(SPECIAL ELECTION ISSUE)

Featured Trades: (CVX), (XOM), (COP), (BP), (RIG), (DO),

(BTU), (JOYG), (SHAW), (CCJ), (DVN), (CHK), (FSLR),

(NOC), (GD), (ZMH), (UNH), (HUM), (PFE), (DV), (STRA), (COCO),

(TBT), (TMV)

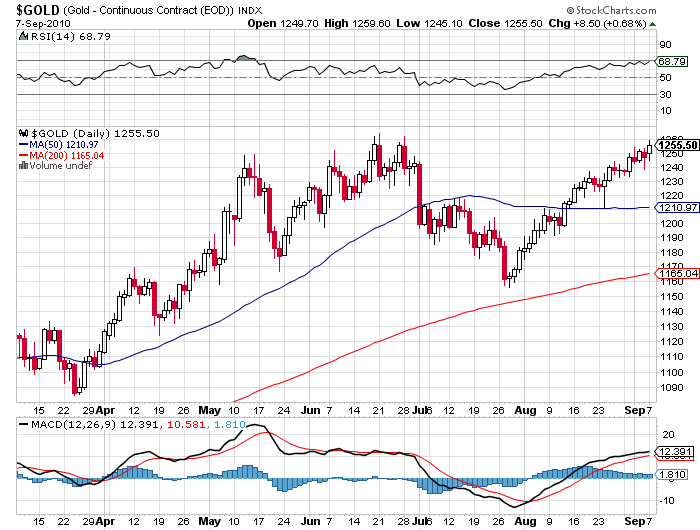

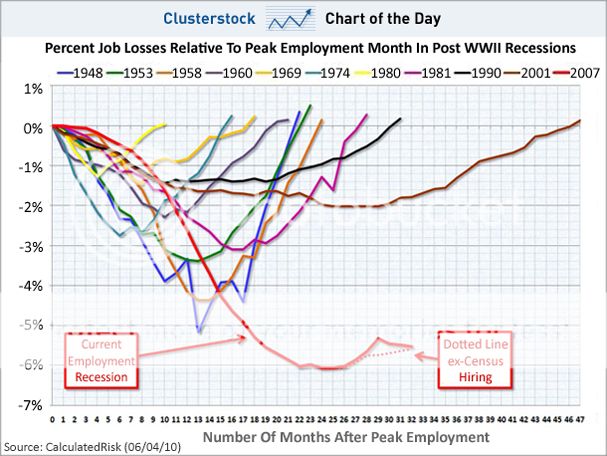

3) The Republican Portfolio. Let's say I'm all wrong, and the Republicans take everything in November, what will it mean for your portfolio?? This is an easy call to make. Expect a dramatic roll back of the leftward policies the country has adopted over the last two years, and a sudden revival of the industries that have suffered as a result. In fact, if you look at the charts below, many of the stocks I am suggesting have already started to discount a conservative win.

