Below please find subscribers’ Q&A for the September 8 Mad Hedge Fund Trader Global Strategy Webinar broadcast from the safety of Silicon Valley.

Q: Do you think we’ll see the under $130 in the United States Treasury Bond Fund (TLT) before January 2022?

A: I don’t think so; I think we could go below $140, maybe below $135. But $130 would be a brand new low in the move and would be a stretch. We basically lost 4 months on this trade due to the countertrend rally, which just ended. I would come out of your (TLT) $130-$135 vertical bear put spreads right here while they still have time value, but keep the $135-$ 140s, the $140-$145’s, and especially the $150-$155’s. The idea was that you just keep averaging up and up until the market turns, and then you make back any loss. We move into accelerated time decay on those deep out of the money put spreads in December, so I would take the money and then offset it with the gains you made in those positions.

Q: Does Palantir (PLTR) look like it’ll hit $100 by year-end?

A: No, the stock has been dead, and management has not been doing anything to promote it. We did get a move up to $45 but it failed. It’s still a great long-term idea as they are growing at 50% a year. Also, they did buy $50 million worth of gold bars as a hedge. But as a short-term trader, Palantir isn’t working. If you have an options position on that I would probably get out of it or roll it forward to 2023.

Q: PayPal (PYPL) is fluctuating up and down with Bitcoin. Do you like PayPal?

A: Absolutely, but it obviously is being dragged down by Bitcoin. It is a temporary down move caused by a one-time-only event in El Salvador. Buy the dip in PayPal. It is a leader in the whole move into a digital financial system.

Q: When is Freeport McMoRan (FCX) likely to move up?

A: As soon as we shift out of the tech trade into the domestic recovery trade, which could be in weeks or months at the latest. We’ll switch from one side of the barbell to the other.

Q: Where do you see Tesla (TSLA)?

A: It keeps going up, so my guess is we top $800 by the end of the year, and maybe $850. The big news here is that Tesla has gone into the chip business, making its own chips in-house which is easy for them to do in Silicon Valley. But it does make them the first global car maker that is also a chip maker, and therefore the stock deserves a higher premium. The stock went up $30 on the news and is great for all Tesla holders. I hope you have the 2023 LEAPS.

Q: Too late to buy Tesla LEAPS?

A: Unless you’re really deep in the money, with something like a $600-$650; but the return on that will only be about 50% in 2 years.

Q: The Biden administration just set a goal of 45% solar by the end of 2050. Which solar stock should I buy here?

A: The problem with solar is as soon as Biden started winning primaries, every solar stock took off like a rocket, figuring he’d win, which he did. All of them went up 6-fold or more as a result of that, then gave up one-third of their gains and are now moving sideways. So if you look at the charts, the classic one to buy here is the Invesco Solar ETF (TAN), a basked of the top solar companies. All of these peaked in February and have been doing sideways “time” corrections since then, which means they eventually want to go higher. The other two that have charts that look like they’re finally starting to break out to the upside are First Solar (FSLR) and SunPower (SPWR) after 8 months of consolidation.

Q: Why is the second half of September almost always bad? Is it due to institutional repositioning?

A: Not really, the cash comes into the market at certain times of the year, like end of the year, beginning of the year, and end of each quarter. September seems like the month where they kind of just run out of money. But there's actually also a historical reason for that. For most of American history, we had an agricultural economy. Farmers were more than half the population, and the period of maximum distress for farmers is September, where they put all the money into seed and fertilizer and labor into the field, but they haven't harvested it yet. So, traditionally, they always did a lot of borrowing in September, which caused a cash squeeze and interest rate spike, and a stock market panic as a result. So that's the history behind weak Septembers and Octobers. Once the farmers get the crops in and sell them, that resolves the cash squeeze, interest rates fall, and it’s straight up for stocks for the rest of the year most of the time.

Q: SPACs (Special Purpose Acquisition Companies) seem to be losing interest. Do you recommend any or stay away?

A: Stay away—they’re all rip-offs and are simply a means by which managers can increase their fees from 2% to 20%. That's what they did with virtually all of them. This will end in tears.

Q: What's your feeling about satellite internet phone service replacing current internet cell service in the future?

