Global Market Comments

May 8, 2013

Fiat Lux

Featured Trade:

(JULY 16 BERLIN STRATEGY LUNCHEON),

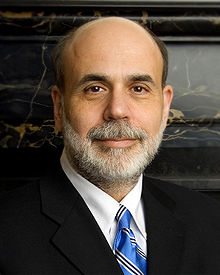

(WHY BEN BERNANKE HATES ME)

Come join John Thomas for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Berlin, Germany, at 12:00 noon on Tuesday, July 16, 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $219.

The lunch will be held at a downtown Berlin hotel within sight of the Brandenburg Gate, the details of which will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

I don?t just think he hates me. He truly despises me. In fact, he does everything he can to put me out of business.

Take last Wednesday, for example, when the Federal Reserve Open Market Committee gave me and my views a complete thrashing. Additional quantitative easing was the last thing in the world I was expecting because it was not justified by the current fundamentals. Most other independent analysts agreed with me, including several Fed governors.

He could have let me off easy by announcing some minor back door easing, like ceasing interest rate payments on deposits from private banks. But, no, Ben decided to make me look like a complete idiot, not by just announcing more QE, but one infinite in size that goes on forever. To make matters worse, he got his pals, ECB president Mario Draghi and BOJ governor Haruhiko Kuroda, to join in. Talk about pouring salt on my wounds.

It?s not that I am not an all right guy. I am kind to children and small animals. I donate generously to many charities. I just sent my mother a card for Mothers Day, even though she is 85 and not expected to last much longer. I even occasionally escort little old ladies across the street, although this is a holdover from my days as an Eagle Scout.

It?s just that Ben Bernanke and I don?t see eye-to-eye on a lot of important issues. He wants stocks to go up. As a hedge fund manager who plays from the short side more often than not when the economy is growing at a paltry 2% rate, I want them to go down. He wants bonds to go up too, as he clearly elicited with his recent announcement. I, on the other hand, want bonds to sell off because I know that when the bill comes due for all of this monetary easing, the crash will be momentous.

These are not the only matters we differ on. He wants to create jobs. He can wish this until the cows come home, but he?s not going to get them because of the gale force demographic headwinds the country is now facing and the massive deleveraging by the public and private sector. The 6 million jobs we exported to China are never coming back.

However, all he has to do is make a mere mention of his desires, or even just mention the letter ?Q?, and asset prices go through the roof, forcing me to stop out of my shorts at losses. This is why I was in such a foul, acrimonious, and detestable mood over the weekend, after stocks blasted through to new all time highs.

My problem is that Ben Bernanke isn?t the only person who dislikes me. President Obama doesn?t think much of me either. And it?s not because I refuse to buy a cold chicken dinner at his St. Francis Hotel fund raisers for $35,000 or $70,000 if I bring a date. He talks about jobs too. He frequently speaks about the need to improve our education system, even though I know he is poised to slash the budget for the Department of Education as part of some deal with the Republicans. Ditto for Social Security and defense.

Fortunately for me, I wrote off any prospect of getting a retirement check a long time ago and have made other arrangements, like becoming a hedge fund manager. Either the payments will be too small for me to live on, subject to a means test that excludes fat cats like myself, or they will be made in worthless Zimbabwean dollars.

I got along with former Treasury Secretary, Timothy Geithner, OK, who keeps me on his ?must see? list whenever he stops in San Francisco. But we go way back. There are not a lot of people around who read my first book on the Japanese financial system. There are only four people in US history who can discuss Japanese monetary policy of the 1920?s in depth, and do it in Japanese just for laughs (it was clearly too easy, but they had to reflate after the 1923 Great Kanto Earthquake. Some things never change).

Two of them, Senator Mike Mansfield of Montana and Harvard professor, John K. Fairbank, died ages ago. So he is kind of limited in his choices. Besides, there are not a lot of people out there who can give him a 40-year view on the global economy, and I am one of them.

There are plenty of others who don?t think I am so hot. Try making a fortune in a market crash when everyone else is losing their shirt. While others in the locker room at my country club are slamming doors, tearing their hair out, and breaking golf clubs in half when they see the price feed on CNBC, I am chirping happily away about selling short at the top. I might as well be letting out a loud fart in Sunday church service. This explains why I stopped getting invitations to social dinners ages ago.

It?s not that my relationship with Ben Bernanke is totally hopeless. When the demographic picture turns from a headwind to a tailwind and individuals and corporations cease deleveraging and return to re-leveraging, we?ll probably be reading from the same page of music. But according to the US Census Bureau, the earliest this can happen is 2023. By then, he probably won?t be the Fed governor anymore and I won?t care if he likes me or not.

