Global Market Comments

November 22, 2017

Fiat Lux

Featured Trade:

(TRADING THE KENNEDY ASSASSINATION)

Passing through Dallas, Texas on the way to my Strategy luncheon, I couldn't help but remember the assassination of president John F. Kennedy, on November 22, 1963, over 50 years ago.

The tragedy offers valuable lessons for today's traders, although we have to travel a circuitous route to get there.

It was one of those epochal events, where people remember exactly what they were doing when they heard the news, like the 1942 Japanese attack on Pearl Harbor, and the 9/11 attacks on the World Trade Center.

During the middle of my 5th grade class there was a school wide announcement that the president had been shot while campaigning in Dallas, Texas, but was still alive. Hours later, we were told he was dead. The teachers started crying, and we were all sent home.

For the rest of the week, we were transfixed by the tumultuous events on our black and white, rabbit eared television sets. Lyndon Johnson was sworn in as president on Air Force One. Lee Harvey Oswald was arrested. Then nightclub owner Jack Ruby shot him in a Dallas jail.

It was all so surreal, witnessing history unfold before you. I remember that my dad told me this all might be a prelude to a military coup d' etat, or a Soviet nuclear attack, and that we should be prepared for the worst.

Our stockpile of canned food to feed our family of nine from the previous year's Cuban Missile Crisis was still in its cases. So were the boxes of ammunition. Those were scary times.

It seemed like the country went to pieces after that. The Vietnam War ramped up, igniting huge national demonstrations. Some 60,000 of our guys died, including three from my high school graduating class.

Race riots followed, setting cities on fire. I got caught in the ones in Los Angeles and Detroit. Then came the Oil Crisis, Watergate, and the Iran Hostage Crisis.

Things didn't get back to normal until the 1980's, and guess what? The stock market started going up, and I got into the hedge fund business.

The Kennedy assassination sparked an entire industry of conspiracy theorists, armchair historians, and assorted nut jobs, whose mission was to debunk the conclusions of the Warren Report.

Thousands of books were published, and even more lectures delivered. It inspired us all to distrust our government.

After all, we were told that Oswald made an impossible shot, and only a "magic bullet" could achieve what the report claimed. Witnesses died like flies, against all actuarial probability. The old Italian rifle he used to commit the crime was impossibly flawed.

I tended to believe the version that was taught in California state textbooks as late as the 1990s, that Kennedy was the victim of either a CIA, Mafia, or Cuban plot. The Hollywood director, Oliver Stone, fanned the flames with his 1991 film, JFK.

Then one day during the late eighties, while visiting big oil clients for Morgan Stanley, I found myself with a couple of free hours to kill in Dallas, Texas. I took a taxi to the Texas School Book Depository on Elm Street, now a museum.

It was a weekday, and I was the only visitor. So I took the elevator up to the 6th floor. There, at a corner window, cases of books were set up exactly as Oswald had placed them on that fateful day.

I looked around, saw no one else, and then deftly stepped over the rope that barred public access.

It turned out that I shared some personal history with Lee Harvey Oswald. We had both been in the Marine Corps, and obtained a marksman's rating, which earned you a few extra dollars a month.

He had also been stationed in Japan a few years before, at a base I knew well. So I had always been curious about Oswald's incredible shot.

I sat down in the exact spot that Oswald had and watched the traffic below. At 62 feet away, the cars were moving at 8 miles per hours, the same speed as the Kennedy motorcade. Then it hit me.

This was not an impossible shot. This was not even a hard shot. I could make this shot. In fact, half the Marines who went through basic training at Camp Pendleton could have made this shot on a bad day with a stiff wind.

It was a revelation.

It meant that the Warren Report was right. Oswald was the single shooter. It meant that all of the conspiracy theories I had heard about over the decades were lies.

Not only that, I also realized then that all conspiracy theories about everything were untrue, usually manufactured by people with ulterior motives, almost always driven by the desire to make money. The level of cooperation required between large numbers of people is far too improbable.

After that, theories about the Kennedy assassination started to unravel. During the 1990s, the investigative TV program, 60 minutes, got several professional marksmen to easily replicate Oswald's feat of getting off three shots with the same antiquated bolt action rifle in less than three seconds.

