Facebook Goes from Strength to Strength

Everyone and their mother was waiting for Facebook (FB) to fluff their lines, but they defied the odds by posting solid performance.

The data police can go back to eating doughnuts because it is obvious that regulation won't fizzle out the precious growth drivers that Mark Zuckerberg relies on to please investors.

I even begged readers to buy the regulatory dip, and I was proved correct with Facebook shares rebounding from $155 to $173.

The dip buying was proof that investors have faith in Facebook's business model.

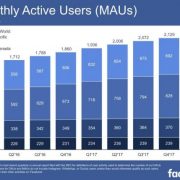

The Cambridge Analytica scandal threatened to tear apart the quarterly numbers and place Facebook in the tech doghouse, but stabilization in Monthly Active Users (MAU) and bumper digital ad revenue growth was the perfect elixir to an eagerly anticipated earnings report.

Facebook showed resilience by growing (MAU) to 2.2 billion, up 13% at a time when attrition could have reared its ugly head.

The market breathed a huge sigh of relief as the Facebook beat came to light.

The battering that Facebook received in the press effectively lowered the bar and Facebook delivered in spades.

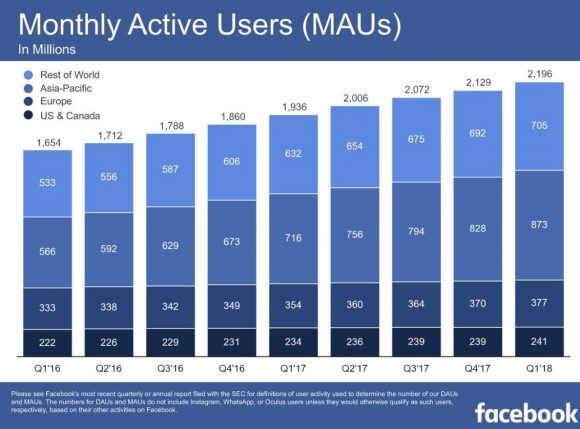

The unfaltering migration to mobile continues throughout the industry with mobile digital ad revenue making up 91% of ad revenue, which is a nice bump from the 85% last quarter.

Overall, Facebook grew revenues 49% YOY to $11.97 billion.

There is no getting around that Facebook is a highly profitable business due to the lack of costs. I should be so lucky.

Remember at Facebook, the user is the product.

Instead of paying for rising TAC (Traffic Acquisition Costs) as does Google (GOOGL) or the $8 billion outlay for Netflix's (NFLX) annual content budget, Facebook pours its money into improving its digital platform and advancing its ad tech capabilities.

However, moving forward, Facebook will have to cope with extra regulatory costs.

Facebook recently hired a legion of content supervisors at minimum wage to root out the toxic content roaming around on its platform.

Site operators have doubled to 14,000. This number gives you a taste why the large cap tech names are best positioned to combat the new era of regulation.

Doubling the staff of any business would be a tough cost pill to swallow.

Many companies would go under, but Facebook has the cash to mitigate the additional cost of doing business.

This defensive initiative casts Facebook in a better light than before like a superhero rooting out the evil villain.

Facebook and its co-founder Mark Zuckerberg need to hire a better public relations team to ensure that Mark Zuckerberg isn't pigeonholed in mainstream media as the monster of tech.

The Amazon-effect is infiltrating every possible industry, and even the bigger tech names are coping with the Amazon (AMZN) spillage onto competitors' turf.

A risk down the line is Amazon's booming digital ad business nibbling away at Facebook's own digital ad model.

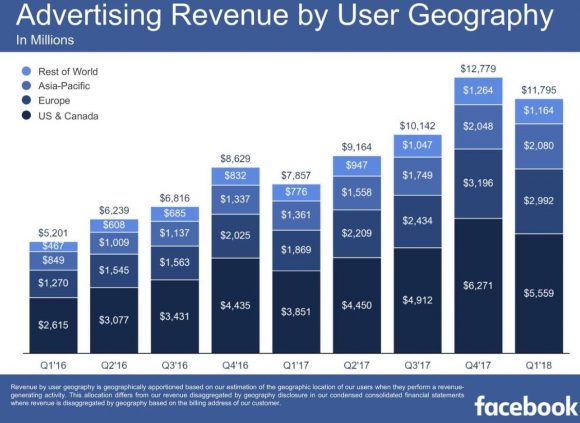

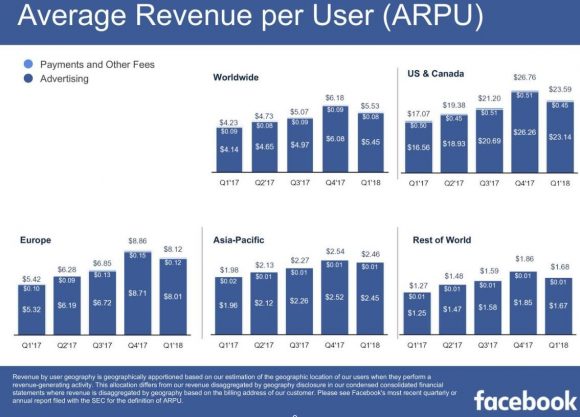

ARPU (Average Revenue Per User) remains robust with Facebook earning $23.59 per North American user, which is the most lucrative geographic location.

Artificial Intelligence (A.I.) is a tool that Facebook has implemented into its platform and monitoring apparatus.

Removing damaging content preemptively is the order of the day instead of being blamed for harboring nefarious content.

One example of this use case has been targeting ISIS- and Al Qaeda-related terror content with 99% of inappropriate content removed before being flagged by a human.

Heavy investments in A.I. will make Facebook a safer place to share content.

Big events exemplify the strength of Facebook.

During the Super Bowl in February, around 95% of national TV advertisers were simultaneously posting ads on Facebook because of the viral effect commercials and posts have during massive events.

Tourism Australia is another firm that bought ads on Instagram and Facebook platforms during the Super Bowl.

The campaign was hugely successful with half the leads for Tourism Australia coming directly from Facebook.

Facebook acts as the go-to provider for quality digital marketing and this will not change for the foreseeable future.

Investors can feel comfortable that there was no advertiser revolt after the big data chaos.

Facebook is improving its ad tech, and new ad products will be introduced to the 2.2 billion MAUs.

For instance, Facebook developed a carousel of rotating ads on Instagram Stories, and advertisers will be able to share up to three video or photos now instead of one. If the user swipes up, the swipe will take them directly to the advertisers' websites.

The shopping experience is more personalized now with an updated news feed that will show a full-screen catalog to help the user find whatever is in their search.

Facebook will only get better at placing suitable ads that mesh with the users' interests or hobbies.

Investors must be cautious to not let macro-headwinds sabotage existing positions.

Facebook's underlying growth drivers remain intact, but the stock is vulnerable to regulation headline risk that caps its short-term upside.

There is also the possibility that another Cambridge Analytica is just around the corner, which would result in a swift 10% correction.

Next earnings report should be interesting because it will reflect the first quarter that Facebook has operated with higher security expenses and will go a long way to validating its business model in a new era of rigid regulation.

If Facebook does not fill in the moat around the business, then Facebook is braced to grow top and bottom line with minimal resistance.

The cherry on top was the additional $9 billion of buybacks giving the stock price further support.

Facebook is a long-term hold but a risky short-term trade.

_________________________________________________________________________________________________

Quote of the Day

"Never trust a computer you can't throw out a window." - said Apple cofounder Steve Wozniak.