As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

You would think that this was going to be a good day. Weekly jobless claims fell to 388,000, a new six month low. New permits for home construction in October were up 10.2%. The October CPI even fell by 0.1%.

But the second that Spanish bond yields spiked, it was all over but the crying. The S&P 500 opened weak, and then proceeded to plunged 25 points, decisively breaking a triangle to the downside on the charts that has been narrowing for the past three weeks. Once again, improving fundamentals in the US were trumped by contagion fears in Europe. If you don?t bounce off the 50 day moving average on Friday, then we?ll be on the Lexington Avenue Downtown Express to 1,150 or worse.

The ?RISK OFF? nature of the move across all asset classes could not have been more clear. Oil skidded by $5, gold gave up $65, silver pared $2.20, copper gave back 15 cents. Ten year Treasuries, which never believed in this ?RISK ON? rally for two seconds, received a nice little boost, but not as much as you might expect. Perhaps we are near a top in this most bubblicious of asset classes? In the meantime, the (TBT) was beaten like a red headed stepchild.

One cannot underestimate the impact of the bankruptcy of MF Global, which has deprived the market of $600 million of trading capital. It is particularly serious in the metals and energies, where MF was particularly active. Hence the gut churning moves. The peripatetic CNBC commentator and Tea Party founder, Rick Santelli, is finding out that ?let the chips fall where they may? means that all his friends on the Chicago CME floor get fired.

Strangely, the Euro, the currency that everyone loves to hate, was one of the best performing assets of the day, down less than a penny. The headline risk here is huge. Will the European Central Bank continue buying enough bonds? Forex traders tell me this is because of a number of temporary, one off factors like European bank repatriation of funds back into Euros to shore up their balance sheets and Asian and Middle Eastern central bank purchases of high yield PIIGS bonds. The second shoe has yet to fall on this beleaguered means of exchange.

While recently winging my way across the South Pacific, I spotted an unusual job offer:

WANTED: Social worker, tax free salary of $60,000 with free accommodation and transportation, no experience necessary, must be flexible and self-sufficient.

With the unemployment rate stuck at 9.1%, and running as high as 45% for recent college grads, I was amazed that they were even advertising for such a job. Usually such plum positions get farmed out to a close relative of the hiring officials involved. Intrigued, I read on.

To apply you first had to fly to Auckland, then catch a flight to Tahiti. After that you must endure another long flight to the remote Gambler Island, then charter a boat for a 36 hour voyage. Once there, you had to row ashore to a hidden cove, as there was no dock, or even a beach.

It turns out that the job of a lifetime is on remote Pitcairn Island, some 2,700 miles ENE of New Zealand, home to the modern decedents of the mutineers of the HMS Bounty. History buffs will recall that in 1790 Fletcher Christian led a rebellion against the tyrannical Captain William Bligh, casting him adrift in a lifeboat.

He then kidnapped several Tahitian women and disappeared of the face of the earth. When he stumbled across Pitcairn, which was absent from contemporary charts, he burned the ship to avoid detection. An off course British ship didn?t find the island until some 40 years later, only to find that Christian had been killed for his involvement in a love triangle decades earlier.

The job is not without its challenges. There is one doctor, and electric power is switched on only 10 hours a day. Supply ships visit only every three months. The local language is a blend of 18th century English and Tahitian called Pitkern, for which there is no dictionary. Previous workers have a history of going native. Oh, and 10% of the island?s 54 residents are registered sex offenders, due to its long history of incest.

The next time someone you know complains about being unable to find a job, just tell them they are not looking hard enough, and to brush up on their Pitkern.

?We know things are upside down when we have an Italian central banker and a German pope. That?s not the way it is supposed to be,? said Steve Cortez of Veracruz Research.

One of the most frequently asked questions at my recent round of strategy luncheons, seminars, and keynote speaking engagements has been ?Is it time to buy a home?? I responded with ?No, no, a thousand times no,? and proceeded to rail off the countless reasons. My answer always piques listeners? interest, as 67% of Americans are still homeowners, and probably more at these assemblies.

My expectation is that house prices have another 25% to go before we reach a final bottom. Of course, such comments invite truckloads of abuse from the real estate industry, which has been insisting that a recover is just around the corner for at least five years now. For those of you who were unable to attend these events, let me list off everything that will go wrong with real estate over the next two years:

*80 million baby boomers are attempting to sell their homes to 65 million Gen Xer?s who make a lot less money than their parents did. Don?t plan on selling your house to your kids, especially if they are still living rent free in the basement.

