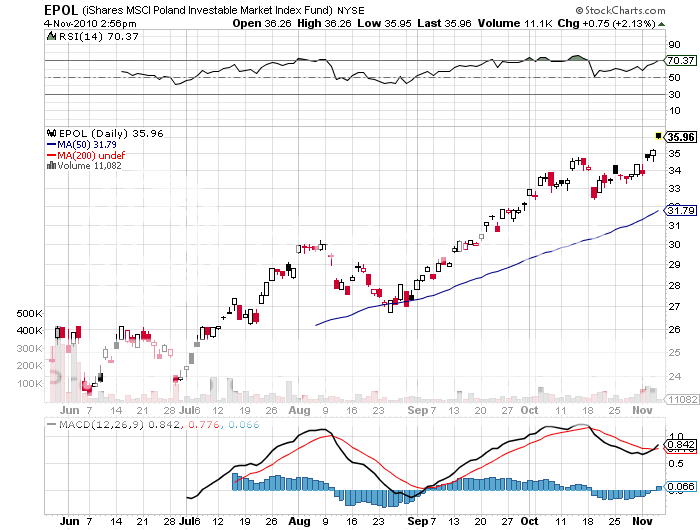

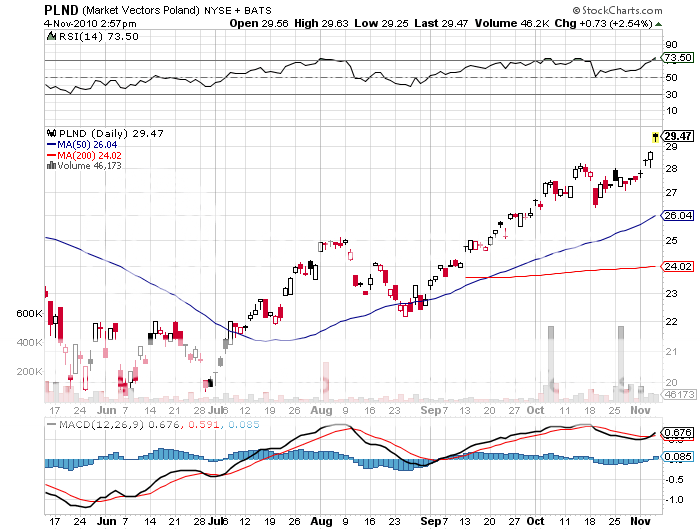

Featured Trades: (POLAND), (PLND), (EPOL)

2) Where to Play QEII in Europe. In one of the worst timed ETF launches of the year, Van Eck brought out the Market Vectors Poland ETF (PLND) in November, 2009, just on the eve of the Euro collapse. iShares followed with their MSCI Poland Investable Market ETF (EPOL) at the end of May. Since then, it has been off to the races.

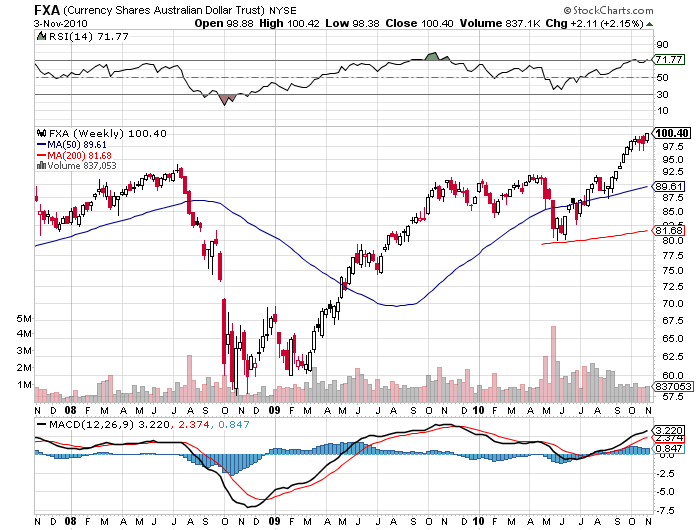

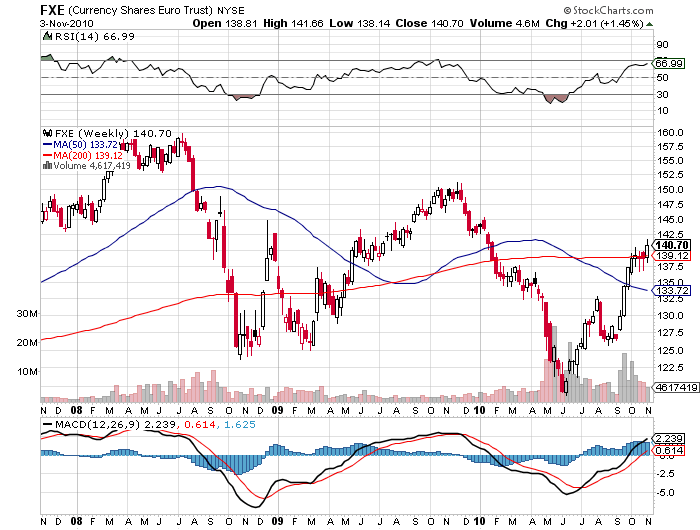

Poland is one of Europe's own emerging markets, and its close links with the German economy will enable it to ride the coat tails of any future economic recovery. Take the euro to parity against the buck, which could happen in the next substantial dollar rally, and you have the makings of a massive export boom down the road to the Fatherland.

Poland also sits on a gigantic coal bed, and with its weak environmental regulation, will make it ground zero for importing American 'fracting' techniques to unleash massive natural gas supplies.

The coming collapse of the Euro, the world's most despised currency, means that down the road, Poland can ditch the Zloty and join the European Community at a highly favorable exchange rate.

My Euro maven ex-Economist colleague, Vivian Lewis, of the daily Global Investing letter (click here for her site at http://www.global-investing.com/ ) also says that the country is embarking on a privatization program that will sell off relics from its communist past at discount prices. When the United Kingdom did this during the eighties, everyone, including myself, made a fortune.

As long as QEII is alive and well, you can load up on Poland and sleep like a baby.

I've Got Poland in My Portfolio