Finally, investors were reminded of the fact that stocks don't rise in value every day like a sinecure.

We even witnessed a rare $250 point draw down in the Dow Average. In 2017, these have become as rare as hen's teeth.

You can thank the Republican Party's proposal to delay all corporate tax cuts to 2019 for that one.

The closely watched average has not seen a 3% correction in a torrid 370 days, a record.

In the meantime, concentration is increasing to perilous extremes, never a healthy development.

NVIDIA (NVDA), my top market pick for this year, is up 680% in 18 months, making it one of the largest stocks in the market, compared to 37.64% for the Dow Average.

By the way, I hope you have since deservedly fired all those newsletters who were bearish 18 months ago.

As good as 2017 has been, even IT will come to an end.

After earnings, the tax reform bill being mooted by congress has become the sole driver of share prices.

That has made life miserable for strategists such as myself, as trial balloons are floated one day, only to be shot down the next.

For a start, the bill is misnamed as a tax cut, as almost everyone I know will pay higher taxes, and I'm talking acquaintances in all 50 states.

The bill would cost me $100,000 personally, as I own a lot of real estate. The hit promises to heavily influence my vote in the next election.

Vastly complicating matters is the fact that the House and the Senate bills are wildly conflicting on basic issues, meaning that reconciliation is going to be impossible.

In the end, it may be a lot of fuss over nothing.

The bill that makes it to the president's desk for signing will be determined by the most liberal Republican member of the Senate, which at this point is either Maine's Susan Collins and Alaska's Lisa Murkowski.

And at this point Collins has confirmed that she won't vote for ANY bill without public hearings, and certainly WON'T vote for the elimination of the estate (death) tax.

In the end, it may be the erstwhile voters of Alabama who decide the matter.

They vote for a new Senator on December 12, and due to unforeseen circumstances, the Democratic candidate has suddenly shot to a 46% to 42% lead.

However, the margin of error is 4.1%. So once again, we are forced to bet on an event on where we have absolutely no idea of the outcome.

And you wanted to work in show business?

If this is all the bull market has to hang on, it could be in trouble.

It is this conclusion that prompted me to add my first short positions in stocks in many months.

In particular I sold the Russell 2000 (IWM), which actually has only 1,700 stocks left after mergers, bankruptcies, and private equity buyouts.

This is the index you love to hate in falling markets because of the fragility of smaller companies during times of economic uncertainty.

Of course my big trade of the week, if not the year, was my recommendation to buy the March 2018 $123-$125 vertical bear put spread LEAP.

Two days later saw the sharpest bond market selloff of the year, nearly two full points.

Those who got in at the $0.80 Wednesday low saw an eye-popping 69.50% return on capital by the Friday close.

It's another example of how the harder I work, the luckier I get.

Did Christmas come early for me?

I bought the exchange position limit maximum of 2,000 contracts with an average cost of $0.90, meaning that coined $50,000 in two days to cover my coming Christmas shopping bills (front row seats for Hamilton in Chicago, etc.).

Oops, looks like I am going to have to save some for a higher tax bill for 2018 as well.

The third quarter earnings are now winding down to a close, but we still have a few biggies in the coming week.

Troubled General Electric (GE), Wal-Mart (WMT), Home Depot (HD), and Bank of America (BAC) are all reporting.

On Monday, November 13, there is no economic data of any import.

On Tuesday, November 14 at 6:00 AM EST we get a new NFIB Small Business Optimism Index, which is based on a questionnaire of only 10 common business outlook questions.

On Wednesday, November 15, at 7:00 AM EST we obtain MBA Mortgage Applications, which should tail off, given the recent sharp rise in interest rates.

The weekly EIA Petroleum Status Report is out at 10:30 AM.

Thursday, November 16 at 8:30 AM EST we learn the Weekly Jobless Claims, which have been plumbing new 43 year lows.

On Friday, November 17 at 1:00 PM, we receive the Baker-Hughes Rig Count, which lately has been rolling over.

As for me, I'll be personally trying to reinvigorate the economy of Napa Valley by engaging in some high end wine tasting.

The community lost the entire month of October, normally their busiest of the year, and they are trying to get locals to fill the gap left by out-of-state cancellations. Layoffs are now rampant.