A: It’s in the future, but it may be 10 years off in the future. If it happens sooner, it’s because Elon Musk was able to deliver cheap rocket service. He already has 20,000 satellites in the sky for his own Starlink global cell phone service for internet access.

Q: How does one buy a Bitcoin stock?

A: Well first of all, I highly recommend you buy the Mad Hedge Bitcoin Letter, which you can get in our store. But there's also the Greyscale Bitcoin Trust (GBTC) which allows you to buy a Bitcoin proxy very easily. I’ll even honor the discounted $995 price for my Bitcoin Letter for another day by clicking here.

Q: Is Warren Buffet and his value philosophy something I should be following, or is he outdated?

A: I have to say, buying stocks cheap with high cash flow will never go out of style. Currently, Warren’s big holdings are domestic industrials, banks, and Apple. All of those look like they will do well moving forward. Buffet’s Berkshire Hathaway (BRKB) has a built-in barbell element to it and is the subject of one of our LEAPS recommendations which has already been hugely successful.

Q: Is Home Depot (HD) at $330 a bargain?

A: Well, we just had a selloff and it bounced hard, and now we’re waiting for the domestic post delta recovery. It's hard to imagine both Home Depot and Lowes not doing well in this scenario.

Q: What will happen to tech when interest rates rise?

A: My bet is they go sideways to down small until you get another peak in interest rates (the next peak will be at 1.76% in the ten year US Treasury bond, the 2021 high) and once you hit that, then tech will take off like a rocket again, and in the meantime, you play the domestics while interest rates are rising. That is the game and will continue to be the game for a couple of years.

Q: Should I buy IBM (IBM) on a turnaround story?

A: No, I've been waiting for IBM to turn around for 10 years. They just don’t seem to get it. What they do is whenever a division starts to make money, they sell it and get cash like they did with the PC division and this year with its infrastructure business called Kyndryl. So, they’re not leaving any growth for the actual IBM holders.

Q: Do you like Square (SQ) at $256?

A: Yes, and that would be a great 2023 LEAPS candidate. All of the digital settlement payment systems are going to do well in the Bitcoin future. They also own quite a lot of Bitcoin. They are leading the charge into a digitized financial system.

Q: What’s a good Ethereum ETF?

A: The Greyscale Ethereum Trust (ETHE) is just the ticket.

Q: So you avoid energy, meaning oil and gas?

A: Yes, alternative energy we like, but it’s had an enormous run already so after a 7-month time correction it’s probably safe to get into solar. Traditional oil and gas (USO) is in a long-term secular bear market that started 13 years ago and will eventually go to zero. Last year’s visit to negative futures prices is just a start. Since 2020, the energy market weighting has gone from 15% to 2%.

Q: Is Natural Gas the only rational core fuel for the grid?

A: No, natural gas (UNG) still produces carbon even though it’s only half the amount of oil. This all gets replaced by solar in the next ten years. That’s why I tell people to stay away from energy like the plague. Would you rather buy natural gas at $4.50/btu or get solar electricity for free? Those are basically going to be the choices in ten years.

Q: Who is the biggest Aluminum producer?

A: Alcoa (AA) which we are a buyer on dips. By the way, if we do have to build 200,000 miles of long-distance transmission lines to cover the electrification of the US energy supply, all of that has to be made of aluminum. You don't use copper for long distances, you use aluminum (aluminum for you Brits).

Q: Would you buy Uber (UBER) at $40 today?

A: Probably, yes; it had a nice 40% correction. However, you are buying into the battle over gig workers—whether they should be treated as full-time or part-time workers. That is going to be a continuing drag on the stock until they win.

Q: What do you think of meme stocks?

A: You're better off buying a lottery ticket. Even with a low payoff, you get a 1:10 chance of winning on a $1 lottery ticket. Meme stocks could double or go to zero with no warning whatsoever—there’s no logic to this market at all.

Q: What do you think of Uranium?