After a deal with congress in 1992, the government released 5 million pages of evidence on which the Warren Report conclusion was based, which had previously been secret (click here for the National Archives link).

We obtained hours of classified testimony from Marina Oswald, Lee Harvey's Russian wife, about how troubled the man was.

We discovered that a dozen people saw a man with a rifle in the window of the Book Depository minutes before Kennedy was due to pass by. They screamed at the police to intervene, but none could hear them over the noise.

The fourth shot from the "grassy knoll" recorded over a police radio with a broken microphone button turned out to be an echo off a building.

The FBI was aware that Oswald had taken a shot at the home of an army general only months before. A memo warning the Secret Service of the threat was found crumpled up in a Dallas agent's desk drawer.

The Kennedy assassination has become a favorite topic of modern risk analysts who advise hedge funds. The Secret Service was well aware of many assassination risks for the liberal, democratic president from Boston from a wide assortment of right wing fanatics in the Deep South, and they chased down many of them.

No one imagined that the actual attempt would come from the left, and they were blindsided. It is a valuable lesson that we trade and invest by today.

Finally, it was all put together is a 2007 book by Vincent Bugliosi, Reclaiming History: The Assassination of President John F. Kennedy.

I had the misfortune of working with Bugliosi while he was prosecuting cult mass murderer, Charles Manson (while working for the Los Angeles County Coroner, I had dug up some of his victims in the California desert, one with a missing head). I always found him a show boater and a tireless self-promoter.

However, in the book, Bugliosi does a masterful job of weaving together declassified evidence, testimony from missing witnesses, and the contribution of modern technology.

His conclusion: the Warren Report was dead right. As deranged as Oswald was, there was one thing he could do well, and that was to shoot straight. He then proceeds to expertly demolish every conspiracy theory out there, and uncover their promoters as the profit driven charlatans that they are.

Oliver Stone was a better storyteller than a historian.

It turns out that being perennially disbelieving of conspiracy theories is quite a useful philosophy to have as a trader. We are often asked by the media to believe in the conspiracies that underpin certain investment theses. Bet against them, and you'll win every time.

If we don't fight them in El Salvador, then we'll be fighting them in the streets of Los Angeles. Russia wants to take over the world, and when they finish their work in the Ukraine, we are next.

We have to invade Iraq because Saddam Hussein is imminently going to use his weapons of mass destruction against us. And don't get me started on the Ebola Virus.

When gold hit $1,900 an ounce six years ago, I heard that the bars inside Fort Knox were made of lead and painted gold. When this was discovered, the price of the barbarous relic was supposed to soar to $50,000 an ounce. I sold gold short.

After Barack Obama was elected president in 2008, the Internet abounded with assumptions of a vast left wing conspiracy that pegged our new president as a socialist, was born in Kenya, was going to destroy corporate America, and take away all of our guns.

Those who bought the story sold all their stocks because the market bottom, unloaded their homes, and ditched all their bonds because the US government was going to default on its debt, ignite hyperinflation, and collapse the dollar. The advice was to put all your money into gold.

I didn't believe any of this for a second, and did the exact opposite of what the Armageddon crowd was urging on to followers.

I bought stocks, ultra high yielding junk bonds, MLP's, REITS, and every other risk asset out there while avoiding gold like the plague. I sold short the Japanese yen and the Euro against the US dollar. So did my subscribers. You know the rest of the story. Some of my picks rose tenfold.

I met Senator Ted Kennedy when he was running for president in 1982, and have kept in touch with his staff ever since. They told me he hit the deck whenever he heard a loud noise, be it a firecracker, a backfiring car, or even a slammed door. He lived a lifetime in constant fear of assassination.

Some scars never heal.

On my next trip to Tokyo I will be spending some time at the magnificent, white stucco edifice that has been the residence of US ambassadors there for nearly 100 years.

I will also give a briefing to our ex ambassador, Caroline Kennedy, the daughter of the late president, who served as the 29th United States ambassador to Japan until January, 2017.

The National Archives will release the last of its files on the assassination 70 year after the event, on November 22, 2033.

I hope to live that long, for by then I'll be nearly 82. Then for me, the Kennedy story will come full circle.