I'll also be helping relatives sift through the wreckage to salvage what few mementos they can.

I Call Them As I See Them

Global Market Comments

November 10, 2017

Fiat Lux

Featured Trade:

(SELLING SHORT THE STOCK MARKET),

(IWM), (RWM), (SPY),

(A TRIBUTE TO A TRUE VETERAN)

As much as you may think I have just gone MAD, I believe it is time to start dipping your toe in on the short side in the stock market.

I don't want to boast, take credit, or run a victory lap about the Trade Alert I sent out yesterday.

After all, two hours after I sent out the Trade Alert to sell short the Russell 2000, the small cap index has plunged $2, or 1.36%, creating an instant $1,480 profit for my nimbler followers.

No, I won't go there.

Instead, I want to continue on with the finer points of the rationale for doing this trade.

I didn't have time earlier because I was in a rush to get the Trade Alert out while the (IWM) was still rallying to its high for the day.

The new Republican plan floated yesterday to delay corporate tax cuts to 2019 has certainly put the cat among the pigeons with equity investors.

It has reminded them how high stocks have run, and how much now withering unrealized profits are sitting on their books.

The Russell 2000 is actually misnamed, as it now has only 1,700 stocks.

The rest have disappeared over the years through mergers, privatizations, or bankruptcies, and have not been replaced, as happens quarterly with the S&P 500 (SPY).

For you and me this means that the (IWM) is more illiquid that the (SPY). When stock markets fall, the (IWM) falls about 1.5 times faster than the (SPY).

In other words, it's a great short to have in a falling market.

I think stocks markets may be starting to either top out, or roll over here, at least for the short term.

That is especially true of the Russell 2000, which has not participated in the rally for the past month.

An approaching yearend is a big risk for the markets, as are overstretched valuations and prices.

The warning signs of a selloff are absolutely everywhere, but until now, have been ignored.

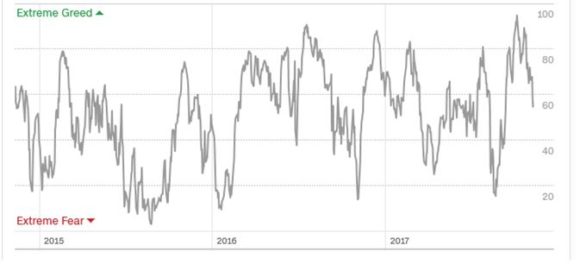

My Mad Hedge Fund Trader Market Timing Index has been living in overbought territory for the past two months. The normal life of a medium-term top is, guess what? Two months.

To see how risky markets are right now, take a look at the three-year history of my market timing index.

It shows that the normal life of a medium-term topping process is two months.

When will that two months end?

About mid-December, two weeks before gigantic deferred tax selling hits the market in January.

Another way to play this is to buy the ProShares Short Russell 2000 ETF (RWM), a bet that small cap stocks will fall.

If you are looking for other ways to hedge your portfolios you might consider the Trade Alert I also sent yesterday to buy gold (GLD).

Look at the chart below for the barbarous relic and you see that we have a sideways triangle formation setting up over the past month that will be a nice springboard for a sudden move upward.

All we need is one more threat to the tax cuts, which these days, seem to be coming out of the woodwork.

Listening to subscribers in all 50 states, I don't know a single individual who is seeing the prospect of lower taxes as a result of the Republican plan.

It appears that those earning between $200,000 and $500,000 a year will bear the entire burden of the package, who make up the bulk of my readers.

The benefits gained through a doubling of the personal exemption don't even come close to offsetting losses from lost tax and mortgage interest deductions.

And where is the cut in capital gains taxes, long a Republican goal?

If you make anything over $500,000 a year, you're golden.

Since job prospects for high school graduates in rural Pennsylvania in 1936 were poor, Mitch walked 200 miles to the nearest Marine Corp recruiting station in Baltimore.

After basic training, he spent five years rotating between duty in China and the Philippines, manning the fabled gunboats up the Yangtze River.

When WWII broke out, he was a seasoned sergeant in charge of a machine gun platoon. That put him with the seventh regiment of the First Marine division at Guadalcanal in October, 1942.

