Global Market Comments

November 12, 2014

Fiat Lux

SPECIAL FRACKING ISSUE

Featured Trade:

(WHY FRACKING WILL MAKE YOUR 2015 PERFORMANCE),

(USO), (DIG), (UNG), (XOM), (OXY),

?(DVN), (APC), (DIG), (COG)

United States Oil ETF (USO)

ProShares Ultra Oil & Gas (DIG)

United States Natural Gas ETF (UNG)

Exxon Mobil Corporation (XOM)

Occidental Petroleum Corporation (OXY)

Devon Energy Corporation (DVN)

Anadarko Petroleum Corporation (APC)

ProShares Ultra Oil & Gas (DIG)

Cabot Oil & Gas Corporation (COG)

Be nice to investors on the way up, because you always meet them again on the way down. This is the harsh reality of those who have placed their money in the fracking space this year.

The hottest sector in the market for the first half of the year, investors have recently fallen on hard times, with the price of oil collapsing from a $107 high in June to under $77 this morning, a haircut of some 28% in just five months.

Prices just seem to be immune to all the good news that is thrown at them, be it ISIL, the Ukraine, or Syria.

It wasn?t supposed to be like that. Using this revolutionary new technology, drillers are in the process of ramping up US domestic oil production from 6 million to 10 million barrels a day.

The implications for the American economy have been extraordinarily positive. It has created a hiring boom in the oil patch states, which has substantially reduced blue-collar unemployment. It has added several points to US GDP growth.

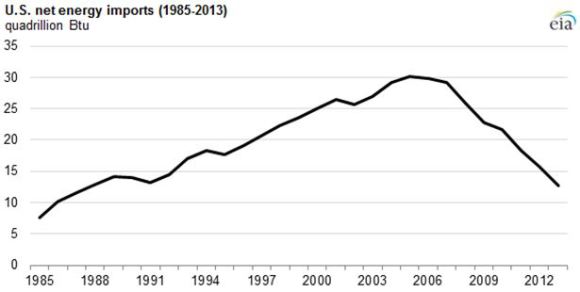

It has also reduced our dependence on energy imports, from a peak of 30 quadrillion Btu?s in 2005 to only 13 quadrillion Btu?s at the end of last year. We are probably shipping in under 10 quadrillion Btu?s right now, a plunge of 66% from the top in only 9 years.

The foreign exchange markets have taken note. Falling imports means sending hundreds of billions of dollars less to hostile sellers abroad. Am I the only one who has noticed that we are funding both sides of all the Middle Eastern conflicts? The upshot has been the igniting of a huge bull market in the US dollar that will continue for decades.

That has justified the withdrawal of US military forces in this volatile part of the world, creating enormous savings in defense spending, rapidly bringing the US Federal budget into balance.

The oil boom has also provided ample fodder for the stock market, with the major indexes tripling off the 2009 bottom. Energy plays, especially those revolving around fracking infrastructure, took the lead.

Readers lapped up my recommendations in the area. Cheniere Energy (LNG) soared from $6 to $85. Linn Energy (LINE) ratcheted up from $7 to $36. Occidental Petroleum moved by leaps and bounds, from $35 to $110.

Is the party now over? Are we to dump our energy holdings in the wake of the recent calamitous falls in prices?

I think not.

One of the purposes of this letter is to assist readers in separating out the wheat from the chaff on the information front, both the kind that bombards us from the media, and the more mundane variety emailed to us by brokers.

When I see the quality of this data, I want to throw up my hands and cry. Pundits speculate that the troubles stem from Saudi Arabia?s desire to put Russia, Iran, the US fracking industry, and all alternative energy projects out of business by pummeling prices.

The only problem is that these experts have never been to Saudi Arabia, Iran, the Barnett Shale, and wouldn?t know which end of a solar panel to face towards the sun. Best case, they are guessing, worst case, they are making it up to fill up airtime. And you want to invest your life savings based on what they are telling you?

I call this bullpuckey.

I have traveled in the Middle East for 46 years. I covered the neighborhood wars for The Economist magazine during the 1970?s.

