Featured Trades: (GDP IS ANOTHER BUCKET OF COLD WATER)

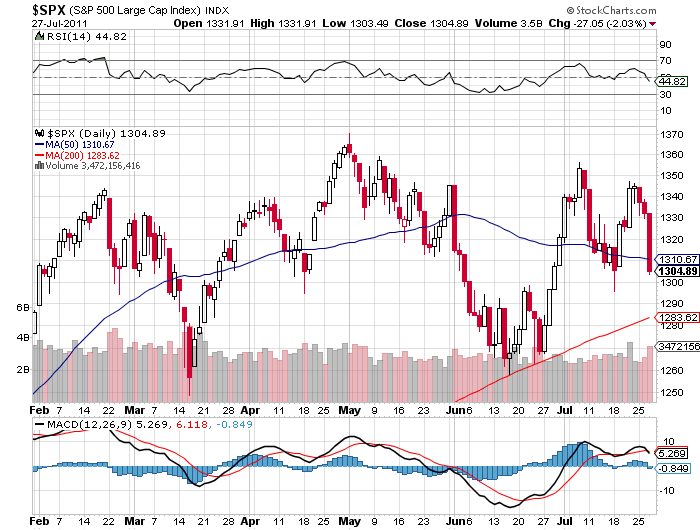

1) GDP is Another Bucket of Cold Water. Another bucket of cold water was thrown on financial markets on Friday with the shocking release of Q2 GDP of 1.3%. The whisper number prior to the release was at 1.9%, and even this figure is far short of the Federal Reserve's GDP forecast for 2011 of 3.0%.