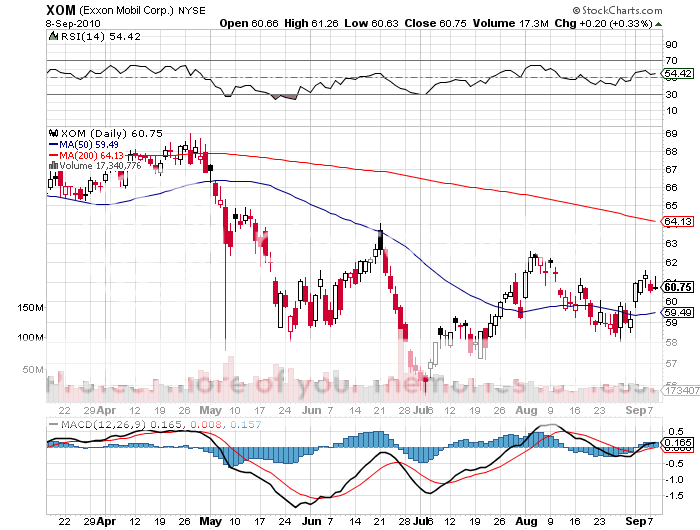

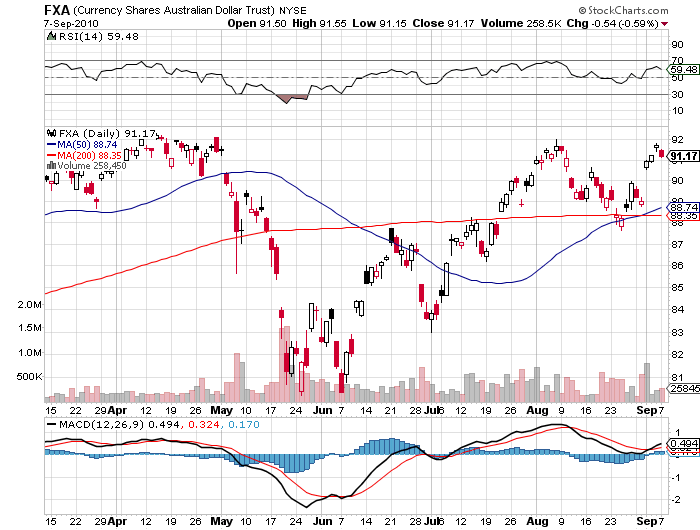

Big oil companies will be huge winners. American oil imports from the Middle East will accelerate, where the industry earns 80% of its profits. That will bring peak oil sooner, easily taking crude over $100/barrel quickly, and eventually to $150 or $200. Restrictions on both onshore and offshore drilling will get rolled back to their Bush era laissez faire levels, cutting costs and boosting profitability. You want to own Chevron (CVX), ExxonMobile (XOM), Conoco Phillips (COP), and of course, BP (BP). The drilling and service companies, like Transocean (RIG) and Diamond Offshore (DO), should do spectacularly well.

