'Average is over. If you just show up now for your job in an average way, that's not going to cut it anymore. James Reston, a famous columnist in the sixties and seventies, used to have my office, and he would come into work each day wondering what his seven competitors were going to write about. I come into work wondering about what my 70 million competitors are going to do,' said Tom Friedman, a columnist for the New York Times.

4) Testimonial.? I am a 25 year veteran of the financial industry and run one of the largest wealth management teams at one of the largest banks in the country.? This is my second time subscribing, I'm always looking for good ideas.? My man, you are a freak. If this were a few hundred years ago we would burn you at the stake as a Warlock. I have never, ever, written a congratulatory email??But day after day, you are the most accurate trader I have ever seen. I'm truly flabbergasted. My wife even heard me say "holy ****".

Barry

Atlanta, Georgia

'There's no retail inflows. The hedge fund community has derisked. So the algorithm based, high frequency traders have taken up the slack, and are now responsible for 70% of the total trading activity in the market every day. It's a very difficult environment to create alpha, or excess returns in. Are your clients frustrated?

Featured Trades: (BUY THE DIP IN CORN), (CORN), (DBA), (JJG)

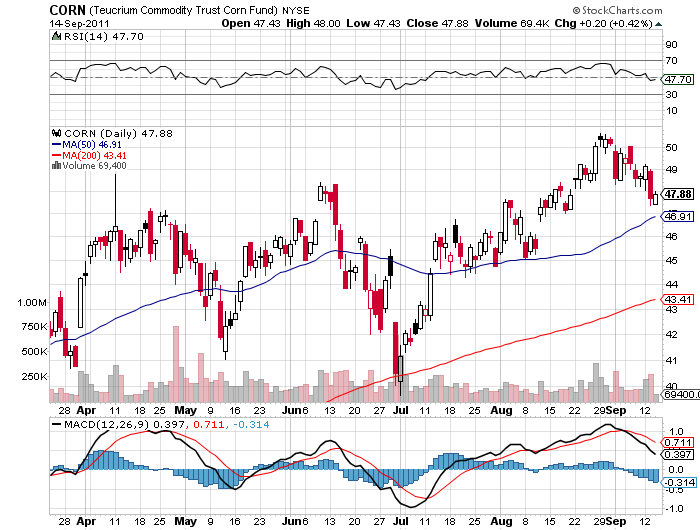

1) Buy the Dip in Corn. The US Department of Agriculture released its monthly crop report on Monday, underlining the tremendously bullish conditions for corn, which I have been harping away about in this letter for months. What did the markets do? They sold off, delivering a classic 'buy the rumor, sell the move' type of reaction.

As I expected, corn yields were chopped from 153.0 bushels per acre to 148.1. The total US crop was downsized from 12.914 billion bushels to 12.497 billion. Global demand conditions were reduced, which I find incredible, given the distressed conditions found around the world. Since the department collected its data, conditions have worsened appreciably, thanks to the incredibly hot weather that has been searing the South and the Midwest. Look no further than the unprecedented Texas fires.

This is not a market that has given you a lot of windows to get into. I will try to hang on for a pull back to the 50 day moving average for the ETF (CORN) at $46.90, down 8% from its recent high. Every dip over the last 2 1/2 months has been a 'buy' for corn, and I expect that this time will be no different.