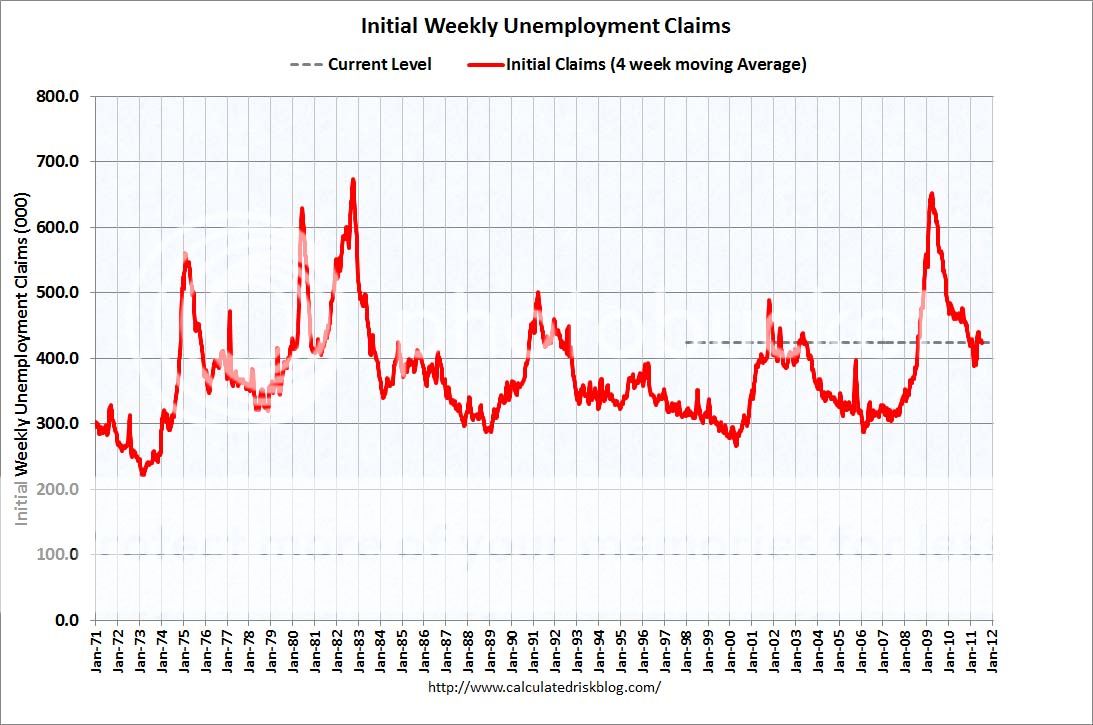

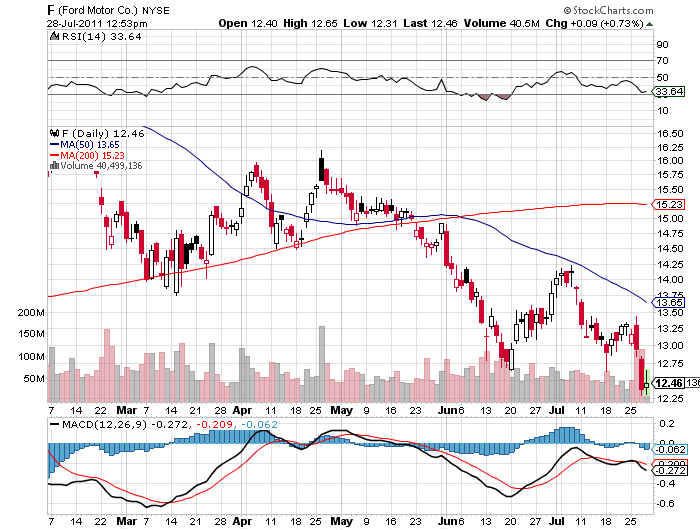

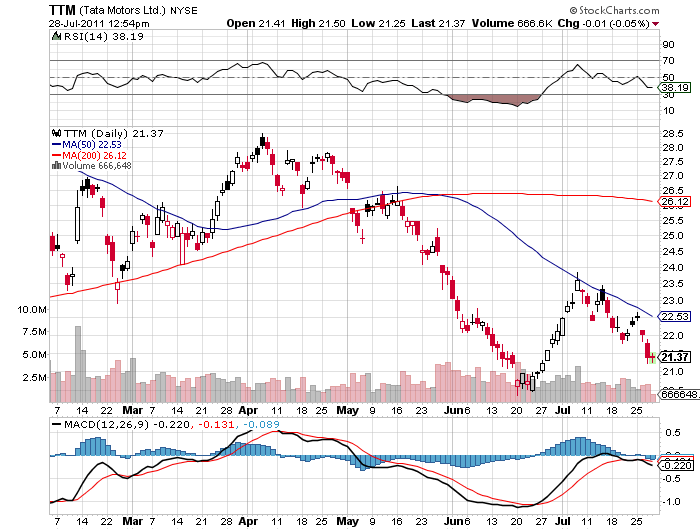

Keep in mind that these are backward looking numbers giving us data that is three months old. Some of the drag was caused by a Japanese tsunami slowed car industry, which the Ford earnings this week are telling us is already starting to snap back. That's why we had a sudden drop in weekly jobless claims this week be 28,000 to 398,000, the lowest since April 2, and the most important coincident indicator there.

I have been trading my own book all year based on a much more modest 2.0%-2.5% growth estimate, and it has served me well. I believed that most economists were vastly underestimating two crucial factors. State and local spending would continue to be a huge fiscal drag as local authorities enforce emergency measures the staunch bleeding deficits.

