Global Market Comments

October 31, 2023

Fiat Lux

ANOTHER SPECIAL SOLAR ISSUE

Featured Trade:

(HOW TO BUY A SOLAR SYSTEM),

(SCTY), (SPWR), (TSLA), (USO)

Global Market Comments

October 30, 2023

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE TRAPPED MARKET)

(TSLA), (NVDA), (GOOGL), (AMZN), (NLY)

I should have stayed in Ukraine.

At least that way I would know which direction the fire was coming from, the east. Back here in the US markets, the fire seemed to be coming from every direction all at once.

Good news was bad news and bad news even worse. An S&P 500 down 2.5% certainly left a bruise. The geopolitical outlook in the idle East is getting worse by the day.

But where others find nothing but despair, I see opportunity. Despite all the doom and gloom, all the elements of a yearend rally are setting up nicely. And it could be a sharp one as the time for it to play out is ever shrinking.

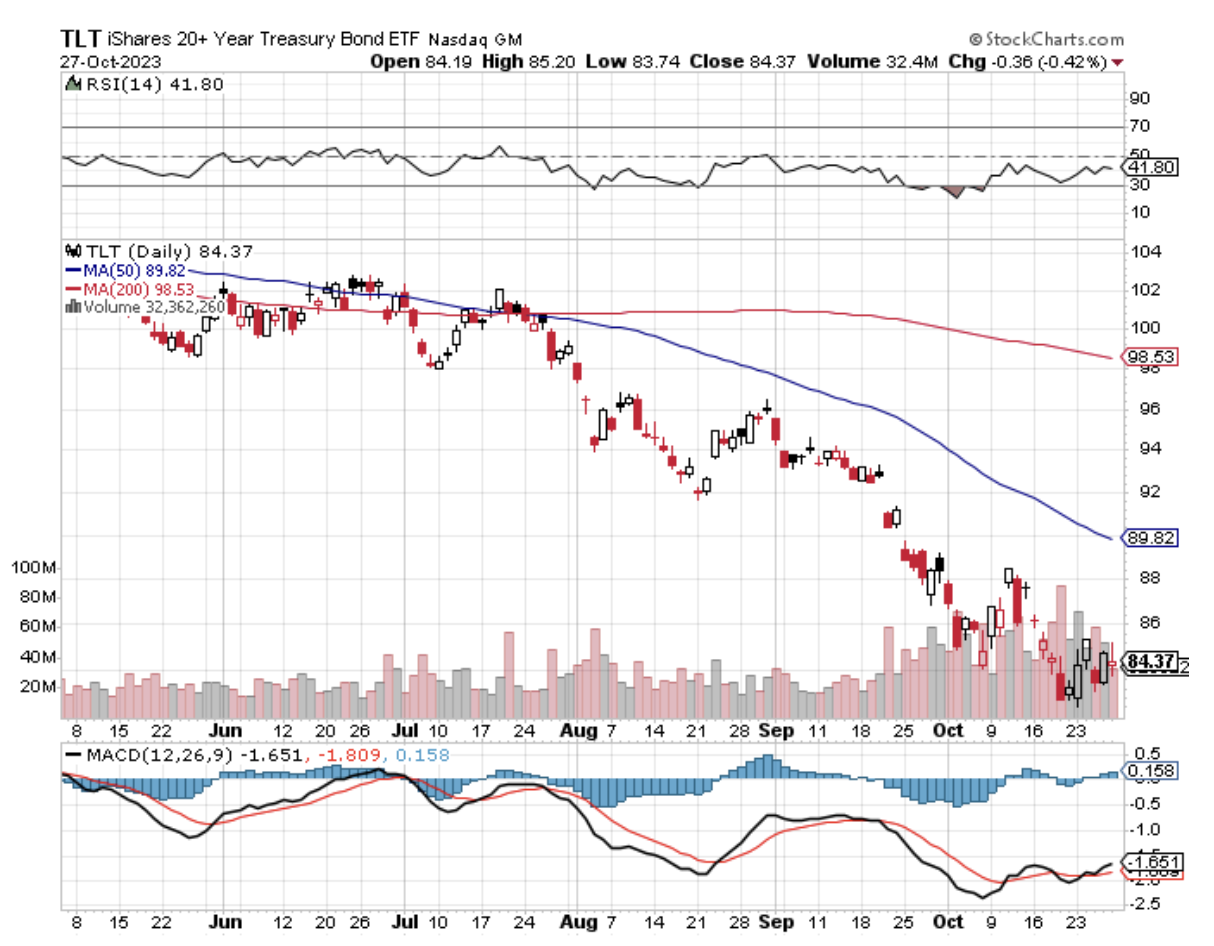

Hedge fund quantitative, momentum, and systemic shorts are at all-time highs, creating lots of buying power. AI has gone silent. Key earnings events will be done with the Apple announcement on Thursday, November 2. Ten-year bonds have repeatedly tried but failed to break the 5.00% yield.