*Fannie Mae and Freddie Mac, which are currently refinancing 95% of US home mortgages, are in receivership. Having wiped out their capital in the housing crash, they are unlikely to get refunded by congress. A wholly privatized home loan market is likely to raise borrowing costs by 200 basis points, as it already does in the non-conforming jumbo market.

*Get ready to say goodbye to that home mortgage deduction as part of any budget balancing effort in Washington. This government subsidy, worth $13,000 per homeowner with a mortgage less than $1 million, is costing the government $250 billion in tax revenues annually. Any flat tax proposal does the same thing. How long should renters continue to subsidize homeowners?

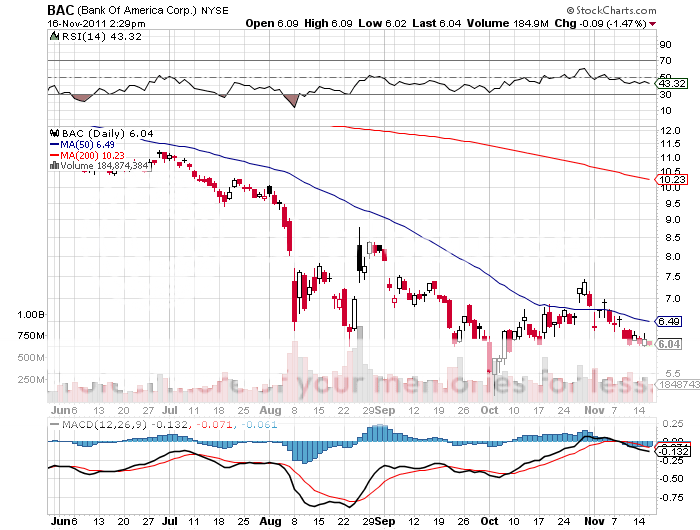

*Ben Bernanke?s ?twist? program has dramatically flattened the positive yield curve, depriving banks of recapitalizing themselves with the shrunken positive carry. This is what bank share prices have been telling us with their horrific performance, with lead stock Bank of America (BAC) plunging from $14 to $5 in just six months. Translation: fewer bank loans for you and I mean lower house prices.