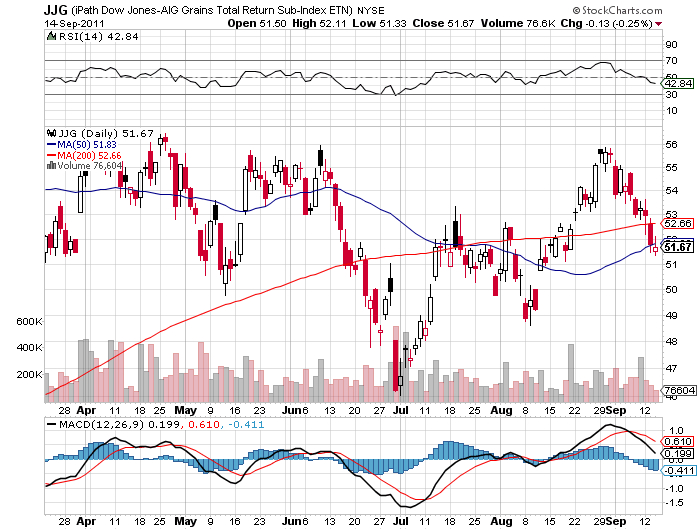

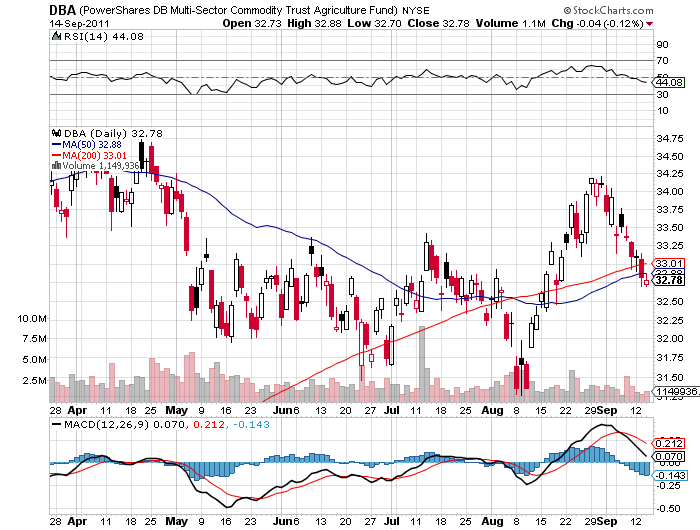

You can also take a look at the grain ETF (JJG) and the PowerShares DB Multisector Commodity Trust Agriculture Fund (DBA). And if I'm wrong, you can always take delivery and eat your position.

-

-

-

-

Is This a Buy Signal?

Featured Trades: (SELLING OIL AGAIN FOR A HEDGE), (USO)

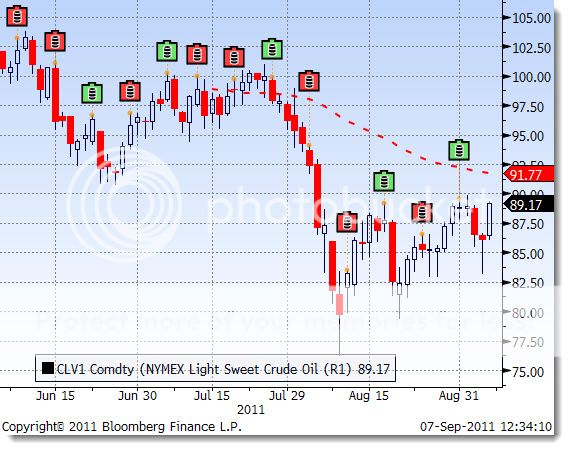

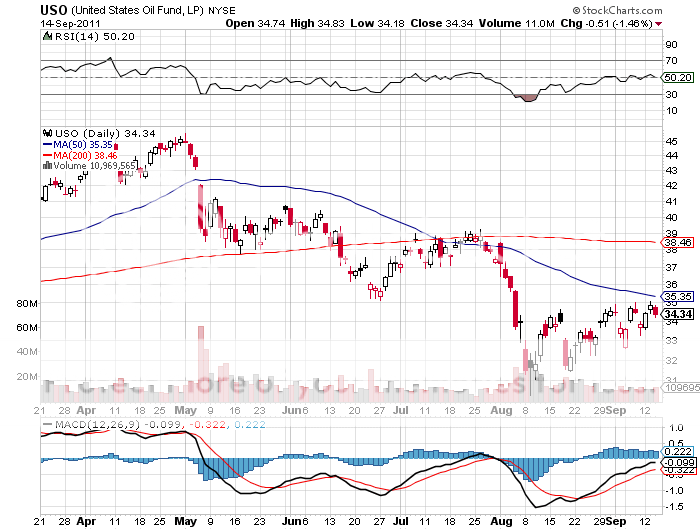

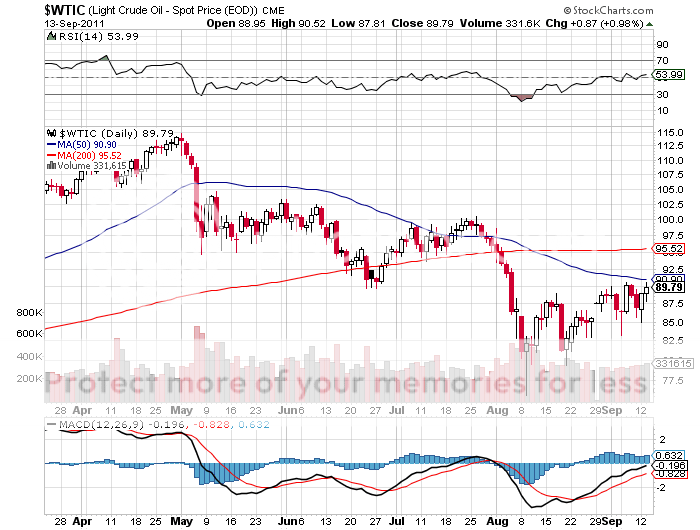

2) Selling Oil Again for a Hedge. With oil having bounced $5.50 over the last couple of days, I am going to flip back to the short side for several reasons, not all of which have to do with Texas tea.

