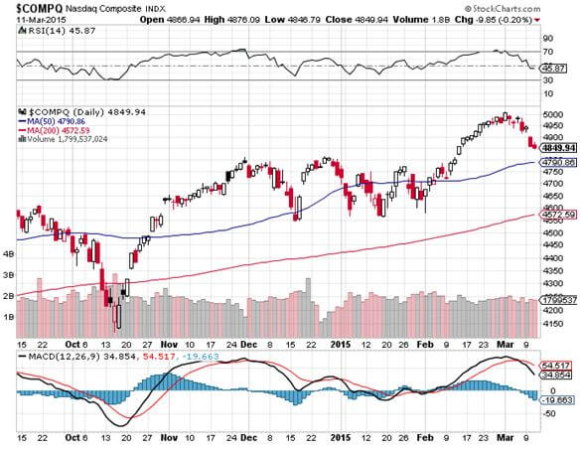

He sees a massive rotation out of large caps (SPY) into small caps (IWM), as investors flee the adverse effects of the euro collapse on American corporate profits. That is bringing the (SPY) 200 day moving average at $199. Key support for all equity markets will be found when the NASDAQ hits 4,265.

Sector leadership could change daily, with a brutal rotation, depending on whether the price of oil is up, down, or sideways.

The market is paying the price of having pulled forward too much performance from 2015 back into the final month of 2014, when we all watched the December melt up slack jawed.

Jim is a 40-year veteran of the financial markets and has long made a living as an independent trader in the pits at the Chicago Mercantile Exchange. He worked his way up from a junior floor runner to advisor to some of the world?s largest hedge funds.

We are lucky to have him on our team and gain access to his experience, knowledge and expertise.

Jim uses a dozen proprietary short-term technical and momentum indicators to generate buy and sell signals.

If you are not already getting Jim?s dynamite Mad Day Trader service, please get yourself the unfair advantage you deserve. Just email Nancy in customer support at support@madhedgefundtrader.com and ask for the $1,500 a year upgrade to your existing Global Trading Dispatch service.

Global Market Comments

March 11, 2015

Fiat Lux

Featured Trade:

(WHAT ALMONDS SAY ABOUT THE GLOBAL ECONOMY),

(BE CAREFUL WHO YOU SNITCH ON),

(COULD YOU QUALIFY TO BECOME A US CITIZEN?)

Yes, that?s right, you read it correctly, almonds.

By now, many of you have figured out that I like calling my paid subscribers to find out how they find the service. I always ask for suggestion for improvements. Then I ask what they do besides trade the markets.

I get an amazing array of answers. One reader flew helicopters in Alaska to inspect oil pipelines, executing trades on his cell phone in between flights. Another ran a Russian hedge fund in Moscow.

The sheep farmer in Australia relied on me as his connection with the rest of the world. The family office in Spain valued my American view of the world.

Then I called Brad in Modesto, California, who said he was in the Almond business. My interest piqued, I proceeded to grill him. And with that, I obtained a fascinating insight into an obscure corner of the global economy.

If you thought marijuana, estimated by the DEA at $6 billion a year, was California?s largest cash crop, you?d be wrong. Grapes used to be our largest legal crop, at $5 billion a year. But almonds will beat all this year, possibly reaching as high at $8 billion.

You can blame the California drought, now in its fourth year. It has only rained once in the Golden State so far in 2015. This has driven the price of almonds from $1/pound a few years ago to as much as $4/pound today.

The price spike has ignited fierce water wars across the state, with increasingly desperate farmers battling over an ever-diminishing commodity. Those located in the eastern half of the Central Valley (which you will remember from your freshman English class in The Grapes of Wrath) are sitting pretty.

They have long term contracts to buy water from federal public works projects at subsidized prices that date back to the Great Depression. These rights can make or break the value of a farm, and are passed down from one generation to the next.

The Western half of the valley is another story. When construction of Interstate 5 was completed in 1979, most of it was still barren desert, a rain shadow effect of the state?s coastal mountain range.

Only the oil industry was there in force, especially around the Elk Hills oil find (watch the Daniel Day Lewis movie, There Will Be Blood). I know because my grandfather worked there for Standard Oil during the 1920?s.

So when large scale farming developed there during the eighties, they had to buy water on the spot market. The problem is that during a draught, there is very little water for sale. So parched farmers have turned to drilling to irrigate their fields.

This has lead to an even bigger headache. In the 19th century, you could drill 100 feet and find all the water you wanted. Today, they have to go as deep as 1,200 feet, and even these ancient deep aquifers are drying up. And that?s assuming you have the $1 million it costs to drill such a well.

Indeed, the elevation of the Central Valley has fallen by ten feet over the past century because of the underground water that has been withdrawn so far. Destruction of rural buildings through catastrophic subsidence is becoming widespread.

The only alternative is to let your crops die. You see this in abundance while making the drive from San Francisco to Las Angeles, withered trees frozen in tortured, grotesque death throes. Also plentiful are irate billboards attacking the government for depriving local farmers of their cheap water.

Even if you have plenty of water, it is still not smooth sailing in the almond business these days. China is the world?s largest buyer of almonds. The demand there has been so great that the Chinese have become major buyers of almond farms throughout the state, at premium prices.

However, the Middle Kingdom?s recent anti corruption campaign is starting to take a big bite out of sales.

In years past, individuals would buy dozens of boxes of almond cookies to pass out to friends, customers, employers, government officials and regulators during the Lunar New Year celebrations. Not so today. The difference has lead to the cancellation of a few shiploads of the prized nuts.

Brad kindly invited me to tour his roasting and packaging facilities the next time I was in the neighborhood.

I was left thinking, this really is a global economy that is so integrated that, when a butterfly flaps its wings in Brazil, it causes a typhoon in Japan. It is also a great example of how information about one asset class can provide insights about all the others.

With that, I opened a fresh can of Blue Diamond almonds that I picked up at Costco and grabbed a handful.

Another Batch for China

Another Batch for China

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.