Try This Reliable Data Center Stock

One of the seismic outcomes from the current rollout of 5G is the plethora of generated data and data storage that will be needed from it.

In the land of tech stocks — more data means more money.

If one fashions themselves as a cloud purist and wants to bet the ranch on data being the new oil (and one would be daft not to realize it is) then look no further than Equinix (EQIX).

This is a tech firm that connects the world's leading businesses to their customers, employees, and partners inside the most interconnected data centers.

We are really talking about the backbone of the internet.

This is what the company represents and without this spine, the internet would be way more primitive and not as robust.

On this global platform for digital business, companies fuse together worldwide on five continents to reach everywhere, interconnect everyone and integrate everything they need to reap a digital windfall.

And whether we like it or not, the future will be more interconnected than ever because of the explosion of data and the 5G that harnesses the data.

This is precisely why the data will motivate businesses to extend their reach across the globe and expand their addressable audience.

It’s not me just talking up these bunch of overachievers; the numbers back me up fully.

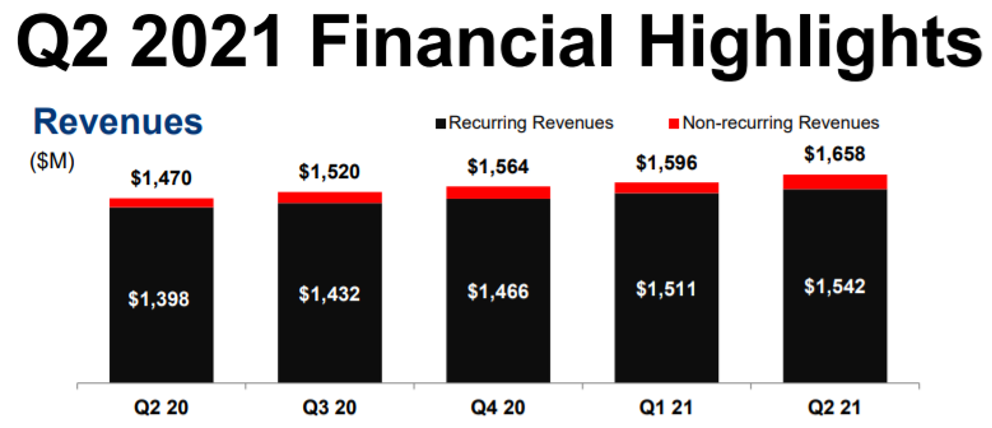

This past quarter Q2 revenues were $1.658 billion, up 8% over the same quarter last year due to strong business performance across EQIXs platform, led by the Americas region.

And as expected, nonrecurring revenues increased quarter-over-quarter to 7% of revenues due to a meaningful step-up in joint venture fees in Asia and Europe and custom installation work across all three regions.

As we must grapple with, nonrecurring revenues are inherently lumpy and therefore, as a result, EQIX expects Q3 nonrecurring revenues to decrease by $8 million compared to Q2. Cloud and IT verticals also captured strong bookings led by SaaS as the cloud diversifies towards a hybrid multi-cloud architecture.

High single digits might not look so glossy at first, but this is not a $1 billion per year in revenue company.

It’s probably one of the most stable businesses around since, unlike software, they can go out of fashion quite quickly if the next version bombs, yet storage space is more about economies of scale.

Other won deals lately include a leading SaaS provider expanding to support growth in new markets and with the Federal Government as well as an AI-powered commerce platform upgrading to enhance user experience support a rapidly growing customer base.

As digital transformation accelerates, the enterprise vertical continues to be Equinix’s sweet spot led by healthcare, legal, and travel sub-segments this quarter and the main catalysts to why I keep recommending readers this data storage company.

Other expansions this quarter included Zoom, a leading video communications platform, expanding coverage and scale to support market demand, and a cloud-delivered enterprise network security provider deploying infrastructure to support offerings in new locations.

EQIX’s enterprise vertical achieved record bookings, with broad global strength punctuated by an exceptionally strong quarter in the Americas across several subsegments, including healthcare, consumer services, business and professional services, and retail. New wins and expansions included Red Bull, a major sports energy drink manufacturer, deploying infrastructure across all three regions to take advantage of EQIX's cloud ecosystem.

EQIX can boast 65 consecutive quarters of increasing revenues, which eclipses every other company in the S&P 500, and it anticipates 8%-10% in annual revenue growth through 2022.

But now they are rolling out upgraded 2021 guidance by $15 million, forecasting to grow 10% to 12% year over year.

This represents a company that cuts across every nook and cranny of the tech sector by taking advantage of the unifying demand and storage requirements of big data.

This company will only become more vital once 5G goes blooms and being the global wizards of the data center will mean the stock goes higher in the long-term.

The momentum behind digital transformation is as robust as ever and shows no signs of letting up.

As a world digital infrastructure company, Equinix plays a unique role in this evolving story and is positioned to be both a catalyst and a key beneficiary as they partner with customers to unlock the enormous promise of digital.

They will continue to scale, doubling down on the strength of their core business, investing to further scale a go-to-market machine to win new customers, putting capital to work to add capacity in existing markets, and executing on targeted operational improvements to standardize, simplify and automate, driving expanded operating margins and providing a better experience for customers and partners.

Delivering advanced features to sustain momentum in EQIXs market-leading interconnection franchise and driving adoption of digital infrastructure services to deepen our relevance to customers is still paramount for the firms’ prospects.

I recommended this stock at $491 and now it sits nicely at $840.

My premise of buying and holding long term still holds true and any dip should be bought to take advantage of dollar-cost averaging.

I expect Equinix to be a slow and steady climb because let’s face it, it’s not a 40% per year growth story, but the stock does the job and rarely declines while providing a stable dividend.