The trigger was oil's failure to rally in the wake of a surprisingly large draw down in inventories this week, some 6.7 million barrels. This comes off the back of a large build in gasoline inventories of 2 million barrels, which has been a great leading indicator for crude.

For a start, I have run out of 'RISK OFF' positions, having covered them all during the last big dip in risk assets, quite profitably I might add. We have seen a nice rallyette in the (TBT), and I want to hedge these gains by going short oil. The 'RISK OFF' (USO) puts can also be used to hedge any additional 'RISK ON' positions I may want to add in the near future.

Finally, this is just an outright punt. Looking at the charts, we are clearly at the upper end of a rising channel. There should be a chance to capture a $3-$4 break in oil, even if we continue in the uptrend. This could be worth a quickie 50% gain in the puts. This is a flyer I can afford to take, as my book is now small, and I am up 37% year to date. If it doesn't work, I can always stop out when oil hits $93. Notice, also, that I am rolling out to the November expiration on this trade to duck the accelerated time decay.

It gives us some downside participation if the financial markets choose to have one more puke-out before the fall rally begins. It is also a great put on the next bombshell coming out of Europe, which could occur as early as this weekend.

-

-

-

Is There One More Puke Out Left in the Markets?

Featured Trades: (TRADING SHIFTS TO THE FOREIGN EXCHANGE MARKET)

2) Trading Shifts to the Forex Market. Those of us who have been in the business for four decades have been overwhelmed by the growth of the foreign exchange business. Since the late sixties, it has grown from a handful of low level clerks speaking on transatlantic lines doing a few hundred million dollars' worth of deals a day, to a breathtaking $4 trillion a day. The move has accelerated since 2008, as traders, attracted by the tight spreads and bottomless liquidity, flee other asset classes into the foreign exchange markets.

Along these lines, a friend of mine, Jason Stapleton, CEO of Triple Threat Trading, is launching a new foreign exchange trading service for individual investors. It neatly compliments my own Macro Millionaire trade mentoring program. It is called the 2011 Protrader Bootcamp, and Jason has kindly agreed to give the readers of this newsletter a free two week trial to the program that includes ten training sessions.

You can't beat the dollar for value. The sessions will feature Live Trading, Guest Speakers, and hours of high quality Forex trading education covering strategies and techniques to keep your portfolio in the black.

Featured Trades: (WHAT'S ON THE MENU?) (FXE), (EURO), (UUP), (GLD)

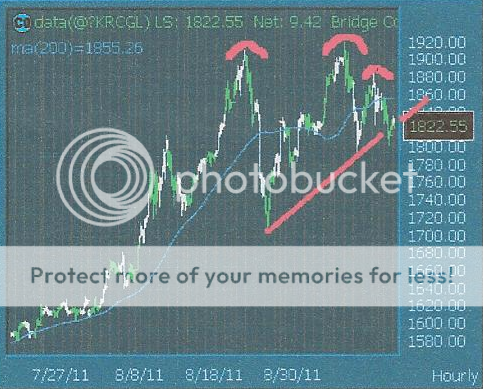

4) What's On the Menu? I am posting these charts below from a variety of sources outlining some trades that I may execute in the near future. Call it my 'short watch list'.

Look at the two longer term charts for gold, which seems to be putting in a more convincing top by the day. The first one shows that gold is clearly stalling at the top of a three year up channel. The second shows the price action for this year, and could be interpreted as a ragged 'head and shoulders' top. Message: use price spikes to the upside to buy out of the money puts two months out.

-

The next chart for the PowerShares DB US dollar index (UUP) is showing that we have seen a major sea change in the US dollar, breaking the recent downtrend and reversing a multiyear decline. You can witness further confirmation of this in the subsequent chart for the Euro, which has 'breakdown' written all over it. If you have any doubts, look at the third chart, which convincingly shows that we have been in a three year channel pointing south all along. Message: use rallies in the Euro to buy out of the money puts starting at the 50% retracement level for the recent move at $1.38, or buy the leveraged bearish Euro ETF (EUO).

Just thought you'd like to know what I was thinking.