When representing Morgan Stanley in the firm?s dealings with the Saudi royal family in the 1980?s, I paused to stick my finger in the crack in the Riyadh city gate left by a spear thrown by King Abdul Aziz al Saud when he captured the city in the 1920?s, creating modern Saudi Arabia.

They only mistake I made in my Texas fracking investments is that I sold out too soon in 2005, when natural gas traded at $5 and missed the spike to $17.

So let me tell you about the price of oil.

There are a few tried and true rules about this industry. It is far bigger than you realize. It has taken 150 years to build. Nothing ever happens in a hurry. Any changes here take decades and billions of dollars to implement.

Nobody has ever controlled the market, just chipped away at the margins. Oh, and occasionally the stuff blows up and kills you.

As one time Vladimir Lenin advisor and Occidental Petroleum founder, the late Dr. Armand Hammer, once told me, ?Follow the oil. Everything springs from there.?

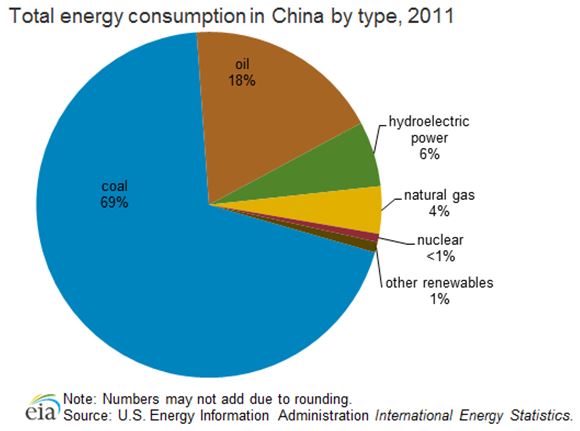

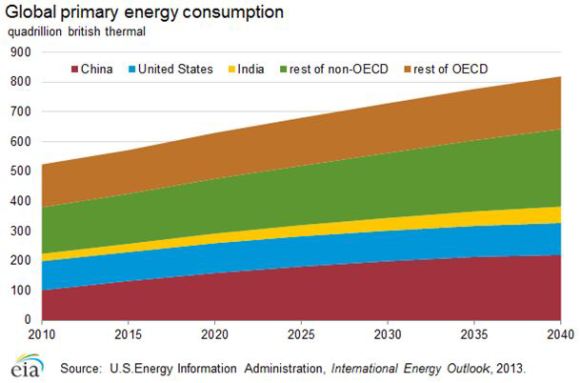

China is the big factor that most people are missing. Media coverage has been unremittingly negative. But their energy imports have never stopped rising, whether the economy is up, down, or going nowhere, which in any case are rigged, guessed, or manufactured. The major cities still suffer brownouts in the summer, and the government has ordered offices to limit air conditioning to a sweltering 82 degrees.

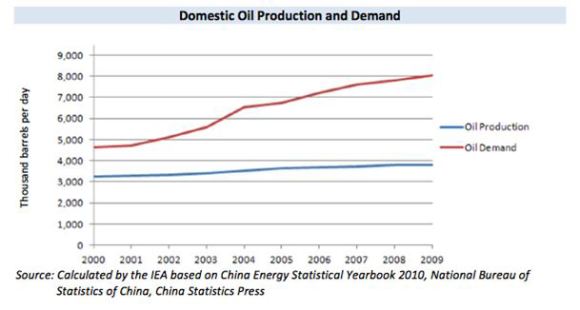

Chinese oil demand doubled to 8 million barrels a day from 2000-2010, and will double again in the current decade. This assumes that Chinese standards of living reach only a fraction of our own. Lack of critical infrastructure and storage prevents it from rising faster.

Any fall in American purchases of Middle Eastern oil are immediately offset by new sales to Asia. Some 80% of Persian Gulf oil now goes to Asia, and soon it will be 100%. This is why the Middle Kingdom has suddenly started investing in aircraft carriers.

So, we are not entering a prolonged, never ending collapse in oil prices. Run that theory past senior management at Exxon Mobil (XOM) and Occidental (OXY), as I have done, and you?ll summon a great guffaw.

