The conspiracy theorists will love this one.

The IRS has long despised the barbaric relic (GLD) as an ideal medium to make invisible large transactions. Did you ever wonder what happened to $500, $1,000, $5,000, and $10,000 bills?

Although the Federal Reserve claims on their website that they were withdrawn because of lack of use, the word at the time was that they disappeared to clamp down on money laundering operations by the mafia.

In fact, the goal was to flush out income from the rest of us.

Currency trivia question of the day: whose picture was engraved on the $10,000 bill? You guessed it, Salmon P. Chase, Abraham Lincoln's Secretary of the Treasury.

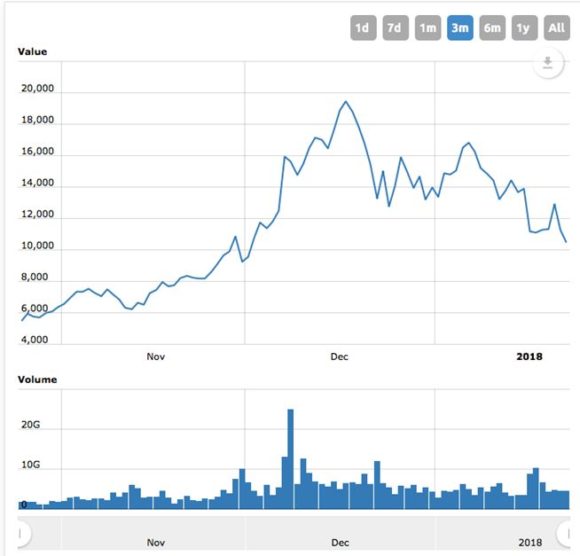

Now organized crime, terrorists, and tax cheats have another means with which to sidestep the IRS: Bitcoin.

When India dumped its high denomination banknotes in 2016, to where did everyone flee? To Bitcoins.

When China clamped down on individuals desperate to get their savings out of the country, what means did they use? Bitcoin.

As a result, the price of Bitcoins exploded some 110% to $1,100 over the past six months, and then crashed.

It is an old nostrum that if you block one means to avoid taxes, new ones will spring up to replace them.

This is a classic case.

Out With the Old

In With the New

Anyone wondering about the long term future of the US economy is amazed at how fast it is evolving.

There has been an unrelenting growth of services' share of American GDP, from 25% to 45% over the last sixty years.

Far and away the fastest growth area for the past eight years has been health care, thanks to Obamacare. With that program now headed for the dustbin of history, those job gains are about to be quickly unwound.

It takes one health care professional to take care of 14 Americans. If you eliminate health care for 20 million, that eliminates 1.42 million jobs.

That's what will happen if our national health care is eliminated without a replacement.

This is not necessarily a bad thing. Would you rather be mining coal or designing a website? Do you want to earn $12 an hour, or $150?

These statistics make us the envy of the world, as services are where the future lies. By creating so many key technologies, our country has been the most successful in the world in climbing up the value chain.

China can have all the $3 an hour jobs it wants.

Services largely comprise pure intellectual content, require no raw materials, and the end product can be transmitted over the Internet.

There is a reason why nearly a million foreign students have flocked to the US for an education.

Emerging nations like China and South Korea, which only see services generating 10%-15% of their GDP, are wracking their brains trying to figure out how to play catch up.

Global Market Comments

January 22, 2018

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or CLOSED FOR BUSINESS),

(SPY), (TLT), (TBT), (GLD), (AAPL), (FB),

(BUSINESS IS BOOMING AT THE MONEY PRINTERS)

(TESTIMONIAL)

There is nothing quite like selling short sovereign bonds and then seeing the country in question go into default.

That was a big trade during the 1970's and 1980's, when after two oil shocks the credit worthiness of emerging nations went into a tailspin. I think I made three round trips on Brazil alone.