Taking the Story Full Circle

Global Market Comments

November 21, 2017

Fiat Lux

Featured Trade:

(DON'T LET THOSE UNICORNS BITE YOU IN THE ASS),

(APRN), (SNAP), (GPRO), (SQ), (TSLA),

(TESTIMONIAL)

With the stock market at all-time highs, the IPO engine is starting to rev up once again.

Hardly a day goes by without an investor asking me if they should take the latest high tech stock allocation being offered by their broker.

My answer is always the same: No, not with my money, not with your money, and not even with Donald Trump's money.

The reason is very simple.

Look at the track record of recent tech IPO's and what you find is nothing less than disastrous.

From the first day of trading for digital photo app maker (SNAP), the company that put those goofy dog ears on kids' photos, the shares have plunged 58%.

Blue Apron (APRN), whose delicious and well thought out door to door delivered meals I devour twice a week, saw their shares get food poisoning and puked on an incredible 75% in only seven months.

Action camera producer GoPro (GPRO) has shed an amazing 92% since its post IPO pop to $100.

Adding fuel to the fire is the fact that there horrific returns have been dished up with the tailwind of a hugely positive stock market, with the Dow Average up 35% over the past two years, and 40% with dividends.

I spoke to a senior venture capitalist the other day who you all know well, and what I learned was amazing.

There are 170 start-up "Unicorn" companies with a combined market capitalization of $600 billion. Most of these are located in the San Francisco Bay area.

They are accounting for an outsized portion of the profits of the US economy. Essentially, Silicon Valley is sucking up the best talent in the world and creating monster profits from whole cloth, much of which is spent locally.

There is nothing like watching history unfold on your doorstep.

And here is the problem.

Unicorns, by definition, are all privately held companies. Breathtaking profits are only shared among the founders, senior employees, and venture capitalists that took the leap of faith to invest during the firm's early days.

As for the rest of us, we can only benefit from the profits of publicly listed companies, whose earnings fell 3% last year.

So while VC investors are feasting on the hyper growth in the technology sector, the rest of us have to get by with leftovers.

In other words, the Unicorns are eating our lunch.

This wasn't a problem during the Dotcom boom of yore for the simple fact that almost no one made money back then.

That was the time of market share, the big idea, the creative business plan, endless potential, and "eyeballs," with profits coming somewhere down the road.

They never showed for most companies.

The only thing the public investor missed when the inevitable bust occurred 17 years ago was the horrific capital losses that followed.

BUT THIS TIME IT IS DIFFERENT!

Unicorns are now making serious money.

The largest, the ride sharing company Uber, is worth $68 billion according its latest fund raising round.

It is expected to earn $2.5 billion this year. That could rise to $4 billion as its international expansion unrolls, and ancillary business lines evolve, like same hour intra-city delivery services.

Guess what I passed on Interstate 80 the other day?

An Uber truck hauling a load it picked up at the last minute, thanks only to an online bidding system.

Unlike past VC cycles, Unicorns are staying private for far longer, and there are many more of them. It seems that managers and owners are trying to milk their investment for all they are worth before letting the public in.

If only when the companies are about to go low growth, or ex growth, and even ex profits that they are listed through an initial public offering on a public stock exchange, like the NYSE or NASDAQ.

That explains the recent diabolical performance of many recent IPO's. After the initial post IPO euphoria, Twitter (TWTR) collapsed 65%, while Alibaba (BABA) took a 54% nosedive. More than half of all the IPO's issued this year are underwater.

Remember, Wall Street is all about selling stocks, not buying them.

This is why I have been advising readers to avoid IPO's like the plague. If you apply for shares and get them, watch out below!

It has gotten to the point where many VC investors are demanding that unicorns quit being such hogs and milking their firms for all they are worth before unloading them.

They want their investments to go public so they can cash out and roll the profits into the next generation of technology investment. This constipation of capital is so serious that it is actually slowing the rate of technological development.

And it's always better to leave some profits for the next guy, lest the industry evolves into a gigantic pump and dump scheme. At least, that's what my late mentor, Barton Biggs, taught me.

The unicorns are taking more than just cash from the rest of the country.

There is now a wholesale brain drain under way whereby unicorns are seducing the best managers and programmers from across the country with the promise of lucrative stock options. These have the potential to appreciate several hundred-fold.

I have been brought in as a "supervising adult" at a couple of start ups, and it was an eye-opening experience.

