Global Market Comments

June 6, 2025

Fiat Lux

Featured Trade:

(PLEASE SIGN UP NOW FOR MY FREE TEXT ALERT SERVICE RIGHT NOW)

“In the next recession, the US will be the worst-performing stock market in the world. We won’t see new highs again in my lifetime,” said Doubleline Capital’s Jeffrey Gundlach.

Global Market Comments

June 5, 2025

Fiat Lux

Featured Trade:

(LEARNING THE ART OF RISK CONTROL)

Global Market Comments

June 4, 2025

Fiat Lux

Featured Trade:

(THE TWO CENTURY DOLLAR SHORT),

(UUP), (FXA), (FXE), (FXY), (FXC)

“Artificial Intelligence will be beneficial for us if it doesn’t kill us first, said Senator John Kennedy of Louisiana.

Global Market Comments

June 3, 2025

Fiat Lux

Featured Trade:

(LOOKING AT THE LARGE NUMBERS)

(TLT), (TBT) (BITCOIN), (MSTR), (BLOK), (HUT)

“It’s not true that the government spends money like a drunken sailor. A drunken sailor spends his own money,” said JP Morgan CEO Jamie Diamond.

Global Market Comments

June 2, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or HEADING INTO STALL SPEED),

(GLD), (SPY), (MSTR), (AAPL), (QQQ), (TSLA), (SLV), (SIL), (WPM)

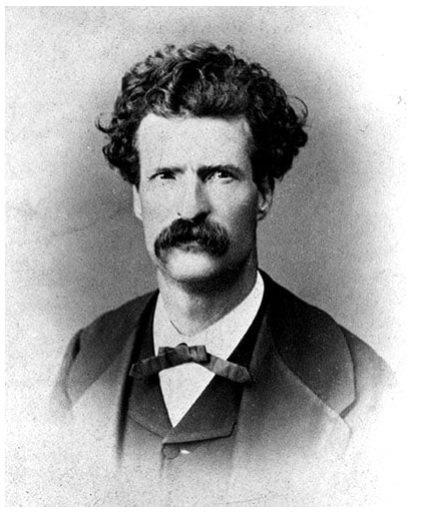

“I think we never become really and genuinely our honest selves until we are dead. And not then until we have been dead years and years. People ought to start dead and then they would be honest so much earlier,” said the great American writer Mark Twain.

Global Market Comments

May 30, 2025

Fiat Lux

Featured Trade:

(The Mad Hedge June Traders & Investors Summit is ON!)

(MAY 30 BIWEEKLY STRATEGY WEBINAR Q&A),

(MSTR), (DAX), (SPY), (UPS), (UNP), (FDX), (SLV), (GLD)