Global Market Comments

August 20, 2013

Fiat Lux

Featured Trade:

(I?M BACK!)

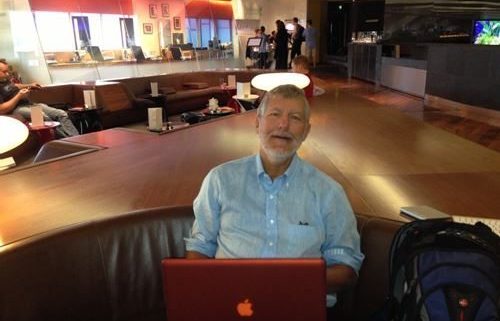

I sit here at Virgin Atlantic?s upper class lounge at London?s Heathrow airport, awaiting their transcontinental nonstop service to San Francisco, listening to Bach?s Sonata No.1 in G Minor on my headphones. I am returning from a two-month tour of Europe that was highly informative, exciting, and even mind expanding. The proof is the ten new pounds that I am packing under my belt.

Living in the US, all I hear about are America?s weaknesses and the strength?s of foreign countries, mostly China. Traveling abroad, one is barraged with admiration for our country?s strengths and endless mewling about their weaknesses. So to look at the United States objectively, it is necessary to spend a certain amount of time abroad. This I did in spades.

It was first class and five stars all the way. I?m talking palaces, presidential suites, and Michelin three star restaurants. My credit card is worn out, the magnetic strip a mere fragment of its former self, and shall be retired to stud when I get home. PayPal is laughing all the way to the bank. As for my travel blazer, it needs to be shot and buried, being far beyond the reach of even the most diligent dry cleaner.

My global strategy luncheons in London, Amsterdam, Berlin, Frankfurt, Portofino, Mykonos, and Zermatt were a blowout success. Several venues required rebooking to larger facilities to accommodate greater than anticipated numbers.

It appears that a 37% return in a year when everyone else is tearing their hair out is a real crowd draw. All went away with a broadened view of the world, and I picked up some first class intelligence. It was well worth the investment for all.

The adventures came fast and furious. I picked up a new fedora at Locke & Co., just down St. James Street from my old office at The Economist magazine, the firm that supplied Lord Nelson of Trafalgar and all the kings and queens of England with their fine hats. Tea at the Ritz is a people watching experience par excellence.

The red light district in Amsterdam has gone tourist, with families perusing the bikini clad ladies of the evening in the bay windows, who are now mostly from Russia. After a major cleaning job, Rembrandt?s Night Watch looks even better than it did when I first saw it 45 years ago. The international flower market performed a logistical masterpiece that would have done the founders of the original Dutch East India Company proud.

The city of Dresden was a cultural gem long outside my reach in the old communist East Germany. The shadow of the mass firebombing that killed most of the population in 1945 is ever present. Looking at the crown jewels of the Saxon kings, it is easy to understand from where the anti tax movement sprung.

It was an emotional moment for me riding my bicycle across the site of the former Berlin Wall. Where machine guns once threatened, a million flowers now bloom. My deluxe accommodations at the Hotel Adlon were the old wartime Gestapo headquarters. That is a vast improvement over the dilapidated student dormitory where I stayed in the sixties, which, remarkably, is still standing. Goering?s solidly built Air Ministry still exists just down the street, an Art Deco tour de force. Scouring the city?s vintage shops, I managed to score an Italian embroidered suede alpine jacket that fit perfectly for only ?8.

My free afternoon in Frankfurt?s botanical gardens saw me curiously exploring such oddities as barrel cactus, cholla, and octillo, the kinds of flora we have in abundance in the deserts back home.

Portofino, on the Italian Riviera, was beautiful to look at, but was plagued by European summer vacations crowds that are typical for this time of year. One only hoped that the competing Russian oligarchs attempting to maneuver their mega yachts into the village?s tiny harbor didn?t break out into a shooting war. Watching a pod of dolphins race with the bow of our own ship made it all worth it.