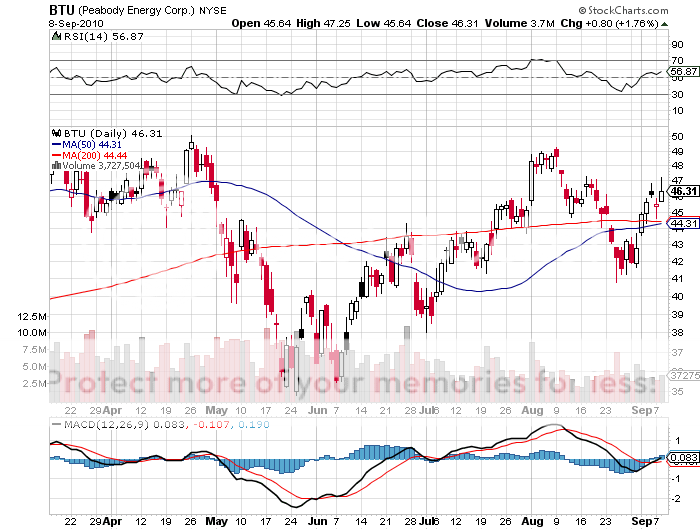

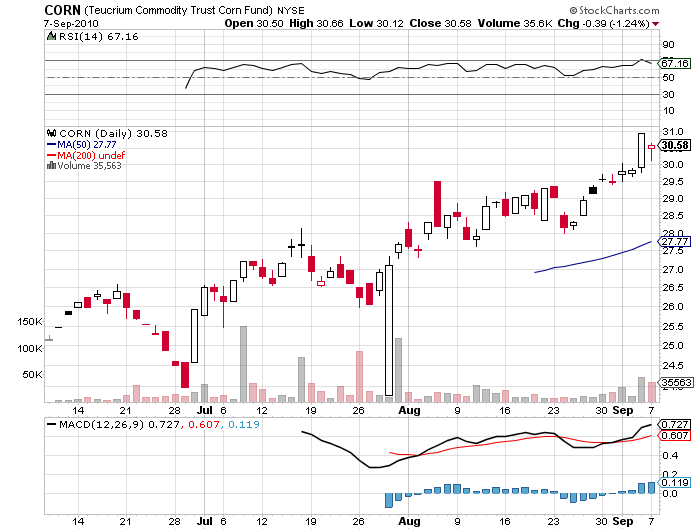

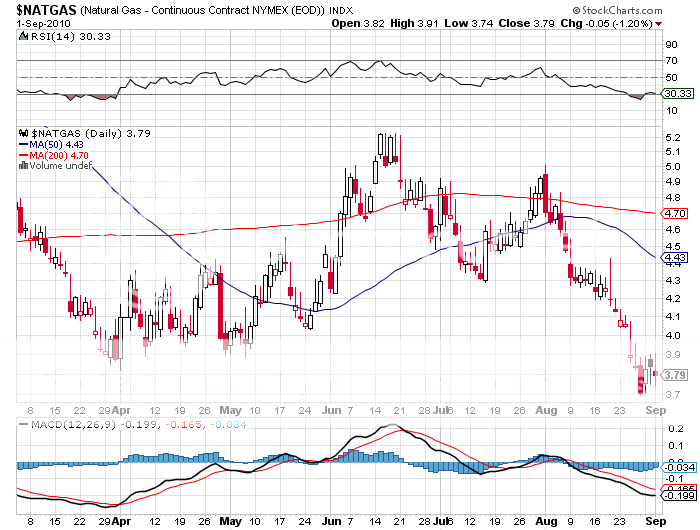

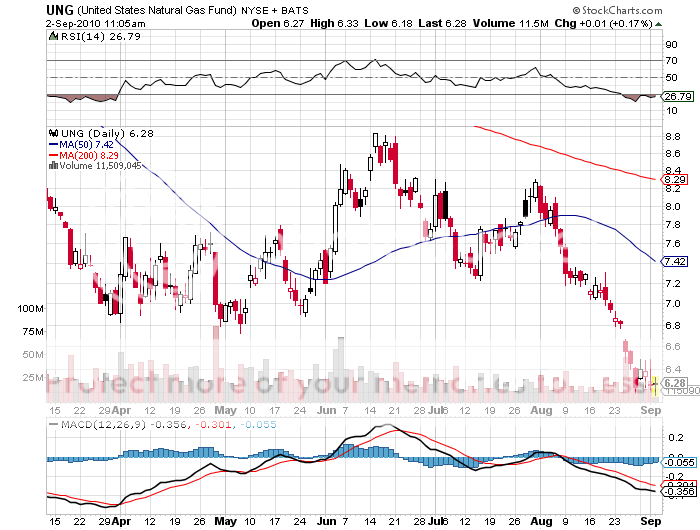

Coal will benefit immensely from relaxed environmental regulation, paving the way for more exports to China. You want to own Peabody Energy (BTU) and Joy Global (JOYG). Nuclear Energy is a big beneficiary here, which should drive you into Shaw Group (SHAW) and top uranium producer Cameco (CCJ). Forget about natural gas companies, like Chesapeake Energy (CHK) and Devon Energy (DVN). Relaxed environmental controls will stonewall restrictions on the new fracking technology that is unleashing huge supplies on the market, driving prices for CH4 to the basement.