However, this time the sovereign in question is the United States of America. The government shut down that ensued on Friday triggers a de facto default on all its IOU's.

As a result, US Government bond prices have sold off sharply, taking yields on the ten-year Treasury bond from 2.44% to 2.64%, a four-year high.

The charts on bond prices couldn't look uglier, with many important long-term trend lines shattered. The double top is bleakly staring you in the face.

If you happen to be a coupon cutter not to worry. The Treasury has enough cash in the pipeline to keep up interest payments for at least a month.

And there is a silver lining behind the giant black clouds roiling over Washington. If you are being audited by the IRS this week the meeting is cancelled. Agents won't show if there's no money to pay them.

Such is trading and investing in the modern age, which seems to change by the day. Governments were never really all that reliable anyway; here today, gone tomorrow.

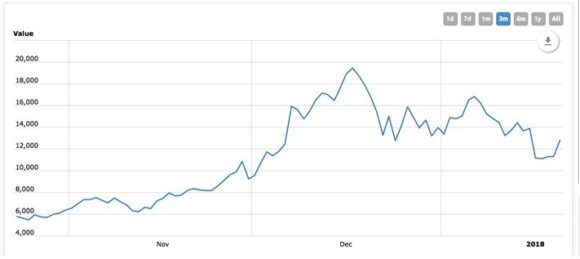

One of my 2018 forecasts has already played out. A Bitcoin crash would lead to a major rally in gold. That is exactly what has happened, with the crypto currency down an amazing 55% from its December high.

The barbarous relic popped smartly, some 8.54%. Is this the beginning of its long-awaited run to the old high at $1,928? We shall see.

After a slow start, no doubt the after effects of the Chicago winter, it's off to the races again with the Mad Hedge Fund Trader's Trade Alert Service.

At the Friday close we were up 3.1% so far in 2018, and boast a trailing 12 month profit of 58.68%, thanks to longs in Apple (AAPL) and Facebook (FB) and a short in Treasury bonds (TLT).

It hasn't been an easy market to get into. You essentially had to close your eyes and BUY. I sold into a brief short covering rally in bonds because they were so obviously falling apart.

I picked up the first of my long's during the 300 point dump triggered by the Steve Bannon subpoena. So far, I'm batting 100% in 2018.

This week will be all about housing data, which we already know are hotter than hot. Then there's the all-important Q4 GDP data on Friday. You'll have to count on individual company earnings reports as the wellspring of any volatility.

We are now into Q4 earnings season so those should be the dominant data points of the coming weeks.

On Monday, January 22, at 8:30 AM, the week kicks off with the December Chicago Fed National Activity Index, a leading indicator of inflation. Haliburton (HAL) announces Q4 earnings.

On Tuesday, January 23 at 10:00 AM EST the December Richmond Fed Manufacturing Index, a read on southern business activity. Johnson & Johnson (JNJ) announces earnings.

On Wednesday, January 24, at 10:00 AM EST, we obtain December Existing Home Sales. Ford Motors (F) announces earnings.

Thursday, January 25 leads with the 8:30 EST release of the Weekly Jobless Claims. At 10:00 AM December New Homes Sales are announced. The weekly EIA Petroleum Status Report is out at 11:00 AM EST. Celgene (CELG) announces earnings.

On Friday, January 26 at 8:30 AM we learn the first read on Q4 GDP, which should be very positive. Honeywell International (HON) announces earnings.

Then at 1:00 PM, we receive the Baker-Hughes Rig Count, which has started going ballistic.

As for me, I shall be flat on my back trying to recover from the flu. Yes, I am writing this letter in bed with a 103-degree fever watching the WWII movie Fury (my dad was a tanker).

Some 30 years of flu shots didn't do me any good this time, and 74 people in California have already died from this epidemic. However, as poorly as I may feel, the work schedule continues unabated. No rest for the wicked!

How about that (TLT) short!! It turns out that imminent government default on their bond obligations makes bond prices fold like a wet taco.