The worst nightmare of the trip was the check in at budget Meridian Airlines for the flight to Mykonos. It was me and 200 hard partying Italian kids. The seats were jammed so close together I nearly suffered a double amputation (see photo below). It was so disorganized I barely made the flight. Better to leave the Italians to food, fashion, and race cars, than to running airlines and cruise ships.

With Italy in its third year of recession, the bargains in Milan were to die for. The children are outfitted for the next two years. I even bought clothes for people I didn?t like, and shipped them home in suitcases bought at 50% off. Only the 100 degree heat and the clouds of mosquitoes drove me away from a longer stay. There?s nothing like flaunting death in a taxi racing to the airport at 100 miles per hour tailgating the car in front by ten feet.

Mykonos was the first ?sit on the beach and do nothing? holiday I?ve enjoyed in many years. But I still got a lot of writing done between racing around the island on a beat up quadracycle and the girls dancing on the tables.

I finally made it to the top of the Matterhorn in Switzerland, all 14,800 feet of it. Knock that item off the bucket list. What I hadn?t bargained for was the rescue effort I got involved in on the way down. More on that in a future piece. Zermatt is a fantasy destination that I will keep returning to every year to climb as long as I live. Having just bagged my 45 year pin from the tourist bureau, can I shoot for 90?

I completed my journey by climbing the highest mountain in Wales, Mount Snowdon. The weather was perfect, rare for this part of the world. I took it as a good omen for the future. Scaling rocky crags, the view of the lakes and the Irish Sea was breathtaking. By then I was just plum worn out from traveling, and longed for my own bed and the morning edition of the San Francisco Chronicle, even one soaked by the sprinklers. California wine is looking pretty good right now, with the fall harvest fast upon us.

I return with a new lease on life, my batteries recharged, and chomping at the bit. It doesn?t hurt that my Trade Alert performance is tickling yet another all time high, up 92% since inception two and a half years ago. I?ll get some new Trade Alerts out soon to throw the hard core traders among you some red meat. It is going to be a very good year.

Many thanks for all your support. You, the readers, make it all worth it.

I?m on the plane now, two hours into the Atlantic. Below are the endless glaciers and snowfields of Greenland. I?ve made it all the way to Bach?s Partita No. II in D Minor. Iceland is in our rear view mirror. The stewardess is asking me to make room for my steak and cabernet. So that?s it for now.

Global Market Comments

August 19, 2013

Fiat Lux

Featured Trade:

(HOW THE GOVERNMENT UNDERSTATES THE ECONOMY),

(HOW TO GET A FREE TRIP TO EUROPE)

I am writing this in the second-class cabin of the Wales to London express train, which is packed to the gills with holiday revelers. In the adjacent seat there is a gaggle of four young ladies dressed to the, nines sporting feathers from their hats, obviously headed for a late summer wedding. They are sharing a bottle of Cava, or cheap Spanish Champagne, and the spirited conversation is increasing in volume with each passing mile. As it is all in Welsh I can?t understand a word.

Nevertheless, I shall attempt to impart to you some market insights, even in these most trying of conditions.

There is a major contradiction going on in the US economy these days. The government data releases speak of a feeble rate of business expansion that is puttering along at only 2% rate. But speak to the CEO?s of major companies and they talk of growth, expansion, and increased capital investment with a guarded optimism that lines up with a more robust 4% GDP growth rate. This is going on not just into the US, but in Europe, Asia, and Australia as well.

Who?s got it right, the government, or the CEO?s?

One of the most valuable lessons I learned as a journalist many decades ago is that you always follow the companies. Speak to management, and they will magically reveal trends that won?t show up in the public data releases for months, or even years. And capital always follows the companies, as JP Morgan head of investment, Carl Van Horne, once told me.

That is one of the many reasons you read this letter, to discover economy trends before the rest of the world does. And what is the collective wisdom of the planet?s CEO?s? That things are a lot better than they appear. Who has already figured this out? The stock market. This is why the S& P earnings multiple has expanded by tree points this year, from 12.5X to 15.5X, or some 25%. This is also why this has been the most hated stock market rally in history.

