Global Market Comments

January 9, 2018

Fiat Lux

Featured Trade:

(TRADING THE COMING EARNINGS HIT IN APPLE),

(AAPL), (GOOG), (ORCL), (MSFT),(PFE), (JNJ),

(PG), (GS), (RDS/A), (DDAIF), (BMWYY), (TLT),

(BIDDING MORE FOR THE STARS),

(SPY), (INDU), (NVDA)

By now, you are all long up the wazoo with the shares of Apple (AAPL).

How would you respond if I told you that Steve Jobs' creation is about to take a gigantic $33 billion earnings hit?

My guess is that you'd jump off the nearest bridge, slit your wrists, or at the very least, come down with a severe case of Montezuma's Revenge.

I can pretty much guarantee you that such a blockbuster announcement is headed your way in the coming weeks, if not days.

What the heck happened? Wasn't the dream scenario playing out for big tech, as predicted by the Mad Hedge Fund Trader for the past decade?

It is. But these days, things are complicated. Very complicated.

Buried in the tax bill passed with great haste at the end of 2004 is a provision that allows US companies to repatriate profits they have held overseas for the past 14 years. We're not talking small beer here.

The latest estimate for this figure is some $2.8 trillion, which is stashed away in the bank accounts of subsidiaries in Switzerland, the Cayman Islands, and Lichtenstein.

Five companies account for about one third of this total, including Apple (AAPL), Microsoft (MSFT), Pfizer (PFE), Cisco (CSCO), and Oracle (ORCL).

Oil companies, and other companies with major international business, like Johnson & Johnson (JNJ), Morgan Stanley (MS), and Procter & Gamble (PG), account for much of the rest.

Until now, if management wanted to bring this money back to the US they would have to count it as regular income and pay a stiff 35% tax rate. As of January 1, they can repatriate the funds and pay as little as 8%.

And here's the problem. These one-time-only tax payments have to be counted as a current expense. The amounts are so huge that they be enough to wipe out all present operating earnings.

For example, in Apple's case one estimate has the tax bill as high as $33 billion as the company brings home money from dozens of different foreign domiciles.

The writing is already on the way. Goldman Sachs (GS) has already said that it expects a tax hit of $5 billion, while Royal Dutch Shell (RDS/A) has come in at $2.3 billion.

The logic behind the tax cut is that repatriated money would be used to build more factories and hire more people in the good old USA.

Past repatriations prove that nothing of the sort will take place. In 2004 the Bush administration engineered just such a break. Some $312 billion was brought back and almost entirely invested in share buy backs and dividend payments.

This all goes back to my argument at the end of 2017 that one way or the other the entire $1.5 trillion tax package will end up in the stock market one way or the other. The market action since then totally vindicated that view.

So what to do about Apple? Here's where it really gets complicated.

Going forward, multinational companies now have to pay only a 10.5% on their foreign earnings and 21% for domestic earnings. It is a big incentive to close down US production facilities and ship them, and their jobs, overseas. You really have to wonder who thought this stuff up.

After all, does Apple want to pay the $14 an hour it gives low end workers in the US now, or $1 an hour to workers in India where its next big growth market is located?

Apple has been expected a reoccurrence of exactly this sort of tax windfall for at least a decade and has been reserving for it annually. But it thought the tax rate would be much higher, around 13%.

The net result is that by underestimating the generosity of future administrations it has over reserved for the prospect, meaning that instead of generating a monster $33 billion loss repatriation could create a surprise $3 billion profit!

So the bottom line here for Apple is that you hang on to the stock, where I have a price target of $200, and is now looking exceedingly conservative.

If for some reason the tax announcement DOES generate a big drop in the shares, jump in with both hands and buy it.

There are other weird quirks to the new tax law. Foreign companies operating in the US are also entitled to use the break. This means that if your US operations have been running at a loss, which is the case with Daimler Benz (DDAIF) and BMW (BMWYY), it generates a surprise $1 billion profit!

Tax breaks for Germans. Who ever thought of that? Talk about unintended consequences with a turbocharger.