When the Japanese counterattacked, Mitch was put in charge of four Browning .30 caliber water-cooled machine guns and 33 men, dug in at trenches on a ridge above Henderson Field.

The Japanese launched massive waves of suicide attackers in a pouring tropical rainstorm all night long, frequently breaking through the line and engaging in fierce hand-to-hand combat.

If the position fell, the flank would have been broken, leading to a loss of the airfield, and possibly the entire battle. WWII would have lasted two more years.

After the first hour, all of Mitch's men were either dead or severely wounded, shot or slashed with samurai swords.

So Mitch fired one gun until it was empty, then scurried over to the next, and then the next. In between human waves, he ran back and reloaded all the guns.

To more easily pitch hand grenades, he cut the arms off his herringbone fatigues. When the Japanese launched their final assault, and then retreated, he picked up a 40-pound Browning and ran down the hill after them, firing all the way, and burning all the skin off his left forearm.

Mitch's commanding officer, Col. Herman H. Hanneken, heard the guns firing all night from the field below.

He was shocked when he visited the position the next morning, finding Mitch alone in front of a twisted sea of 1,000 Japanese bodies, not a scratch on him.

Henderson's Ridge in 1942

The iconic fictional hero in the 1949 film, Sands of Iwo Jima, Sergeant John M. Striker, was modeled after Mitch.

Tradition dictated that all military officers salute Mitch, even five star generals, and he was given a seat to attend every presidential inauguration from FDR on. Pacific countries issued stamps with his image, and Mattel sold a special GI Joe in his likeness.

When Mitch got older and infirm, I used my captain's rank to escort him on diplomatic missions overseas to attend important events, like the 40th anniversary of D-Day in Normandy.

Whenever Mitch was in town, he would join me for lunch with some of my clients with a history bent, and a more humble and self-effacing guy you never met. Mitch passed away in 2003 while he was working as a technical consultant for the pre-production of the HBO series, The Pacific. The funeral in Riverside, California was marked by an eagle continuously circling overhead which, according to the Indian shaman present, only occurs at the services for great warriors.

When I got back from the parade, I took out the samurai sword Mitch captured on that fateful day, a 1692 Muneshige, the hilt still scarred with 30-caliber slugs, and gave it a ritual polishing in sesame oil and powdered deer horn, as samurai have done for millennia.

To learn more about the First Marine Division's campaign during the war, please read the excellent paperback, The Island: A History of the First Marine Division on Guadalcanal by Herbert Laing Merillat, which you can buy from Amazon by clicking on the title.

Global Market Comments

November 9, 2017

Fiat Lux

Featured Trade:

(NOVEMBER 8 2017 GLOBAL STRATEGY WEBINAR Q&A),

(TAKE A RIDE IN THE NEW SHORT JUNK ETF),

(THE COOLEST TOMBSTONE CONTEST)

Below please find a transcription of the viewer questions that popped up in my chat box during the November 8 Global Strategy Webinar, along with my answers.

If you find this useful please email Nancy in Customer Support at support@madhedgefundtrader.com and we will make it a regular feature of the service. Just put "Webinar Questions" in the subject line.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

1) What do you see for the banks?

Jim

They are totally slaved to the interest rate outlook, and I expect interest rates to bottom right around here. If you get another spike up in interest rates, the banks will take off like a rocket and go up for 3 more years. I still see a double in the banks.

2) Would you touch Wells Fargo?

Bill

I like Wells Fargo the most because you have a huge number of scandals built into the price now, and they really have run out of scandals. All you need is all quiet on the Western Front for a little bit and the stock will catch up with the rest of the banking sector.

3) Is biotech a long term buy?

Steve

Absolutely! If you only have to pick 2 sectors and forget everything else that's going to be technology and biotech.

4) Will tech perform well next year?

Doug

Answer, yes but only expect to get 1/3 to 1/2 the gains that we saw this year. Stock prices have run way ahead of earnings and we need earnings to catch up with share prices, so that is why I am saying rotate out of tech, but only for the short term. Long term, tech will be the top performing sector for the next 20 years.

5) What is going on with Tesla?

Matthew

This is a very difficult stock to trade. My inclination is wait for it to test $280 and then buy it with both hands. They are now at their maximum spend to create a 500,000 a year rate assembly line. So big cash drawdowns this quarter, probably again next quarter, are to be expected. After that we probably get to see the actual numbers that the investment in production will create.

