Featured Trades: (JULY NONFARM PAYROLL)

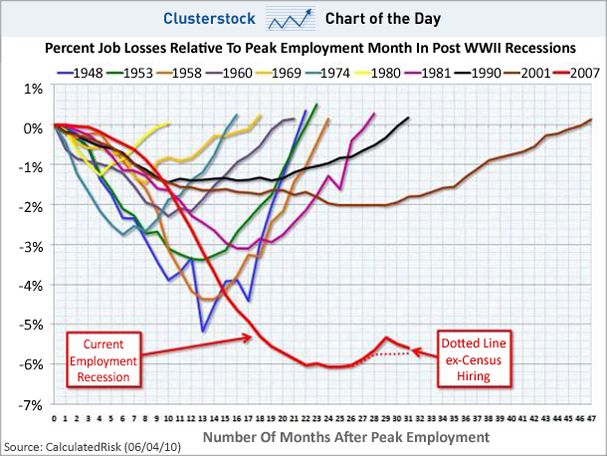

1) Job Creation is Still on Vacation. If I have learned one thing from 40 years in the financial markets, it's that traders demand instant gratification. So when the July nonfarm payroll showed a loss of 131,000 jobs, an unchanged unemployment rate at 9.5%, and total unemployment of 14.6 million, you can count on them to head for the exits.

You can blame the government, as usual, which chopped 202,000 jobs, including 143,000 census workers. The state and local governments are emerging as a big problem, which cut 50,000 jobs, including 38,000 teachers, and are shoveling money out of the economy faster than the feds can shovel it in. Just when our leaders are pointing to education as our economic salvation, we are packing 45 kids into classrooms with broken computers, missing textbooks, and depleted teaching supplies. Should I be surprised that the girl in my local FedEx office doesn't know that Tokyo is in Japan?

The scary thing is that the drag from the states and municipalities is a long term structural issue that has only made a few halting baby steps towards solution. In terms of management efficiencies and pension benefits, they are about where corporations were in 1980. Decades of cutting and reorganization are ahead of them. Some analysts see 250,000 in further cuts from them just in the next 18 months.

Of course companies don't want to hire in front of a diminished long term GDP growth rate of 2% which I have been advertising ad nauseum in these pages.? Just emerging from the near death experience of the century, they will only hire a few temps which they can jettison at the first sign of trouble. What's the point of ramping up production when there are no new customers? This is why we saw a pitifully small increase in private sector jobs from 31,000 in June to 71,000. Forget about uncertainty. That is the political red herring of this election year.

I think we are suffering from permanent unemployment at the current levels, much like Germany saw in the eighties and nineties. If you are out of this economy, you are out for good, not exactly inspirational news for business. There is nothing either political party can do about this but blame each other, which we will hear a lot of in coming months.

My pet solution is for the government to borrow $1 trillion for ten years at the current, impossibly low interest rate of 2.88% and rebuild our entire aging, dilapidated interstate system. When I drive across the Oakland Bay Bridge into San Francisco it is a little disconcerting to see the blue water below shimmering through the cracks in the road. Using conventional multipliers, this would create 35 million jobs heavily weighted at the blue collar end of the skill spectrum where we need them the most. These jobs can't be exported to China, and all 50 states will be in for some serious dosh.

This is an easy, efficient way to solve our employment nightmare. It is affordable, as it would only add $28.8 billion to our budget deficit, mere pocket change these days.? I therefore don't ever expect the idea to see the light of day.