The Empty Pipeline of Tech Innovation

The oligarchical regime of Northern Californian tech companies stopped innovating because they don’t have to.

When you have a monopoly – you have one objective – to crush anything that remotely resembles competition.

That has been happening for years now by the Silicon Valley oligarchs and the government still hasn’t taken their finger out to do much about it.

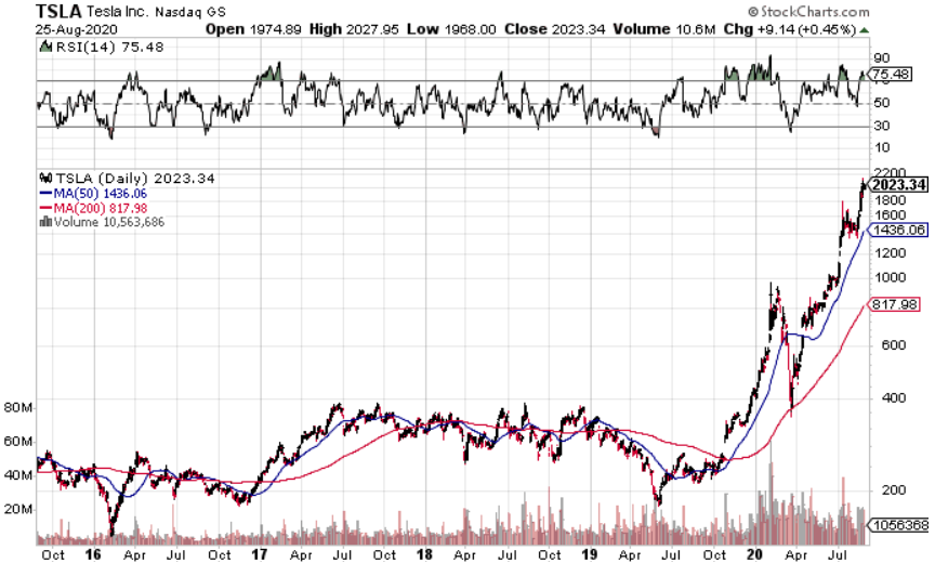

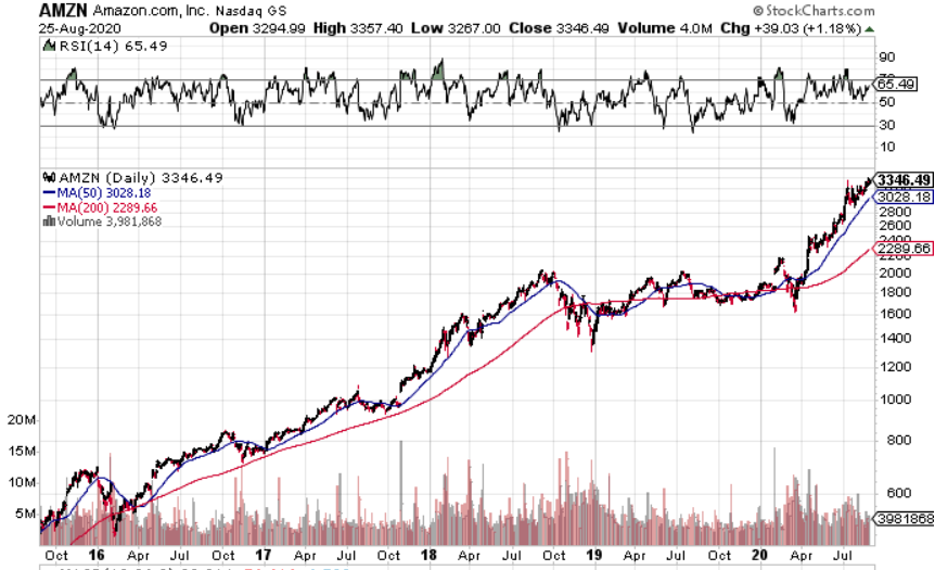

Honestly, my bet is that most of U.S. Congress own stock portfolios and these portfolios are spearheaded by the likes of Apple (AAPL), Facebook (FB), Amazon (AMZN), Google (GOOGL), Netflix (NFLX), and possibly even Tesla (TSLA), if they want a little growth.

It’s a direct conflict of interest, but that's not surprising for politics in 2020, is it?

The government likes to jawbone to the public saying they will make competition a level playing field, but actions show they are doing the opposite.

The Silicon Valley oligarchs are whispering in the ear of Congress and they listen.

Who would want Congress to lose money in their retirement portfolios, right?

Well, what now?

Fast forward to the future - mid-September, TikTok — the Chinese-owned, video-sharing phenomenon — MUST sell its U.S. operations.

Given the app’s 100 million U.S. users, this forced divestment by President Trump has triggered a delirious auction now pitting tech giants Microsoft (MSFT), Oracle (ORCL), and Twitter (TWTR) against one another.

The White House and Big Tech are boiling the free for all down to a combined story of national security and opportunistic capitalism amid unfortunate geopolitical tension between the U.S. and China.

But the ultimatum to ByteDance, TikTok’s owner, is more accurately understood as a dark window into Silicon Valley’s utter failure to innovate, and a warning signal of its transformation into a mere protector of long-established turf.

Silicon Valley has long adhered to the motto, “Move fast and break things” – but that was long ago when Steve Jobs was busy making the first iPhone.

The truth is Silicon Valley couldn’t be more corporate than it is now, and they use the corporate machine to serve the ends they desire.

Big Tech is just in love with buybacks like the rest of corporate America and the only reason they avoid it now is to appear as if they are in tune with public discourse and not tone deaf.

Huawei, another punching bag of the Trump administration’s tech war with China, best foreshadowed the optics.

In remarks to reporters in March 2019, Chinese politician Guo Ping said, “The U.S. government has a loser’s attitude. They want to smear Huawei because they can’t compete with us.”

ByteDance produced the hottest new social media platform on a global scale, and Facebook, in typical fashion, responded by brazenly copying TikTok, adding a feature called Reels to Instagram.

Don’t forget that Mark Zuckerberg has been attempting to destroy Snapchat (SNAP) for years after CEO Evan Spiegel refused to sell it to Zuckerberg.

The rest of the tech ecosphere has turned a blind eye to the anti-trust violations because they don’t want to be the next takeout target.

Make no bones about it, Silicon Valley, with the help of the Trump administration, is about to do a smash and grab job on China’s best tech growth asset.

This cunning maneuver alone has the knock-on effect of not only extending the tech rally in U.S. public markets but increasing the scarcity value and emboldening the Silicon Valley oligarchs.

I’m all about good deals and robbing Chinese tech in broad daylight is overwhelmingly bullish for the U.S. tech sector.

Imagine adding another Instagram to the appendage of an already mammoth tech company.

So why innovate? Why deploy capital into research and development when you can just nick a foreign company's crown jewel?

Even if you hate Silicon Valley at a personal level, it is literally impossible to short them, and now they are resorting to stealing companies, what other passes will government, society, and corporate America give American tech?

In either case, it’s not for me to judge, and as a technology analyst - I am bullish U.S. tech.