In the meantime, attorneys and accounts are pouring over the new code harvesting hundreds of new tax loopholes no one ever thought possible. We will stay turned and keep you informed of the important ones, as taxes are a regular part of the coverage of this letter.

My bet is that unintended consequences are creating entire new industries that no one imagined possible. That is how an innocent tax break to help new technology startups with carried interest turned into the gargantuan trillion dollar private equity industry of today.

Here's another unintended consequence for you. The combined tax paid this year by repatriating companies should total around $235 billion. That will slow the current meteoric growth in the US budget deficit and means you short position in the bond market may take a little longer to play out.

Don't we live in a bizarre, upside down Alice in Wonderland world these days?

In the meantime, I'll be checking out commercial real estate in Switzerland, the Cayman Islands, and Lichtenstein.

Going to Visit My Money

Global Market Comments

January 8, 2018

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or FEEDING THE GEESE)

(THE PASSIVE/AGGRESSIVE PORTFOLIO)

"Feed the geese when they are quacking."

That is the motto I heard on a daily basis while running a trading desk at Morgan Stanley for a decade. What it means is that when investors want to buy stocks, you give them to them. And gave them we did.

There seem to be a lot of squawking geese flying around Wall Street these days, and records are being broken like clay pigeons on an Olympic skeet sheeting final.

It has been the strongest start to a year in two decades. Last year, the stock market rose every month for the first time in 70 years!

In the meantime, the sell signals have started popping up like poisonous mushrooms in the aftermath of a San Francisco Bay Area rainstorm.

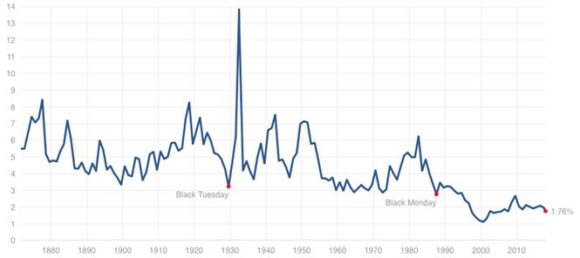

This week, the inversion of the yield curve continued its relentless advance, like "The Blob" that ate New York. The two-year Treasury bill yield surpassed 1.98%, exceeding the S&P 500 dividend yield for the first time since 2009.

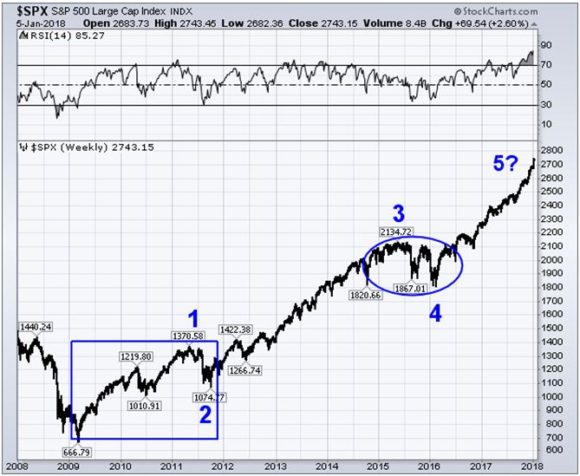

My friends over at Stockcharts.com have observed that we are now in the fifth (and final) Elliot Wave move up in a bull market that started in 2009.

Not that you should worry about any of this today. Just add it to your "I told you so" diary, which you can start showing to your friends in about 18 months.

I could go on and on. But I don't want to say anything that might prompt readers to sell shares prematurely. As I have noted many times, tops can take years to form, and early sellers always look foolish.

Traders were selling short the Nikkei average from 1985 onward, and dotcom stocks from 1995, both times with grievous results.

When you throw bad news on a market and it fails to go down, you buy the daylights out of it.

That was certainly the case when the December Nonfarm Payroll Report came out Friday at a flaccid 148,000. The headline unemployment rate held steady at 4.1%. This should have been an excuse to pause and let reason have its say.

