'The direction of interest rates is up. There is only one direction in the future and it is up. It's a timing thing,' said Kevin Ferry of Cronus Futures Management.

Featured Trades: (OIL'S BIG PUSH ON CORN), (CORN), (DBA), (ADM), (JJG)

2) Oil's Big Push on Corn. You would think that with oil crisis levitating over $100/barrel and gasoline continuing its relentless march towards $5/gallon, farmers would be wringing their hands, wondering how they can afford the fuel for their machinery. Not so.

The burgeoning demand for energy has spilled over to the corn market, where demand for feedstock by ethanol refiners is going from strength to strength. Nearly 40% of the country's corn crop is being diverted to ethanol production. Margins at the big ethanol producers, like Archer Daniels Midland (ADM), once nonexistent, are now widening rapidly.

I have been a huge bull on the whole food complex since I put out my watershed piece last May (click here for 'Going Back Into the Ags' ). Now that we are into the planting season, you might expect the volatility of food prices generally to increase. There are still drought conditions in many of the world's major producing areas. Stockpiles are near record lows. Much of the unrest in the Middle East is over rapidly rising food prices, where they are huge importers.

Notice that once the S&P 500 bounced, the first thing that traders poured back into were the ags, soaking up ETF's (JJG) and (DBA) as fast as they could click their mice. I think we are one year into a decade long bull market for food, and that investors should be buying every substantial dip in the sector.

-

-

-

-

-

-

Featured Trades: (THE SWORD HANGING OVER THE HOUSING MARKET)

3) The Sword Hanging Over the Housing Market. Some 97% of the financing for the housing market is about to disappear. That is how much bankrupt federal agencies Fannie Mae and Freddie Mac are taking down in loan guarantees to the residential housing market.

Created in the wake of the Great Depression (the last one, not this one), these agencies were created to provide subsidies to the homeowners to revive a moribund market. These agencies entered prime time by accepting the securitization of these loans in 1968.They worked in quite obscurity in Washington for decades, quietly fueling successive postwar real estate bubbles. Much of their debt was sold to foreign investors looking to pick up a small premium over Treasuries.

That was until they went one bubble too far, funding the explosion of borrowing that took place during the early part of the 2000's. In 2004, a deregulation move resulting in the dropping of rules against using government guarantees to finance predatory, high cost lending to subprime borrowers.

It was all over but the crying. Once the market broke, default rates skyrocketed, and it suddenly became abundantly clear that these agencies had been grotesquely underpricing risk for decades. Borrowers starting making claims on their guaranties en masse, wiping out their entire capital. In 2008, the two agencies entered a conservatorship administered by the Federal Housing Finance Agency (FHFA), a de facto bankruptcy.

These lenders have been operating in limbo ever since. Like the other sacred cows of entitlements and defense spending, federal home financing is an issue our leaders would rather keep their heads in the sand over. It is clear they need to be recapitalized. But the chance of this congress, fueled by populist, libertarian fantasies, providing another $100 billion in bail out money for a federal agency is zero. That leaves the possibility that they will be eventually be phased out, leaving the private sector to take up the slack.

What will a fully privatized home loan market look like? Try a lot more expensive. That is where you find the jumbo market, which is already fully privatized, as there was never a government mandate to finance the homes of millionaires.

If you have a FICO score over 750, move all of your assets to you lender, including your IRA, 401k, 529 plan, and all of your securities business, you might get a jumbo loan for a 100 basis point premium over a convention FHA loan under $729,750. If you don't jump through all these hoops and refuse to offer your first born child up as collateral, expect to pay a premium of up to 250 basis points, or 7.5% at today's rates. This is why abandoned McMansions have soared across the land like a great blight, and can be rented for 30% of the cash flow demanded by an outright purchase.

What does this mean for residential real estate prices? I'll attempt some quick, back of the envelop calculations here. Raise the cost of financing by 40%, and you can knock 40% off the value of your property. That is off of today's prices, which are already down 40%-60% from the 2007 peak, depending on your neighborhood.

This will inevitably lead to a secondary banking crisis and another stock market crash. If you are wondering about those Armageddon type forecasts that have the Dow plunging down to 3,000, this is the intellectual foundation behind them. That is when we find out how much freedom really costs.

Rent, don't buy. If the roof leaks, the furnace breaks, and the toilet blocks, you just call the landlord, as I have done with my wonderful new rental here in sunny California.

Damn! Should have Refied When I could

-

Could This Be a Shorting Opportunity?

Featured Trades: (MILLENIAL VOTERS)

3) Watch Out for the Millennial Voter.? I have been banging the table for years now about the importance of demographic trends for the economy, the financial markets, and the housing market. Well, politics is no different, as the table below of Obama's approval rating shows.

