After the catastrophic 25% fall in the units of Linn Energy (LINE) over the past three days, I thought I?d better take another look at the company. The company?s units have now crashed by an eye popping 55% since the May $31 high.

The units have been trading as if the company is imminently going bankrupt. The contradiction is that it clearly isn?t. This is basically a healthy company that is undergoing some volatility typical for the sector.

Is this logical or rational?

No, not at all. But when a real panic hits, you sell first, and ask questions later. That has clearly been happening in the oil patch for the past month.

At the $14 low on Monday, the units were yielding a spectacular 20.7% annualized. This is not some imaginary pie in the sky estimate. This is what the actual $0.24 monthly cash payout announced by the company as recently as December 1 works out to for holders of record as of Thursday, December 11.

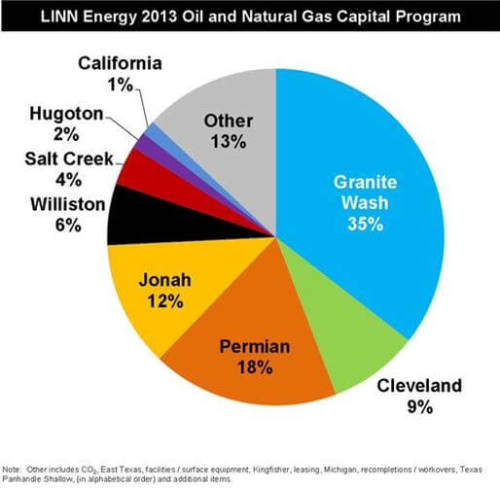

Nor are these spectacular yields based on some wild leveraged bets in the financial markets. (LINE) is predominantly a natural gas company, a commodity which has seen its price go largely unchanged for the past two years, hovering above $3.50. And much of its production has already been hedged against any downside risk with offsetting positions in the futures market.

I always try to use every loss as a learning opportunity, or the lesson goes wasted, and is doomed to repetition.

The reasons above were why I shot out a quick Trade Alert last week to buy (LINN) at $16.67. It was an uncharacteristically cautious position for me. But calling bottoms in major trends is always a risky enterprise, so I went small, very small. I bought the underlying units, not the options, and then in unleveraged form.

Initially things went great, rocketing 13% right out the door. Short term, smart traders, like Mad Day Trader Jim Parker, then put in tight stop losses below. That way, he was playing with the house?s money in any further upside, and is assured against loss during any rapid reversal.

I, unfortunately was too slow to do so, and had to bear the cost of the sudden 25% drop. Remember, being right 80% of the time means that I am wrong 20% of the time. But with only a 10% position, my loss never exceeded 1.60% of my total portfolio, something I can live with, and ride out until any recovery.

My guess is that many (LINE) holders violated my ?Sleep at night rule,? lured by the hefty dividend payout into owning too many units.

Once burned, twice forewarned.

My advice to you now is ?Hang on.? You?ve already taken the hit. Don?t bail here and miss the recovery, which will probably begin in earnest next year.