While some coders are no doubt brilliant at punching in long strings of "0's" and "1's", apparently, they don't teach business ethics, accounting, tax law, or even manners at programming school.

You need to possess all of these skills to create a truly successful and enduring company worthy of the public's attention.

There is a possible happy ending to this fairy tale. As we approach the end of this economic cycle, which clearly has years to run, unicorns will start eyeing the EXIT doors more nervously. That means going public earlier, and at lower valuations.

And public company profits are set to improve in 2018.

And not every tech IPO is a disaster. Look at the chart for online credit card processor Square (SQ) which has rocketed an impressive 470% from its 2016 low.

My strategy towards these issues is very simple. Wait for prices to drop by half from the IPO prices, then take a look.

That's what I did with Tesla (TSLA). After it came public at $32 it cratered to $16.50.

Then I issued the Trade Alert to buy that became the stuff of online trade mentoring legends. (TSLA) shares eventually went ballistic to $394, up some 2,300%!

It's a strategy that seems to work.

From the start, I have really enjoyed the newsletters and webinars. My day begins at 0700 AM reading about your global adventures with a big smile.

And you keep amazing me with your financial skills and somehow always seem to surprise me with an original market view and a constant stream of new stock discoveries.

With your guidance I am now actually making money, although my trading skills are still lousy. I know you have heard this so many times, but it feels like a honour to look over your shoulders.

I really feel lucky and privileged, that I found you!

Rolf

The Netherlands

Global Market Comments

November 20, 2017

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, OR

DUCKING THAT PUNCH),

($INDU), (TLT), (BITCOIN), (UUP), (JNK), (SJB),

(SIGN UP NOW FOR TEXT MESSAGING OF TRADE ALERTS)

When I trained for the Japan National Karate Championships, fought in Tokyo's fabled Nippon Budokan 45 years ago, there was one rule my sensei never failed to beat into me.

Ducking the punch is far more important than landing one.

Certainly stock market traders took that rule to heart last week.

Four out of five days, a weak US dollar triggered a stock selloff in Europe that led to triple digit declines at the New York opening.

Yes, humble managers are becoming aware that they are not smart enough to achieve the returns they have made in 2017, therefore they are getting nervous.

In every case shares battled back to recover the losses.

The week ended with a push, and stocks largely unchanged. It was all a lot of work for absolutely nothing.

The Volatility Index (VIX) made a rare visit to the $14 handle, whereupon the entire planet sold into it.

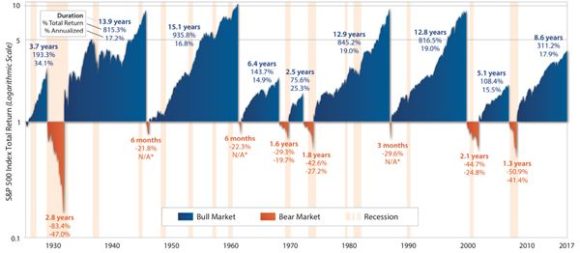

You can blame the advanced age of this bull market, now approaching an eye popping nine years old.

Shares have not seen more than a 2% decline for 62 weeks, the most extended since 1965.

Indeed, we have seen the second longest bull market of the past half century, defined as a pull back from the top of more than 20%.

To beat the record, stocks have to rise for six more years to match the torrid 15 year run that started with the US national railroad strike in 1946 and ended with the Cuban Missile Crisis in 1962.

Looking at the chart below what is truly fascinating is how short bear markets are, usually measures in mere months.

You have to go all the way back to the Great Depression to find a bear that lasted two years and eight months.

Yes, hanging on to your stocks always IS the right thing to do.

The bigger questions is: Why aren't you leveraging 2:1 like a hedge fund does?

Much of the flip flopping this week can be traces to the violent evolution of the tax bill, which seemed to change shape by the hour, and is currently opposed by 59% of the voting population.

As if this weren't hard enough, the Republicans at the last minutes decided to also make it a health care bill, wiping out coverage for 13 million.

Here's your math.

Passing the House was the easy lift, where the Republicans hold a 56-seat majority. Still, it was only able to garner a 10-vote win.

The tax bill next has to pass the Senate, where Republicans hold a paper thin two seat majority, and five have already expressed their opposition.