I'm happy to renew my subscription to The Mad Hedge Fund Trader. This current, very perplexing market demands a coach advising you on what it is doing.

If you do not step up to the plate and hit what is being pitched you will not succeed. The same is true with this market.

With a personal 35+ years of investing, some as a professional, I do not know of anyone that can interpret this confusing market better than John Thomas.

He has led me to some singles, occasional doubles and more than once led me to hit it right out of the park (+440% in the Jan FXE puts!).

The occasional high hard one coming straight at you can be painful, like with the (TBT), but it is all part of the game! You make nothing by sitting on the bench.

Keep them coming John.

Frank

West Chester, Pennsylvania

"An S&P 500 index fund never beats the index. There's fees, there's friction costs, and other costs involved," said Robert Reynolds, a manager at Putnam Investment Fund.

Global Market Comments

January 19, 2018

Fiat Lux

SPECIAL CLEVER OPTIONS TRADING ISSUE

Featured Trade:

(A CHEAP HEDGE FOR THIS MARKET),

(VIX), (VXX), (XIV), (SPY),

(HOW TO EXECUTE A VERTICAL BULL CALL SPREAD)

(FB),

(TESTIMONIAL)

The S&P 500 is now 5.66% above its 50-day moving average, the biggest gap in history, which itself is rising sharply.

So financial advisors, pension fund managers, and cautious individuals have been ringing me up asking what is the best way to hedge already heady 2018 gains.

You can forget about buying the Volatility Index (VIX), (VXX). The huge contango, the discount front month futures contracts have to far month ones, almost guarantees that your hedge will be enormously expensive and expire worthless before it has the chance to do any good.

If you don't believe me, check out the chart for the Velocity Shares Daily Inverse Short VIX ETN (XIV), which has gone ballistic since the last election, from $12 to $146, and is a bet on falling volatility.

No, there's a much better way to do this

Buy deep out-of-the-money, long dated S&P 500 (SPY) put options. You want to go deep out-of-the-money so your insurance policy is cheap.

You also want to go long dated, so time decay doesn't kill you and your option position lives long enough to do some good. By long dated I'm thinking five months out, like the June 15 2018 option expiration date.

All of this logic points to the (SPY) June 2018 $250 puts today priced at $2.50, which as of today are 10% out-of-the-money.

Here is the beauty of this position. A put option rises in value in falling markets. But so does option implied volatility, creating a leveraged hickey stick effect on the value of your put position. And deep out-of-the-money options always see implied volatilities rise much faster than near money ones.

You don't need the market to drop the full 10% to make enough profit on this position to offset losses elsewhere in your portfolio.

A much more likely 5% market correction would cause the value of the June 2018 $250 puts to jump from $2.50 to $4.10, a gain of 64%, as long as that drop happens soon. However, add in an expected pop in implied options volatility and the profit could be as much as 100%.

So how many June 2018 $250 puts should you buy?

Let's say you have a $100,000 portfolio. Only four put option contracts would provide enough coverage for your entire exposure ($100,000/100 shares per contract/$250 (SPY) strike price) = 4 contracts rounded off. Four contracts of the June 2018 $250 puts will cost you $1,000 (4 X 100 shares per contracts X $2.50).

In other words, $1,000 buys you an insurance policy on $100,000 portfolio exposure for five months. Sounds like a deal to me.

There are a few qualifications with such a simple hedge. Let's say that you read the Diary of a Mad Hedge Fund Trader and have a highly concentrated portfolio focused on technology, energy, financial, commodities, and industrials.

It such a case the tracking error between the (SPY) and your portfolio will be large (after all, that is the point), and you may not get all the downside protection you want.

On the other hand, what if we really get the 10% correction? What if the black swans suddenly land in flocks? In that case the value of your June 2018 $250 puts soars to at least $8.25, and more likely $12 when you add in the expected effects of rocketing implied volatilities. The value of your hedge rises to $4,800.