I have always been a strong believer in the wisdom of crowds, that markets see events and their implications well before single individuals can. A good example is the 1942 Battle of Midway, where Japan lost four aircraft carriers, thanks to a masterstroke of American intelligence. Look at your 100-year stock charts, and you will see this, to the day, marked the beginning of a bull market that lasted until the early 1970?s, even though the actual outcome of the battle was kept top secret for years.

However, I think there is much more going on here than human mass psychology. When guests ask at my lectures and luncheons about the accuracy of government data coming out of China, I shoot back ?What about our data?? The entire field of government statistics is greatly flawed, no matter who is issuing it.

As a former scientist, I was horrified when I first saw such large bets placed by investors on such weak information. As my college math professor used to say, ?Statistics are like a bikini. What they reveal is fascinating, but what they conceal is essential.?

The very nature of government information collecting guarantees that it is riddled with flaws. The US is a massive country, with reporting entities often reaching the tens of thousands. The time frame over which of these collects data can vary, leading to wonderful apple an orange comparisons. Surveys are the worst, easily falling victim to the natural human tendency to tell people what they want to hear. Often, they say the opposite of what they believe.

Then there is the GDP. The pattern that has emerged over recent years has been for a number to start out strong, and then get revised down substantially in the following quarters. Or visa versa. The monthly nonfarm payrolls are even worse.

This is why PIMCO boss, Bill Gross, says that the weekly jobless claims are the one statistical update he?d welcome if stranded on a desert island. A least the mistakes are flushed out every week, rather than monthly or quarterly. For what its worth, that number is at 330,000, a five year low, predicting further share price gains.

The Treasury?s Bureau of Economic Analysis has recently tried to bring the GDP numbers closer to reality by redefining the term. It finally changed ?research and investment? from an expense to an investment to be depreciated over many years, which it really is.

It also created a new category for ?intellectual property?. What are the reruns of ?Bewitched?, ?Bonanza,? and ?Gilligan?s Island? worth? Before, it was nothing. Now it is something. This has enormous implications for technology companies and content creators of every stripe, including myself. That Hedge Fund Radio interview I did with Barton Biggs four years ago is still generating mouse clicks, and therefore revenues, even though he sadly passed away last year. Barton would be proud.

All told, the changes added $560 billion to US GDP, taking the total up 3.6% to $16.6 trillion. That is the equivalent to adding another State of New Jersey to our economy out of thin air. Of course, the right cried foul, as it always does, deriding the attempt to make the country look better than it actually is. In reality, the government data is still miles away from reflecting a true picture of the economy. So what changes are coming next is anyone?s guess.

I?ll ask Treasury Secretary, Jack Lew, when I meet him in person on Thursday.

Well, the ladies next door are fairly plastered now, having moved up from Champagne to blueberry Vodka. One girl is clearly wearing more of her drink than she has imbibed. They have even offered the kindly, white haired old man with the beard in the next seat a glass. I will, no doubt, regale them with great wisdom on the pleasures and pitfalls of married life.

So that?s it for now.

![Jack Lew]() Treasury Secretary Jack Lew

Treasury Secretary Jack Lew

During my recent trip to Europe, I made another startling discovery about the woeful state of America?s 19th century health care system. I needed to get refills on my prescription drugs when I was in Zermatt, so I stopped by the local pharmacy and placed an order. This was for three different drugs I take daily for a typical guy my age for blood pressure, cholesterol, and arthritis.

Since my insurance isn?t valid in Switzerland, I was expecting to get gouged on the bill. I was amazed when I was told it was only $20 for a month?s supply. The tab in the US without insurance was $200. Even the copay with my insurance came to $60. Why are identical drugs manufactured by the same company, Roche, ten times more expensive at home than they are in Switzerland? Even when they are invented in the US?

I asked the pharmacist if she had more of the same pills at these prices. She said sure, that I could buy all I want with a doctor?s approval. So that night, I emailed my doctor at home for new prescriptions. I then marched back in the next day and bought a one-year supply for everything. Total cost: $360, and presumably, Roche is making at least a 20% profit margin on at these prices. The full ticket price for this at home would be $2,400, and the copays alone would total $720.