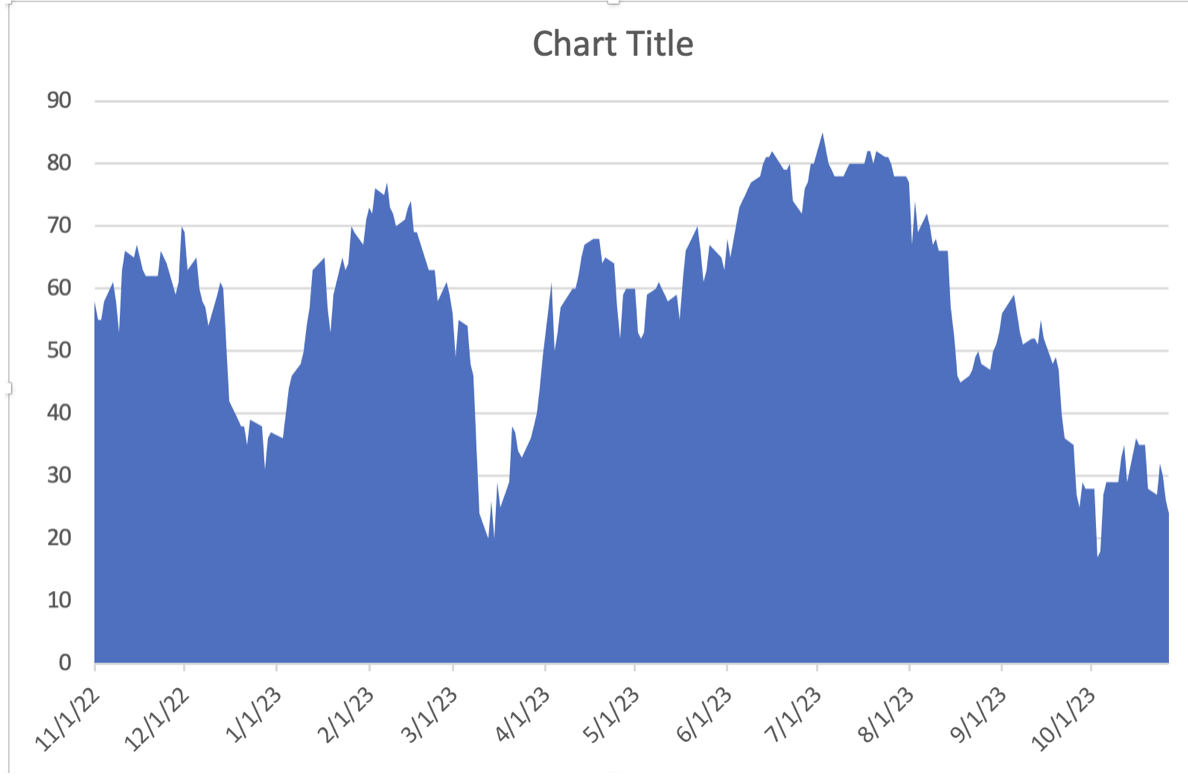

Major tech stocks like (TSLA), (NVDA), (GOOGL), and (AMZN) have seen 20% corrections. The Mad Hedge AI Market Timing Index is unable to close below $20 and has been chopping a lot of wood under $30. If a new House speaker cuts a deal to avoid a government shutdown before November 17, it could be off to the races.

The smart thing to do here is to build up a list of stocks higher leverage to falling interest rates. All stocks benefit from falling rates but some much more than others.

One of my favorites is Annaly Capital Management (NLY), one of the largest mortgage real estate investment trusts (REITS). The company borrows money, primarily via short-term repurchase agreements, and reinvests the proceeds in asset-backed securities.

The company’s shares are unusually sensitive to rising overnight interest rates, and its shares are down 50% in a year. A monster rally in the stock is brewing. Oh, and it has a 17% dividend, which will likely get cut but still remain extremely high.