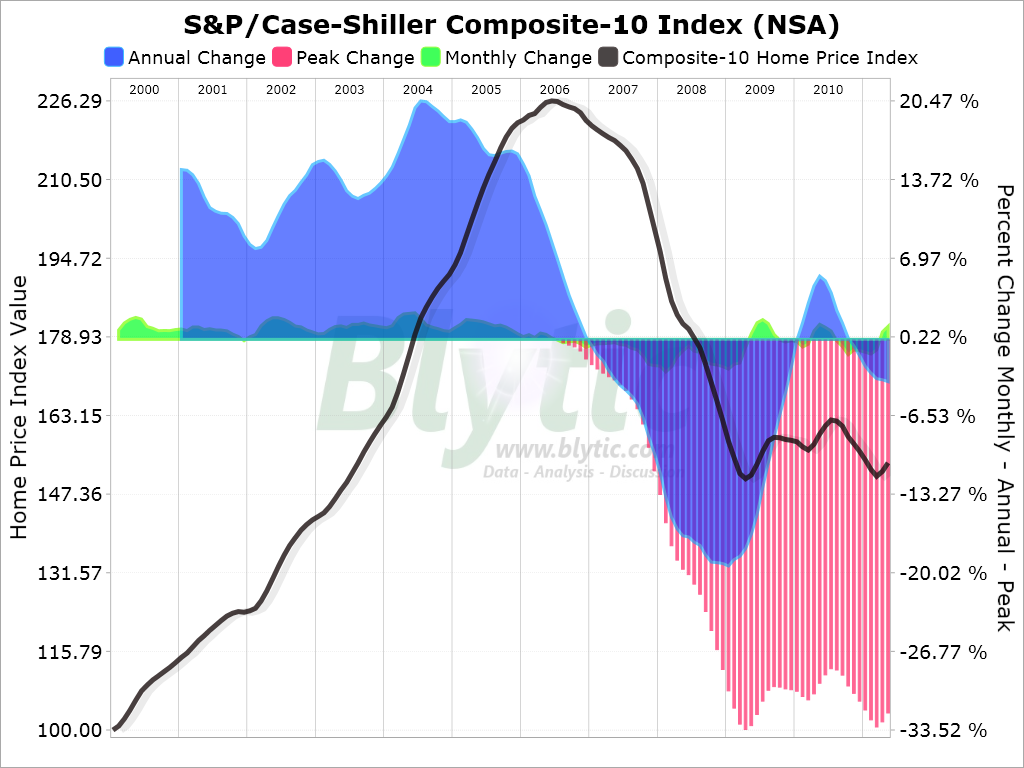

Remember, for every $3 the federal government shovels into the economy, the states are taking out $1. And now the feds are going to stop pouring money into the economy. I also thought that there would be no bounce back in real estate in a deleveraging world, a major component of past recoveries. This makes a hash of sell side predictions of economic growth this year that ranged as high as 4%.

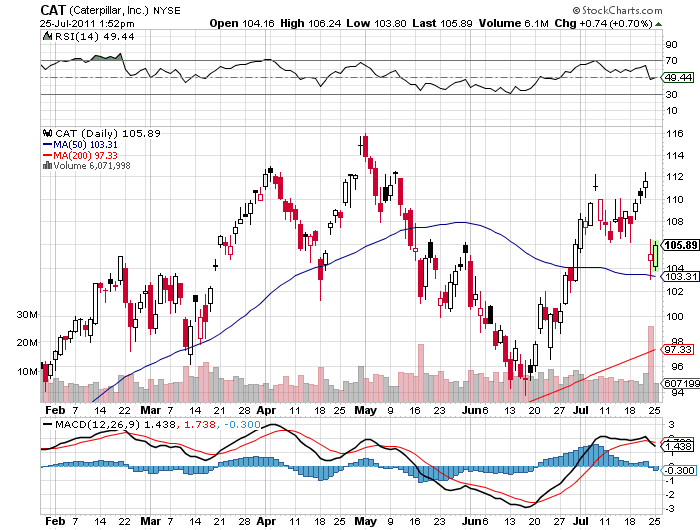

Billions of dollars is being spent to make you believe that the slowing economy is the result of excessive regulation, burdensome taxes, excessive budget deficits, and 'uncertainty.'? The truth is that the drag is being caused by deleveraging, gun shy bankers afraid to lend, paranoid corporations nervous about hiring, the retirement of 80 million baby boomers, and the disappearance of a consuming idle class. Multinationals sitting on cash mountains are investing it in China and India, not here. These are all long term structural drivers that no one can do anything about.

