Not the Sexiest Tech Stock -- But Highly Reliable

Readers of this tech letter know that I have been wildly bullish on ecommerce company eBay (EBAY) precisely when vulture hedge fund Elliot Management acquired it in January 2019.

Alongside fellow activist fund Starboard Value LP, Elliott pressured eBay to revamp its operations. At their urging, the company pledged to sell off its Stubhub ticketing and its internationally-focused classifieds businesses, and replace its CEO.

My recommendation was spot on, and shares are up 220% since Elliot forced massive changes to first, the crappy management, and second, to the business model.

Luckily, those changes have staying power as Elliot exited their investment at the end of last year at then — all-time highs.

Elliot’s legacy will inherently be one of turning around eBay into what it is now, and I write to you today to say that eBay is coming into its own even after Elliot’s exit.

It’s not only about discontinued legacy tactics that led to low value, infrequent or one-and-done buyers.

Such an unsustainable strategy makes you want to tear your hair out.

But now, a fledgling buyer base is starting to evolve based on a re-optimized strategy.

These high-volume buyers are growing compared to a year ago and their spend on eBay is growing even faster.

This higher-quality mix of buyers increases value for sellers and will lead to improved health of eBay’s ecosystem over the long term.

Payments and Advertising initiatives continue to deliver a simpler product experience and meaningful benefits for sellers, buyers, and shareholders.

Managed Payments is now live in every market globally, and the transition is progressing faster than expected.

eBay management is now driven via a multiyear journey to become the best global marketplace for sellers and buyers, through a tech-led reimagination.

Their priorities are to grow the core, become the platform of choice for sellers, and cultivate life-long trusted relationships with buyers, by turning them into enthusiasts.

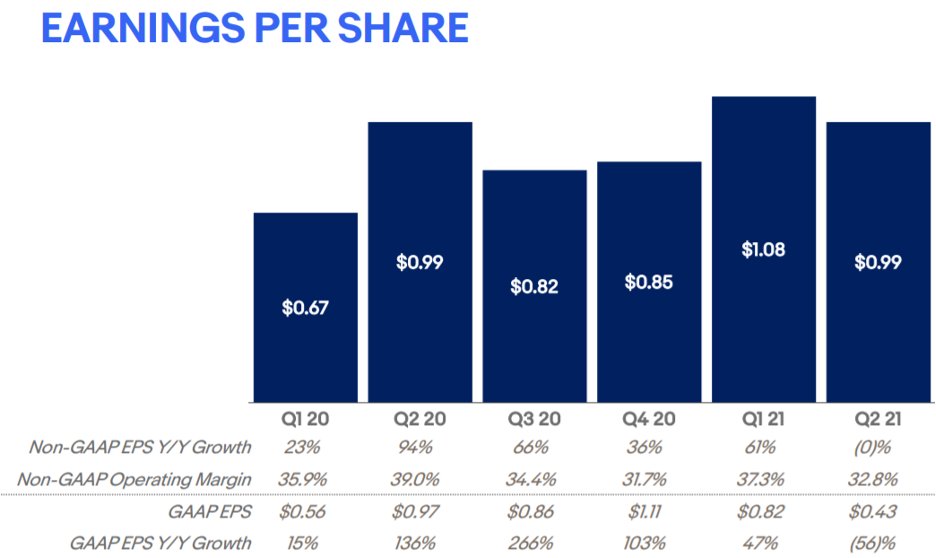

They finally completed the transition of eBay's Classified business, which was initiated by Elliot, to Adevinta.

This deal was originally valued at approximately $9.2 billion, but a closing in June had appreciated to $13.3 billion.

In June, eBay announced the sale of over 80% of their Korean business to Emart for approximately $3 billion, bringing together two leading e-commerce and retail companies that can unlock significant potential in Korea.

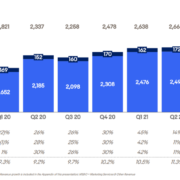

Revenue grew 11% driven by the acceleration in the Payments migration and advertising growth.

Luxury watches are also sustaining double-digit growth. Improved buyer trust is leading to strong cross-category shopping behavior similar to what eBay has experienced in sneakers. The next luxury category eBay is focused on is handbags.

They also expanded the My Garage feature to Canada, Italy, France, and Spain, which allows buyers to store their vehicle data, leading to a more tailored shopping experience. eBay plans to launch more technology-driven innovations in this category later this year to further build on their success.

To sum it up, eBay delivered strong short-term results, ahead of expectations, while transforming the company for the longer term.

Obviously, the moves they are making at the top level to create over $20 billion of shareholder value give the company capital to intensely focus on growing the core.

Now the focus is laser-like to grow that central engine of ecommerce and the Covid bump forced a realization to the executive level here that it’s a no-brainer to double down at the core when the revenue runway is there.

To migrate into something else while the green, lush vegetation is right there for them to harvest would be nothing more than lunacy.

Management even felt confident enough to spin the cash from the Korean, Classified, and StubHub deals into an increased 2021 share buyback program to $5 billion for an initial $2 billion.

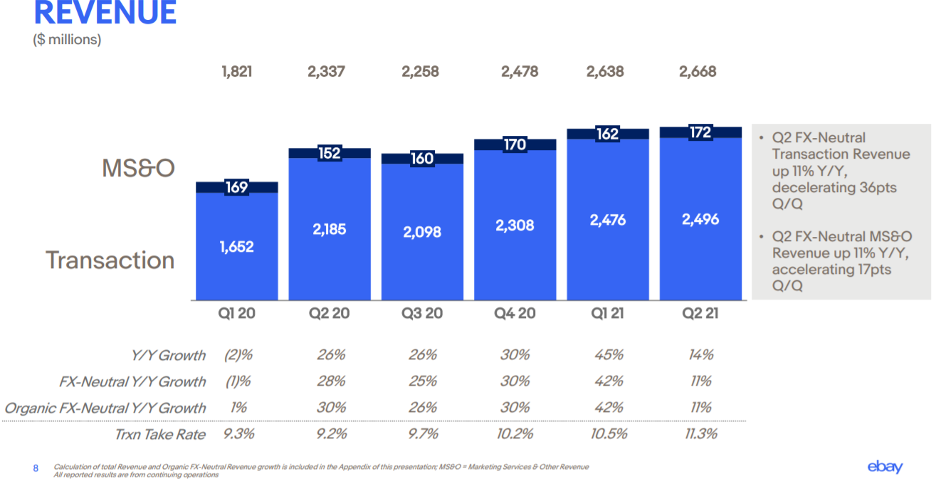

Granted that eBay isn’t a YOLO growth company to throw money at and its implied Q2 guidance between $2.58 billion and $2.63 billion of revenue growing 8% to 10% isn’t going to make you do cartwheels in the street, nor is the 11% Q2 revenue expansion, but this is a solid tech bet whose stock will grind up.

Management is also on a run of profitable deals that are meaningfully segueing into higher share buybacks.

Sometimes readers don’t need to focus on the sexiest tech stock, and just go with old reliable.