I have been trading the Volatility Index (VIX) since it was first created in 1993.

Let me tell you, the Volatility Index we have today is not your father's Volatility Index.

The (VIX) was originally a weighted measure of the implied volatility of just eight S&P 100 at-the-money put and call options.

Ten years later, in 2004, it expanded to use options based on a broader index, the S&P 500, which allows for a more accurate view of investors' expectations on future market volatility. That formula continues until today.

There were two generational lows in the (VIX) that have taken place since inception.

The first was in 1998 during the heyday of the mammoth hedge fund Long-Term Capital Management. The firm sold short volatility down to the $8 level and used the proceeds to buy every bullish instrument in the universe, from Japanese equities to Danish mortgage bonds and Russian government debt.

Then the Russian debt default took place and the (VIX) rocketed to $40. LTCM suffered losses in excess of 125% of its capital, and went under in two weeks. It took two years to unwind all the positions, while the (VIX) remained $40 for a year.

To learn more detail about this unfortunate chapter in history, please read When Genius Failed by Roger Lowenstein. The instigator of this whole strategy, John Meriwether, once tried to hire me and is now safely ensconced in a massive estate at Pebble Beach, CA.

The second low came in January of 2018, when the (VIX) traded down to the $9 handle. This time around, short exposure was industrywide. By the time the (VIX) peaked on the morning of February 6, some $8 billion in capital was wiped out.

So here we are back with a (VIX) of $20.48. But I can tell you that there is no way we have a (VIX) $20.48 market.

This is because (VIX) is calculated based on a daily closing basis. It in no way measures intraday volatility, which lately has become extreme.

During 11 out of the last 12 trading days, the S&P 500 intraday range exceeded 2%. This is unprecedented in stock markets anywhere any time.

It has driven traders to despair, driven them to tear their hair out, and prompted consideration of early retirements. The price movements imply we are REALLY trading at a (VIX) of $50 minimum, and possibly as high as $100.

Of course, everyone blames high frequency traders, which go home flat every night, and algorithms. But there is a lot more to it than that.

Heightened volatility is normal in the ninth year of a bear market. Natural buyers diminish, and volume shrinks.

At this point the only new money coming into equities is through corporate share buybacks. That makes us hostage to a new cycle, that of company earnings reports.

Firms are now allowed to buy their own stock in the run up to quarterly earnings reports to avoid becoming afoul of insider trading laws. So, the buyers evaporate a few weeks before each report until a few weeks after.

So far in 2018 this has created a cycle of stock market corrections that exactly correlate with quiet periods. This is when the Volatility Index spikes.

And because the entire short volatility industry no longer exists, the (VIX) soars higher than it would otherwise because there are suddenly no sellers.

So, what happens next when companies start reporting Q1, 2018 earnings? They announce large increases in share buybacks, thanks to last year's tax bill. And a few weeks later stocks take off like a scalded chimp, and the (VIX) collapses once again.

That's why the Mad Hedge Fund Trader Alert Service is short the (VIX) through the IPath S&P 500 VIX Short Term Futures ETN (VXX) April, 2018 $60-$65 in-the-money vertical bear put spread.

Just thought you'd like to know.

Global Market Comments

April 10, 2018

Fiat Lux

Featured Trade:

(DON'T MISS THE APRIL 11 GLOBAL STRATEGY WEBINAR),

(IT'S ALL ABOUT WHAT HAPPENS NEXT),

($INDU), (GOOGL),

(HOW AMERICA'S PLUNGING EDUCATION SURPLUS WILL DAMAGE YOUR PORTFOLIO), (UUP)

My next global strategy webinar will be held live from Silicon Valley on Wednesday, April 11, at 12:00 PM EST.

Co-hosting the show will my friend Jim Kenney from Option Professor.

I'll be giving you my updated outlook on stocks, bonds, commodities, currencies, precious metals, and real estate.

The goal is to find the cheapest assets in the world to buy, the most expensive to sell short, and the appropriate securities with which to take these positions.

I also will be opining on recent political events around the world and the investment implications therein.

I usually include some charts to highlight the most interesting new developments in the capital markets. There will be a live chat window with which you can pose your own questions.

The webinar will last 45 minutes to an hour. International readers who are unable to participate in the webinar live will find it posted on my website within a few hours.

I look forward to hearing from you.

To log into the webinar, please click on the link we emailed you entitled, "Next Bi-Weekly Webinar - April 11, 2018" or click here.

Stock markets are only in the business of discounting what happens next. I spend so much time anticipating the coming moves in shares that I can't even remember what I had for breakfast.

This is why technical analysis is such a bust as an investment strategy, except on an intraday basis only, as it is entirely founded on historical data. It is 100% backward looking.