Instead, feverish investors afraid of getting left behind took the Dow Average up some 225 points.

Health Care added a robust +31,000 jobs as we baby boomers besiege our Medicare covered doctors. Construction added +30,000 as Homebuilders race to meet a structural shortage of houses. Manufacturing picked up +23,000 jobs.

What was truly gob smacking was the loss of -20,000 jobs by Retail in what is normally the strongest month of the year. The year on year number is now a mind numbing -67,000. Macy's (M) has already announced the closing of another dozen stores this week. Clearly, the Amazonification of the economy continues full speed ahead.

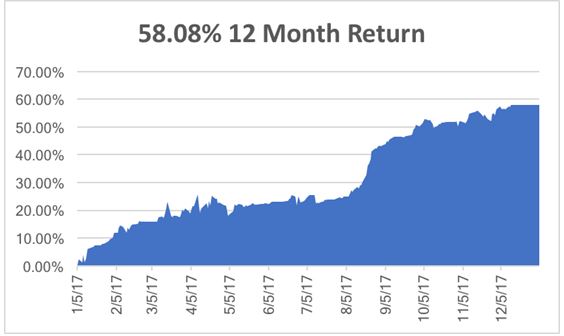

My own trading performance continues to flat line at an all-time high at +58.08% on a trailing twelve-month basis. With virtually every asset class overbought after the New Year feeding frenzy, there is nary a sweet spot entry to be found. Just give it time.

After last week's fireworks on the jobs front, the coming week's economic data points will be painfully dull by comparison.

On Monday, January 8, at 3:00 PM EST, November Consumer Credit is published, a lagging monthly read on outstanding credit card balances, which have recently been rising.

On Tuesday, January 9 at 8:55 AM EST, we get the November JOLTS Report on job openings, which is already at all-time highs.

On Wednesday, January 10, the weekly EIA Petroleum Status Report is out at 10:30 AM EST.

Thursday, January 11 leads with the 8:30 EST release of the Weekly Jobless Claims.

On Friday, January 12 at 8:30 AM EST the December Consumer Price Index is out, a read on inflation. Given the accelerating improvement of technology the number may actually fall from last month's 2.2%.

Then at 1:00 PM, we receive the Baker-Hughes Rig Count, which lately has started to turn up again.

As for me, now that the New Year crazy days are winding down, I'll be headed up to Lake Tahoe to dig into serious research. I might even search for some inspirational leadership by reading Michael Wolf's new book, "Fire and Fury" and see what all the fuss is about, but only if I can tear myself away from the ski slopes long enough.

137 Years of S&P 500 Dividend Yields

What if you want to be a little more aggressive with your investment strategy, say twice as aggressive? What if markets don't deliver any year on year change?

Then you need a little more pizzazz in your portfolio, and some extra leverage to earn your crust of bread and secure your retirement.

It turns out that I have just the solution for you. This would be my "Passive/Aggressive Portfolio".

I call it passive in that you just purchase these positions and leave them alone and not trade them. I call it aggressive as it involves a basket of 2x leveraged ETF's issued by ProShares, based Bethesda, MD (click here for their link).

The volatility of this portfolio will be higher. But the returns will be double what you would get with an index fund, and possibly much more. It is a "Do not open until 2035" kind of investment strategy.

Here is the makeup of the portfolio:

(ROM) - ProShares Ultra Technology Fund - The three largest single stock holdings are Apple (AAPL), Microsoft (MSFT), and Facebook (FB). It was up 80.95% last year. For more details on the fund, please click here.

(UYG) - ProShares Ultra Financials Fund - The three largest single stock holdings are Wells Fargo (WFC), Berkshire Hathaway (BRK.B), and JP Morgan Chase (JPM). It was up 38.42% last year. For more details on the fund, please click here.

(UCC) - ProShares Ultra Consumer Services Fund - The three largest single stock holdings are Amazon (AMZN), Walt Disney (DIS), and Home Depot (HD). It was up 3.71% last year. For more details on the fund, please click here.