It will reorganize, restructure, and move into new technologies and markets, as they have already done with fracking. My theory is that they will buy the entire alternative energy industry the second it become sustainably profitable. It certainly has the cash and the management and engineering expertise to do so.

What we are really seeing is the growing up of the fracking industry, from rambunctious teenage years to a more mature young adulthood. This is its first real recession.

For years I have heard complaints of rocketing costs and endless shortages of key supplies and equipment. This setback will shake out over-leveraged marginal players and allow costs to settle back to earth.

Roustabouts who recently made a stratospheric $200,000 a year will go back to earning $70,000. This will all be great for industry profitability.

What all of this means is that we are entering a generational opportunity to get into energy investments of every description. After all, it is the only sector in the market that is now cheap which, unlike coal, has a reasonable opportunity to recover.

Oil will probably hit a low sometime next year. Where is anybody?s guess, so don?t bother asking me. It is unknowable.

When it does, I?ll be shooting out the Trade Alerts as fast as I can write them.

Where to focus? I?ll unfurl the roll call of the usual suspects. They include Occidental Petroleum (OXY), Exxon Mobil (XOM), Devon Energy (DVN), Anadarko Petroleum (APC) Cabot Oil & Gas (COG), and the ProShares 2X Ultra Oil & Gas ETF (DIG).

Fracking investments should be especially immune to the downturn, because their primary product is natural gas, which has not fallen anywhere as much as Texas tea. Oil was always just a byproduct and a bonus.

CH4 was the main show, which has rocketed by an eye popping 29% to $4.57 in the past two weeks, thanks to the return of the polar vortex this winter. We are now close to the highs for the year in natural gas.

The cost of production of domestic US oil runs everywhere from $28 a barrel for older legacy fields, to $100 for recent deep offshore. Many recent developments were brought on-stream around the $70-$80 area. So $76 a barrel is not the end of the world.

On the other hand, natural gas uniformly cost just under $2/Btu, and that number is falling. Producers are currently getting more than double that in the market.

And while on the subject of this simple molecule, don?t let ground water pollution ever both you. It does happen, but it?s an easy fix.

Of the 50 cases of pollution investigated by MIT, most were found to be the result of subcontractor incompetence, natural causes, or pollution that occurred 50 or more years ago. Properly regulated, it shouldn?t be happening at all.

When I fracked in the Barnett Shale 15 years ago, we used greywater, or runoff from irrigation, to accelerate our underground expositions. The industry has since gotten fancy, bringing in highly toxic chemicals like Guar Gum, Petroleum Distillates, Triethanolamine Zirconate, and Potassium Metaborate.

However, the marginal production gains of using these new additives are not worth the environmental risk. Scale back on the most toxic chemicals and go back to groundwater, and the environmental, as well as the political opposition melts away.

By the way, can any readers tell me if my favorite restaurant in Kuwait, the ship Al Boom, is still in business? The lamb kabob there was to die for.

Don?t Throw Out the Baby with the Bathwater

Don?t Throw Out the Baby with the Bathwater

Global Market Comments

November 11, 2014

Fiat Lux

Featured Trade:

(THE TAX RATE FALLACY),

(A TRIBUTE TO A TRUE VETERAN)

Global Market Comments

November 10, 2014

Fiat Lux

Featured Trade:

(SHOPPING FOR A NEW BROKER)

Global Market Comments

November 7, 2014

Fiat Lux

Featured Trade:

(HOW TO TRADE THE REST OF 2014),

(TRIBUTE TO A GIANT OF JOURNALISM, ROY ESSOYAN)

?Be Fearful When Others Are Greedy, and Greedy When Others Are Fearful.?

That is one of my favorite quotes from Oracle of Omaha, Warren Buffet, and it was never more true than during the past 30 trading days.

It turns out that the lowest risk day to buy stocks in 2014 was October 15, when we saw a giant, capitulation, spike low in the S&P 500 (SPY) down to $182.

That was the most fearful day I can recall over the last three years. You wouldn?t believe how many people I begged not to sell out entire portfolios that day!

