Global Market Comments

December 22, 2014

Fiat Lux

Featured Trade:

(LAST CHANCE TO ATTEND THE CHICAGO TUESDAY, DECEMBER 23 GLOBAL STRATEGY LUNCHEON)

(THE ONE BRIGHT SPOT IN REAL ESTATE),

(A SHORT HISTORY OF HEDGE FUNDS),

(THE POPULATION BOMB ECHOES), (POT), (MOS), (AGU),

(THANK GOODNESS I DON?T LIVE IN SWEDEN), (EWD)

Potash Corp. of Saskatchewan, Inc. (POT)

The Mosaic Company (MOS)

Agrium Inc. (AGU)

iShares MSCI Sweden (EWD)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Chicago on Tuesday, December 23. A three course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $219.

I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a downtown Chicago venue on Monroe Street that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

I feel obliged to reveal one corner of this bubbling market that might actually make sense.

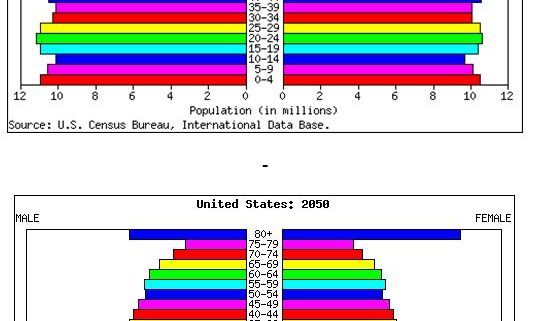

By 2050 the population of California will soar from 37 million to 50 million, and the US from 300 million to 400 million, according to data released by the US Census Bureau and the CIA fact Book (check out the population pyramid below).

That means enormous demand for the low end of the housing market, apartments in multi-family dwellings. Many of our new citizens will be cash short immigrants. They will be joined by generational demand for limited rental housing by 65 million Gen Xer's and 85 million Millennials enduring a lower standard of living than their parents and grandparents. These people aren't going to be living in cardboard boxes under freeway overpasses.

The trend towards apartments also fits neatly with the downsizing needs of 80 million retiring Baby Boomers. As they age, boomers are moving from an average home size of 2,500 sq. ft. down to 1,000 sq ft condos and eventually 100 sq. ft. rooms in assisted living facilities. The cumulative shrinkage in demand for housing amounts to about 4 billion sq. ft. a year, the equivalent of a city the size of San Francisco.

In the aftermath of the economic collapse, rents are now rising dramatically, and vacancies are shrinking. Fannie Mae and Freddie Mac financing is still abundantly available at the lowest interest rates on record. Institutions combing the landscape for low volatility cash flows and limited risk are starting to pour money in.

Pack your portfolios with agricultural plays like Potash (POT), Mosaic (MOS), and Agrium (AGU) if Dr. Paul Ehrlich is just partially right about the impending collapse in the world's food supply. You might even throw in long positions in wheat (WEAT), corn (CORN), soybeans (SOYB), and rice.

The never dull and often controversial Stanford biology professor told me he expects that global warming is leading to significant changes in world weather patterns that will cause droughts in some of the largest food producing areas, causing massive famines. Food prices will skyrocket, and billions could die.

At greatest risk are the big rice producing areas in South Asia, which depend on glacial run off from the Himalayas. If the glaciers melt, this crucial supply of fresh water will disappear. California faces a similar problem if the Sierra snowpack fails to show up in sufficient quantities, as it has for the past two years.

Rising sea levels displacing 500 million people in low-lying coastal areas is another big problem. One of the 80-year-old professor's early books The Population Bomb was required reading for me in college in 1970, and I used to drive up from Los Angeles to the San Francisco Bay area just to hear his lectures (followed by the obligatory side trip to the Haight-Ashbury).

Other big risks to the economy are the threat of a third world nuclear war caused by population pressures, and global plagues facilitated by a widespread growth of intercontinental transportation and globalization. And I won't get into the threat of a giant solar flare frying our electrical grid.

?Super consumption? in the US needs to be reined in where the population is growing the fastest. If the world adopts an American standard of living, we need four more Earths to supply the needed natural resources. We must to raise the price of all forms of carbon, preferably through taxes, but cap and trade will work too. Population control is the answer to all of these problems, which is best achieved by giving women an education, jobs, and rights, and has already worked well in Europe and Japan.

All sobering food for thought.

Buy Now While Supplies Last!

Buy Now While Supplies Last!

Global Market Comments

December 19, 2014

Fiat Lux

SPECIAL END OF YEAR ISSUE

Featured Trade:

(GO LONG CHRISTMAS CHEER AND HOT BUTTERED RUM),

(MY LAST RESEARCH PIECE OF THE YEAR)

Global Market Comments

December 18, 2014

Fiat Lux

Featured Trade:

(VOLATILITY HERE IS PEAKING),

?(VXX), (VIX), (XIV),

(HEDGE FUNDS: THE NEW DUMB MONEY)

(TESTIMONIAL)

iPath S&P 500 VIX ST Futures ETN (VXX)

VOLATILITY S&P 500 (^VIX)

VelocityShares Daily Inverse VIX ST ETN (XIV)

Much of the recent buying of stocks has been generated by hedge funds panicking to cover shorts.

Convinced of the imminent collapse of Europe, the impotence of governments to do anything about it, and slow economic growth at home, many managers were running a maximum short for the umpteenth time, and were forced to cover at a loss. Meet the new dumb money: hedge funds.