A: Three words come to mind: Chernobyl, Fukushima, and Three Mile Island. I think uranium's time has passed, even though China is building a hundred nuclear power plants. It’s just too expensive to compete against solar on a large scale and impossible to insure. If you still like Uranium though, the Uranium Royalty Corp. (UROY) has had a nice pop recently. But the issue is that nuclear technologies can’t keep up with solar and digital. And they blow up.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

September 9, 2021

Fiat Lux

Featured Trade:

(HOW THE “UNDERGROUND” ECONOMY IS EXPLODING)

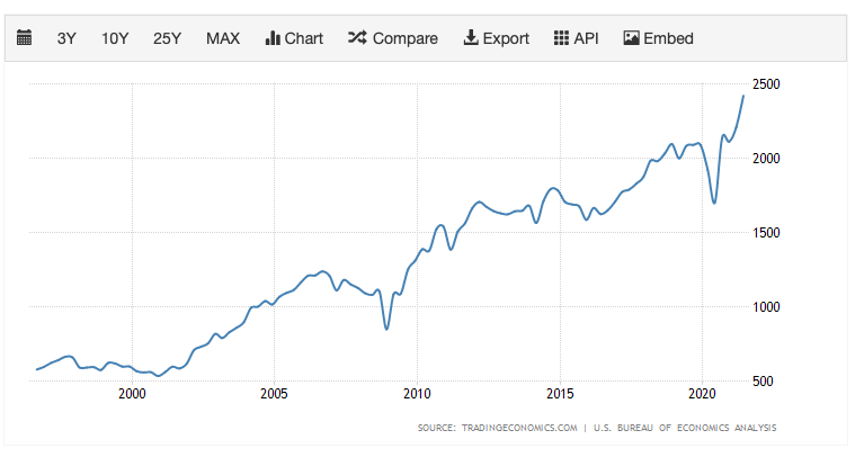

There is no doubt that the “underground” economy is growing.

No, I’m not talking about violent crime, drug dealing, or prostitution.

Those are all largely driven by demographics which right now are at a low ebb.

I’m referring to the portion of the economy that the government can’t see at all, and therefore is not counted in its daily data releases.

This is a big problem.

Most investors rely on economic data to dictate their trading strategies.

When the data is strong, they aggressively buy stocks, assuming that a healthy economy will boost corporate profits.

When data is weak, we get the flip side and investors bail on equities. They also sell commodities, precious metals, oil, and plow their spare cash into the bond market.

We are now more than halfway through a decade that has delivered unrelentingly low annual GDP growth, around the 2%-2.5% level.

We all know the reasons. Retiring baby boomers, some 85 million of them, are a huge drag on the system, as they save and don’t spend.

Generation Xers do spend, but there are only 58 million of them. And many Millennials are still living in their parents’ basements—broke and unable to land paying jobs in this ultra cost-conscious world.

But what if these numbers were wrong? What if the Feds were missing a big part of the picture?

I believe this is in fact what is happening.

I think the economy is now evolving so fast, thanks to the simultaneous hyper-acceleration of multiple new technologies that the government is unable to keep up.

Further complicating matters is the fact that many new internet services are FREE, and therefore are invisible to government statisticians.

They are, in effect, reading from a playbook that is a decade or more old.

What if the economy was really growing at a 3-4% pace, but we just didn’t know it?

I’ll give you a good example.

The government’s Consumer Price Index is a basket of hundreds of different prices for the things we buy. But the Index rarely changes, while we do.

The figure the Index uses for Internet connections hasn’t changed in ten years.

Gee, do you think that the price of broadband has risen in a decade with the 1,000-fold increase in speeds?

In the early 2000s, you could barely watch a snippet of video on YouTube without your computer freezing up and exploding the local server.

Now, I can download a two-hour movie in High Definition in just 10 seconds on my Xfinity 1 gigabyte per second business line.

And many people now watch movies on their iPhones. I see them in the rush hour traffic and on planes.

I’ll give you another example of the burgeoning black economy: Me.

My business shows up nowhere in the government economic data because it is entirely online. No bricks and mortar here!

Yet, I employ a dozen people, provide services to thousands of individuals, institutions, and governments in 140 countries, and take in millions of dollars in revenues in the process.

I pay a lot of American taxes too.

How many more MEs are out there? I would bet tens of millions.

If the government were understating the strength of the economy, what would the stock market look like?

It would keep going up every year like clockwork, as ever-rising profits feed into stronger share prices.