The savings were enough to take a substantial bite out of the cost of my trip to Europe. US customs didn?t care when I brought them back in. It has to be the multiple 100% mark ups by middlemen along the way, plus some extra cash that somehow gets into the pocket of Blue Cross. The lobbyists in Washington probably cost a bundle too. So if you plan to visit Europe bring your doctor?s prescriptions with you. The savings will amount to a small fortune, enough to buy another trip to Europe.

Global Market Comments

August 16, 2013

Fiat Lux

Featured Trade:

(WHY I LOVE/HATE THE OIL COMPANIES), (XOM),

(KNOWING THE PRICE OF EVERYTHING AND THE VALUE OF NOTHING)

(WHY BUFFET HATES GOLD), (GLD), (GDX), (ABX)

Exxon Mobil Corporation (XOM)

SPDR Gold Shares (GLD)

Market Vectors Gold Miners ETF (GDX)

Barrick Gold Corporation (ABX)

The first thing I do when I get up every morning is to curse the oil companies as the blood sucking scourges of modern civilization. I then fall down on my knees and thank God that we have oil companies.

You?ve got to love ExxonMobil (XOM), which constantly trades places with Apple (AAPL) for being the world?s largest company. This is why petroleum engineers are getting $100,000 straight out of college, while English and political science major are going straight on to food stamps.

I recommend (XOM) and other oil majors as part of any long-term portfolio. The price of oil has gone up in my lifetime from $3 a barrel up to $149, and then back down to $107 today. The reasons for the ascent keep growing, from the entry of China into the global trading system, to the rapid growth of the middle class in emerging nations. They?re just not making the stuff anymore, and we can?t wait around for more dinosaurs to get squashed.

Oil companies aren?t in the oil speculation business. As soon as a new supply comes on stream, they hedge off their risk through the futures markets or through long term supply contracts. You can find the prices they hedge at in the back of any annual report.

When oil made its big run a few years ago, I discovered to my amazement that that (XOM) had already sold most of their supplies in the $20 range. However, oil companies do make huge killings on what is already in the pipeline.

Working in the oil patch a decade ago pioneering the ?fracking? process for natural gas, I got to know many people in the industry. I found them to be insular, God fearing people not afraid of hard work. Perhaps this is because the black gold they are pursuing can blow up and kill them at any time. They are also great with numbers, which is why the oil majors are the best managed companies in the world.

They are also huge gamblers. I swallow hard when I see the way these guys through around billions in capital, keeping in mind past disasters, like Dome Petroleum, the Alaskan oil spill, Piper Alpha, and more recently, the ill-fated Macondo well in the Gulf of Mexico. But one failure does not slow them down an iota. The ?wildcatting? origins made this a faith based industry from day one, when praying was the principal determinant of where wells were sunk.

Unfortunately, the oil companies are too good at their job of supply us with a steady and reliable source of energy. They have one of the oldest and most powerful lobbies in Washington, and as a result, the tax code is riddled with favorite treatment of the oil industry. While social security and Medicare are on the chopping block, the industry basks in the glow of $53 billion a year in tax subsidies.

When I first got into the oil business and sat down with a Houston CPA, the tax breaks were so legion that I couldn?t understand why anyone was not in the oil racket. Every wonder why we have had three presidents from Texas over the last 50 years, and are possibly looking at a fourth?

Three words explain it all: the oil depletion allowance, whereby investors can write off the entire cost of a new well in the first year, while the income is spread over the life of the well. This also explains why deep water exploration in the Gulf is far less regulated than California hair dressers.

No surprise then that that the industry has emerged in the cross hairs of the debt ceiling negotiations, under the ?loopholes? category. Not only do the country?s most profitable companies pay almost nothing in taxes, they are one of the largest users of private jets.