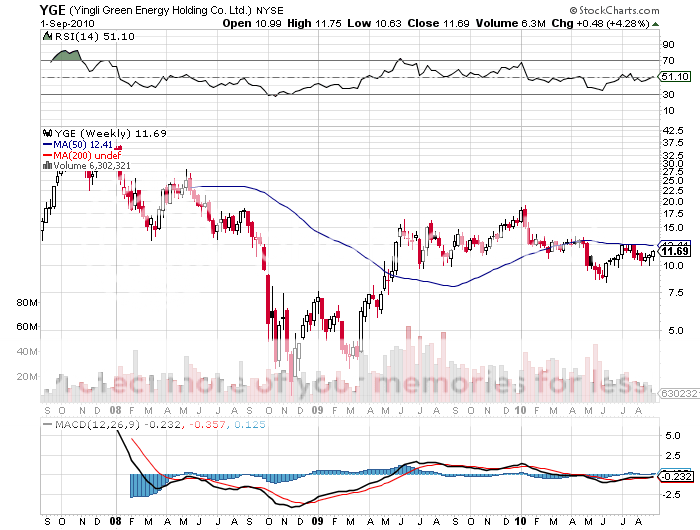

You can count on subsidies for alternative energy to get axed as unaffordable luxuries, which have created 500,000 jobs in California alone in the past two years. After all, global warming is nothing more than a leftist hoax, right? The good news is that the higher oil prices Republican policies are guaranteed to bring means that green companies of every stripe will become profitable in their own right, making subsidies unnecessary. Remember, Bush policies took crude from $20/barrel to $150, topping up the Strategic Petroleum Reserve at the absolute top. Buy First Solar (FSLR) on the knee jerk sell off after the election.

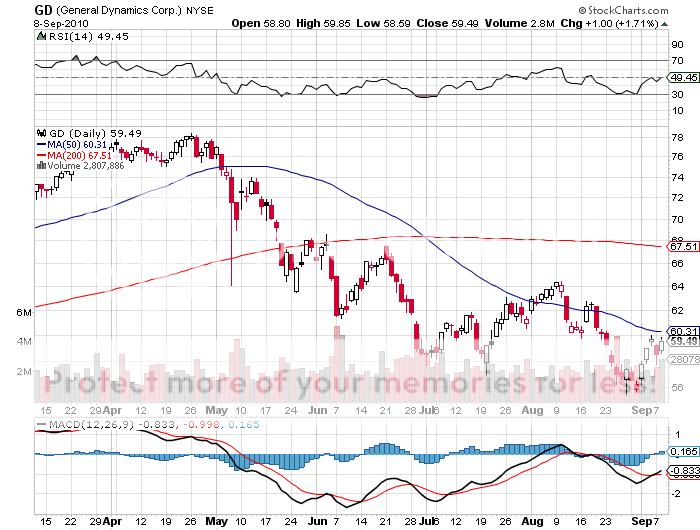

The Republican portfolio should also have a heavy weighting in defense companies, as an expanded war against terrorism means we will be fighting more wars in more places for longer. Any shopping list should include Northrop Grumman (NOC) and General Dynamics (GD). Also prospering mightily will be the makers of prosthetic limbs for the military, like Zimmer Holdings (ZMH).

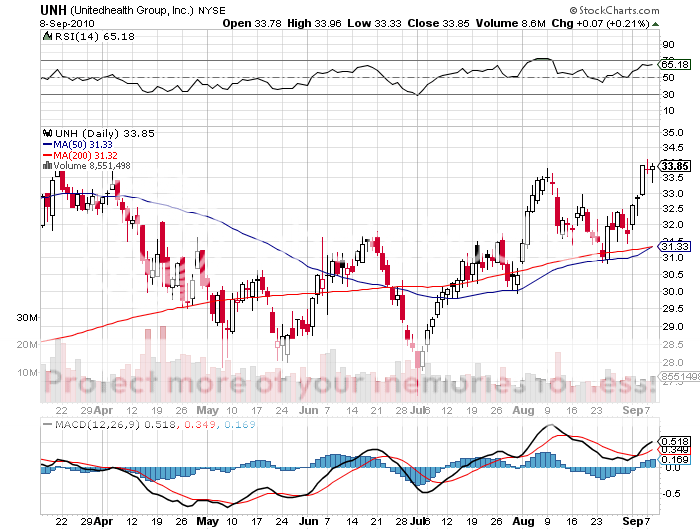

Health care is a natural. It is unlikely that we could see a complete abolition of Obama care until 2016 at the earliest. But a Republican win in the House would eliminate the possibility of any expansion of socialized medicine. Health care companies like United Health (UNH), Humana (HUM), and Pfizer (PFE) will do well.

The government's war on for profit education will grind to a complete halt (click here for my last piece). With a tidal wave of government subsidized loans to the industry assured, and hapless students stuck with the bill, companies like DeVry (DV), Strayer Education (STRA), and Corinthian Colleges (COCO) will rocket.