But multiples would never get very high (now at 27 times earnings) because no one believed in the rally, since the economic data was so weak.

That would leave them constantly underweight equities in a bull market.

Stocks would miraculously and eternally climb a wall of worry. Did I mention that the S&P 500 is at another all-time high?

On the other hand, bonds would remain strong as well and interest rates low because so many individuals and corporations were plowing excess, unexpected profits into fixed income securities.

Structural deflation would also give them a big tailwind.

If any of this sounds familiar, please raise your hand.

I have been analyzing economic data for a half-century, so I am used to government statistics being incorrect.

It was a particular problem in emerging economies, like Japan and China, which we're just getting a handle on what comprised their economies for the first time.

But to make this claim about the United States government, which has been counting things for 225 years, is a bit like saying the emperor has no clothes.

Sure, there has always been a lag between the government numbers and reality.

In the old days, they used horses to collect data, and during the Great Depression, numbers were kept on 3” X 5” index cards filled out with fountain pens.

But today, the disconnect is greater than it ever has been by a large margin, thanks to technology.

Is this unbelievable?

Yes, but you better get used to the unbelievable.

As for that bull market in stocks, it just might keep on going longer than anyone thinks.

There May Be More Here Than Meets the Eye

“At an age when other high school kids were sneaking out of the house to go partying, Paul and I would sneak out to go use the computers in a lab at the University of Washington,” said Bill gates about his late partner, Paul Allen.

Global Market Comments

September 8, 2021

Fiat Lux

Featured Trade:

(A NOTE ON ASSIGNED OPTIONS, OR OPTIONS CALLED AWAY)

(SPY), (TLT)

I know all of this may sound confusing at first. But once you get the hang of it, this is the greatest way to make money since sliced bread.

I still have two positions left in my model trading portfolio, they are all deep-in-the-money, and about to expire in seven trading days. That opens up a set of risks unique to these positions.

I call it the “Screw up risk.”

As long as the markets maintain current levels, ALL of these positions will expire at their maximum profit values.

They include:

|

(TLT) 9/$155-$158 put spread |

10.00% |

|

(SPY) 9/$410-$420 call spread |

10.00% |

With the September 17 options expirations upon us, there is a heightened probability that your short position in the options may get called away.

If it happens, there is only one thing to do: fall down on your knees and thank your lucky stars. You have just made the maximum possible profit for your position instantly.

Most of you have short option positions, although you may not realize it. For when you buy an in-the-money vertical options spread, it contains two elements: a long option and a short option.

The short options can get “assigned,” or “called away” at any time, as it is owned by a third party, the one you initially sold the put option to when you initiated the position.

You have to be careful here because the inexperienced can blow their newfound windfall if they take the wrong action, so here’s how to handle it correctly.

Let’s say you get an email from your broker telling you that your call options have been assigned away.

I’ll use the example of the S&P 500 (SPY) $410-$420 in-the-money vertical BULL CALL spread.

For what the broker had done in effect is allow you to get out of your call spread position at the maximum profit point days before the September 17 expiration date. In other words, what you bought for $8.90 on August 17 is now worth $10.00, giving you a near-instant profit of $1,210 or 12.35%!

All you have to do is call your broker and instruct them to “exercise your long position in your (SPY) September 17 $410 calls to close out your short position in the (SPY) September 17 $420 calls.”

You must do this in person. Brokers are not allowed to exercise options automatically, on their own, without your expressed permission.

This is a perfectly hedged position, with both options having the same name and the same expiration date, so there is no risk. The name, number of shares, and number of contracts are all identical, so you have no exposure at all.

Calls are a right to buy shares at a fixed price before a fixed date, and one options contract is exercisable into 100 shares.

Short positions usually only get called away for dividend-paying stocks or interest-paying ETFs like the (TLT). There are strategies out there that try to capture dividends the day before they are payable. Exercising an option is one way to do that.

Weird stuff like this happens in the run-up to options expirations like we have coming.

Adequate shares may not be available in the market, or maybe a limit order didn’t get done by the market close.

There are thousands of algorithms out there that may arrive at some twisted logic that the puts need to be exercised.

Many require a rebalancing of hedges at the close every day which can be achieved through option exercises.