Finally, I want to bid a sad farewell to my old friend and fellow iconoclast Byron Wien. Byron was late of Blackstone and much earlier from Morgan Stanley.

Byron was famed for his “Ten Surprises” which he published each New Year and with which I used to assist him in the early years. This was a list of possible developments which, if they occurred, would have a disproportionate effect on the market.

Byron was 90 and will be missed. One of his favorite pieces of advice was to never retire and Byron was working right up until last week.

Hmmmm. Sounds like good advice to me.

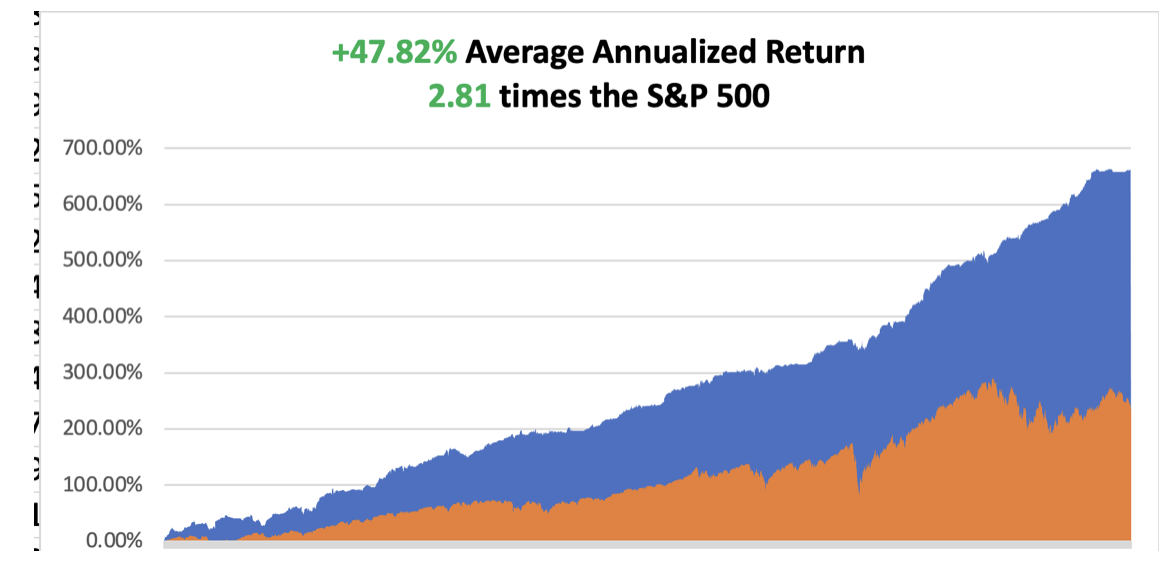

So far in October, we are up +3.56%. My 2023 year-to-date performance is still at an eye-popping +64.36%. The S&P 500 (SPY) is up +7.89% so far in 2023. My trailing one-year return reached +74.44% versus +8.09% for the S&P 500.

That brings my 15-year total return to +661.55%. My average annualized return has fallen back to +47.89%, some 2.81 times the S&P 500 over the same period.

Some 44 of my 49 trades this year have been profitable.

Car Payment Delinquencies Hit Record Rate, with repossessions rising. With interest rate hikes making newer loans more expensive, millions of car owners are struggling to afford their payments. It’s a clear indication of distress at a time when the economy is sending mixed signals, particularly about the health of consumer spending. Usually, a recession indicator but not this time.

US Government Wraps up Fiscal 2023 with a $1.7 Trillion Deficit, up 23% from the previous year, which ended on October 31. It’s a major reason why bonds have been under such pressure since July. But the purchasing power of the total US national debt of $32 trillion fell by $260 billion last year, thanks to the torrid 8.1% inflation rate.

US Core PCE Jumps 0.3% in September, the most in four months. It’s the Fed’s favorite inflation indicator. Drugs, travel, and used cars saw the big price increases. Resilient household demand paired with a pickup in inflation underscores momentum heading into the fourth quarter

Ukraine War has Become a Big Generator at US Defense Companies. Companies such as Lockheed Martin (LMT), General Dynamics (GD), and others expect that existing orders for hundreds of thousands of artillery rounds, hundreds of Patriot missile interceptors, and a surge in orders for armored vehicles expected in the months ahead will underpin their results in coming quarters. Buy the sector on dips

Don’t Expect a Real Estate Crash Anytime Soon, with supplies at 40-year lows. Yes, 8% mortgages are a buzz kill, but 95% of homeowners with mortgages date back to the 3.0% era. No one wants to give up their free lunch. If you’re a mortgage originator, it’s another story.