6) Is it life or death on taxes for the Republicans?

Bart

Yes Bart, I would agree on that. If they can't get a tax package through next year we are looking at an all Democratic congress in November 2018, and we are already seeing a preview on that with the Democratic win in the Virginia and New Jersey governor's races yesterday.

7) Could change in the Fed chair also change the QE status, i.e. no bond sales?

George

The answer is yes. It could change if they postpone QE, bonds will rocket, yields would collapse and the stock market would continue rising for another year. That has always been a risk with a new Fed governor if he superheats the economy to try and get the 4% growth rate that the President promised in the campaign. So you cannot rule that out. It's unlikely, because stimulus is not needed now with stocks delivering their best year in decades. Corporate profits at all-time highs, unemployment at 20 year lows signal no need for further Fed stimulus. But you never know with this President.

8) John, would you buy TBT at these levels?

Joseph

It's a screaming buy. In fact, as soon as I finish with this webinar, I'm going to buy more (TBT).

9) Will the strong dollar hurt emerging markets as they try to pay off debt in US dollars?

Jim

Yes, it will. In fact, it could trigger a few trillion dollar's worth of defaults, which we have seen in past cycles because emerging market companies have almost all their debt in US dollars. This means the value of their debt increases just through currency appreciation.

10) What do you think Applied Materials?

Matt

I'd be a buyer on the dips. I think the artificial intelligence boom goes for several more years. Certainly, until the end of this bull market which is 18 more months.

11) Is it time to take profits on home builders?

Doug

I'd say no. Here's your big trade on home builders. If they cut out the loss of deductibility of local taxes and mortgage interest then the housing sector takes off like a rocket. That's going to be a big 2018 trade, so that is why you want to watch this sector. If you already have the home builders, I would probably hang on to them depending on what your risk tolerance is.

12) What do you think of GE?

Andrew

No way to tell if this is bottoming, but it could be a big 2018 trade. Classic Dog of the Dow situation.

13) Am I late to buy energy now?

Renee

I do think it is late on energy. They were getting thrown out with the bath water for most of this year. It just had a monster run. I would rather go out and short treasury bonds, short the Euro, short the Japanese yen, and buy gold on bigger dips. At this point, buying an energy name is at the bottom of the list.

14) Any thought on buying VIX calls as insurance?

Michael

You can do that Michael, but it is very expensive. We did this in October and it ended up eating up 3/4 of my performance for the month with only a 5% weighting. We bought (VIX) calls with the (VXX) at $40 and it went to $34. Ouch! The value of our call options dropped by half. Remember, in the (VXX) you have giant contango that guarantee about a 40% a year loss in any long position, so you are trying to trade against that. It really is a classic catching a falling knife situation.

15) Should i buy tech laggards?

Thomas

If you're going to be in tech then you might as well go with the Gucci stocks, and those are the FANG's. That's what people want to buy. Those are still cheap relative to the rest of the market, rather than chasing these marginal names like (SNAP) that have had monster sell offs.

Global Market Comments

November 8, 2017

Fiat Lux

Featured Trade:

(BEHOLD THE POWER OF THE LEAP!),

(TLT), (TBT), ($TNX),

(EUROPEAN STYLE HOMELAND SECURITY),

(TESTIMONIAL)

The recent 4 1/2 point jump in the US Treasury bond market has just given us another chance at the brass ring.

Except that this time, it's different.

Now we have a technical picture that is also setting up an almost perfect head and should top on the charts.

How would you like to get some free lottery tickets?

Except that these are better than lottery tickets.

Instead of a one in a million chance of winning some substantial dough, the odds of a big payoff are more like 90:10.

Have I piqued your interest? Are you ready to take a flier? Do you feel like rolling the dice?

And here's another come-on.

The last time I recommended this exact trade in August followers earned an eye-popping 50% return on capital in only four weeks!

It's really quite simple.

This morning, the yield on the ten-year Treasury bond briefly touched 2.29%, a new three month low.

Let's say that's the low for the year, and that yields rise from here for the next four months, pummeling the bond market.

