Global Market Comments

April 25, 2018

Fiat Lux

Featured Trade:

(TUESDAY, JUNE 12, NEW ORLEANS, LA, GLOBAL STRATEGY LUNCHEON)

(WHY IT'S A "SELL THE NEWS" MARKET),

(TLT)

(PLEASE USE MY FREE DATABASE SEARCH)

Come join me for lunch at the Mad Hedge Fund Trader's Global Strategy Update, which I will be conducting in New Orleans, LA, on Tuesday, June 12, 2018. An excellent meal will be followed by a wide-ranging discussion and an extended question-and-answer period.

I'll be giving you my up-to-date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I'll be throwing a few surprises out there, too. Tickets are available for $268.

I'll be arriving at 11:30 AM, and leaving late in case anyone wants to have a one-on-one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at an exclusive downtown restaurant. The precise location will be emailed with your purchase confirmation.

I look forward to meeting you and thank you for supporting my research.

To purchase tickets for the luncheon, click on our online store.

It could have been the 3.0% print on the yield for the US 10-year Treasury bond yield (TLT).

It could have been the president's warlike comments on Iran.

It could even have been rocketing commodity prices that are driving consumer staple stocks out of business.

No, none of these are the reason why the stock market melted down 700 points intraday yesterday.

The real reason is that we have had too much fun for too long.

Some nine years and 400% into this bull market, investors are starting to take some money off the table.

Not a lot mind you, but enough to make a big difference on a single day.

The Fed was seen carrying off the punch bowl, and the neighbors have called the police. Clearly, the party is over. At least for now.

If you had to point to a single cause of the Tuesday rout in share prices it had to be Caterpillar's (CAT) rather incautious prediction that its earning peaked for this business cycle in Q1, and it was downward from here.

Traders, being the Einstein's that they are, extrapolated that to mean that ALL companies saw earnings peak in Q1, and you get an instant 700-point collapse.

I think they're wrong, but I have never been one to argue with Mr. Market. You might as well argue with the tides not to rise.

In a heartbeat, investors shifted from a "sell earnings on the news" to "sell NOW, earnings be damned."

All of this vindicates my call that markets would remained trapped in a wide trading range until the November congressional elections.

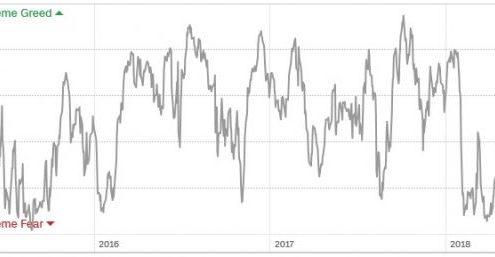

This has been further confirmed by the three-year chart of my Mad Hedge Market Timing Index.

For the second time this year, the Index peaked in the 40s, instead of the 80s, which is what you normally get in a bull market. The new trading strategy for the Index is to buy in the single digits and sell in the low 40s.

This is why I have been aggressively taking profits on long positions and slapping on short positions as hedges for the remaining longs. The Global Trading Dispatch model portfolio went into this week net short.

My Mad Hedge Technology Letter has only one 10% position left, in Microsoft (MSFT).

While a 3% 10-year is neither here nor there, the rapidly inverting yield curve is. The two-year/10-year spread is now a miniscule 53 basis points.

The 10-year/30-year spread is at a paper thin 18 basis points. To show you how insane this is, it means investors are accepting only an 18-basis point premium for lending money to the US government for an extra 20 years!

This is a function of the US Treasury focusing its new gargantuan trillion dollar borrowing requirements at the short end of the curve. This is the exact opposite of what they should be doing with yields still close to generational lows.

What this does is create a small short-term budgetary advantage at a very high long-term cost. This is constant with the government's other backward-looking Alice in Wonderland economic policies.

When the yield curve inverts, watch out below, because it means a recession is near.

If the stock market continues to trade like this, as I expect it will, you can expect the next stock market rally to start in two months when we ramp up into the Q2 earnings reports.

Until then, we will probably just chop around. Enjoy your summer.