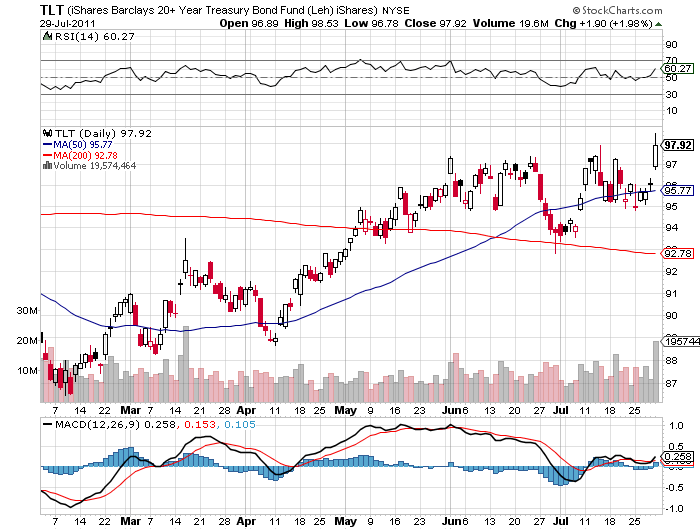

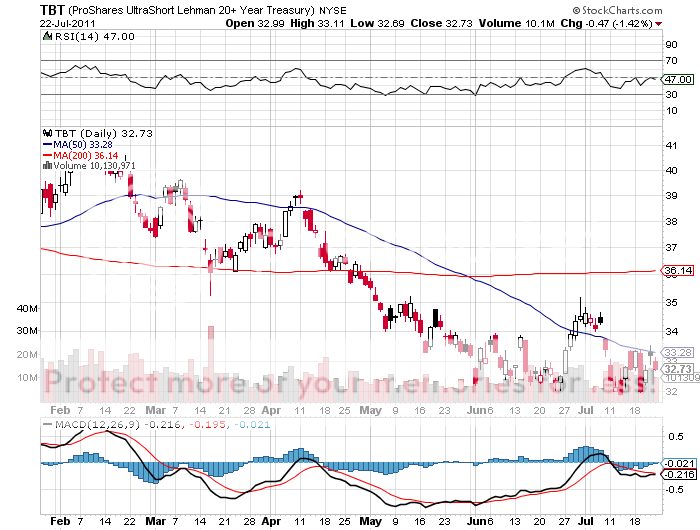

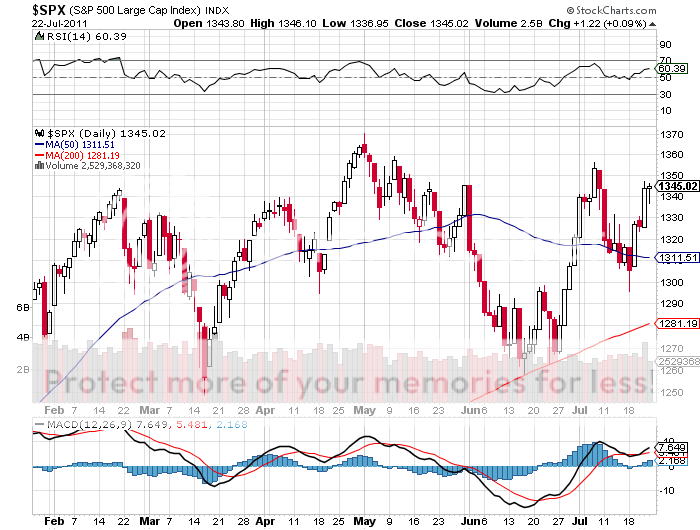

My long term scenario assumes that financial markets peak sometimes next year, about six months before we go into the next recession. Then the next crash ensues. If these GDP figures continue to deteriorate, I may have to move those targets forward.

-

Coming Sooner Than Expected?