Farewell to Quantitative Easing

Finally, at long last, after infinite amounts of speculation and false starts, the Federal Reserve has decided to end quantitative easing.

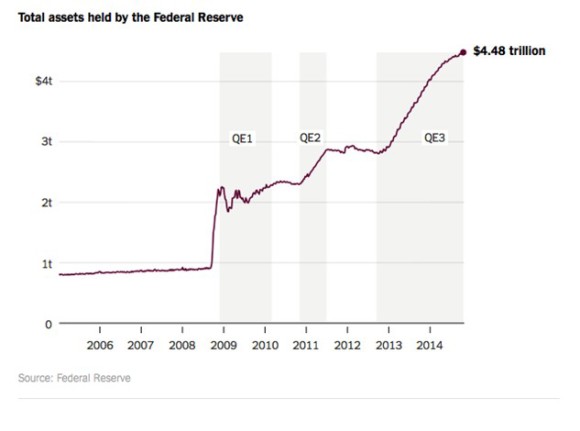

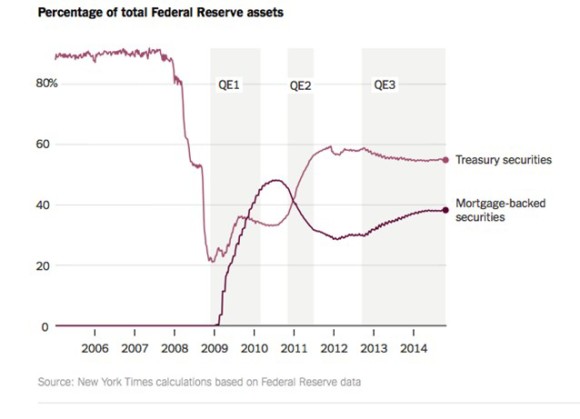

After five years of soaking up both public and private debt in the marketplace, some $4.5 trillion worth, America?s central bank will quit picking up paper sometime next month. The printing presses are getting turned off and put into cold storage, job well done.

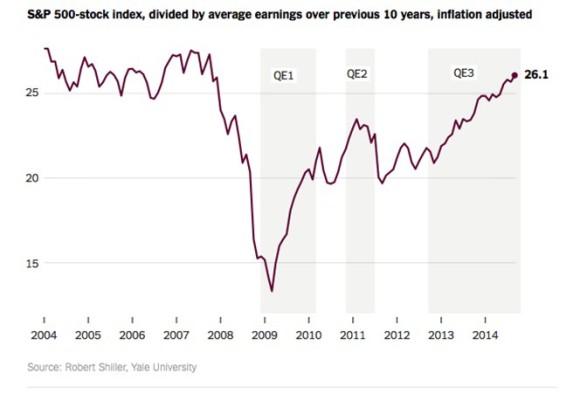

Boy, that was one hell of a monetary stimulus program, the likes of which has not been seen since the Great Depression. So much money flooded into the economy that homes values doubled on the bottom, stock indexes tripled, enriching quite a few traders along the way, including many followers of the Mad Hedge Fund Trader.

Who ended up making most of the money? Risk takers, equity owners, and the 1%. Everyone else was left in the dust, still waiting for the economic recovery to begin.

Since the controversial program was dreamed up and implemented by the former Fed governor, Ben Bernanke, five years ago, some $12 trillion was added to the value of equities alone. Some of my picks, like Cheniere Energy (LNG), Baidu (BIDU), ad Tesla (TSLA) soared by nearly 20 times.

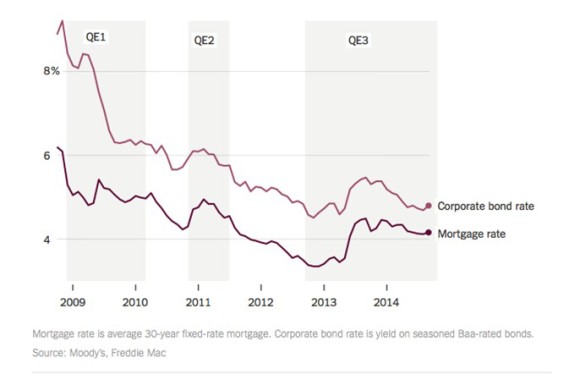

Conservatives hated QE, fearing that such easy money would lead to hyperinflation and the collapse of the US dollar. The only problem is that the Consumer Price Index didn?t get the memo, with deflation now the country?s greatest economic threat. As I write this, the greenback is tickling new multiyear highs.

What QE did do was pull the US away from the brink of complete economic collapse. As far as the Fed is concerned, mission accomplished.

The other message that emanated from the Fed today is that it may raise interest rates sooner than expected. That trashed the bond market, taking Treasury bond yields to 2.35%, off an amazing 40 basis points from the low only two weeks ago.

There are some important points to take here for our trading strategy going forward.

First of all, the final top in bonds is looking more convincing by the day.

Second, the top in bonds, and slightly hawkish tone taken by the Fed today are extremely positive for the banks. I have already loaded up followers with Bank of America (BAC), which just pierced $17 on the upside and appears poised to claim new highs for the year.

I am inclined to add to this position on dips, and expand to my exposure to other names. On the menu are Morgan Stanley (MS), Golden Sachs (GS), JP Morgan (JPM), Wells Fargo (WFC), and American Express (AXP).

The dollar rocketed. Those who followed my recent Trade Alerts to aggressively sell short the Euro (FXE), (EUO) and the yen (FXY), (YCS) were sent laughing all the way to the bank.

I spoke to my colleague after the close today, ace Mad Day Trader, Jim Parker. We concluded that if the market doesn?t show any weakness Thursday morning, we could continue a straight line run up into the month end book closing on Friday, and then on to new all time highs.

I know it?s not gentlemanly to say ?I told you so,? but I told you so.

If you are bemoaning the loss of quantitative easing, don?t worry, it may not be gone for long.

When the economy goes into the tank in two or three years, it may well return from the dead in all its glory, especially if the inflation rate peaks in this cycle at an Appalachian 2.5% and then heads for negative numbers.