And yes, options even get exercised by accident. There are still a few humans left in this market to blow it by writing shoddy algorithms.

And here’s another possible outcome in this process.

Your broker will call you to notify you of an option called away, and then give you the wrong advice on what to do about it.

There is a further annoying complication that leads to a lot of confusion. Lately brokers have resorted to sending you warnings that exercises MIGHT happen to help mitigate their own legal liability.

They do this even when such an exercise has zero probability of happening, such as with a short call option in a LEAPS that has a year or more left until expiration. Just ignore these, or call your broker and ask them to explain.

This generates tons of commissions for the broker but is a terrible thing for the trader to do from a risk point of view, such as generating a loss by the time everything is closed and netted out.

There may not even be an evil motive behind the bad advice. Brokers are not investing a lot in training staff these days. In fact, I think I’m the last one they really did train.

Avarice could have been an explanation here but I think stupidity and poor training and low wages are much more likely.

Brokers have so many ways to steal money legally that they don’t need to resort to the illegal kind.

This exercise process is now fully automated at most brokers but it never hurts to follow up with a phone call if you get an exercise notice. Mistakes do happen.

Some may also send you a link to a video of what to do about all this.

If any of you are the slightest bit worried or confused by all of this, come out of your position RIGHT NOW at a small profit! You should never be worried or confused about any position tying up YOUR money.

Professionals do these things all day long and exercises become second nature, just another cost of doing business.

If you do this long enough, eventually you get hit. I bet you don’t.

Global Market Comments

September 7, 2021

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE “ENDLESS BID” MARKET),

(VIX), (SPY), (TLT)

I am usually hiking at Lake Tahoe this time of year, doing the deep research, hiking ten miles a day, and the stripping down to jump into the lake at the end.

This year, climate change had other ideas.

So I am visiting a childhood haunt in Newport Beach, CA, where my late uncle used to live. Remember him? He was the former CFO of Penn Central Railroad in 1970 who made a fortune buying puts just before the company went bankrupt. I guess that was allowed back then.

He lived next door to John Wayne, and we kids used to wave at him, astonished at his bald head. I still miss The Duke.

I am still typing one finger at a time, my left wrist in a brace and elbow in a huge bandage. I told the doctor I couldn’t get to Reno for him to take the stitches out because of the wildfires, so I would do it myself with a pocketknife with Jack Daniels as a sterilizer. He said, “Knock yourself out.”

Traders are so frustrated waiting for the normal summer correction they are starting to call “The Endless Bid Market.” That has left them underweight, trying to catch up, which is why we didn’t get a drop of more than 4% this summer.

Of course, they are also getting rich with what they already have, but they all want to get richer. Greed is trouncing fear big time. Forget about investing.

You can’t buy the dip anymore because there are no dips. You simply use new cash flows to add to your winners, the more they have gone up, the better.

That’s why large-cap tech stocks have been on an absolute tear, hitting new all-time highs. Of course, I am just as guilty as the rest, with a retirement fund loaded with big tech. Google (GOOG) is now my largest position, not through savvy stock selection but purely because of price appreciation.

Of course, it helps that the higher stocks go, the cheaper they get.

Earnings are melting up maintaining the same price-earnings multiple and stock prices are simply following suit. There is nothing overheated about it.

Company profit margins are soaring to record highs as companies make enormous productivity investments to deal with chronic labor shortages. If you live here in Silicon Valley, you see this happening around you every day.

If you don’t, stock valuations are fantasies coming from a faraway land, therefore the surprise at market strength.

Haven’t you noticed how hard it is to get a human on the phone outside of the Philippines, where workers feel rich when they are making $300 a month?

If anything, the market is still undervaluing stocks rather than overvaluing relative to their upside earnings potential.

An S&P 500 target of $500 is now my easy target for 2022.

Any credit crunch that could trigger a recession is years off, and one Fed governor away. A delta variant that won’t quit, or the upcoming Mu variant is another worry.

Consensus forecasts constantly lagging the market has the effect of leaving institutions and individuals under-invested and trying to get in, hence no real dips for almost a year.

Afghanistan proves the market could care less about any geopolitical surprise.