-

-

-

Featured Trades: (MY TAKE ON THE 2012 PRESIDENTIAL ELECTION)

1) My Take on the 2012 Presidential Election. As I write this, I am sitting at the San Francisco consulate of the People's Republic of China, awaiting the issuance of my business visa. Since I will soon be in the neighborhood, I plan to interview some companies that I want to buy on the next upswing in the global financial markets. The Defense Department has asked me to call on my senior contacts in the People's Liberation Army to try and get a read on the Middle Kingdom's next likely president, Xi Jinping. Also, it has been ages since I had a decent Peking Duck.

It seems that whenever you do anything with China, there are always scads of people around. I had to wait in line on cold and foggy Geary Street an hour just to get into the building, pestered by assorted anti-government demonstrators. I'm now inside with my laptop, but my number is A288, and so far they have only gotten up to A24. It looks like I have a long haul.

Therefore, I am going to take advantage of the very rare luxury of some extra free time and speculate at length on the prospects of another president, that of Barrack Hussein Obama. Having spent time in the White House Press Corp under Carter and Reagan, I have some inside knowledge about how whole election process works.

The most important factor to affect global financial markets next year and years beyond will be the outcome of the 2012 presidential election. As card carrying paid up members of the Mad Hedge Fund Trader network, I therefore have not only the responsibility, but the obligation to give you my forecast about how this is going to play out.

To believe that President Obama is anti-business and bad for the economy is lunacy of the highest order. Barack knows more American history than either you or I will ever forget. He is well aware that a poor economic performance has been the primary creator of one term presidents since WWII.

Kennedy was assassinated, Johnson retired early, Carter was demolished by the stagflation caused by the Iranian revolution and the second oil shock, and George H.W. Bush was turfed out by a minor recession, despite winning the first Gulf War. Therefore, the economy had to be Obama's top priority from the first day in office. To do otherwise was for Obama to risk becoming one of the countless jobless himself.

I believe that the economy that Obama inherited was so broken that it will take decades to fix, if ever. It is easy to forget that virtually the entire financial system was bankrupt, the credit markets had seized up, and the ATM's were two weeks away from failing to dispense cash. The government newly found itself a major investor in the country's 20 largest banks, General Motors, and AIG.

But the reflationary measures he was able to get through a reluctant congress were too small to engineer the recovery he needed. The boldness of the moves seen during the Great Depression was sadly absent. Remember, Franklin Roosevelt directly hired 3 million men during his first two years through the Civilian Conservation Corps, immediately preventing 5 million from immediate starvation. This was when the population was less than half of what it is today.

To a large extent, Obama has become the fall guy for the excesses of earlier administrations. The big problems facing the country are long term and structural. The $15 trillion national debt is the product of 30 years of tax cuts and spending increases, primarily for defense.

Our runaway health care costs can be traced by our failure to nationalize health care when the rest of the developed did so in the late 1940's, enabling them to keep their medical expenses to two thirds of ours, with better results. Social security and Medicare were financially flawed from the day they were launched, and modern day politicians were loath to touch them once they became sacred cows. None of these intractable problems are amenable to a quick fix.

All of this leaves Obama's popularity in the polls falling, going into one of the most acrimonious and hard fought elections in American history. Obama has become the Jackie Robinson of American politics, the first African-American to play in major league baseball. The better the job he does, the more people hate him. Robinson died at 53, largely due to stress.

Is Obama the Jackie Robinson of American politics?

-

If he can't pull out of his tailspin, I believe the president will withdraw his candidacy, and throw it open to other contenders. That is what Lyndon Johnson did in 1968 due to declining health and an unpopular war. When you try to push history forward too quickly, sometimes it bites you back. The election of Obama was such a generational leap in so many ways that some retracement was inevitable. Blame it all on the excesses of the previous administration, which were many. After all, the Democrats don't want to commit suicide.

There are two potential candidates. I believe that Hillary Clinton was given the safe position as Secretary of State precisely to hold her in reserve as a backup candidate in 2012 in case something happened to Obama. People of both political parties agree that she has done a spectacular job managing America's role in the Arab spring, providing military support to drive Khadafy out of power, and keeping the Chinese buying out gargantuan debt issues. But as a presidential candidate, she is not without baggage.

Who wins This Contest?

-

The dark horse in the race is Michael Bloomberg, the highly popular mayor of New York. If there was ever a politician who can change his spots, it is Michael. A lifetime Democrat, he switched parties to win as a Republican in a Democratic town. He could flip flop again, or bolt to form a third party. I have known Michael since he went door to door on Wall Street seeking funding to start his data business to replace the aging Quotrons. A more quixotic mission there never was.