Existing Home Sales Hit 13-Year Low at 1.13 million, down 8% YOY. The Median Home Price was up 2.8% to $394,300. This is 17% of the peak rate we saw in 2021 when overnight rates were still zero.

Pending Home Sales Rise 1.1% in September to 72.6, but are down 13% YOY. On a signed contract basis. But the absolute level is the lowest in two years. High mortgage rates are the buzz kill. Affordability is at a record low.

Adjustable Rate Mortgages Make a Big Comeback, with 5/1 ARMS costing only 6.99% compared to 8.0% for the conventional 30-year fixed, a 23-year high. Mortgage originations are now down 22% YOY.

US Economy Red Hot at 4.9% Growth Rate, the highest in two years. Unfortunately, the stock market sees a major slowdown in the current quarter. Consumer spending was the big driver.

Tech Selloff has Taken NVIDIA down to a 25 Times Earnings Multiple, the same as Walmart and Target, despite 50% earnings growth for the foreseeable future. This is just at the start of an AI super cycle. Get ready to start loading the boat.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, October 30 at 8:30 AM EST, the Dallas Fed Manufacturing Index is out.

On Tuesday, October 31 at 2:30 PM, the S&P Case Shiller National Home Price Index is released.

On Wednesday, November 1 at 8:30 AM, the JOLTS Job Openings Report is published.

On Thursday, November 2 at 8:30 AM, the Weekly Jobless Claims are announced.

On Friday, November 3 at 2:30 PM, the October Nonfarm Payroll Report is published. At 2:00 PM the Baker Hughes Rig Count is printed.

As for me, one of the benefits of being married to a British Airways stewardess in the 1970s was unlimited free travel around the world. Ceylon, the Seychelles, and Kenya were no problem.

Usually, you rode in first class, which was half empty, as the British Empire was then rapidly fading. Or you could fly in the cockpit where, on long flights, the pilot usually put the plane on autopilot and went to sleep on the floor, asking me to watch the controls.

That’s how I got to fly a range of larger commercial aircraft, from a Vickers Viscount VC-10 to a Boeing 747. Nothing beats flying a jumbo jet over the North Pole on a clear day, where the unlimited view ahead is nothing less than stunning.

When gold peaked in 1979 at $900 an ounce, up from $34, The Economist magazine asked me to fly from Japan to South Africa and write about the barbarous relic. That I did with great enthusiasm, bringing along my new wife, Kyoko.

Sure enough, as soon as I arrived, I noticed long lines of South Africans cashing in their Krugerands, which they had been saving up for years in the event of a black takeover.

There was only one problem. My wife was Japanese.

While under the complicated apartheid system, the Chinese were relegated to second class status along with Indians, Japanese were treated as “honorary whites” as Japan did an immense amount of trade with the country.

The confusion came when nobody could tell the difference between Chinese and Japanese, not even me. As a result, we were treated as outcasts everywhere he went. There was only one hotel in the country that would take us, the Carlton in Johannesburg, where John and Yoko Lennon stayed earlier that year.

That meant we could only take day trips from Joberg. We traveled up to Pretoria, the national capital, to take in the sights there. For lunch, we went to the best restaurant in town. Not knowing what to do, they placed us in an empty corner and ignored us for 45 minutes. Finally, we were brought some menus.

The Economist asked me to check out the townships where blacks were confined behind high barbed wire fences in communities of 50,000. I was given a contact in the African National Conference, then a terrorist organization. Its leader, Nelson Mandela, had spent decades rotting away in an island prison.

My contact agreed to smuggle us in. While blacks were allowed to leave the townships for work, whites were not permitted in under any circumstances.

So, we were somewhat nonplussed Kyoko and I were asked to climb into the trunk of an old Mercedes. Really? We made it through the gates and into the center of the compound. On getting out of the trunk, we both burst into nervous laughter.

Some honeymoon!

After meeting the leadership, we were assigned no less than 11 bodyguards as whites in the townships were killed on sight. The favored method was to take a bicycle spoke and sever your spinal cord.