(DIG)- ProShares Ultra Oil & Gas Fund - The three largest single stock holdings are ExxonMobil (XOM), Chevron (CVX), and Schlumberger (SLB). It was DOWN 9.20% last year. For more details on the fund, please click here.

(BIB) - ProShares Ultra NASDAQ Biotechnology Fund - The three largest single stock holdings are Amgen (AMGN), Regeneron (REGN), and Gilead Sciences (GILD). It was up 40.49% last year, please click here.

You can play around with the sector mix at your own discretion. Just focus on the fastest growing sectors of the US economy, which the Mad Hedge Fund Trader does on a daily basis.

It is tempting to add more leveraged ETF's for sectors like gold (UGL), to act as an additional hedge.

There is also the 2X short Treasury bond fund (TBT), which I have been trading in and out of for years, a bet that long-term bonds will go down, interest rates rise.

There are a couple of provisos to mention here.

This is absolutely NOT a portfolio you want to own going into a recession. So, you will need to exercise some kind of market timing, however occasional.

The good news is that I make more money in bear markets than I do in bull markets because the volatility is so high. However, to benefit from this skill set, you have to keep reading the Diary of a Mad Hedge Fund Trader.

There is also a problem with leveraged ETF's in that management and other fees can be high, dealing spreads wide, and tracking error huge.

This is why I am limiting the portfolio to 2X ETF's, and avoiding their much more costly and inefficient 3X cousins, which are really only good for intraday trading. The 3X ETF's are really just a broker enrichment vehicle.

There are also going to be certain days when you might want to just go out and watch a long movie, like Gone With the Wind, with an all ETF portfolio, rather than monitor their performance, no matter how temporary it may be.

A good example was the flash crash, when the complete absence of liquidity drove all of these funds to huge discounts to their asset values.

Check out the long-term charts, and you can see the damage that was wrought by high frequency traders on that cataclysmic day, down -53% in the case of the (ROM). Notice that all of these discounts disappeared within hours. It was really just a function of the pricing mechanism being broken.

I have found the portfolio above quite useful when close friends and family members ask me for stock tips for their retirement funds.

It was perfect for my daughter, who won't be tapping her teacher's pension accounts for another 45 years, when I will be long gone. She mentions her blockbuster returns every time I see her, and she has only been in them for five years.

Imagine what technology, financial services, consumer discretionaries, biotechnology, and oil and gas will be worth then? It boggles the mind. My guess is up 100-fold from today's levels.

You won't want to put all of your money into a single portfolio like this. But it might be worth carving out 10% of your capital and just leaving it there.

That will certainly be a recommendation for financial advisors besieged with clients complaining about paying high fees for negative returns in a year that is unchanged, or up only 1%-2%. Virtually everyone has them right now.

Adding some spice, and a little leverage to their portfolios might be just the ticket for them.

It's Time to Spice Up Your Portfolio

Global Market Comments

January 5, 2018

Fiat Lux

Featured Trade:

(HAPPY DAYS ARE HERE AGAIN!),

(SPY), (QQQ), (TLT), (USO), (FXY), (FXE), (GLD), (ITB),

(THE DIFFERENCE BETWEEN MAD HEDGE FUND TRADER AND MAD DAY TRADER)

I have always been a positive person.

As I am about to turn 66, I believe that my life is only half over, and that the best half is right in front of me.

However, being positive does have its price. I have been unrelentingly bullish since I called the market bottom nine years ago, on March 20, 2009.

In the meantime, some 90% of my newsletter competitors have been bearish for the past nine years.

The reason is very simple. Predictions of Armageddon and that the Dow Average is about to crash to 3,000 sells more newsletters. There are reasons why I have only a dozen employees, while the competition employs 1,000.

But as this is my retirement I am not in it for the money. I would rather be right than richer. And helping the average Joe beat Wall Street is enormously satisfying at this stage in my life.

Having said all that, the stock market has so far gone up every day in 2018, easily breaching 25,000. Be careful what you wish for.