Millennials, who are now aged 18-29 (I have three of them) are suspicious of government, have a strong anti-business bias, are opposed to new regulation, are highly conscious of environmental issues, and give the president his highest marks. They also happen to care the least about health care, and put a high value on ethics. We also have learned that they don't bother to vote in midterm elections. This is important because the Millennium Generation surpassed in size 80 million baby boomers last year.

No wonder the last election focused so much energy on Internet campaigning and fund raising. Is the outcome of future elections to be determined by clicks and bandwidth? The data effectively means that the population of liberals is growing, while that for conservatives is shrinking. Politician planners and makers of campaign tchotchke take note.

Age??????????????????????????????? Approve???????????? Disapprove

Millennials? 18-29??????? 60%?????????????????????? 40%

Gen X? 30- 46??????????????? 56%?????????????????????? 44%

Baby Boomers 47-63?? 56%??????????????????????? 45%

Featured Trades: (MY TAKE ON THE EURO), (FXE), (SPY)

1) My Take on the Euro. Entering 2011 as the currency that everyone loved to hate, the Euro has staged a dramatic comeback, much to the chagrin of hedge fund managers and traders alike. Since January, the troubled currency has rallied ten cents from $1.28 to $1.38. Is this the beginning of something big? Or has it shot its wad and headed for a spill?

I vote for the later. The euro is essentially winning the best deck chair on the Titanic contest, the fastest horse at the glue factory, and the prettiest girl at the ugly ball. It's really all about interest rate differentials. At the end of last year, the US economy was growing gangbusters, while Europe was in intensive care. That sent medium and long term American interest rates skyward, while those in Europe languished.

Now the tables have turned. High oil prices are starting to act as a drag on the US, causing economists to rapidly pare back forecasts. Treasury bonds have come back from the dead, bringing the yield on the ten year from 4.70% down to 4.4%. In the meantime, European Central Bank officials have been jawboning the Euro up, threatening interest rate hikes to deal with imagined inflation, no matter that such a policy would be insane to pursue. Hence, we are seeing Euro strength and dollar weakness.

There is another wrinkle to the Euro story here. You would think that high oil prices would be Euro negative, as the continent is a massive importer from that troubled part of the world. But what do Arabs do with the dollars they get for this oil? They buy Euros in order to keep their reserves in a diversified spread. That is why the lurch in crude to $112 in Europe was accompanied by the Euro move to $1.38. This is why the traditional flight to safety bid for the dollar failed to show this time, as it has in all previous oil crises. Some of this spill over buying also explains why the Japanese yen has recently been strong, holding on to the ?81 handle, despite its dismal fundamentals.

How does this party end? US stocks rally once again, US bonds tank, and oil takes a rest, falling well back into the nineties. That could then take the Euro back down to the bottom of its ten dent trading range. A put on the Euro has become a de facto call on US stocks. That's when we test the lower end of the European currency's recent trading range.

-

-

This Party Will Not End Well for the Euro

Featured Trades: (GOLDCORP COINS IT IN THE GOLD TRADE)

3) Goldcorp Coins it in the Gold Trade. I managed to touch base with Canadian miner Goldcorp's CEO, Charles Jeannes, who's stock I have been shamelessly pushing for the last three years (click here). When I last spoke to him two and a half years ago, back when the yellow metal was trading at $950, he made the then outrageous claim that gold would soon break $1,050 to make an all-time high.

Some $450 later, and you never saw a happier man. The company has been aggressively cutting costs, making acquisitions, and disposing of non core assets. This will lead to a production increase of 60% to 4 million ounces a year over the next five years.? Goldcorp is currently extracting the barbarous relic in Canada, the Dominican Republic, Guatemala, Mexico, Argentina, and the US. Both physical and investment demand are soaring. This will continue, as all the gold and gold backed instruments in the world only add up to 1% of global financial assets.

Goldcorp's average cost is $274/ounce, giving it elephantine profit margins that enabled it to bring in a net $791 million in profits last year. Costs are growing at 6% a year, well below the 15% industry average. The company just doubled its dividend. Talk about a license to print money.

I have been a huge bull on gold since I put out my call to buy it more than three years ago at $800. While I continue to believe that we will steadily appreciate in coming years to the old inflation adjusted high of $2,300, I also think the glory days are behind us. We'll probably only see single digit, or small double digit annual returns getting us there. My only trading play this year was on the short side, which proved immediately profitable. That is on par with high yield junk bonds or distressed muni bonds, but nothing like last year's blistering 28% appreciation.