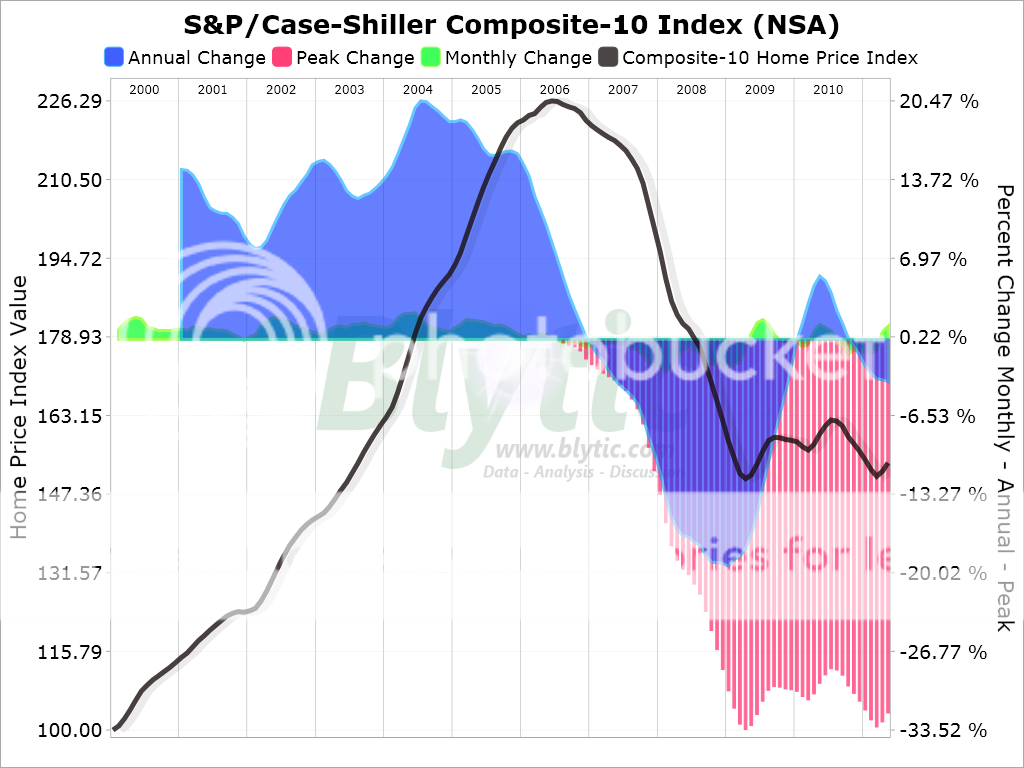

*Look at the chart of September Case-Shiller data below. Despite the greatest real estate stimulus in history, prices have flat lined in for two years. The 30 year mortgage is under 4%, a 60 year low, and affordability is at a 60 year high. Until this year, buyers in California were getting a combined state and federal tax breaks of $18,000 to buy a house. What happens when the stimulus ends?

* According to the Federal Reserve, 35% of US homes have less than 10% equity or negative equity. That means that 50 million homeowners will have nothing left after a sale, including closing costs. We now have negative equity states, like Nevada and Arizona.? People are trapped in their homes, and can?t move to accept new jobs elsewhere.

*To say there is an inventory overhang would be a huge understatement. There are 1 million new homes and 5 million existing homes now on the market. According to Zillow.com, another 10% of homeowners, or 15 million, would sell on any improvement in prices.

*Add up all the above, and of a total market in the US of 150 homes, there are 21 million homes for sale, and 50 million buyers shut out of the market.

*Has anyone heard there might be a recession next year? What little buying that is going on has to dry up. The expanded U-6 unemployment rate, including ?discouraged? workers and those with expired benefits, is likely to soar from the current 16% to 25% to match Great Depression highs.

*After the 1929 stock market crash, home prices took 25 years to recover pre-crash levels. I think that we are seeing a repeat of this phenomenon, with 2006 as the start date. Get ready to cash in on the new bull market in real estate in 2031, when newly enriched Millennials start to join the fray in large numbers.

With all that said, I am still looking for a home to buy. That will most likely occur on a courthouse?s steps, where cash is king. Why not, if I can get the 2020 price today, down 50% from today?s level? Until then, I will happily rent, not buy.

Is This a Sell Signal?

I was driving through a prominent San Francisco neighborhood last Sunday, looking for a McMansion open house. When I came to one key intersection there were more than a dozen signs directing me to competing offerings. What a joke. And the agent told me that market conditions were gradually improving! It looks like current and former millionaires are in a rush to unload their properties before then next recession hits, noticeably adding to the already bloated inventory of unsold homes.

I heard this morning that the Federal Housing Authority, the government agency that insures residential real estate loans, has lost nearly all its cash reserves to cover losses. Since last year, these reserves have fallen from $4.7 billion to $2.6 billion.

Federal law requires it to maintain a reserve of 2% of the $1.2 trillion of loans it currently has outstanding. Reserves will fall from 0.5% to 0.24% by 2012. Independent analysts say that the agency is underestimating loan losses by at least $50 billion.

That means the FHA will need a bail out next year, and therein lies the problem. In its current gridlocked mode, it is highly unlikely that congress will approve the multibillion dollar refunding of a controversial federal agency. The ?let the chips fall where they may? crowd seem to have the upper hand. The FHA currently insures one third of US mortgages, up 560% since 2006, largely through the demise of its private competitors. No insurance means no loans. For you and I that means lower home prices.

The FHA specializes in loans with less than 5% down. With home prices in a six year nosedive, more than half of these are now underwater. With $30 billion in liquid capital and $1.2 trillion in outstanding guarantees, it now has a 43:1 leverage ratio. Sound familiar? The shorthand for this is that the FHA is basically a government version of Lehman Brothers begging to happen.

Even while congress is starving the FHA of new funds, it is asking the beleaguered agency to stick its neck out even more. Conforming loan limits went from $729,750 down to $625,000 on October 1. Congress wants to return to old limits. This would be a big deal for homeowners in the expensive states of California and New York. But again, action is needed.