If we continue at that breakneck pace we will hit my final target for this bull market of 28,000 not in mid 2019, but sometime in February. Markets are just on the verge of entering bubble territory.

And I will repeat what I said the day after Donald Trump was elected in 2016. He will bring a higher high in stock prices, followed by a lower low. That is the guaranteed outcome of pouring massive fiscal stimulus on an economy that is entering its ninth year of recovery. So far, so good.

Look no further than the ADP National Employment Report that came out this morning, a monthly read on the hiring of 400,000 American companies. It printed at a red hot 250,000 figure.

There are now a record 6 million job openings in the US. With immigration on the wane, the country is about to run out of workers. What follows is a bidding war for employees, driving wages through the roof, and bringing a return of inflation.

Apparently, the bond market believes it this time around as it is not giving up the recently 2.40% handle on the ten-year Treasury bond. Bond prices are now at a nine-month low. The exploding US government deficit created by the tax bill is imminently going to become a BIG issue.

You were worried about government borrowing soaring from $20 trillion to $30 trillion? It may well go to $40 trillion.

The other development today is the Justice Department's announcement that it is going to step up enforcement of the marijuana laws. I have been begging readers to avoid this flavor of the day sector like the plague.

The reason is very simply. The states can legalize pot all they want. But it is still illegal at the federal level, and as any lawyer will tell you, federal law trumps state law all day long. Investors certainly are worried. They have taken the ETFMG Alternative Harvest ETF (MJX) down 15% today.

It is particularly symbolic that the Feds made the move in the wake California's legalization of recreational marijuana. It is all part of the administration's continuing war on the Golden State. What is to come next? The expansion of offshore oil drilling? That will go over like a lead balloon.

The reason that I am telling you all of this is that I know a lot of you are financial advisors, and that your phones are ringing off the hook with customer calls asking what they should do in these eye-popping markets.

If you have been reading my letter for a while you are already overweight stocks (SPY), especially technology companies (QQQ), protecting yourselves from falling bond prices (TLT), long oil or oil shares (USO), short the Japanese yen (FXY) and long the Euro (FXE), long some gold (GLD) as a risk control measure, and keeping your home (ITB), even though everyone is trying to get you to sell it, including the federal government.

Then all you have to say to clients is "Thank you very much."

If you are new to the Mad Hedge Fund Trader service, it may be time to reassess.

I have not issued a Trade Alert so far this year. The reason is very simple. I am waiting for a sweet spot. Here is what I am itching to do:

Stocks - buy the dip, especially in tech

Bonds - sell any rally

Foreign Exchange - sell the yen on rallies and buy the Euro on dips

Energy - buy oil and oil stocks on dips and avoid natural gas

Precious Metals - buy the dips

Commodities - buy the dips

Real Estate - keep the homebuilders

Quite simply, bonds are more expensive here than stocks are cheap.

In closing, I offer you below a picture from the New Year Eve party I attended in San Francisco. And I'll part with a final piece of prescient advice. It is a really bad idea to mix Champagne, Jack Daniels, and Jameson whiskey. That's why I started out 2018 with a monster headache.

What? Only 66 More Years to Go?

Thanks to our ballistic, market beating performance, up 57.91% last year, we have recently enjoyed a large influx of new subscribers, especially from Australia and New Zealand. So, I want to take this opportunity to clarify exactly what you bought.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader will exploit money-making opportunities over a brief ten minute to one month window.

It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

The Diary of a Mad Hedge Fund Trader is written by myself, John Thomas, who you may have met during my many Global Strategy Luncheons around the world.

I use a combination of deep, long term fundamental research, technical analysis, and a global network of long time contacts to generate great investment ideas for you, the reader.

The target holding period can be anywhere from three days to six months, although if something fortuitously doubles in a day, I don't need to be told twice to take a profit (yes, this happens sometimes).

Last year, I issued over 200 Trade Alerts, of which 84% were profitable.