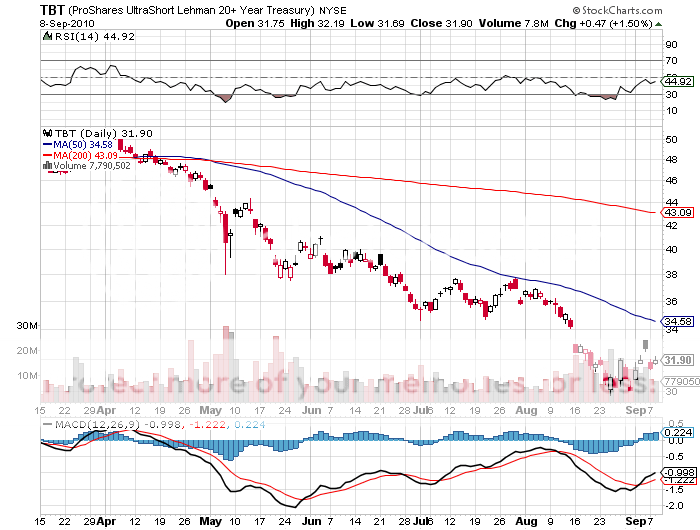

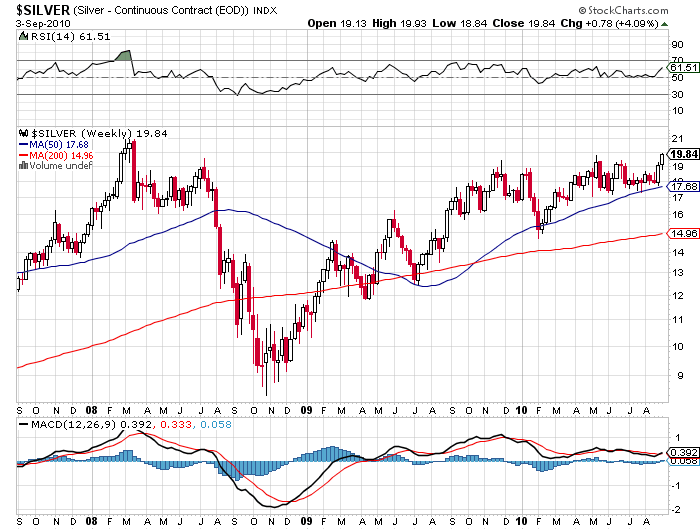

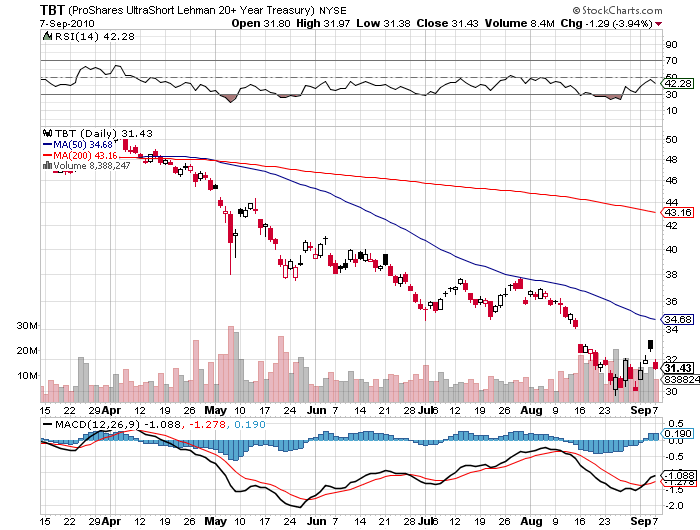

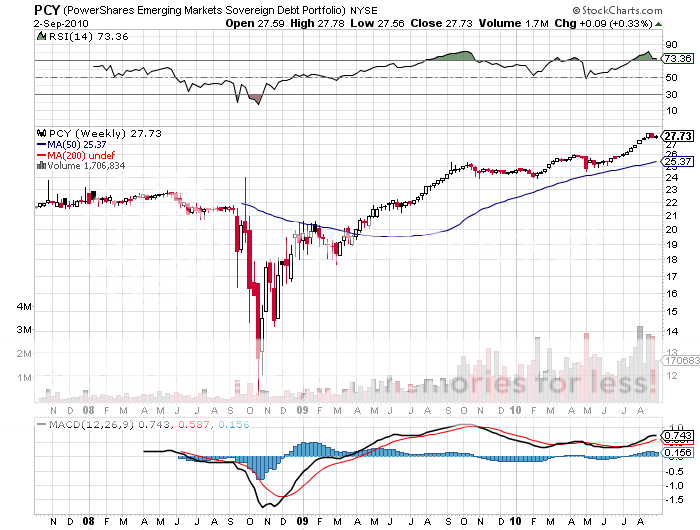

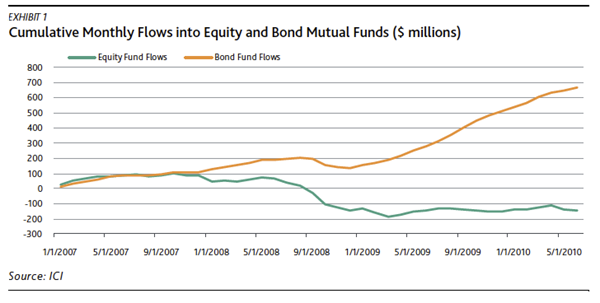

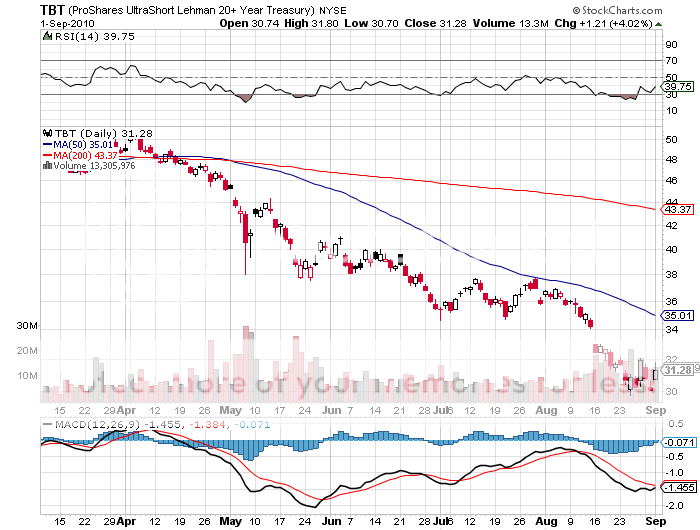

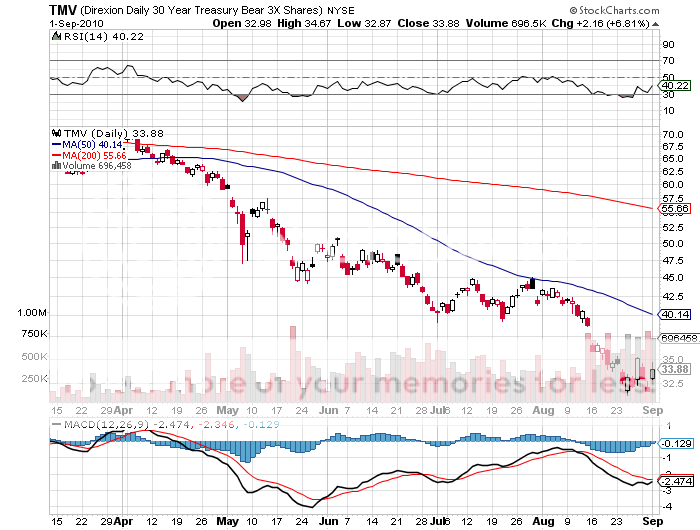

Major tax cuts for the top 2% of income earners costing $700 billion over ten years and more loopholes for corporations pared with increased defense spending promise to send deficits through the roof. That will last bring an end to the 30 year bull market in Treasury bonds, which are teetering as I write this. The double short Treasury ETF (TBT) and the triple short (TMV) will have to be a core holding in any long term portfolio.

As the two parties are diametrically and violently opposed to each other on virtually every issue, the impact of a regime change on the economy and the markets promises to be huge. I could write on this for days, so these are just the high points.

Meet the Republican Portfolio