We drove the compound inspecting plywood shanties with corrugated iron roofs, brightly painted and packed shoulder to shoulder. The earth was dry and dusty. People were friendly, waving as we drove past. I interviewed several. Then we were smuggled out the same way we came in and hastily dropped on a corner in the city.

Apartheid ended in 1990 when the ANC took control of the country, electing Nelson Mandela as president. A massive white flight ensued which brought people like Elon Musk’s family to Canada and then to Silicon Valley.

Everyone feared the blacks would rise up and slaughter the white population.

It never happened.

Today, South Africa offers one of the more interesting investment opportunities on the continent. The end of apartheid took a great weight off the shoulders of the country’s economy. Check out the (EZA), which nearly tripled off of the 2020 bottom.

Kyoko passed away in 2002 at age 50.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

"Freedom of the press is only true if you own a press," said A.J. Liebling, a famed journalist for the New Yorker.

Global Market Comments

October 27, 2023

Fiat Lux

Featured Trade:

(SIX REASONS WHY GOLD WILL CONTINUE RISING),

($GOLD), (GLD), (IAU), (NEM), (GOLD), ($TNX),

(A CONVERSATION WITH THE BOOTS ON THE GROUND)

If you are a current gold investor, you have to love the latest monthly statistics just published by the World Gold Council.

After years of a death by a thousand cuts inflicted by endless redemptions of gold ETFs and ETNs, recent reports showed a sudden influx into the barbarous relic.

North American ETFs led the charge, with some 28.8 metric tonnes valued at $1.3 billion pouring into the funds.

The SPDR Gold Shares (GLD) took in the most, 22.4 tonnes worth $1.03 billion, followed by the IShares Gold Trust (IAU), which added 4.6 tonnes worth $266 million.

Europe followed with 6.4 tonnes worth $321 million.

Asia was a net seller of 2 tonnes worth $80 million as investors pulled money out of precious metals and placed it in Bitcoin, Ethereum, and other cryptocurrencies.

Global gold-based ETFs collectively hold 2,295 metric tonnes of gold valued at and have picked up 143.5 tonnes so far this year.

For those used to using American measurements of precious metals, there are 32,150.7 troy ounces in one metric tonne.

The figures augur well for continued cash inflows and higher gold prices.

My experience is that sudden directional shifts of fund flows like this are NOT one-offs. They continue for months, if not years.

Of course, the trigger for these large inflows was the yellow metal’s decisive breakout on big volume from a two-year trading range.

Not only did now longs pile into the market, there was frantic short covering as well.

Too many options traders had gotten comfortable selling short gold call options just above the $1,800 level.

Once key upside resistance was shattered, gold tacked on another $50 very quickly. Bearish traders were smartly spanked.

Gold plays that did well, including Van Eck Vectors Gold Miners ETF (GDX), Barrick Gold (ABX), Newmont Mining (NEM), and Global X Silver Miners ETF (SIL), turned profitable.

There are six reasons why gold has gone off to the races.

1) Ten-year Treasury bond yields are peaking out at 5.0%. The opportunity cost of holding gold is about to drop sharply.

2) Falling interest rates guarantee a weaker US dollar, another big pro gold development.

3) The last of the pandemic stimulus is fading fast.

4) The new conflict in the Middle East has poured the fat on the fire.

5) General concerns about the increasing instability in Washington have driven nervous investors into EVERY flight to safety play.

6) The collapse of trust in crypto has propelled a lot of assets back into gold.

Inflation has historically been the great driver of all hard asset prices.

After such a meteoric move, I would expect gold to consolidate here around this level for a while to digest the recent action. It may drift sideways, or fall slightly.

That’s when I’ll pick up my next basket of longs.

I have spent many hours speaking at length with the generals who are running our wars in the Middle East, like David Petraeus, and James E. Cartwright.

To get the boots-on-the-ground view, I attended the graduation of a friend at the Defense Language Institute (DLI) in Monterey, California, the world's preeminent language training facility.

As I circulated at the reception at the once top-secret installation, I heard the same view repeated over and over in the many conversations swirling around me. While we can handily beat armies, defeating an idea is impossible.

With the planet's fastest-growing population (Muslims are expected to double from one to two billion by 2050), terrorists can breed replacements faster than we can kill them. The US will have to maintain a military presence in the Middle East for another 100 years.

The goal is not to win, but to keep the war at a low cost, slow burn, over there, and away from the Americans.