My bet is that a bill will pass sometime in Q1, 2018 in highly diluted form, without the loss of deductions for mortgage interest, local and state taxes, or an estate tax repeal.

I also think the bill will fail its first vote in the Senate. That will NOT be a good day to be long the market.

Without this funding, the corporate tax rate will be cut to only 25% for the few who pay them.

This will be called a great victory.

This bill could be passed today, but it may take the GOP leadership three months to figure this out.

The net effect on the economy will be nil, and we can all go back to watching corporate earnings as the principal driver of share prices, as they should be.

I expect this will drive the indexes to new highs for at least the next one or two years.

Ironically, it will also move forward the next recession, as stimulating an already hot economy will move forward the next inverted yield curve and interest rate spike.

We could well be solidly in a bear market and recession before the next presidential election.

Certainly the global junk bond markets think so, where we saw the first signs of the smart money sitting down before the music stops playing.

The SPDR Barclays High Yield Bond ETF (JNK) managed a 2.3% swan dive to a three month low.

Certainly, prices had reached insane levels, with the spreads on some issues falling to a scant 200 basis points over US ten year Treasury bonds. In Europe junk yield are BELOW Treasury yields, if you can find any to buy.

However, these days insanity doesn't stop anyone from doing anything.

That's Why I recommended a tactical short position in junk bonds (SJB) a few weeks ago (click here for Take A Ride in the New Short Junk ETF)

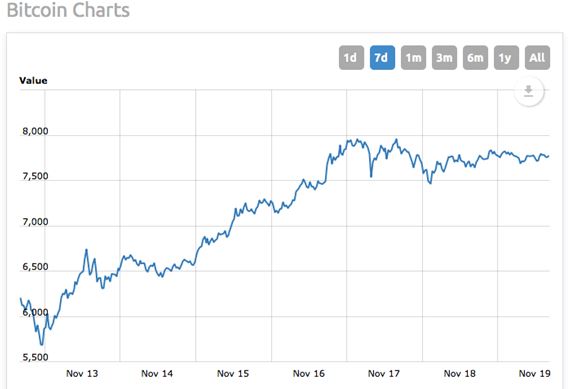

The big revelation for me last week is that I finally understood WHY people were pouring money into bitcoin, which recently touched $8,000.

In one week, it crashed 20%, then soared 30%. It is almost the only place in

the world where you can find this kind of volatility.

I'm sure tulip prices saw the same price action in the early 17th century.

Trading looks to be dull, brutish, and boring in this holiday shortened week. Expect markets to remain flat ahead of the Senate vote on the bill, which I expect to fail.

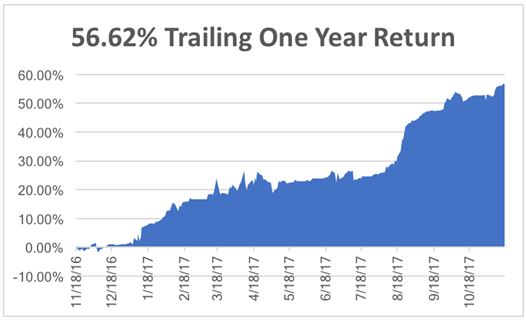

Despite these hair-tearing trading conditions, I managed to push my Trade Alert performance up to new highs, adding 274.15% over the past eight years, generating an average annual return of 34.63%.

I am up 3.54% so far in November, and 56.62% over the past 12 months.

To leave you on a positive note, it's looking like your entire financial future may be determined by the 20% of eligible voters who turn out to vote for a new Senator on December 12.

On Monday, November 20, at 10:00 AM the Index of Leading Economic Indicators is published, a forward-looking basket of ten monthly data points.

On Tuesday, November 21 at 6:00 AM EST we get October Existing Home Sales. Since the data predates the Republican plan to deny mortgage interest and real estate tax deductions, the data should remain hot.

On Wednesday, November 22, most of the week's data bunch up due to the holidays. We obtain October Durable Goods at 8:30 AM. Weekly Jobless claims are out at the same time. October Consumer Sentiment comes out at 10:00 AM.

The weekly EIA Petroleum Status Report is out at 10:30 AM.

Thursday, November 23 the markets are closed for the US Thanksgiving holidays.