In the end, I never made it to the open house I was looking for. Instead, I tripped across another house that was twice as nice for a third less money. With all of these cutthroat price reductions going on, continuing to rent sounds like a really good idea. The taxes, insurance, and maintenance on the last place added up to more than my current rent, and that is not even accounting for a mortgage interest expense, it I could get one.

I?ll tell you the title of the next book that I am going to read. Make Millions with Foreclosures and Short Sales: How to Profit From a Real Estate Crisis can be bought at Amazon by clicking here.

?The problem is not the new ideas, it is escaping from the old ones,? said economist John Maynard Keynes

Have you ever held a basketball underwater in a swimming pool and let go? It flies to the upside and pops you in the nose. That is exactly what gold is doing now. After the barbarous relic peaked at $1,922 on August 24, it traded like an absolute pig, giving up 20% in a matter of weeks. I managed to coin it with a couple of quick in and out trades in (GLD) puts, some doubling over a weekend. So much for the ?safe asset? theory.

You can thank hedge fund titan, John Paulsen, for the action. John gained international notoriety when he earned a $4 billion bonus after making huge bets against subprime loans going into the housing crash.

Since then, his touch has grown somewhat icy. He started out 2011 with a huge, bullish bet on US banks, a play, I confess, I never really understood. This was back when Bank of America (BAC) was trading at a lofty $14/share. As a hedge, he backed up these gargantuan positions with big holdings in gold, which quickly made him the largest owner of the ETF (GLD).

John?s P&L held up reasonably well during the first part of the year. As the banks faded, gold went from strength to strength, limiting his damage. That all changed on April 29 when global financial markets flipped into ?RISK OFF? mode and gold melted along with everything else. Its hedging capability proved to be nil. By August, John?s losses approached a near death 50%.

Needless to say, his investors failed to see the humor in the situation, and rumors of cataclysmic redemptions started sweeping the street. By implication, this could only mean large scale liquidation of the yellow metal. This was happening when the rest of the hedge fund industry was catching daily margin calls, forcing them to dump even more gold into a downward spiral, their best performing holding for the year. When the sushi hits the fan, you sell what you can, not what you want to. By the time the carnage ended, gold was down $392.

When the crying was over, Paulson had reduced his ownership in the ETF (GLD) from 31.5 million shares to 20.3 million. That?s a haircut of $1.76 billion of the shiny stuff. In the end, Paulson says he only suffered redemptions of 10% of his somewhat reduced funds, much lower than expected.

Gold actually anticipated the new ?RISK ON? trade by a week, bottoming on September 26. Since then it has behaved like a paper asset, tracking the S&P 500 almost tick for tick, adding a quick 19.6%. So, what?s up with gold?

As we approach yearend, the downward pressure of this redemption selling is waning, hence my basketball analogy. New bull arguments have also come to the fore. The contagion in Europe has prompted massive buying of all precious metals by panicky individuals, including silver (SLV), platinum (PPLT), palladium (PALL), and even neglected rhodium, with a collapse of the Euro imminent. And how will the ECB eventually end the crisis? With a continental TARP and quantitative easing, which we here in the US already know is hugely positive for gold prices.

How far will the gold get this time? The gold bugs say we?re going to break the old high and power on through to the inflation adjusted high at $2,300. I?m not so sure. I am not willing to bet the ranch here on an asset class that could plunge $1,000 going into the next recession, which could be just around the corner.

But there may be a trade here in precious metals space for the nimble. My pick has been to buy lagging silver, which offers much more bang per buck if the sector starts to build a head of steam. The white metal will not get hit with IMF gold sales, which are also a rumored part of any European bailout package.

I am constantly barraged with emails from gold bugs who passionately argue that their beloved metal is trading at a tiny fraction of its true value, and that the barbaric relic is really worth $5,000, $10,000, or even $50,000 an ounce (GLD). They claim the move in the yellow metal we are seeing is only the beginning of a 30 fold rise in prices similar to what we saw from 1972 to 1979, when it leapt from $32 to $950.

So when the chart below popped up in my in-box showing the gold backing of the US monetary base, I felt obligated to pass it on to you to illustrate one of the intellectual arguments these people are using. To match the 1936 peak value, when the monetary base was collapsing, and the double top in 1979 when gold futures first tickled $950, this precious metal has to increase in value by eight times, or to $9,600 an ounce.