-

-

No Need to Massage the Profits Here

(SPECIAL $100 OIL ISSUE)

Featured Trades: (MY VICTORY LAP ON OIL)

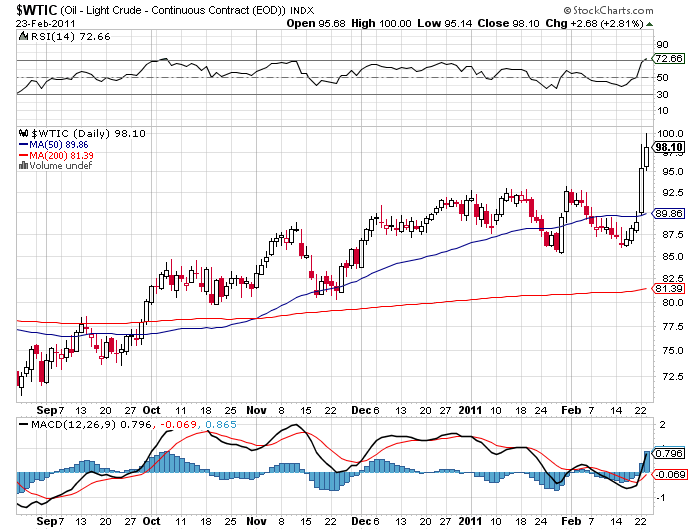

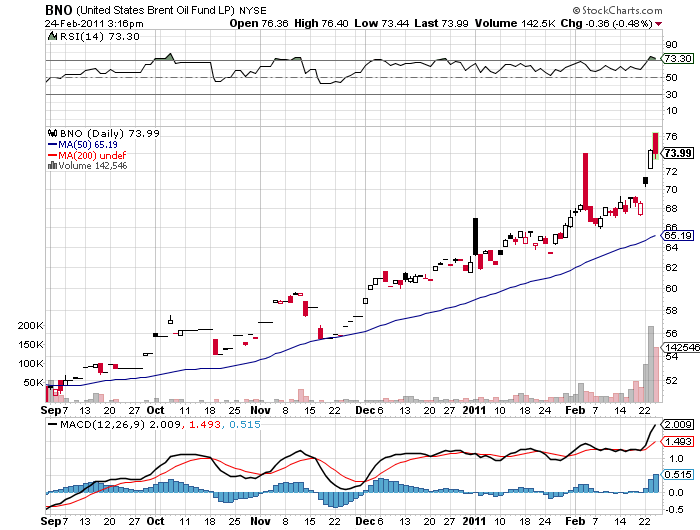

2) My Victory Lap on Oil. One of the boldest predictions that I made in my January 6 asset class forecast for 2011 was that oil would soon hit $100/barrel (click here for the link). My precise words were 'Probably $30 of the current $90 price reflects monetary demand, on top of $60 worth of actual demand from consumers. That will help it grind to $100 sometime in early 2010, and we could spike as high as $120.'

OK, I got the 'grind' part wrong. As it turns out, we have rocketed $18 in a week to a high of $103.40. Brent is up $28 this year. When I made this prediction,? I received tanker fulls of abuse, citing the glut of crude in storage at Cushing, Oklahoma, a slow US economic growth rate, a full strategic petroleum reserve, rapidly progressing conservation measures, and the threat posed by a newly discovered domestic 100 year supply of natural gas. In any case, alternative green energy sources will soon be replacing oil.

Well, there is only two days' worth of supply at Cushing, and they're full because the Canadian tar sands companies have been bringing new supplies on stream. The economy grew at a 4% rate, rather than the 2% many thought. Natural gas is nice, but it will take ten years of infrastructure building and deregulation before it starts to compete with oil. I can assure you that not a drop of SPR is coming on to the market. And alternatives are not going to be making a dent in our energy mix any time soon.

What is my just reward for this call? With gasoline well on its way to $5/gallon, my all-electric Nissan Leaf is looking pretty good, even if delivery has now been pushed back to May.

-

-

Featured Trades: (THE TRUE COST OF HIGH OIL), (OIL), (USO)

1) The True Cost of High Oil. Economists are furiously downsizing their economic growth forecasts for 2011 in the wake of the oil price spike, both for the US and for the world at large. Since last week, West Texas crude prices have soared $12 from $86 to $98. Each $1 increase in the price of oil jumps gasoline prices by 2.5 cents. Each one cent rise in the cost of gasoline takes $1 billion out of the pockets of consumers.