It is an old Washington nostrum that when things start heading south on the domestic front, you beat up the oil companies. It?s the industry that everyone loves to hate. Cut off the gasoline supply to an environmentalist, and he will be the one who screams the loudest. This has generated recurring cycles of accusatory congressional investigations, windfall profits taxes, and punitive regulations, the most recent flavor we are now seeing.

But imagine what the world would look like if Exxon and its cohorts were German, Saudi, or heaven forbid, Chinese. I bet we wouldn?t have as much oil as we do today, and it wouldn?t be as cheap. Hate them if you will, but at least these are our oil companies. Try jamming a lump of coal into the gas tank of your Prius and tell me what happens.

Love Them, Hate Them or Both?

Love Them, Hate Them or Both?

As a fanatical follower of the price of everything, I have long been an avid viewer of the television program, Antiques Roadshow, for 14 years, and the English version of the show well before that. This is where you learn what stuff like majolica is. Many aspiring collectors come into the open appraisal events hoping they have inherited something of untold value from their late Aunt Gertrude.

The show has had its ups and down, and was once ensnared in a scandal where appraiser deliberately overvalued objects to boost ratings. But some of the stories that come with these objects are amazing, and their educational value can?t be underestimated. Once, they really did discover an original seal of the United States, missing since the British burned Washington DC in 1814.

The knowledge that I gained over the years has allowed me to swoop in and pick up incredible bargains, everywhere from Sotheby?s auctions to local garage sales. Some of my better deals have included buying a pair of prewar German Zeiss binoculars for $10 (I recently saw an identical pair inside U-505 at the Museum of Science and Industry in Chicago). I also managed to score three cases of 1909 and 1915 Massandra port and sherry, last own by Czar Nicholas II of Russia, for $25 a bottle. Current market price: $1,000. The taste is amazing.

So it was with some amusement that I noticed yesterday that the show recently made its greatest find in history. A man in Tulsa, Oklahoma appeared with five tea cups that he had purchased at a local antique store in the seventies for a couple of bucks. The Chinese antiquities expert was aghast, informing the surprised owner that these dated from the 17th century, were made from extremely rare rhinoceros horn, and were estimate to worth $1-$1.5 million.

It turns out that the previous record for an object was also Chinese, some? $1 million for some carved jade bowls. It has long been a rule of thumb that when a country sees of burst of strong economic growth, its antiques rise in value. I saw this happen to Japanese screens, swords, and woodblock prints in the seventies and eighties during their economic boom, and it is happening now with Islamic antiquities.

The Tulsa show will air on PBS in 2012. In the meantime, I will continue to visit the local garage sales with a sharp eye. I wonder about that copy of the Declaration of Independence I have lining an attic drawer upstairs. Could it be the real thing?

![Antique Road Show]() How about $300,000 Each?

How about $300,000 Each?

The ?Oracle of Omaha? expounded at length today on why he despises the barbarous relic. The sage doesn?t really care if the yellow metal hit an all-time high today of $1,440. He sees it primarily as a bet on fear. If investors are more afraid in a year than they are today, then you make money. If they aren?t, then you lose money. If you took all the gold in the world, it would form a cube 67 feet on a side, worth $7 trillion. For that same amount of money, you could own other assets with far greater productive power, including:

*All the farmland in the US, about 1 billion acres, which is worth $2.5 trillion.

*Seven Exxon Mobil?s (XOM), the largest capitalized company in the US.

*You would still have $1 trillion in walking around money left over.

Instead of producing any income or dividends, gold just sits there and shines, letting you feel like you are King Midas.

I don?t know. With the stock market peaking around here, and oil trading at $115/barrel in Europe, a bet on fear looks pretty good to me right now. I?m still sticking with my long term forecast of the old inflation adjusted high of $2,300.

Maybe Feeling Like King Midas is Not So Bad

Maybe Feeling Like King Midas is Not So Bad

Global Market Comments

August 15, 2013

Fiat Lux

Featured Trade:

(CALIFORNIA MONEY DOWN THE DRAIN?)

(DEATH OF THE CONSUMER), (SPX)

?S&P 500 Index (SPX)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.