The Mad Day Trader is a separate, but complimentary service run by my Philadelphia based friend, Bill Davis. He uses a dozen proprietary short-term technical and momentum indicators he developed himself to generate buy and sell signals.

These will be sent to you by email for immediate execution. During normal trading conditions, you should receive up to ten alerts a month. The target holding period can be anywhere from a few minutes to a month.

Bill uses far tighter stop loss limits, given the short-term nature of his strategy. The goal is to keep losses miniscule, so you can always live to fight another day.

Bill uses primarily a "Buy-Write" strategy whereby he buys stock and sell short call options against them. Bill also provides outstanding daily US stock market commentary.

You will receive the same instructions for order execution, like ticker symbols, entry and exit points, targets, stop losses, and regular real time updates, as you do from the Mad Hedge Fund Trader.

He supplies key support and resistance levels for several indexes, which the markets will revolve around. Traders love it.

At the end of each day, a separate short-term model portfolio will be posted on the website for both strategies.

Bill is a 30-year market veteran who has spent a career in financial education.

I have followed his work for yonks, and can't imagine a better partner in the serious business of explaining how to make money to you, the reader.

Together, The Mad Hedge Fund Trader and the May Day Trader comprise Mad Hedge Fund Trader Pro, which is for sale on my website for $4,500 a year.

I hope this makes everything crystal clear for the new subscribers. If you have anymore questions, please email my assistant, at support@madhedgefundtrader.com

When Nancy is tied up, calls are automatically routed through to our web developer, Doug. Please remember that Sydney, Melbourne, and Brisbane Australia are 16 hours ahead of Florida, while Perth is 13 hours ahead.

Global Market Comments

January 4, 2018

Fiat Lux

Featured Trade:

(JANUARY 3 GLOBAL STRATEGY WEBINAR Q&A)

(TESTIMONIAL)

Q: Is Apple (AAPL) moving to new highs?

A: The answer is yes, but you're not going to get the same massive returns that you got in 2017 with all of the FANG's.

Q: Will inflation rise in 2018?

A: Yes, but not by much. Technology is still creating giant deflationary headwinds. The only inflationary pressures we'll see is from commodities, energy, and from some wage rises in industries like tech.

Q: Do you see 2, 3, or 4 wage hikes in 2018?

A: I vote for three, but four is an outlier depending on how strong the economy gets.

Q: What do we do about NVIDIA?

A: The answer is to buy it. I was holding on for $160 as an entry point and it's not giving it to us. Long term, I think we have another double here. I spoke to the CEO a few weeks ago and he's wildly bullish about the company. AI is the major driver there and this is a $400 stock someday. They are in the sweet spot for every major trend in technology. Of course, there is some New Year reallocation buying going on now, but you can start dipping your toe in here and add to your position later.

Q: Will Japanese stocks rise fast enough to offset the weakness in the Japanese yen?

A: You could have a situation where they may rise and fall by equal amounts and you end up making no money. The answer is to buy the Wisdom Tree Japan Hedged Equity Fund (DXJ), which buys Japanese stocks and sells short the Japanese yen against it. That way you can play Japan with no yen exposure. It's a way of buying the Japanese stock market in dollar terms. The (DXJ) can add another 20% or 30% this year

Q: The ProShares Ultra Short 20+ Treasury ETF (TBT) is at $34. Do you think it will hit $50?

A: Absolutely yes. We have another 10 points to go at least in the (TBT). And that's the conservative target. The more aggressive one is $60. Ten (TLT) points are worth about 20 (TBT) points because of the 2X leverage in the (TBT). There should be another 50% upside from these levels.

Q: What is the catalyst for long term US bonds to decline?

A: Rising federal deficits and rising US interest rates. It's really that simple, and both of these are sure things.

Q: Will the polar vortex fundamentals helps natural gas prices high?

A: The answer is no. We've had a nice little rally in gas in the last week caused by the polar vortex. I would sell into that. I'm not looking for any sustainable rally in natural gas this year because increased fracking supply generates gas as a byproduct. In fact, it generates more gas than the system can supply. I wouldn't want to mess around with gas when there are so many other better things to do in the stock and bond markets.