So where are we now with the markets? Go back to the beginning of that legendary quote, and the word ?fearful? really stands out.

That means traders are stuck right back in the uncomfortable position in which they have spent most of this year.

Do I try to play catch up here and chase the market for a few extra basis points of performance, even at the risk of enduring another calamitous selloff? Or do I sit here in cash and earn precisely zero and get fired at the end of the year?

It is a choice that would truly vex Salomon. But as a king, at least he had job security.

We are now entering the tag ends of 2014, with only 36 trading days left, including three half days. I think it is safe to say that the trends that have predominated since January 1 will continue. Expect markets to continue to over reward risk takers and over punish risk avoiders.

That means there are only three trades in the world to execute:

1) Buy the US Dollar

A yield advantage for the greenback is sucking in capital from all over the world. Concerns about principal risk is a further driver, creating a ?flight to safety? of prodigious proportions. Thanks to the collapse in energy prices and a ramp up in US domestic production, dollar outflows from America are at decade lows.

This can only mean that we are at the beginning of a multi year bull market in the buck. Sell short the Japanese yen (FXY) and the Euro (FXE), and buy the 2X short yen ETF (YCS), and the 2X short Euro ETF (EUO).

2) Buy US Stocks

The majority of US portfolio managers are still underweight stocks and are desperately trying to get in. Now that the 10% correction is finally behind us, they can afford the luxury of being more aggressive loading up on the dips.

The midterm elections, which saw the Republicans take control of the Senate with a seven seat gain, is a new turbocharger for equities. Congress is now seen as pro business. Since the stock market tripled and corporate profits rocketed with an anti business elected body, imagine how well they will do with a friendly one!

I was hoping for the Senate results to get tied up in runoffs and the courts for a couple of months, triggering a 5% market correction and an opportunity to load the boat once more. It was not to be. What is left for us now is to see the (SPX) grind up to close the year at a 2100 all time high.

Who will be the sector leaders? The usual suspects who have led the charge all year, technology, health care, and financials.

3) Sell Short All Commodities

It is truly impressive to see the entire commodity space collapse all at the same time. This includes oil, natural gas, gold, silver, copper, corn, wheat, soybeans, and the commodity producing currencies of the Australian and Canadian dollars.

They have all been hard hit with a perfect storm; overwhelming supply of product, a strong dollar, and weak demand caused by a slowing global economy. The story is the same everywhere.

Commodity collapses always last longer and deeper than you imagine possible because you cannot turn off production by simply flipping a switch, as you can with the paper assets of stocks and bonds. Cutting off supplies means freezing capital spending worth hundreds of billions of dollars spread over decades, no easy task.

So, before you purchase a hard asset of any kind, lie down and take a long nap first. And please stop emailing me asking if this is the bottom for all of the above. It isn?t.

4) Sell All Bonds

There is a fourth secular trend that began exactly on October 15, right after the market opening. The ten year Treasury bond (TLT) hit a yield of 1.86%. This is a secondary low in yields, high in prices, after the 1.39% yield we saw in 2012. This means we are now two years into a 30-year bear market for all fixed income securities.

However, don?t expect a crash like we saw during the 1970?s, when yields soared up to 13%. Expect a slow grind up in interest rates, often spending 3-6 months in tedious, narrow, sleep inducing ranges.

This makes your entry points on the short side important. Only buy the short Treasury bond ETF (TBT) on substantial dips, lest hair starts growing on the position.

There is one other alternative if you have been following the Trade Alerts of the Mad Hedge Fund Trader all year.

Quit trading and take the rest of the year off. Start your Christmas shopping early. Contribute to retail sales and the national GDP. You earned it. The 42% profit you have earned so far is of heroic proportions.

Let?s hope for more of the same in 2015!

Global Market Comments

November 6, 2014

Fiat Lux

Featured Trade:

(NOTICE TO MILITARY SUBSCRIBERS),

(CHINA?S COMING DEMOGRAPHIC NIGHTMARE),

(THE WORST TRADE OF ALL TIME), (GLD)

SPDR Gold Shares (GLD)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.