On Friday, November 24 at 1:00 PM, we receive the Baker-Hughes Rig Count, which lately has started to turn up again.

As for me, I will be foraging through the High Sierras, looking for the ideal Christmas Tree to take home. My USDA permit allows be to take two.

I Meet Some of the Most Interesting People

As a large number of new subscribers just poured in, I invite them to sign up for our text messaging service.

Paid subscribers are able to receive instantaneous text messages of my proprietary Trade Alerts. This eliminates frustrating delays caused by traffic surges on the Internet itself, and by your local server.

This service is provided free to paid members of the Global Trading Dispatch or Mad Hedge Fund Trader Pro.

To activate your free service, please contact our customer support team at support@madhedgefundtrader.com. In your request, please insert "Free Trade Alerts" as the subject, include your mobile number and if you are located outside the United States then please include your country code.

Time is of the essence in the volatile markets. Individual traders need to grab every advantage they can. This is an important one.

Good luck and good trading.

John Thomas

Global Market Comments

November 17, 2017

Fiat Lux

Featured Trade:

(WHY ENERGY WILL MAKE YOUR 2018 PERFORMANCE),

(USO), (XOM), (CVX), (OXY), (EPD), (AMLP), (MPLX),

(WHY YOUR OTHER INVESTMENT NEWSLETTER IS SO DANGEROUS)

I have traveled in the Middle East for 50 years.

When I first hitch hiked across North Africa in 1968, camels were everywhere, and most of the population was barefoot.

These are the things I recall when dictator Muammar Gaddafi was deporting me from Libya.

When I grew up a few years later, I covered the neighborhood wars for The Economist magazine during the 1970's.

While representing Morgan Stanley in the firm's dealings with the Saudi royal family in the 1980's, I paused to stick my finger in the crack in the Riyadh city gate left by a spear thrown by King Abdul Aziz al Saud when he captured the city in the 1920's, thus creating modern Saudi Arabia.

They only mistake I made in my Texas fracking investments is that I sold out too soon in 2005, when natural gas traded at $5 and missed the spike to $17.

By now, the only camels you ever see are tourist rides at the foot of the pyramids, the racing camels of the Gulf Emirates.

So let me tell you about the price of oil.

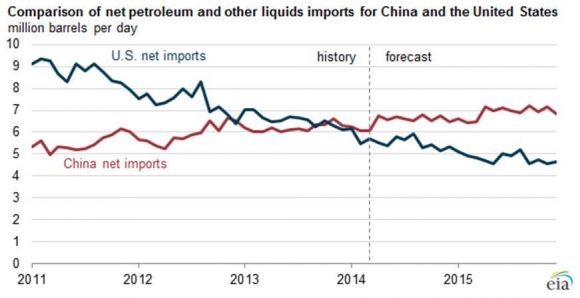

It's going up.

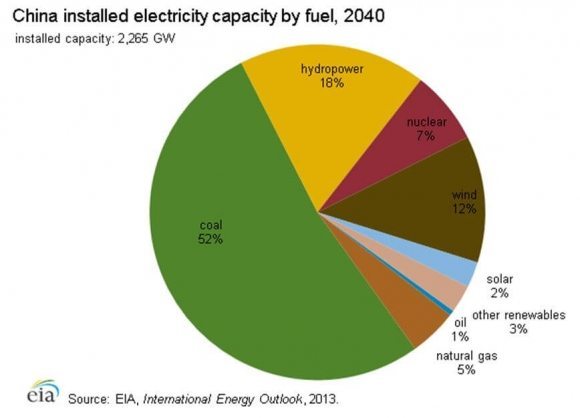

No matter how much oil there is in the world, it is tough to beat a global synchronized economic recovery.

China, Europe, and Japan all running hot at the same time. I bet you didn't know that all of these economies are currently beating America's 3% growth rate, in some cases by miles.

Giving a bow to my new long term forecasts, I don't see the end of global quantitative easing until October 2018. The current bull market in stocks should end in mid 2019, and the next recession won't hit until 2020.

So there is ample room to get one more trade here in oil.

You should do well buying majors like Exxon Mobile (XOM) or Chevron (CVX). You can probably beat those returns through investing in Occidental Petroleum (OXY).