Global Market Comments

April 24, 2018

Fiat Lux

Featured Trade:

(DON'T MISS THE APRIL 25 GLOBAL STRATEGY WEBINAR),

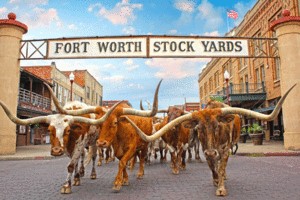

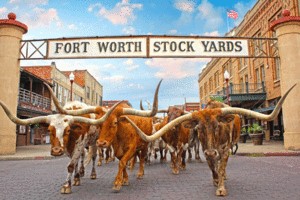

(MONDAY, JUNE 11, FORT WORTH, TEXAS, GLOBAL STRATEGY LUNCHEON)

(WHY INDEXERS ARE TOAST),

(VIX), (VXX), (SPY), (AAPL), (HACK),

My next global strategy webinar will be held live from Silicon Valley on Wednesday, April 25, at 12:00 PM EST.

Co-hosting the show will my friend, options expert Mike Pisani.

I'll be giving you my updated outlook on stocks, bonds, commodities, currencies, precious metal, and real estate.

The goal is to find the cheapest assets in the world to buy, the most expensive to sell short, and the appropriate securities with which to take these positions.

I will also be opining on recent political events around the world and the investment implications therein.

I usually include some charts to highlight the most interesting new developments in the capital markets. There will be a live chat window with which you can pose your own questions.

The webinar will last 45 minutes to an hour. International readers who are unable to participate in the webinar live will find it posted on my website within a few hours.

I look forward to hearing from you.

To log into the webinar, please click on the link we emailed you entitled, "Next Bi-Weekly Webinar - April 25, 2018" or click here.

Come join me for lunch at the Mad Hedge Fund Trader's Global Strategy Update, which I will be conducting in Fort Worth, Texas, on Monday, June 11, 2018. An excellent meal will be followed by a wide-ranging discussion and an extended question-and-answer period.

I'll be giving you my up-to-date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I'll be throwing a few surprises out there, too. Tickets are available for $248.

I'll be arriving at 11:30 AM, and leaving late in case anyone wants to have a one-on-one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at an exclusive downtown private club. The precise location will be emailed with your purchase confirmation.

I look forward to meeting you and thank you for supporting my research.

To purchase tickets for the luncheon, click here.

Hardly a day goes by without some market expert predicting that it's only a matter of time before machines completely take over the stock market.

Humans are about to be tossed into the dustbin of history.

Recently, money management giant BlackRock, with a staggering $5.4 trillion in assets under management, announced that algorithms would take over a much larger share of the investment decision-making process.

Exchange Traded Funds (ETFs) are adding fuel to the fire.

By moving capital out of single stocks and into baskets, you are also sucking the volatility, and the vitality out of the market.

This is true whether money is moving into the $237 billion S&P 500 (SPY), or the miniscule $1 billion PureFunds ISE Cyber Security ETF (HACK), which holds only 30 individual names.

The problem is being greatly exacerbated by the recent explosive growth of the ETF industry.

In the past five years, the total amount of capital committed to ETFs has doubled to more than $3 trillion, while the number of ETFs has soared to well over 2,000.

In fact, there is now more money committed to ETFs than publicly listed single stocks!

While many individual investors say they are moving into ETFs to save on commissions and expenses, in fact, the opposite is true.

You just don't see them.

They are buried away in wide-dealing spreads and operating expenses buried deeply in prospectuses.

The net effect of the ETF industry is to greatly enhance Wall Street's take from their brokerage business, i.e., from YOU.

Every wonder why the shares of the big banks are REALLY trading at new multi-year highs?

I hate to say this, but I've seen this movie before.

Whenever a strategy becomes popular, it carries with it the seeds of its own destruction.

The most famous scare was the "Portfolio Insurance" of the 1980s, a proprietary formula sold to institutional investors that allegedly protected them by automatically selling in down markets.

Of course, once everyone was in the boat, the end result was the 1987 crash, which saw the Dow Average plunge 20% in one day.

The net effect was to maximize everyone's short positions at absolute market bottoms.

A lot of former portfolio managers started driving Yellow Cabs after that one!

I'll give you another example.

Until 2007, every computer model in the financial industry said that real estate prices only went up.

Trillions of dollars of derivative securities were sold based on this assumption.

However, all of these models relied on only 50 years' worth of data dating back to the immediate postwar era.

Hello subprime crisis!

If their data had gone back 70 years, it would have included the Great Depression.

The superior models would have added one extra proviso - that real estate can collapse by 90% at any time, without warning, and then stay down for a decade.

