The Next Digital Arms Race is Here

The arms race for digital content is on and the next leg of the race is all about podcasts.

Wasn’t it just a few years ago that nobody listened to podcasts but kids?

Well, the surge in popularity recently has been nothing short of unfathomable with podcast personality of the stars such as Joe Rogan raking in 190 million downloads per month.

The "off the beaten path" media vehicle has exploited holes left by legacy media and the numbers back me up.

The tech world has taken note of this growing trend with reports that Apple is preparing to double down on original podcast content, purchasing shows that would become exclusive to its Apple platforms.

Apple (AAPL) would most likely try to sync new podcasts with Apple TV+ content and eventually cross-pollinate the video-streaming service.

Nothing has been as catchy as Spotify’s deep investments into the podcast world with $700 million combined for Parcast, Gimlet, Anchor, The Ringer, and The Joe Rogan Experience exclusivity.

Investors have rewarded Spotify for their aggressive strategy and shares are now trading over $190, up from $110 just a few months ago.

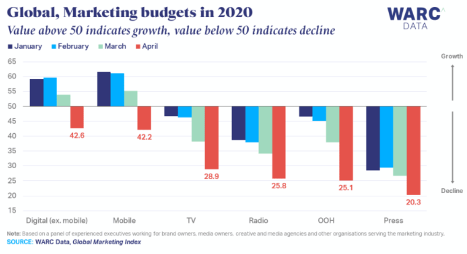

Spotify is all about the digital ad model and the coronavirus pandemic has shown us that TV ads are in a death spiral with ad companies like Facebook (FB) and Google (GOOGL) holding up the digital ad stakeholders.

I will say that the loss of Joe Rogan to YouTube is painful for Alphabet and they could likely continue to bleed big accounts until they cough on the money to buy premium content for itself.

Certain content is worth paying the premium for exclusivity or even overpaying for like a top-five NFL quarterback and podcasts are the new battleground to reach the populace who are fed up with sanitized legacy media who have been throttled by the U.S. culture wars.

“The Joe Rogan Experience” is the top podcast in America in terms of listeners and cultural influence and its over 300 million base is a massive win for Spotify (SPOT).

Rogan has leaped to great heights by interviewing guests like Tesla’s Elon Musk and smoking weed with him on set.

Amazon (AMZN) is reportedly looking for burgeoning podcast talent to fuse with its smart speaker assets.

No doubt the big boys are readying the bazookas.

I believe we are about to see the cornering of all popular podcast shows and the data backs up this strategy for big tech who will most likely become buyers because of their deep pockets.

Over 37% of the U.S. population devour podcasts at least once a month, or 104 million people.

Popular podcasts are ad revenue bell cows.

For instance, Rogan advertises directly to his audience and has brands backing him such as 23andme, Blue Apron, Square’s Cash App, Casper, Dollar Shave Club, Postmates, and Quibi.

The number of monthly podcast listeners jumped 16% in the last year and has doubled since 2015.

Over 55% of monthly podcast listeners are between ages 12 and 34 meaning the content is influential to the daily discourse of popular culture and an incubator of trend formation.

Barstool Sports has more than 30 podcasts and is a top 10 U.S. podcast publisher, with more monthly podcast listeners than sports channel distributor ESPN.

Podcasts are here to stay and the industry’s best will gravitate towards the most lucrative offers.

It doesn’t matter what platforms want to host them because their giant audiences will follow.

After Spotify’s buy of Rogan’s podcast, Apple, Facebook, Google, and Amazon must be contemplating their next move.

The reason we promulgate trades in big tech is because of their nimbleness in adapting their revenue models to the revenues drop off points.

The acceleration of entrenched trends like cord-cutting and digital media adoption offers a great boost to digital products like podcasts.

In the past quarter, legacy media has lost another 2 million subscribers representing a 6% loss.

Keeping tabs on who scoops up the best podcasts will be a lead indicator in who is harnessing funds to secure the best digital content.

My guess is that it is big tech and they will only become more diverse and powerful.