So, I'll take you through the same thought experiments that convinced me to adopt a much more aggressive stance toward the markets after spending two months hiding in the weeds.

What happens after stocks hit new highs? They hit new lows, as they did on April 1, when the Dow Average plunged to 23,600.

What happens after markets hit new lows? They hit new highs again, supported by the strongest earning reports in history, which begin on Friday, April 13.

What happens after the inflation scare we received in the January Nonfarm Payroll Report with the surprise pop in average hourly earnings?

Inflation non-events, which unfolded with average hourly wages that came in subdued with the February and March Nonfarm Payroll Reports.

What follows a trade war? Trade peace, which is yet to come, but will arrive eventually nevertheless.

All of this points to stock markets that are in the process of putting in the lows for 2018. That means it is time to start ramping up your risk, as I did with three rapid Trade Alerts yesterday.

What does this look like on the charts? Alphabet (GOOGL) is a perfect example, which is in the process of putting in a very convincing triple bottom around the $1,000 level, right around the 200-day moving average.

What if I'm wrong?

After all the trade war continues to inflame by the day, the algorithms are still running amok, and the president still has a Twitter account.

What did it today? The Congressional Budget Office forecast of $1 trillion deficits running indefinitely? Or the FBI raids on the offices of the president's personal lawyer?

Then markets will edge down to the next support levels, about 4% lower than the most recently visited bottom, or about 22,600 in the Dow Average.

So, it would seem that the really smart thing to do here is to build options positions that can take that 4% hit, and STILL expire at their maximum profit points.

And this is exactly what I have been doing for the past two weeks: piling on long positions in the best technology stocks, and adding to short positions in bonds.

For fans of LEAPS, long dated out-of-the-money option call spreads one year or more out, this is the best time this year to get involved.

I'll give you an example.

BUY one June 21, 2019 $1,000 call at $145.00

SELL one June 21, 2019 $1,050 call at $120.00

NET COST = $25.00

In the event that (GOOGL) closes over $1,050 on June 21, 2019, or up 3% from today's closing level, the profit on this position would amount to $25.00 from an initial cost of $25.00, or a 100% gain in 14 months.

The only catch is that if the recession comes sooner than expected, the value of this position falls to zero in 14 months.

If you go deeper out-of-the-money with your strike prices, the potential profit rises by a multiple.

You can generate this kind of astronomical return with any of the FANGs assuming no real movement of the stock in a year.

It looks pretty good to me.

You heard it here first.

Winter Is Ending

For the first time in 40 years, the number of foreign students applying for American colleges and universities is declining.

The drop is particularly noticeable at University of California, Berkeley, where Asian students account for about 10% of incoming freshmen. This is turning the Golden State's education budget upside-down, because foreigners pay almost triple the tuition of in-state residents, some $41,942 a year for the 2018-2019 school year.

Trump's China bashing has been widely reported throughout the Middle Kingdom, scaring away prospective applicants.

Who wants to attend school in a country at war with the homeland - trade or the shooting kind?

So has the upturn in attacks in the US on minorities, be they religious, ethnic, national, or otherwise.

Trump certainly made that attitude crystal with his attempted immigration bans, now blocked by the courts.

Students are worried they will be physically attacked, or deported by an aggressive immigration department. That is if they can even get into the country in the first place.

It isn't just California schools that are getting hit. Institutions of higher learning across the nation are reporting similar drawdowns.

Foreign students are instead applying to British and European schools, or not going abroad at all to save money.

If this sorry trend continues, it will cause substantial damage to the American education system, the US economy as a whole, US influence abroad, and the US dollar (UUP).

Higher education has grown into a gigantic service industry for America, with a massively positive impact on our balance of payments, generating an impact on the world far beyond the dollar amounts involved.

According to the nonprofit Institute of International Education, there are 819,644 foreign students in the US today.

This combined student body pays an average out-of-state tuition of $25,000 a year each totaling some $24 billion. The positive impact on the US balance of payments and the US dollar exchange rate is huge.

China is far and away the dominant origin of these students, accounting for 235,597.

South Korea and India take the No. 2 and No. 3 slots, thanks to the generous scholarships provided by their home governments. Saudi Arabia and Brazil are showing the fastest growth rates.

A fortunate few, backed by endowed chairs and buildings financed by wealthy and eager parents, land places at prestigious universities such as Harvard, Princeton, and Yale.

The top destinations of foreign students are the University of Southern California in Los Angeles, CA, the University of Illinois at Urbana-Champaign, Indiana's Perdue University, and New York University, with each of these claiming 9,000 foreign students.

However, the overwhelming majority enroll in the provinces in a thousand rural state universities and junior colleges of which most of us have never heard.

Many of these schools now have diligent admissions officers scouring the Chinese hinterlands looking for new applicants.