If oil stays at this price, it removes $30 billion from the pockets of consumers. At $110/barrel, it short changes them by $60 billion, or? 41% of GDP. If you wonder why hedge fund managers have lurched into an aggressive '?RISK OFF' mode, are throwing their babies out with the bathwater, and why the volatility index is spiking to three month highs, this is why.

-

-

-

Featured Trades: (HOW FAR WILL THE MARKETS FALL?), (VIX), (SPX), (SPY)

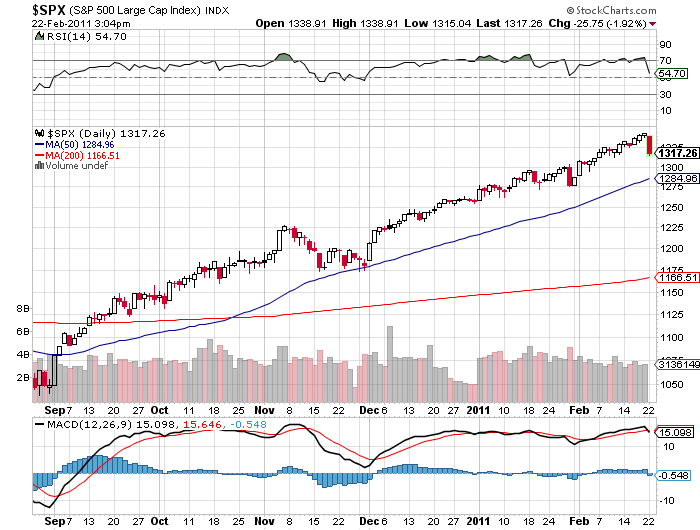

2) How Far Will the Market Fall? Now that we are solidly in 'RISK OFF' mode, traders, managers, and investors are asking how much downside we are looking at. It is safe to say that those who were piling on longs with reckless abandon are now potentially staring into the depths of a great chasm. I have included charts below showing the important Fibonacci support levels. Let's take a look at how far down is down.

*1,300 '? The first big figure. Already broken intraday, but it held the first time.

*1,286 '? The 50 day moving average, the no brainer, most bullish target. The 'buy the dip' crowd takes a first bite here.

*1,280 '? 38.2% Fibonacci support level.

*1,260 '? 50% Fibonacci support level.

*1,230 '? Broken resistance from the November high. Europe blows up again. Take your pick: Spain, Ireland, Britain, Portugal'?

*1,167 '? The 200 day moving average. It must hold for the bull market to stay intact. This is where $5/gallon takes us. Double dip recession talk reemerges. The 'buy the dip' crowd takes a second bite.

*1,117 '? The November low. The 'buy the dip' crowd throws up on its shoes and pukes out the last two 'buys'. We spike down, triggering another 'flash crash.'

*1,000 '? The next really big figure. Ben Bernanke, with the greatest reluctance, announces QE3. Bond prices soar, taking ten year yields to 2%. Homes prices collapse again, triggering a secondary banking crisis.

*666 '? The Saudi regime falls, and 12 million barrels a day disappears from the market for the indefinite future. Unemployment hits 15%. Obama is toast. Your broker turns bearish and tells you to sell everything. Welcome to the Great Depression II. It starts raining frogs.

-

-

But Will He Bounce?

Featured Trades: (S&P 500 IS CRUISING FOR A BRUISING)

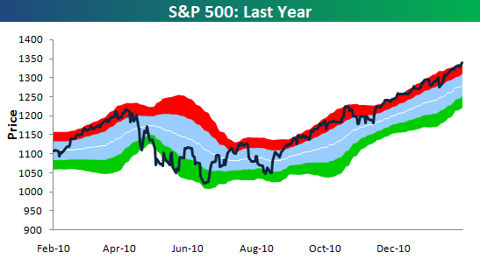

2) The S&P 500 is Cruising for a Bruising.? How overbought is the stock market? My friends at the Bespoke Investment Group produced this chart of the S&P 500 showing that it has remained in nosebleed territory for nearly six months now, except for a few fleeting months in November. This is why many hedge fund managers have been tearing their hair out, become addicted to Maalox, or are contemplating going into the restaurant business, especially if they have been playing from the short side for the past six months. It has been such a straight line move that it hasn't allowed many traders in.

The light blue area in the chart represents one standard deviation above or below the 50 day moving average, which yesterday was at 1,284.? The red area shows where the market is more than one standard deviation above the average, while the green is more than one standard deviation below. Not only that, each individual sector in the (SPX) is overbought, with consumer discretionary, materials, and energy the most overbought.

Just to reach the nearest oversold area, the market has to drop to 1,240, down 100 points, or 7.5% from last night's close. Just thought you'd like to know.

-

-

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.