Featured Trades: (STRATEGY LUNCH)

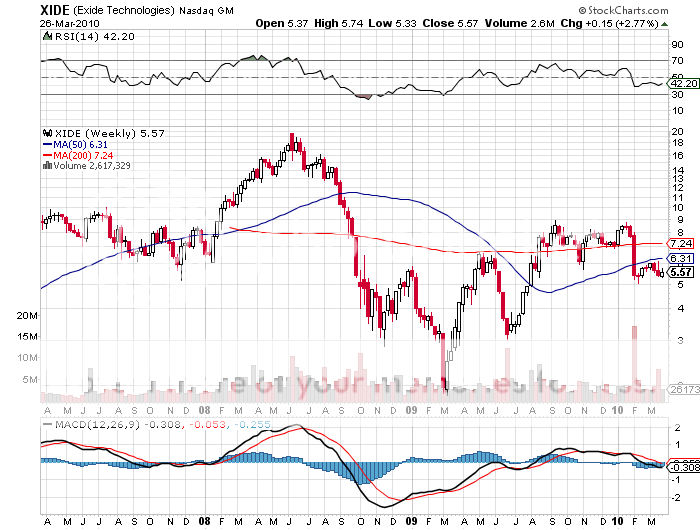

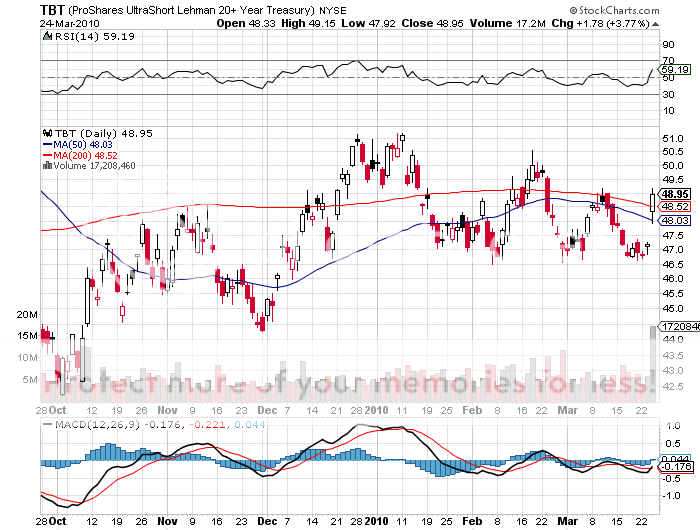

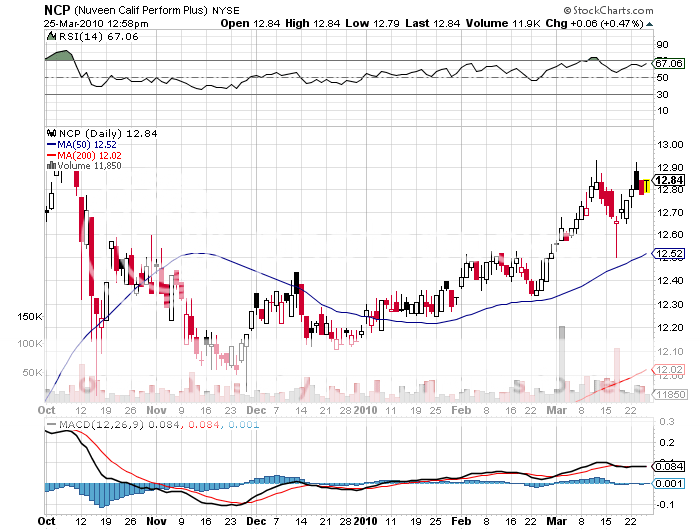

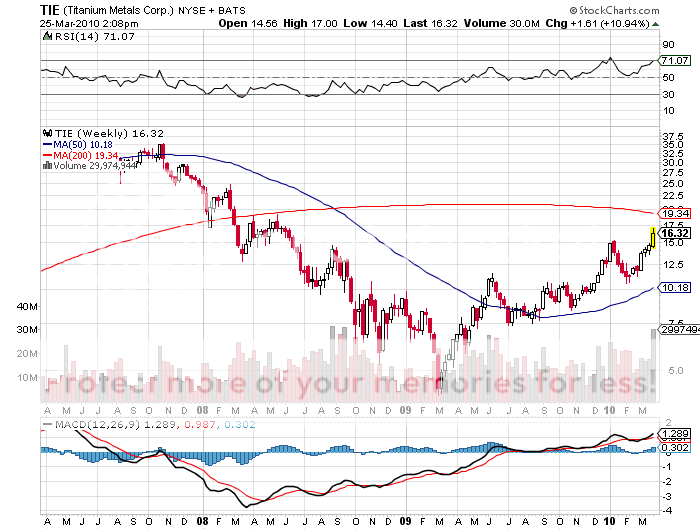

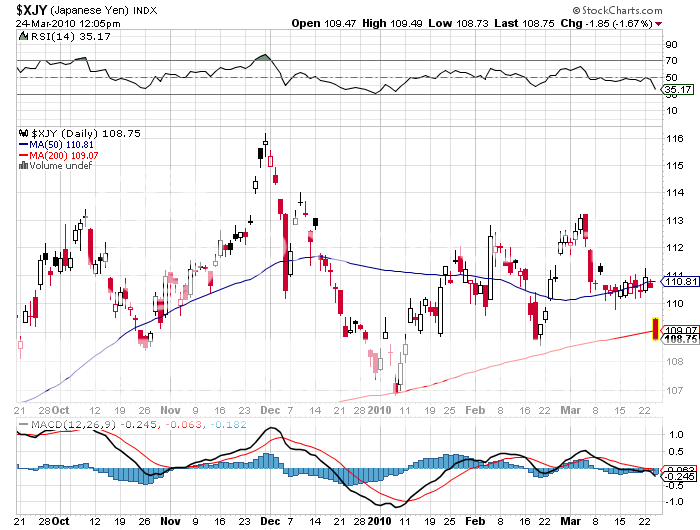

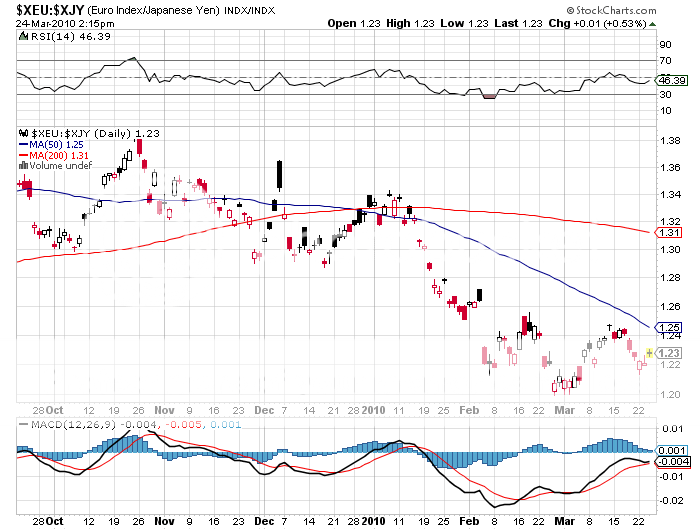

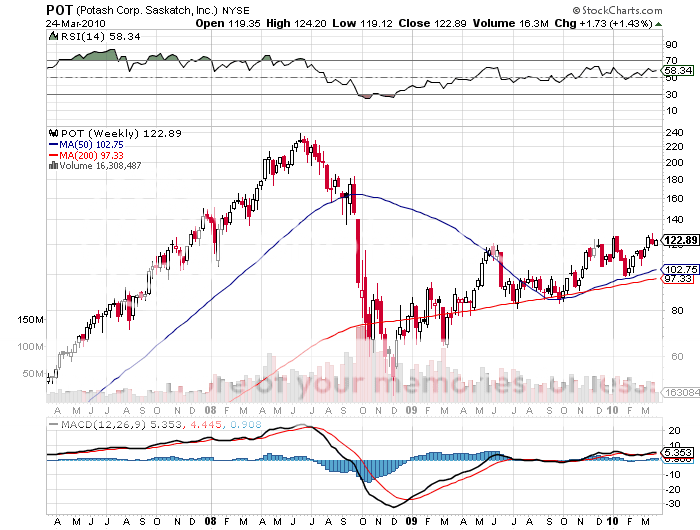

1) Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in a number of venues around the country this year. The first two will be held in San Francisco on April 23, and in New York on May 7. A three course lunch will be followed by a 45 minute PowerPoint presentation and a 30 minute question and answer period. I?ll be giving you my up to date view on stocks, bonds, currencies commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Premium tickets are available for $250, and standard tickets for $95. I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The San Francisco lunch will be held at 12:00 noon on Friday, April 23, at the Marines? Memorial Association. The club can be found at 609 Sutter Street, San Francisco, CA 94102. For visitors from out of town, I have reserved a block of rooms at the Marines? Memorial Association, which is an excellent four star hotel only two blocks from the city center at Union Square and the cable cars. They are available at a special member?s discounted rate of $169 for weekdays and $179 for weekends.

The New York lunch will be held at 12:00 noon on Friday, May 7, at the New York Athletic Club. The club can be found at 180 Central Park South, New York, NY 10019.

I look forward to meeting you, and thank you for supporting my research.