The derivate securities based on THIS more accurate assumption would have been priced much, much more expensively.

And here is the basic problem.

As soon as money enters a strategy, it changes the behavior of that strategy.

The more money that enters, the more that strategy changes, to the point where it produces the opposite of the promised outcome.

Strategies that attract only $10 million market-wide can make 50% a year returns or better.

But try and execute with $1 billion, and the identical strategies lose money. Guess what happens at $1 trillion?

This is why high frequency traders can't grow beyond their current small size on a capitalized basis, even though they account for 70% of all trading.

I speak from experience.

During the 1980s I used a strategy called "Japanese Equity Warrant Arbitrage," which generated a risk-free return of 30% a year or more.

This was back when overnight Japanese yen interest rates were at 6%, and you could buy Japanese equity warrants at parity with 5:1 leverage (5 X 6 = 30).

When there were only a tiny handful of us trading these arcane securities, we all made fortunes. Every other East End London kid was driving a new Ferrari (yes, David, that's you!).

At its peak in 1989, the strategy probably employed 10,000 people to execute and clear in London, Tokyo, and New York.

However, once the Japanese stock market crash began in earnest, liquidity in the necessary instruments vaporized, and the strategy became a huge loser.

The entire business shut down within two years. Enter several thousand new Yellow Cab drivers.

All of this means that the current indexing fad is setting up for a giant fall.

Except that this time, many managers are going to have to become Uber drivers instead.

Computers are great at purely quantitative analysis based on historical data.

Throw emotion in there anywhere, and the quants are toast.

And, at the end of the day, markets are made up of high emotional human beings who want to get rich, brag to their friends, and argue with their spouses.

In fact, the demise has already started.

Look no further than investment performance so far in 2018.

The (SPY) is up a scant 0% this year.

Amazon (AAPL), on the other hand, one of the most widely owned stocks in the world, is up an eye-popping 30%.

If you DON'T own Amazon, you basically don't HAVE any performance to report for 2017.

I'll tell you my conclusion to all of this.

Use a combination of algorithms AND personal judgment, and you will come out a winner, as I do. It also helps to have 50 years of trading experience.

You have to know when to tell your algorithm a firm "NO."

While your algo may be telling you to "BUY" ahead of a monthly Nonfarm Payroll Report or a presidential election, you may not sleep at night if you do so.

This is how I have been able to triple my own trading performance since 2015, taking my 2017 year-to-date to an enviable 20%.

It's not as good as being 30% invested in Amazon.

But it beats the pants off of any passive index all day long.

Yup, This is a Passive Investor

Global Market Comments

April 23, 2018

Fiat Lux

Featured Trade:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or HERE COMES THE FOUR HORSEMEN OF THE APOCALYPSE),

(SPY), (GOOGL), (TLT), (GLD), (AAPL), (VIX), (VXX), (C), (JPM),

(HOW TO AVOID PONZI SCHEMES),

(TESTIMONIAL)

Have you liked 2018 so far?

Good.

Because if you are an index player, you get to do it all over again. For the major stock indexes are now unchanged on the year. In effect, it is January 1 once more.

Unless of course you are a follower of the Mad Hedge Fund Trader. In that case, you are up an eye-popping 19.75% so far in 2018. But more on that later.

Last week we caught the first glimpse in this cycle of the investment Four Housemen of the Apocalypse. Interest rates are rising, the yield on the 10-year Treasury bond (TLT) reaching a four-year high at 2.96%. When we hit 3.00%, expect all hell to break loose.

The economic data is rolling over bit by bit, although it is more like a death by a thousand cuts than a major swoon. The heavy hand of major tariff increases for steel and aluminum is making itself felt. Chinese investment in the US is falling like a rock.

The duty on newsprint imports from Canada is about to put what's left of the newspaper business out of business. Gee, how did this industry get targeted above all others?

The dollar is weak (UUP), thanks to endless talk about trade wars.

Anecdotal evidence of inflation is everywhere. By this I mean that the price is rising for everything you have to buy, like your home, health care, college education, and website upgrades, while everything you want to sell, such as your own labor, is seeing the price fall.

We're not in a recession yet. Call this a pre-recession, which is a long-leading indicator of a stock market top. The real thing shouldn't show until late 2019 or 2020.

There was a kerfuffle over the outlook for Apple (AAPL) last week, which temporarily demolished the entire technology sector. iPhone sales estimates have been cut, and the parts pipeline has been drying up.