Yet he succeeded wildly, making himself a billionaire many times over, proving his credentials as an entrepreneur and a businessman, and creating an urban legend. An early adopter, I have personally paid him over $1 million in fees for the past 20 years for his versatile machine, as have most other hedge fund managers.

Where do the Republicans stand in all of this? They have to spend a year appealing to the conservative base, attempting to outmaneuver each other in a marathon to the right. Then they only have two months to swerve back to the middle to win the election. They have a somewhat hopeless task, and is why we have so many two term presidents.

What Rick Perry harangues about is popular in libertarian, oil based Texas, but will they wear it in Ohio, Washington, or Florida? I think not. Mitt Romney's Mormon origins leave his party's Christian base cold, and he is unelectable without them. Both these men are presenting themselves as modern day incarnations of Ronald Reagan. But I knew Ronnie for decades, first as an aspiring governor of California, and a Reagan they are not. I can't imagine Perry telling me an off color joke.

The rest of the field are just 'also rans'. On top of this, the power of the presidency as a campaign tool is not to be underestimated. Air Force One versus a chartered bus? Give me a break.

Or This One?

-

There are a few imponderables to consider in 2012. Some 4 million immigrants became naturalized US citizens in four years, who have a very high turnout ratio. Given anti-immigrant rants in states like Arizona and Alabama, you can count on almost all of these going Democratic. Another 4 million millennials will have reached voting age. Obama managed to get this group to turn out in unprecedented numbers in 2008. He didn't run in 2010, and they failed to show. Will they return in 2012? Another demographic trend that has been ongoing for 50 years is the migration to the sunbelt, which favors the Republicans. I don't know how all of this nets out, but I bet Carl Rove does. Ask him.

Or This One?

-

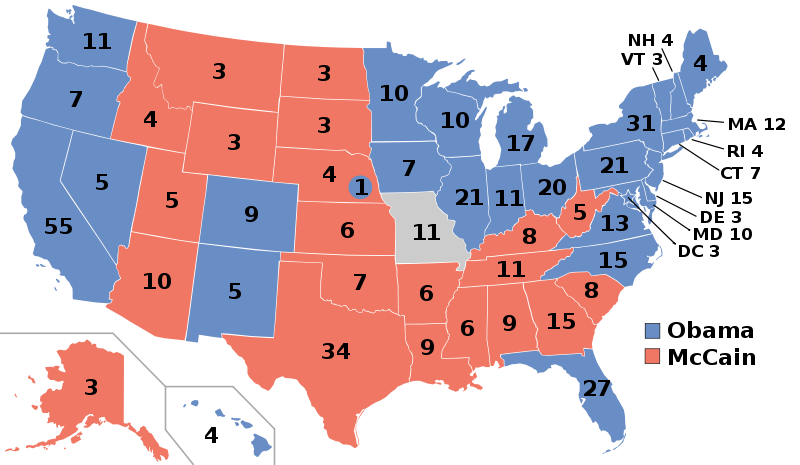

In the end it will come down to Ohio and Florida again, as it has in the last three elections. Few remember that Obama won by a landslide in 2008, taking some 365 electoral votes compared to the 270 needed to win. The Democrats could lose a staggering 94 votes and still take the presidency.

That means losing the entire Midwest and some of the East, including North Carolina (15), Virginia (13), Indiana (11), Missouri (11), Maryland (10), Colorado (9), Iowa (7), Connecticut (7), West Virginia (5), and New Mexico (5), and still seeing blue ties (or pant suits) in the White House. In the end it will come down to Ohio and Florida again, as it has in the last three elections.

This is a race that is wide open and could go in any direction. That is why you are seeing such a plethora of Republican candidates. In politics, 14 months is 14 centuries, and anything could happen by November 6, 2012. New candidates will enter the fray, while old ones fade away. Rick Perry may have already peaked. The economy might even recover, or at least fail to melt down. After all, who heard of Barrack Hussein Obama 14 months before the last election? For those of us who trade for a living, this will be one giant unknown to pile on top of all the others, right up to election day.

Well, they're up to number A285 now, so it's time to fold up the laptop and get in another line. I'm sure at least half of you are disappointed that I can't go on, the other half, not so much. See you in Shensen.

Or Will Obama Pull a Johnson?

-

'An employer now has access to, not only cheap software, cheap automation, cheap robots, cheap labor, but cheap genius as well,' said Tom Friedman, a columnist for the New York Times.

'For the last 20 years we used to trade inside a trend. There's no trend anymore. The day to day trade right now is what is the soup du jour, what is the trade of the day,' said Scott Bauer, a floor trader on the Chicago Mercantile Exchange.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.