I have never met a more determined, disciplined, and motivated group of students. There were seven teachers for 16 students, some with PhDs and all native Arabic speakers. The Defense Department calculates the cost of this 63-week, total immersion course at $200,000 per student.

They are taught not just the language, but also the history, culture, and politics of the region as well. I found myself discussing at length the origins of the Sunni/Shiite split in the 7th century, the rise of the Mughals in India in the 16th century, and the fall of the Ottoman Empire after WWI. This was with a 19-year-old private from Kentucky whose previous employment had been at Walmart! I doubt most Americans his age could find the Middle East on a map.

Students graduated with near-perfect scores. If you fail a class, you get sent to Afghanistan, unless you are in the Air Force, which kicks you out of the service completely.

As we feasted on hummus and other Arab delicacies, I studied the pictures on the wall describing the early history of the DLI in WWII, and realized that I knew several of the former graduates, now long gone.

The school was founded in 1941 to train Japanese Americans in their own language to gain an intelligence advantage in the Pacific war.

General 'Vinegar Joe' Stillwell said their contribution shortened the war by two years. General Douglas MacArthur believed that an army had never before gone to war with so much advanced knowledge about its enemy.

To this day, the school's motto is 'Yankee Samurai'.

My old friends at the Foreign Correspondents' Club of Japan will remember well the late Al Pinder. He spent the summer of 1941 photographing every eastern-facing beach in Japan. He? successfully smuggled the photographs out hidden in a chest full of Japanese sex toys.

He then spent the rest of the war working for the OSS in China. I know this because I shared a desk in Tokyo with Al for nearly ten years. His picture is there in all his youth, accepting the Japanese surrender in Korea with DLI graduates.

I Guess I Should Have Studied Harder

“The Fed only knows two speeds; too fast, and too slow,” said Nobel Prize-winning economist Milton Friedman to me over lunch one day.

Global Market Comments

October 26, 2023

Fiat Lux

Featured Trade:

(LAST CHANCE TO ATTEND THE OCTOBER 31 MIAMI, FLORIDA STRATEGY LUNCHEON)

(THE REAL ESTATE MARKET IN 2030),

(XHB), (ITB), (LEN),

(INDUSTRIES YOU WILL NEVER HEAR FROM ME ABOUT)

A number of analysts, and even some of those in the real estate industry, think that there will never be a recovery in residential real estate. With 8.0% mortgage rates who can blame them.

Long time readers of this letter know too well that I went hugely negative on the sector in late 2005, when I unloaded all of my holdings.

However, I believe that “forever” may be on the extreme side. Personally, I believe there will be great opportunities in real estate that run all the way until 2030.

Let's back up for a second and review where the great bull market of 1950-2007 came from.

That's when a mere 50 million members of the “Greatest Generation”, those born from 1920 to 1945, were chased by 80 million baby boomers born from 1946-1962.

There was a chronic shortage of housing, with the extra 30 million never hesitating to borrow more to pay higher prices.

When my parents got married in 1948, they were only able to land a dingy apartment in a crummy Los Angeles neighborhood because my dad was an ex-Marine sergeant. This is where our suburbs came from.

Since 2005, the tables have turned. There are now 80 million baby boomers attempting to unload dwellings on 65 million generation Xers who earn less than their parents, marking down prices as fast as they can.

As a result, the Federal Reserve thinks that 20% of American homeowners still have either negative equity, or less than 10% equity, which amounts to nearly zero after you take out sales commissions and closing costs.

That comes to 30 million homes. Don't count on selling your house to your kids, especially if they are still living rent-free in the basement.

The good news is that the next bull market in housing has already started.

That's when 85 million Millennials have started competing to buy homes from only 65 million upwardly mobile Gen Xers. Add these two generations together, and you have a staggering 150 million buyers competing for the same housing at the same time!

Fannie Mae and Freddie Mac will soon be gone, meaning that the 30-year conventional mortgage will cease to exist. All future home purchases will be financed with adjustable-rate mortgages, forcing homebuyers to assume interest rate risk, as they already do in most of the developed world.

For you Millennials just graduating from college now, this is a best-case scenario. People will, no doubt, tell you that you are crazy, that renting is the only safe thing to do, and that home ownership is for suckers.

That's what people told me when I bought my first New York coop in 1982 at one-tenth its current market price.

Just remember to sell by 2035 because that's when the next intergenerational residential real estate collapse is expected to ensue. That will leave the next, Generation Z homeowners, holding the bag, as your grandparents are now.