You heard it from me first. If the market can’t selloff over the next two weeks when poor seasonals start to fade away, the they wont for all of 2021.

Nonfarm Payroll Report bombs, coming in at only 235,000 versus an expected 720,000, a huge miss. The headline Unemployment Rate fell 0.2% to 5.2% a new post-pandemic low. Mysteriously, both stocks and bonds hated it. Manufacturing was up 37,000, while Leisure & Hospitality was zero and Retail at -28,000. Education LOST -25,000 during the back-to-school season. Average Hourly Earnings rose an astonishing 0.6% MOM, or 4.3% YOY. The U6 long term unemployment rate fell to 8.8%. Goodbye taper. A shortage of workers was to blame, but the economic data has been worsening for a while now. Delta is taking a bigger bite than we thought.

Stocks hit new August highs the most in history, surpassing the 1929 record of 11 times. The only negative three-month period seen since 1929 are August, September, and October. Remember what happened in 1929? If that doesn’t scare the living daylights out of you, then nothing will. So, it seems we are in for some kind of correction, even if it’s just the 5% kind. Looks like the month end will be hot.

Bitcoin leads crypto, but Ethereum is catching up. Cardano has doubled in a month making it the number three crypto and Avalanche has tripled. Newly minted online broker Robinhood (HOOD) says 60% of its option trading is now in crypto. MicroStrategy’s (MSTR) Michael J. Saylor sees a 50-fold increase in Bitcoin to a total market value of $100 trillion. That is five times the US M3 money supply of $20 trillion. It’s become a financial system of "get crypto or go home."

Oil jumps on Hurricane IDA, with a sharp 8.9% rally. Some 91% of Gulf Production shut in, or 1.65 million barrels a day. Don’t expect it to continue. Sell into the rally on this future buggy whip industry.

SEC is cracking down on Market Gaming by multiple apps aimed at Millennials. It’s shopping for a new set of market rules aimed at regulating those who foster runaway volatility in single stocks like (AMC).

PayPal to enter stock trading, sending the stock up a ballistic $15 in two days. If they pull it off, it will open a huge new profit stream for them, possibly becoming another Robinhood (HOOD), cashing in on the retail trading boom. Earning: regulation costs a lot. Buy (PYPL) on dips.

S&P Case Shiller soars to new highs in June, the National Home Price Index jumping 18.6% YOY, breaking all records. Prices are now 41% higher than the bubble top in 2006. This is the sharpest gain in the 34-year history of the index. Prices in Phoenix leaped 29.6%, followed by San Diego at 27.1% and Seattle by 25.0%. Supply and demand will be seriously out of whack for years.

Pending Home Sales drop for the second straight month on a signed contract basis, down 1.8% in July. Summer slowdown, delta slowdown, or market top? However, supply and demand are still far out of balance.

Your next Apple purchase may be a satellite phone, bypassing local cell phone networks. A Chinese analyst made this prediction for the iPhone 13 out in 2022. The report says that the iPhone 13 includes a Qualcomm X60 baseband modem chip, which includes LEO satellite comms capabilities. If accurate, this means that the upcoming iPhone will have the hardware capability to act as a satellite phone. It certainly would upend the rush to build private satellite networks, like Viasat and Tesla’s Starlink. Enough investors believed the story to send the stock to a new all-time high. Buy (AAPL) on dips.

Air Travel is falling off, with airport security screening dropping to only 1.35 million, the lowest since May 11. Delta is taking its toll, but back to school is a factor as well.

Bond king Bill Gross says treasuries are trash. He sees ten-year yields hitting 2.00% sometime in 2022. The 77-year-old drove bond prices for a decade and also made a fortune collecting stamps. Sometimes Bill is early, but he is always right.

One billion Asians to join middle class by 2030 on top of the existing 3.75 billion today. That will create a vastly larger market for all online services, which the stock market seems to be telling us today. Indonesia, Pakistan, and Bangladesh are expected to see the largest increases. There is a lot of “hope” in this number, i.e., no more covid, no ward, and no depressions.