Yes, you don't get complete 1:1 coverage. But it's better than going into such a route naked, with no downside protection at all.

Let's say you're a cheapskate and you want your insurance policy for free. Yes, this can be done.

In addition to buying your June 2018 $250 puts, you also sell short an equal number of June 2018 $295 call options, which are 5% out-of-the- money. This gets you $740 in cash ($1.85 option cost X 100 X 4 contracts) which you can use to offset the cost of your June 2018 $250 puts.

The net cost of the five-month hedge then drops to only $260 ($1,000 - $740 = $260). This is what the pros do.

This kind of long put short covered call strategy is called a Collar, and is a classic risk control position used by big hedge funds.

Of course there is the risk that the market rises by more than 5% and your short call options get exercised against you. But if that happens you'll probably be too busy dancing in the street to notice, as your entire portfolio has just risen sharply in value.

There is another hedging strategy that is far easier to execute. Just take a long cruise around the world. That way, corrections will come and go and you might not even know about it, unless your butler brings you a copy of the Wall Street Journal every morning, as mine does.

This is the hedging strategy most of you have pursued for the past nine years and it has worked really well. At least you end up with a nice tan and some pleasant photos.

As for the June 2018 $250 puts they're most likely end up expiring worthless, but you'll sleep better at night. Such is the price of peace.

Correction? What Correction?

Global Market Comments

January 18, 2018

Fiat Lux

Featured Trade:

(MAD HEDGE JANUARY 17 STRATEGY WEBINAR Q&A),

(SPY), (GE), (TLT), (TBT), (EDIT), (GS), (BHGE), (USO),

(WMT), (NTLA), (BABA), (LMT), (TRN), (FXA)

(WHY THE REAL ESTATE BOOM HAS A DECADE TO RUN),

(DHI), (LEN), (PHM), (DXJ)

Q: Will deflation outpace inflation given the rapid pace of technology?

A: The answer is yes. We will get some inflation but not much. That's why I am calling the top in this interest rate cycle in the bond market at 4% instead of the 6%, 8%, or 10% we saw in earlier economic cycles. There have really been no real wage increases to really affect the big macro picture. Yes, we got the $2 an hour wage increase at Walmart (WMT), but in the grand scheme of things, that's really not much money. You'll make money on those bond shorts but you won't get a bond crash.

Q: What market is the best way to hedge market risk now?

A: The answer is that the S&P 500 (SPY) has the best hedging tools out there. Go with a deep out-of-the-money, long-dated (SPY) put. And when I say deep-out-of-the-money I'd say 10%, so you should be buying $250 puts on the (SPY), and when I say long dated, go out to June or July, or six months so time decay doesn't kill you. In that situation, just a 5% correction in the market will cause your $250 put to double in value. That will give you a 100% return and a lot of hedging value for a little bit of money if you need downside protection, which your financial advisors absolutely need to be putting on right now.

Q: What about the dividends on those puts (SPY)?

A: If you are long a put, you also can become liable for the quarterly dividend payment on the S&P 500. The way to avoid the assignment risk is to put on put option spreads in the Russel 2000, where there is a much lower dividend payment. It's too small to make an exercise worth it. The other way is to never do quarterly expiration options when the dividends are payable in only a few days. Going forward, do February puts, skip March, and then do April, May options to avoid assignment risk.

Q: Do we buy General Electric (GE)?

A: The answer is no. It?'s trading at $17 and the breakup value of this company is $15. This was a classic widow and orphan stock. Everybody in the universe owned this and it was in the Dow average. There's a lot of long term capitulation selling going and they may break the company up. There is a ton of stuff that could happen you have no insider advantage of what is going to happen, so just stay away. This has become a special situation stock. There are too many better things to buy right now than (GE).

Q: How will AMD earnings turn out?