I am long term bullish on gold, other precious metals, and virtually all commodities for that matter. But I am not that bullish. It makes my own three year $2,300 prediction positively wimp-like by comparison. The seven year spike up in prices we saw in the seventies, which found me in a very long line in Johannesburg, South Africa to unload my own krugerands in 1979, was triggered by a number of one off events that will never be repeated.

Some 40 years of demand was unleashed when Richard Nixon took the US off the gold standard and decriminalized private ownership in 1972. Inflation later peaked around 20%. Newly enriched sellers of oil had a strong historical affinity with gold. South Africa, the world's largest gold producer, was then a boycotted international pariah and teetering on the edge of disaster. We are nowhere near the same geopolitical neighborhood today, and hence my more subdued forecast. But then again, I could be wrong.

You may have noticed that I have not been doing much trading in gold or the other precious metals lately. That is because they are still working off an extremely overbought condition. Given some time, and a nice little dip in prices, and I'll be back there in a heartbeat. You'll be the first to know when that happens.

With smoke still rising from the ruins of the recent silver crash, I thought I'd touch base with a wizened and grizzled old veteran who still remembers the last time a bubble popped for the white metal. That would be Mike Robertson, who runs Robertson Wealth Management, one of the largest and most successful registered investment advisors in the country (click here for his site at www.robertsonwealthmanagement.com).

Mike is the last surviving silver broker to the Hunt Brothers, who in 1979-80 were major players in the run up in the 'poor man's gold' from $11 to a staggering $50 an ounce in a very short time. At the peak, their aggregate position was thought to exceed 100 million ounces.

Nelson Bunker Hunt and William Herbert Hunt were the sons of the legendary HL Hunt, one of the original East Texas oil wildcatters, and heirs to one of the largest? fortunes of the day. Shortly after president Richard Nixon took the US off the gold standard in 1971, the two brothers became deeply concerned about financial viability of the United States government. To protect their assets they began accumulating silver through coins, bars, the silver refiner, Asarco, and even antique tea sets, and when they opened, silver contracts on the futures markets.

The brothers? interest in silver was well known for years, and prices gradually rose. But when inflation soared into double digits, a giant spotlight was thrown upon them, and the race was on. Mike was then a junior broker at the Houston office of Bache & Co., in which the Hunts held a minority stake, and handled a large part of their business. The turnover in silver contracts exploded. Mike confesses to waking up some mornings, turning on the radio to hear silver limit up, and then not bothering to go to work because he knew there would be no trades.

The price of silver ran up so high that it became a political problem. Several officials at the CFTC were rumored to be getting killed on their silver shorts. Eastman Kodak (EK), whose black and white film made them one of the largest silver consumers in the country, was thought to be borrowing silver from the Treasury to stay in business.

The Carter administration took a dim view of the Hunt Brothers' activities, especially considering their funding of the ultra-conservative John Birch Society. The Feds viewed it as a conspiratorial attempt to undermine the US government. It was time to pay the piper.

The CFTC raised margin rates to 100%. The Hunts were accused of market manipulation and ordered to unwind their position. They were subpoenaed by Congress to testify about their motives. After a decade of litigation, Bunker received a lifetime ban from the commodities markets, a $10 million fine, and was forced into a Chapter 11 bankruptcy.

Mike saw commissions worth $14 million in today's money go unpaid. In the end, he was only left with a Rolex watch, his broker's license, and a silver Mercedes. He still ardently believes today that the Hunts got a raw deal, and that their only crime was to be right about the long term attractiveness of silver as an inflation hedge.

Nelson made one of the great asset allocation calls of all time and was punished severely for it. There never was any intention to manipulate markets. As far as he knew, the Hunts never paid more than the $20 handle for silver, and that all of the buying that took it up to $50 was nothing more than retail froth.

Through the lens of 20/20 hindsight, Mike views the entire experience as a morality tale, a warning of what happens when you step on the toes of the wrong people.

And what does the old silver trader think of prices today? Mike saw the current collapse coming from a mile off. He thinks silver is showing all the signs of a broken market, and doesn't want to touch it until it revisits the $20's. But the white metal's inflation fighting qualities are still as true as ever, and it is only a matter of time before prices once again take another long run to the upside.

Silver is Still a Great Inflation Hedge

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.