If you're a short-term trader, you should have sold your position in April 13 when I did. If you are a long-term investor, ignore it. You always get this kind of price action in between product cycles. I still see $200 a share in 2018. This too will pass.

This month, I have been busier than a one-armed paper hanger, sending out Trade Alerts across all asset classes almost every day.

Last week, I bought the Volatility Index (VXX) at the low, took profits in longs in gold (GLD), JP Morgan (JPM), Alphabet (GOOGL), and shorts in the US Treasury bond market (TLT), the S&P 500 (SPY), and the Volatility Index (VXX).

It is amazing how well that "buy low, sell high" thing works when you actually execute it. As a result, profits have been raining on the heads of Mad Hedge Trade Alert followers.

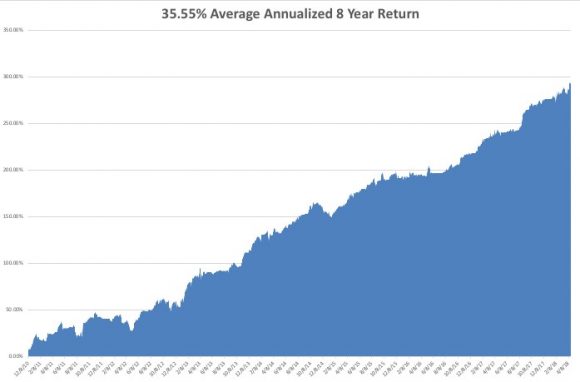

That brings April up to an amazing +12.99% profit, my 2018 year-to-date to +19.75%, my trailing one-year return to +56.09%, and my eight-year performance to a new all-time high of 296.22%. This brings my annualized return up to 35.55% since inception.

The last 14 consecutive Trade Alerts have been profitable. As for next week, I am going in with a net short position, with my stock longs in Alphabet (GOOGL) and Citigroup (C) fully hedged up.

And the best is yet to come!

I couldn't help but laugh when I heard that Republican House Speaker Paul Ryan announced his retirement in order to spend more time with his family. He must have the world's most unusual teenagers.

When I take my own teens out to lunch to visit with their friends, I have to sit on the opposite side of the restaurant, hide behind a newspaper, wear an oversized hat, and pretend I don't know them, even though the bill always mysteriously shows up on my table.

This will be FANG week on the earnings front, the most important of the quarter.

On Monday, April 23, at 10:00 AM, we get March Existing-Home Sales. Expect the Sohn Investment Conference in New York to suck up a lot of airtime. Alphabet (GOOGL) reports.

On Tuesday, April 24, at 8:30 AM EST, we receive the February S&P CoreLogic Case-Shiller Home Price Index, which may see prices accelerate from the last 6.3% annual rate. Caterpillar (CAT) and Coca Cola (KO) report.

On Wednesday, April 25, at 2:00 PM, the weekly EIA Petroleum Statistics are out. Facebook (FB), Advanced Micro Devices (AMD), and Boeing (BA) report.

Thursday, April 26, leads with the Weekly Jobless Claims at 8:30 AM EST, which saw a fall of 9,000 last week. At the same time, we get March Durable Goods Orders. American Airlines (AAL), Raytheon (RTN), and KB Homes (KBH) report.

On Friday, April 27, at 8:30 AM EST, we get an early read on US Q1 GDP.

We get the Baker Hughes Rig Count at 1:00 PM EST. Last week brought an increase of 8. Chevron (CVX) reports.

As for me, I am going to take advantage of good weather in San Francisco and bike my way across the San Francisco-Oakland Bay Bridge to Treasure Island.

Good Luck and Good Trading.

My financial advisory clients, by and large, have expressed a desire to be kept in the loop once a quarter and when it matters in between, but don't want to hear from me on an ongoing constant basis.

I know because I've asked.

They are mostly retired, conservative by nature, and want to enjoy life while trusting that I know what I'm doing.

I often get my talking points from you, and it's interesting to watch the relief on their faces when I talk, for example, about the millennials being the hope behind the national debt.

I point out that we have something China and Japan don't have - a large group of young people coming up the pike. For them those talking points bring a great sign of relief.

I'm going into some detail because it's something to think about when you're marketing your service.

My thoughts off the top of my head.

Cheryl

Portland, Oregon