A college degree once was a uniquely American privilege. In 1974 the US led the world, with 24% of the population getting a sheepskin.

Today, it has fallen to 16th, with 28% completing a four-year program, lagging countries such as South Korea, Canada, and Japan.

The financial windfall has enabled once sleepy little schools to build themselves into world-class institutions of higher learning, with 30,000 or more students.

They boast state-of-the-art facilities, much to the joy of local residents and budget-constrained state education officials.

Furthermore, the overwhelming leadership of education industry is steadily Americanizing the global establishment.

I can't tell you how many times over the decades I have run into the Persian Gulf sovereign fund manager who went to Florida State, the Asian CEO who attended Cal State Hayward, or the African finance minister who fondly recalled rooting for the Kansas State Wildcats.

Remember the recently ousted president of Egypt, Mohamed Morsi? He was a former classmate of mine at the University of Southern California. Go Trojans! Do you think he was singing "Fight on For Old SC" in his jail cell?

Those who constantly bemoan the impending fall of the Great American Empire can take heart by merely looking inland at these impressive degree factories. These students are not clamoring to get into universities in Beijing, Moscow, or Tokyo.

Not a few marry and permanently settle in the US, while many others take their American brides home. Saudi Arabia is home to some 50,000 such wives, who had to agree to sharia law and give up driving to obtain resident permits.

It also explains why the dollar is so strong in the face of absolutely gigantic, structural trade deficits.

When a foreign student pays tuition to a US school, it is treated as an export of a service in terms of the US balance of payments, much like a car or an airplane, our country's largest exports.

Rising exports mean that more dollars are staying home and fewer are going abroad, strengthening the value of the greenback.

And $24 billion and change offsets a lot of imports of cheap electronics, clothing, and toys from China.

The US has plenty of capacity to expand this trade in services. More than 70% of foreign students are concentrated in just 200 of the country's 4,000 colleges.

The University of California has blazed a path that many other cash-strapped institutions are certain to follow. During the financial crisis, the world's greatest public university saw two back-to-back 40% budget cuts from Sacramento.

So, it made up the shortfall by bumping up foreign admissions from 5% to 10%, largely from Asia. They must pay $38,000 a year in tuition, compared to $18,000 for in-state residents.

What is the upshot of all of this for the locals? It is now a lot harder to get an "A" in Math at UC Berkeley.

Global Market Comments

April 9, 2018

Fiat Lux

Featured Trade:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or HERE'S THE BIG CALL),

(JPM), (GOOGL), (GLD), (TLT), (VXX),

(HOW TO "SNOWBALL" YOUR FORTUNE WITH BENJAMIN FRANKLIN)

Well that tears it!

Flamethrowers! Yes, on the list of 125 products that China is imposing new 25% import duties are flamethrowers.

And I was so looking forward to getting a flamethrower of my own with which to singe lazy and errant stock analysts from whom we all are afflicted.

I guess I'll just have to buy American, which I already do with my cars (Teslas).

The real call here is that the NASDAQ has entered a well-defined trading range, from 6,600 to 7,600, where it will remain trapped for six months until the November midterm congressional elections. After that, we will rally 10% in year-end rally.

The deep in-the-money call spread strategy I employ is ideally suited to this kind of go-nowhere market. While other traders are tearing their hair out, you'll be raking in the money every month as if you've just been adopted by a new rich uncle.

The president, absolutely cacophonous about the riches created by a rising stock market, has developed lockjaw in a falling one.

The reason was provided by trade advisor Peter Navarro, who said quite simply that the markets were wrong in their belief that trade wars decimate share prices.

My half century of trading tells that markets are never wrong, only people are.

And while the chief architect of our China trade policy has never been there, I managed to find it in 1974. It's easy. You just head east.

Here are some harsh numbers to show you how quixotic the administration policies are. By imposing $25 billion in import duties to protect dying American industries, investors cut $3 trillion off of US stock market capitalization.

That is a 120:1 risk reward AGAINST us. That's NOT the kind of trade I'm used to strapping on.

I'm sure the Chinese are thinking, "How would you like to lose another $3 trillion?" "How about a recession and bear market?" and "See you $25 billion and raise you $50 billion!"

Here is a number that gets lost in translation of the $1 trillion in two-way trade between the US and China. Some 90% of the profits accrue to the US. It is an issue that officials in Beijing have been complaining to me about for decades, which essentially makes them the low-waged manufacturing colony.

That iPhone X that Foxconn makes for $100 Apple (AAPL) sells for $1,000 in the US.

One then has to ask the cogent question, "If you're winning the game, why change the rules?"

The Chinese are not a nation you want to antagonize. They endured 2 million casualties in Korea just to inflict 50,000 on us. Chosin Reservoir looms large in my family - the best fighting retreat in history carried out by the Marine Corp.