The next market correction won’t come until the Fed makes a mistake and that might be years off, says Wharton finance professor and long-term bull Jeremy Siegel. That will be when the Fed finds itself behind the inflation curve. Until then, the slow grind up continues. Stocks are the best defense against inflation.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

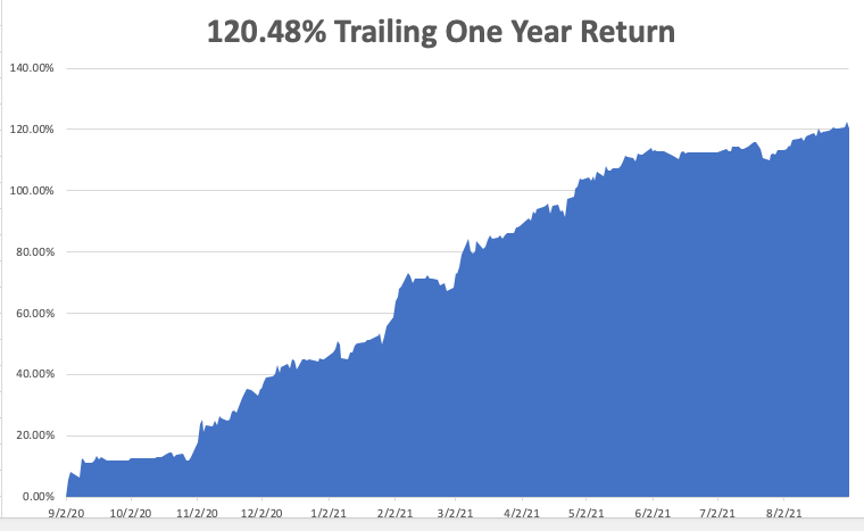

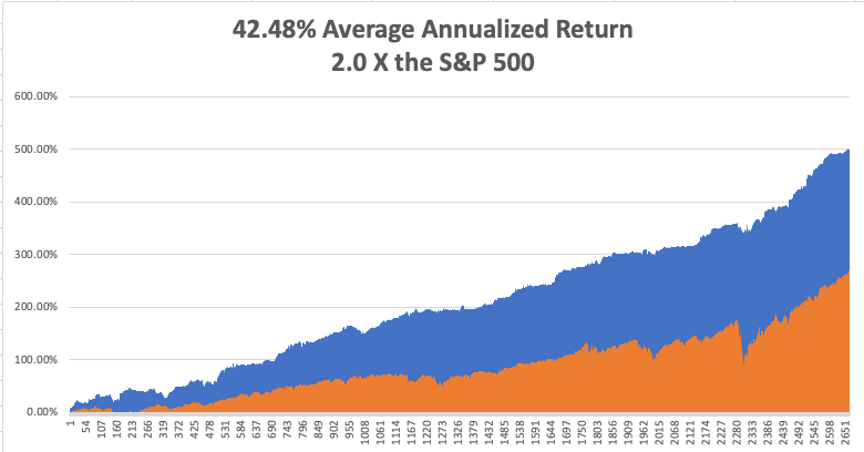

My Mad Hedge Global Trading Dispatch saw a robust +9.31% gain in August. My 2021 year-to-date performance soared to 78.57%. The Dow Average was up 15.82% so far in 2021.

That leaves me 80% in cash at 20% in short (TLT) and long (SPY). Although we have maxed out the profits with these two positions, I’ll keep them as there is nothing else to do. I’m keeping positions small as long as we are at extreme overbought conditions. The “endless bid” market is not giving anyone entry points as long as the Volatility Index (VIX) remains at $16.

That brings my 12-year total return to 501.12%, some 2.00 times the S&P 500 (SPX) over the same period. My 12-year average annualized return now stands at an unbelievable 42.48%, easily the highest in the industry.

My trailing one-year return popped back to positively eye-popping 120.48%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 40 million and rising quickly and deaths topping 645,000, which you can find here.

The coming week will be slow on the data front.

On Monday, September 6 markets are closed for the US Labor Day.

On Tuesday, September 7, there are no special data releases. Everyone will be recovering from hurricanes in the south and east, wildfires in the west, and Covid everywhere.

On Wednesday, September 8 at 9:30 AM, we get API crude oil stocks.

On Thursday, September 9 at 8:30 AM, Weekly Jobless Claims are announced.

