Do the Roomba

You thought you could close the front door and be at peace – wrong.

You thought you could hide under the bed – wrong.

How about speaking freely in your house – triple wrong.

Whether it’s Google Nest Doorbell videoing your front porch or Amazon’s Alexa recording every sound from your kitchen, the data serpents are here to slurp up consumer personal data at a level we have never seen before.

Then when we thought it could go no further, bam!

Hit with another “Device” tracking our whereabouts and that sums up Amazon.com (AMZN) gobbling up a maker of robot vacuum cleaners IRobot Corp (IRBT).

Perhaps CEO of Amazon Andy Jassy can figure out how to train the robot vacuum cleaner to drop individual packages from the front door to the bedroom.

We need this type of innovation in Silicon Valley!

How would that happen?

Well, it basically acquired a mapping company. To be more precise: a company that can make maps of your home.

The company announced a $1.7 billion deal on Friday for iRobot Corp., the maker of the Roomba vacuum cleaner. And yes, Amazon will make money from selling those gadgets. But the real value exists in those robots’ ability to map your house.

This reinforces that data is the new oil.

Monopolizing the smart home is the holy grail for Amazon.

Its Echo smart speakers still outsell those from rivals Apple and Google, with an estimated 9.9 million units sold in the three months through March.

It’s followed that up with a $1 billion deal for the video doorbell-maker Ring in 2018, and the wifi company Eero a year later.

But you still can’t readily buy the Astro, Amazon’s household robot that was revealed with some fanfare last year, is still only available in limited quantities. That, too, seemed at least partly an effort to map the inside of your property, a task that will now fall to iRobot. The Bedford, Mass.-based company’s most recent products include a technology it calls Smart Maps, though customers can “opt” out of sharing the data. Amazon will get your data – mark my words they will some way and somehow.

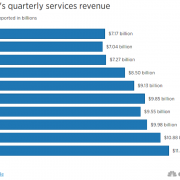

What’s more, the acquisition looks like peanuts for eGiant which had $61 billion of cash at the end of June. The $1.7 billion deal represents a 22% premium to iRobot’s share price before the deal was announced. Less than a year ago, iRobot was valued at $2.5 billion. And it won’t take much to cover the target’s cost of capital. Its predicted profit may only be about $78 million next year, but it also has sales, marketing, and administrative costs of $389 million, a number that Amazon can surely bring down by pumping the products through its existing sales channels.

This deal represents a drop in the bucket for cash-rich Amazon.

As geopolitics mixes with stagflation elements, it’s easy to see how certain companies fall through the cracks.

Amazon is ready to scoop every smart home company and paying 22% premium for a $1.7 billion valuation is a chump change for AMZN.

As dip buyers come out of the woodwork, it’s hard to think that the bottom isn’t in.

The risk rewards favor tech stocks to the upside in what Fed officials have claimed is a “strong” economy and one that is certainly not in recession at all.

Buy every substantial dip in every one of your favorite stocks from here on out. You might be risking 10%-20% over the short term but gain 100% on a three-year view.