The Chinese can also suffer more pain than Americans, with most only one or two generations out of a $300 annual per capita income.

Will the US November congressional election affect economic fundamentals" I doubt it. The mere fact that the election is out of the way is worth a 10% stock market rally into year-end.

The March Nonfarm Payroll Report was a disappointment for the second month in a row, coming in at a feeble 103,000. The headline unemployment rate remains at a decade low of 4.1%.

The stock market didn't care, with the overwhelming focus now on trade issues.

The really important numbers now, Average Hourly Earnings, were up a slightly inflationary 0.3%, but no one noticed.

The January and February reports we revised downward by a steep 50,000.

Manufacturing gained 22,000 jobs, Health Care was up 22,000, and Professional and Business Services up 33,000. Construction lost 15,000 jobs, thanks to raising interest rates.

The Broader U-6 "Discouraged Worker" unemployment rate dropped 0.2% to 8.0%, a new decade low.

As a stand-alone number, the report is not important. However, look at it in the context of a rising tide of recent, slightly negative economic data reports and one has to start to get concerned. Is it the weather, or the beginning of something larger?

We are only a week off from when the Q1, 2018 earnings season kicks off, which will probably deliver some of the strongest reports in US history.

Until then, the data reports will be relatively benign.

On Monday, April 9, nothing of note is announced.

On Tuesday, April 10, we receive March NFIB Small Business Optimism Index.

On Wednesday, April 11, at 8:30 AM EST, we learn the all-important Consumer Price Index, the most important read on inflation. Bed Bath & Beyond (BBBY) reports.

Thursday, April 12, leads with the Weekly Jobless Claims at 8:30 AM EST, which saw a dramatic rise of 24,000 last week (another bad number). BlackRock (BLK) reports.

On Friday, April 13, at 10:00 AM EST, we get the JOLTS Report on private sector job openings. It is the big day for bank earnings, with Citigroup (C), JP Morgan (JPM), and Wells Fargo (WFC) all reporting.

The week ends as usual with the Baker Hughes Rig Count at 1:00 PM EST. Last week brought a drop of 2.

Followers of the Mad Hedge Trade Alert Service enjoyed one of their best weeks in years. Executing on the views above, I nailed the market bottom, hauling in an eye-popping 5.06% in performance in a single day.

I artfully used the huge sell-off days to pile on long positions in Google (GOOGL) and JP Morgan (JPM), and sell short US Treasury bonds and volatility (VXX). On the up days I bought gold (GLD).

It all worked like a charm, and every position is now profitable.

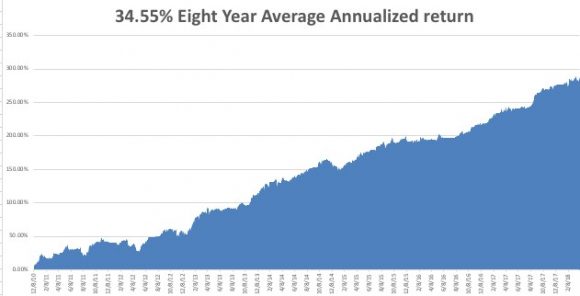

That brings April up to a +4.76% profit, my trailing one-year return to +49.72%, and my eight-year average annualized return up to 34.55%. We are an eyelash short of a new all-time performance high.

As for me, I'll be shutting down my Lake Tahoe estate for a while, not that the snow has turned to rain. The lake level is at a 118-year high, and Reno, NV, is worried about flooding. All the floodgates are open.

What a winter! I barely had time to tear myself away from my screens to visit the slopes.

Good Luck and Good Trading.

"The car business is hell," said Tesla co-founder Elon Musk, when announcing he would sleep in the Fremont, CA, Tesla factory until Model S production reaches 2,500 units a week.

Global Market Comments

April 6, 2018

Fiat Lux

Featured Trade:

(FRIDAY, JUNE 15, DENVER, CO, GLOBAL STRATEGY LUNCHEON)

(DON'T MISS THE APRIL 11 GLOBAL STRATEGY WEBINAR),

(A NOTE ON OPTIONS CALLED AWAY),

(TLT), (GOOGL), (JPM), (VXX)

Come join me for lunch at the Mad Hedge Fund Trader's Global Strategy Luncheon, which I will be conducting in Denver, CO, on Friday, June 15, 2018. An excellent meal will be followed by a wide-ranging discussion and an extended question-and-answer period.

I'll be giving you my up-to-date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I'll be throwing a few surprises out there, too. Tickets are available for $228.

I'll be arriving at 11:30 AM, and leaving late in case anyone wants to have a one-on-one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at an exclusive downtown private club. The precise location will be emailed with your purchase confirmation.

I look forward to meeting you and thank you for supporting my research.

To purchase a ticket, please click here.