A: The answer is they should be good. I like the whole chip sector. It had a sell off on the intel chip design flaw and the actual fact is that I have another Trade Alert already written to buy the stock with a call spread because the charts for the whole chip sector are setting up pretty nicely. That's my view on (AMD).

Q: Is it time to buy Goldman Sachs (GS)?

A: I would say yes. This is a good entry point. You wanted a dip to buy on? This is the dip. Eventually rising interest rates will bail out (GS) and increase bond trading volume where they really make their money, not on the directional call but on the volume. Last quarter the bond trading volume was terrible that generated losses, and by the way, the tax bill allowed them to take a one off write off of $5 billion on their 2017 earnings. That was included in the loss that they announced this morning. Give it one more day, let it sell off a little more, then look to buy. I doubt it will drop below the 200-day average at $231 and we may not even break the 50-day at $248.

Q: What do you think about Alibaba (BABA)?

A: The answer is I like it as a Chinese FANG. Alibaba is essentially a combination of Amazon (AMZN), Alphabet (GOOGA), and PayPal (PYPL) in China, it has had a near doubling over the past year, and I still think there is more in it. I am positive on the FANG'S this year but I don't think you'll get the same meteoric returns we got last year.

Q: Will NVIDIA (NVDA) really double again?

A: The answer is yes, but only off that $180 low that we got in December, and we are already well on the way there. A year ago, I said Nvidia would double and that was the one stock you had to buy. And this year I am also saying Nvidia is my double for the year. The trends in technology are so overwhelmingly in favor of this one name that you absolutely have to buy it on every dip. Don't even ask any questions.

Q: Is TBT more for trading than investing?

A: It is because you have a negative carry on the TBT of about 6% per year. You have to pay two times the US Treasury coupon on an annualized basis, which today is 2.55%, plus the management fees. So ideally, it's a trade and not a long-term investment. Any short play in a high yielding security like this is going to cost money to run over time.

Q: Where do you think TLT will be at the end of February?

A: I would say lower. I'm hoping we will break the $120 level. So here at the $125 level it looks pretty attractive on the short side. Again, we aren't talking gigantic numbers. When we used to see bond sell offs we were talking about 10 to 20 points, now we are looking at 3 to 5 points.

Q: Should i double my (TLT) short position?

A: The answer is yes, but let's see if we can squeeze a little more upside action out of it to $126 like I just mentioned.

Q: Should I keep buying the CRISPR stocks on dips like Intellia Therapeutics (NTLA) and Editas (EDIT)?

A: Absolutely yes, this is like the first floor of a 100-story building. These CRISPR stocks have a lot more to go, and by the way, every single of one of these guys are a takeover target from a major pharma company. I am very bullish.

Q: What about the Aussie dollar (FXA)?

A: It is a commodity currency and we have a commodity boom going on. Eventually, the Aussie should hit US$1.00, so if Australians have any foreign bills to pay, delay them. They will become cheaper by 10% in the next couple of months. This a classic commodity currency because their biggest exports are iron ore, coal, etc.

Q: Should I sell Baker Hughes (BHGE) now?

A: I would take profits here. This company is 60% owned by (GE) and given all the ruckus going on in (GE), this company could get sold and might threaten the 30% gain in one month that we just had. No one ever got fired for taking a profit.

Q: Should we put on an options bull call spreads in the various oil names?

A: Answer is yes, but I would go deep-in-the-money, so when we get the inevitable correction, you won't get shaken out of your position. Also, I'd go short dated which is another way of controlling your risk by only buying the front month call spreads and just adding new ones as the old ones expire. It's a classic late cycle trading strategy.

Q: Do you have any comments on defense companies?

A: I would stand aside at this point because these stocks, like Raytheon (RTN) and Lockheed Martin (LMT) have all doubled in the last year or two. We've had no new wars and we've had no increase in defense spending approved by congress. Too many other better things to play and it's very late in the cycle for defense at this point.