This would be a fabulous time to buy a long dated (TLT) March 2018 $123-$125 out-of the-money vertical bear put spread at $1.00.

If bond yields back up to 2.45% where they were two weeks ago and shave five points off the (TLT) from today's levels, this spread would expire at its maximum theoretical value at $2.00 on March 16, 2018.

The profit on a $10,000 investment would amount to (100 contracts X 100 shares per option X $1.00), or $10,000, giving you a four-month gain of 100%.

Not bad in this yield deprived world.

Please see the screen shot from my Interactive Brokers platform to see how to set up this position.

Now let's say you have a prodigious appetite for risk and want to spend some of the massive profits you earned following the Diary of a Mad Hedge Fund Trader in recent months.

Let's say that you are willing to bet that bond yield are likely to back all the way up to the 2.62% where they traded in March.

In that case, you want to buy the (TLT) March 2018 $116-$118 deep out of-the-money vertical bear put spread at $0.28.

If you are correct, and bond yields back up to a lofty 2.62% and cut 11 points off the (TLT) from today's levels, this spread would expire at its maximum theoretical value of $2.00 on March 16, 2018.

The profit on a $10,000 investment would amount to (356 contracts X 100 shares per option X $1.72), or $61,232, giving you a four-month gain of 512.32%.

Please see the screen shot from my Interactive Brokers platform to see how to set up this much more aggressive high-risk position.

If you add either one of these super aggressive positions you are making a number of different bets.

1) The global synchronized economic recovery continues.

2) Jerome Powell, the next Fed governor, will continue with Janet Yellen's policy of raising interest rates 25 basis points per quarter.

3) Pernicious deflation moderates, thanks to the large scale recovery spending wrought by Hurricanes Harvey in Texas and Irma in Florida and the fires in Northern California.

4) Some kind of tax cut gets passed by congress within the next four months, no matter how modest.

These may not be bets that you are willing to make with your own hard earned cash.

But if they are, the potential payoff is enormous, a lot like winning the lottery.

I am not necessarily saying this is going to happen with any certainty.

Nevermind that every financial guru out there, including Warren Buffet, Ray Dalio, David Tepper, and George Soros agree with me and argue vociferously that bonds are wildly over priced, at a bubble top, and long overdue for a huge fall.

So far, they have all been wrong, including me.

I'm just sayin...

Here's the Brass Ring Trade for the Rest of 2017

The English are feeling the pinch in relation to recent geopolitical events, and have therefore raised their security level from "Miffed" to "Peeved."

Soon, though, security levels may be raised yet again to "Irritated" or even "A Bit Cross." The English have not been "A Bit Cross" since the blitz in 1940, when tea supplies nearly ran out.

Terrorists have been re-categorized from "Tiresome" to "A Bloody Nuisance." The last time the British issued a "Bloody Nuisance" warning level was in 1588, when threatened by the Spanish Armada.

The Scots have raised their threat level from "Pissed Off" to "Let's get the

Bastards." They don't have any other levels. This is the reason they have been used on the front line of the British army for the last 300 years.

The French government announced yesterday that it has raised its terror alert

level from "Run" to "Hide." The only two higher levels in France are "Collaborate" and "Surrender." The rise was precipitated by a recent fire that destroyed France's white flag factory, effectively paralyzing the country's military capability.

Italy has increased the alert level from "Shout Loudly and Excitedly" to

"Elaborate Military Posturing." Two more levels remain: "Ineffective Combat Operations" and "Change Sides."

The Germans have increased their alert state from "Disdainful Arrogance" to

"Dress in Uniform and Sing Marching Songs." They also have two higher levels: "Invade a Neighbor" and "Lose."

Belgians, on the other hand, are all on holiday, as usual; the only threat they

are worried about is NATO pulling out of Brussels.

The Spanish are all excited to see their new submarines ready to deploy. These beautifully designed subs have glass bottoms so the new Spanish navy can get a really good look at the old Spanish navy.

Australia, meanwhile, has raised its security level from "No worries" to

"She'll be alright, Mate." Two more escalation levels remain: "Crikey! I think we'll need to cancel the barbie this weekend!" and "The barbie is canceled." So far no situation has ever warranted use of the final escalation level.

-- John Cleese - British writer, actor and tall person.