Q: AMZN has a forward price earnings multiple of $130 so do you think that's expensive?

A: No, it's not expensive, it's meaningless. Amazon has never had an earnings growth type strategy. They've always been about market share. Amazon profits are about to double with all the things they have going on with Alexa, the cloud, AWS, and so on. Some 25% of all US retail sales went to Amazon in 2017. This is clearly a business that is growing by leaps and bounds. There is another double in Amazon, but I don't necessarily want to buy it today.

Q: I am hearing wildly divergent opinions about TESLA, what is your opinion?

A: That will always be the case. The world is divided into two different types of people; the believer and non-believers in the TESLA vision. Non-believers tend to be Trump type Republicans who see it all as a liberal conspiracy. I can tell you that I have been in the Tesla factory every quarter for the last 8 years, and I can tell you that Tesla is a real company and has real products. As they ramp up to 500,000 units per year, they will take over the world. They will be by far the largest car company in the world in 10 years and many value investors agree with me and have major positions in the stock. So, do not sell short (TSLA) under any circumstance. You will get your head handed to you if you do. Elon Musk loves squeezing shorts and has proved to be one of the most successful short squeezers of all time. Since I have been following the stock since it was $16.50, this has certainly been the case.

Q: Will emerging markets do better than the US markets in 2018?

A: Yes they will. You are really getting a perfect storm for emerging markets. A lower dollar, higher commodity prices, and a global synchronized economic recovery are all positive for emerging markets. Think of them as the small cap stock in the global stock world. They do better in these circumstances so look for them to do better than US stocks in 2018. My favorite is India, and you buy it with the (PIN).

Q: Should markets be worried about North Korea?

A: Forget about it because it's all noise. The two leaders are feeding off of each other using a tweet war to get publicity and public notice. It's all very damaging for the US over the long term and it hurts our long term interests in Asia by lowering us to North Korea's level. But no war will ever happen. North Korea has no ability to wage war, they have no single member in their military who has combat experience, while the US has been at war almost nonstop for the past 40 years. The North Korean missiles which you see on TV almost every day have no targeting system. All they can do is fire them in the air and watch them fall into the ocean. You do not arm those missiles with nuclear warheads, especially when 75% crash on take-off on the people who fired them. It's all a distraction from what is really happening on the geopolitical front and the financial market, which is a global US retreat from its alliances and international relationships. Don't waste any time worrying about North Korea.

Q: What do you think about cannabis stocks?

A: I don't want to touch them because they cannot participate in the banking system. Federal anti drug and money laundering banking laws prevent them from using banks. It's an all cash business or all bitcoin business where money is moved around in suitcases. By the way, these business are now the most heavily taxed businesses in the United States. There were no provisions for cannabis companies in the tax bill. Here in San Francisco, where it just became legal to buy pot for the first time, the sales tax is 35%. This will be a huge earner for the states that sell pot. California is looking to take in $8 billion in cannabis sales tax this year. I would not consider it a valid investment theme. Most people didn't even know that cannabis was illegal in California.

Q: Would you hold the CRISPR stocks like Editas Medicine (EDIT) and Intellia Therapeutics (NTLA) through 2018?

Yes, absolutely. CRISPR will be one of the big stories of 2018. These stocks have basically doubled since i recommended them last summer. You want to hang on to them because CRISPR technology is only just getting started. In the last few weeks, we have seen the first FDA approval of CRISPR generated technologies creating custom cures for rare diseases. Don't get off at the 2nd story of a 100-story elevator ride.

Q: Would an impeachment or resignation be market positive?

A: That could happen because it removes the prospect of impeachment and resignation and makes it a certainty. While it's an unknown, it will act as a greater drag on stocks than a known. I don't think it will happen this year. The Justice Department moves very slowly and we may not start getting investigator Robert Mueller's results until after the November midterm elections where you maybe get a Democratic majority. Then it'll be safe for the FBI to come out of its bunker and make its Russia investigation findings public.