On Friday, September 10 at 8:30 AM, we learn the Producers Price Index for August. At 2:00 PM, the Baker Hughes Oil Rig Count is disclosed.

As for me, a few years ago, I was visited in London by an old friend who had once served on the British Army staff of General Bernard Law Montgomery, the hero of Alamein, who was known to his friend as “Monty” (he had no friends).

I asked if there was anything I could do for him and he said, “Actually, I haven’t had a dish of moules mariniere (steamed mussels in white wine sauce) on the Grand Square in Brussels for a while. I said, “No problem, let’s go.”

We drove my Mercedes 6.0 to an old Battle of Britain hanger (one-inch-thick bombproof steel doors) on the outskirts of London where I kept a twin-engine Cessna 340 with turbocharged engines with a maximum speed of 225 kts. We landed in Brussels in an hour.

We savored the mussels on the square, as good as ever, the national dish of Belgium. The autumn air was brisk, tourists gawked, we drank, and everyone had a good time.

I left my fried there talking to some Belgian beauty for an early return to England. I wanted to park my plane at the grass airfield in Salisbury in Wiltshire, home of the tallest cathedral in England, which I nearly took out several time. The problem was that the runway had no lights.

Unfortunately, I ran into an Atlantic headwind and was running late, so I skipped a refueling stop at Ostend. When My instruments showed I was right over the airfield, I saw nothing but black.

I did, however, remember the radio frequency of the pub at the end of the field which constantly kept a speaker on. I radioed the pub, “if anyone will roll up some newspapers set them on fire and line the runway, I will buy them a pint of beer.”

The entire pub emptied out and within secondss I had a perfectly lighted runway on both sides. Landing was a piece of cake.

When I taxied up to the pub, the starboard engine ran out of gas. I walked in and made good on my promise, even buying a second round for my rescuers. I then crawled back into my airplane and went to sleep, waking up the next day with the worst hangover ever.

My flying these days is much more sedentary. The FAA requires me to do three take offs and landings every three months to keep my license current, and I usually bring along my kids for this chore. On the last landing, I always shut off my engine and glide in.

I warn the kids and they always say, “No dad, don’t,” but I do it anyway. I tell them it’s the only way to practice engine failures.

As I said before, I crash better than anyone I know.

I think I’ll watch the John Wayne classic “The Searchers” one more time tonight.

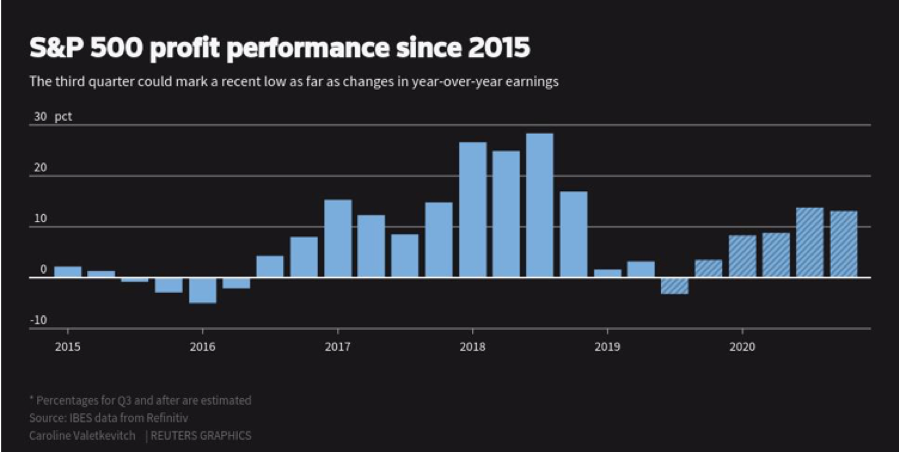

US Corporate Profits Through End 2020

“An investment strategy that depends on the Fed quitting sounds pretty risky to me….The Fed can remain solvent longer than you can remain solvent,” said Chris White, the CEO of Bondcliq.

Global Market Comments

September 3, 2021

Fiat Lux

Featured Trade:

(LOOKING AT THE LARGE NUMBERS)

(TLT), (TBT) (BITCOIN), (MSTR), (BLOK), (HUT)