When I first started on Wall Street in the seventies, you heard a lot about the ?dumb money?. This was a referral to the low-end individual retail investors who bought the research, hook-line-and-sinker, loyally subscribed to every IPO, religiously bought every top, and sold every bottom.

Needless to say, such clients didn?t survive very long, and retail stock brokerage evolved into a volume business, endlessly seeking to replace outgoing suckers with new ones. When one asked ?Where are the customers? yachts,? everyone in the industry new the grim answer.

Since the popping of the dot-com boom in 2000, the individual investor has finally started to smarten up. They bailed en masse from equities, seeking to plow their fortunes into real estate, which everyone knew never went down. Since 2007, the exit from equities has accelerated.

I bet the average individual investor outperformed the average hedge fund in 2013 by a large margin. Look no further than the chart below, which shows an average return by hedge funds, compared to an S&P 500 index gain of 30%, including dividends.

This takes me back to the Golden Age of hedge funds during the 1980?s. For a start, you could count the number of active funds on your fingers and toes, and we all knew each other. The usual suspects included the owl like Soros, the bombastic Robertson, steely cool Tudor-Jones, the nefarious Bacon, the complicated Steinhart, of course, myself, and a handful of others.

The traditional Wall Street establishment viewed us as outlaws, and believed that if the trades we were doing weren?t illegal, they should be, like short selling. Investigations and audits were a daily fact of life. It wasn?t easy being green. I believe that Steinhart was under investigation during his entire 40 year career, but the Feds never brought a case.

It was all worth it, because in those days, if you did copious research and engaged in enough out of the box thinking, you could bring in enormous profits with almost no risk. I used to call these ?free money? trades. To be taken seriously as a manager by the small community of hedge fund investors you had to earn 40% a year or you weren?t worth the perceived risk. Annual gains of 100% or more were not unheard of.

Let me give you an example. In 1989, you could buy a leveraged warrant on a Japanese stock near parity, for $100, that gave you the right to own $500 worth of stock. You bought the warrant and sold short the underlying stock. Overnight yen yields then were at 6%, so 500% X 6% = 30% a year, your risk free return.

Most Japanese stock dividends were near zero then, so the cost of borrowing was almost nothing. The position effectively created a high yield synthetic convertible bond. If the stock then fell, you also made big money on your short stock position. This was not a bad portfolio to have in 1990, when the Nikkei stock index plunged from ?39,000 to ?20,000 in three months, and some individual shares dropped by 80%.

Trades like this were possible because only a smaller number of mathematicians and computer geeks, like me, were on the hunt, and collectively, we amounted to no more than a flea on an elephant?s back. Today, there are over 10,000 hedge funds managing $2.5 trillion, accounting for anywhere from 50% to 70% of the daily volume.

Many of the strategies now can only be executed by multimillion-dollar mainframe computers collocated next to the stock exchange floor. Winning or losing trades are often determined by the speed of light. And as the numbers have expanded exponentially from dozens to hundreds of thousands, the quality of the players has gone down dramatically, with copycats and ?wanabees? crowding the field.

The problem is that hedge funds are no longer peripheral to the market. They are the market, and therein lies the headache. How are you supposed to outperform the market when it means beating yourself? As a result, hedge fund managers have replaced the individual as the new ?dumb money?, buying tops and selling bottoms, only to cover at a loss, as we witnessed today.

When markets disintegrate into a few big hedge funds slugging it out against each other for infinitesimal spreads, no one makes any money. I saw this happen in Tokyo in the 1990?s, when hedge funds took over the bulk of trading. Volumes shrank to a shadow of their former selves.

How does this end? We have already seen the outcome; that investors flee markets run by hedge funds and migrate to those where they have less of an impact. That explains the meteoric rise of trading volumes of other assets classes, like bonds and foreign exchange.

Thanks so much, John and Jim, for coming up with The Mad Day Trader! I especially appreciate that you'll be using ETFs (they are so convenient...and I can trade without triggering short-term taxes, in my IRA).

I Also like that you're including a focus on metals, as I'm already?trading (GLD), (SLV) and their inverses (DGZ),?(GLL), (ZSL), and (DUST) on my own (and?making excellent profits), but have been wondering, "Where can I find a pro's guidance on daily?entry, exit, and pivot points."

Well, you just answered that burning question and have made my month!

Count me in as a?subscriber. Send an invoice as soon?as you want!

All good wishes,

Gary

Garden City, NY

Global Market Comments

December 17, 2014

Fiat Lux

Featured Trade:

(CHICAGO TUESDAY, DECEMBER 23 GLOBAL STRATEGY LUNCHEON),

(WHY ALL SHARES ARE NOW OIL SHARES),

(USO), (FXE), (TLT), (FXY), (BHP), (KOL), (CU), (RSX),

(THE RECEPTION THAT THE STARS FELL UPON),

(NLR), (CCJ), (CORN), (WEAT), (SOYB), (DBA)

United States Oil ETF (USO)

CurrencyShares Euro ETF (FXE)

iShares 20+ Year Treasury Bond (TLT)

CurrencyShares Japanese Yen ETF (FXY)

BHP Billiton Limited (BHP)

Market Vectors Coal ETF (KOL)

First Trust ISE Global Copper ETF (CU)

Market Vectors Russia ETF (RSX)

Market Vectors Uranium+Nuclear Engy ETF (NLR)

Cameco Corporation (CCJ)

Teucrium Corn ETF (CORN)

Teucrium Wheat ETF (WEAT)

Teucrium Soybean ETF (SOYB)

PowerShares DB Agriculture ETF (DBA)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.