But I'll tell you where the real money will be made:

Master Limited Partnerships, or MLP's.

I always find it a useful exercise to sift through the wreckage of past investment disasters. Not only are there valuable lessons to be learned, sometimes decent trades emerge.

I have been doing that lately in the energy sector, a hedge fund favorite these days, and guess what?

MLP's are back. And no, I'm not talking about the Maui Land and Pineapple Company (MLP) (yes, there is such a thing!).

But these are not your father's MLP's.

With overnight cash yields still at a paltry 0.50%, the allure of high yielding MLP's is still there.

Let me start with my investment thesis.

It is always better to invest in an asset class that has its crash behind it (energy) than ahead of it (equities, bonds).

And lets face it, the final bottom in oil at $25 is in.

We may bounce around in a $45-$60 range for a while. But eventually, I expect a global synchronized economic recovery to take it higher.

And while I have never been a fan of OPEC, they are showing rare discipline in honoring the production quotas negotiated in late 2016.

That eliminates much of the downside from MLP's for the next 18 months and makes it one of the more attractive risk/reward trades out there.

The fact is that the energy revolution in the U.S. remains very much intact.

Keep a laser like focus on the weekly Baker Hughes rig counts, as I do, and you see that we have been on a relentless upturn for nearly two years.

Except that this time it's different.

Thanks to hyper accelerating technology (yes, there's that term again), new wells employ a fraction of the labor of the old ones, and are therefore more profitable.

That means they can function, and even prosper, with a much lower oil price.

Since everything is political these days, I would remiss in not bringing this unsavory issue up.

To say that the new administration is friendly to the oil industry would be the understatement of the century.

Look no further than the Keystone pipeline, which after languishing for eight years, saw approval from the new president during his first week in office.

That means lower taxes, more subsidies, and less regulation of the business, all profit boosting measures.

There is another angle too.

By now, you should all be experts on inflation plays, since you read my opus on the subject in my newsletter only yesterday.

Oil is a great inflation play. As prices rise, consumers can pay ever-higher prices for energy.

The great thing for MLP investors is that many revenue streams are inflation-linked according to fixed formulas, much like TIPS, (Treasury Inflation Protected Securities).

But you have to be clever by half to take advantage of these new trends.

Thanks to the crash, the surviving MLP's are now a much better quality investment.

Balance sheet quality has improved as a result of deleveraging in the last three years, and the worst of the ratings downgrade cycle is behind us.

Importantly, some $50 billion- $60 billion worth of growth opportunities for MLPs are expected during FY2017-2020.

That makes the industry one of the great secular growth stories out there today.

As an old fracker myself I can tell you that the potential of the revolutionary new technology has barely been scratched.

Thanks to technology that is improving by the day, a Saudi Arabia's worth of energy reserves remain to be exploited, and maybe two, turning the US into an energy-exporting powerhouse.

Industry experts expect MLP distributions to grow by 3%-5% annually over the coming years. Few other industries can beat this.

That means avoiding upstream Exploration and Production companies; where there is still a ton of risk, and placing your bets on midstream companies that operate pipelines.

And by midstream I don't just mean pipelines, but also processing facilities for natural gas liquids and storage and terminal facilities.

You especially want to look at companies with high barriers to entry and attractive assets in high- growth and low-cost production regions.

Companies with a sustainable cost advantage, operated by experienced management with proven geological prowess are further pluses.

MLP's also stack up nicely as a diversifier for your overall portfolio.

Over longer time periods MLP's have generated similar returns to equities, with similar to slightly higher levels of volatility.

Historically they have traded at lower yields than high yield bonds, but currently they are yielding 250 basis points more.

And now for the warning labels.

This is not a new story.

As you can see from the charts below, MLP's have been rallying hard since oil bottomed in January, 2016.

Still, with yields in the 7%-10% range, a certain amount of pain is worth it.

Still interested?

Take a look at the Alerian MLP ETF (AMLP) (6.11%), the Global X MLP Energy Infrastructure ETF (MLPX) (6.11%), and Valero Energy Partners LP (VLP) (4.72%).

By the way, can any readers tell me if my favorite restaurant in Kuwait, the ship Al Boom, is still in business? The lamb kebab there was to die for.

Don't Throw Out the Baby With the Bathwater