There are other Fed governors who are not in the least bit interested in all this quantitative easing malarkey. They are much more similar in philosophy to Herbert Hoover?s Treasury Secretary, Andrew Mellon, who popularized the ?let the chips fall where they may? approach to economic policy. ?Liquidate, liquidate, liquidate?, he said. Kick the props out from under this market and all of a sudden Dow 3,000 is on the table, as argued by Global strategist and demographics maven, Harry Dent.

They might even go as far as unwinding the Fed?s hefty $3.5 trillion balance sheet. That would give the Chinese, who hold $1 trillion of these bonds, a heart attack. But who cares? It would create the mother of all trading windfalls for me. Hell, they might not even care if I torture small animals, beat children with a switch, and strand little old ladies in the middle of onrushing traffic. I think we would get along just great.

Screw Social Security, and Ben Bernanke too.

The Great Kanto Earthquake of 1923

The Great Kanto Earthquake of 1923

Global Market Comments

May 7, 2013

Fiat Lux

Featured Trade:

(I?M OFF TO THE SALT CONFERENCE),

(JULY 12 AMSTERDAM STRATEGY LUNCHEON),

(BE CAREFUL! YOUR PC IS WATCHING),

(TESTIMONIAL)

I will spend the rest of the week attending the 5th annual SALT conference at the Bellagio Hotel in Las Vegas. This is the preeminent get together of the major players in the hedge fund industry. There, I will hook up with readers, consulting clients, old pals, and former staff, many of whom now run their own multi billion dollar hedge funds. I could write a letter entirely composed of tips from my former employees, and it would be a damn fine one too.

On Wednesday, May 8, I will sneak away for a few hours to present my own Las Vegas Global Strategy Luncheon to a select group of Mad Hedge Fund Trader subscribers.

SALT is organized by my friend, Anthony Scaramucci, managing partner of SkyBridge Capital, which manages and advises $6.9 billion of hedge fund assets. Among the listed speakers are Dr. Doom, Nouriel Roubini, Clintons chairman of the Council of Economic Advisors, Dr. Laura Tyson, former CIA director, Leon Panetta, an ex prime minister of Israel, Ehud Barak, and hedge fund legends Leon Cooperman of Omega, and Daniel Loeb of Third Point. The actor, Al Pacino, will also be there too.

I can?t tell you who I will be meeting with, or I will have to kill you. According to the terms of my invitation, I am not permitted to directly quote, record, or photograph any of the speakers. Such an off-the-record format enables them to open up and share thoughts on what?s really happening in today?s complex markets.

But as readers of the Mad Hedge Fund Trader you will greatly benefit from whatever views and hard information I pick up in future letters. It is a level of access you can?t obtain elsewhere.

The SkyBridge Alternatives (SALT) Conference is committed to facilitating balanced discussions and debates on macro-economic trends, geo-political events and alternative investment opportunities within the context of a dynamic global economy. With over 1,800 thought leaders, business professionals, hedge fund managers, and investors from over 26 countries and 6 continents, the SALT Conference provides an unmatched opportunity for attendees from around the world to connect with global leaders and network with industry peers.

Over the course of the program, more than 100 speakers will participate in some three dozen panels, speeches, and breakout sessions that address critical geopolitical and economic issues. The agenda is designed to provide multiple perspectives on a variety of salient topics within the context of a dynamic global economy.

For more information about the SALT Conference, please visit their website at http://www.saltconference.com.

Come join John Thomas for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Amsterdam, The Netherlands, on Friday, July 12, 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $229.

The lunch will be held at a downtown Amsterdam hotel near Nieumarkt that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

Hey! You there, staring at this monitor. This is your PC talking to you. No, not you over there standing in the background. I?m talking to the guy sitting in front of me poking at my keys. Ouch! That one hurt!

So you thought no one was watching, did you? Let me straighten you out. About a month ago you clicked on a certain website, and I installed myself as a cookie on your computer, which is an innocuous little text file that you can?t see. Since then, I have been tracking your every move, recording websites you clicked on, the pages you visited, and the stuff you ordered. I then used this handy little algorithm to build a profile of exactly who you are. I now know you better than your own mother. In fact, I know you better than you know yourself.

For example, I am aware that you make more than $250,000 a year, live in a posh zip code in San Francisco, belong to a fancy country club, and drive a Mercedes. You donate to Republican political causes, send your kids to a prestigious private school, and bill it all to an American Express Platinum Card. Did I leave anything out?

Because I know every detail of your life, down to your inside leg measurement, I am able to harness the power of this machine to more precisely service your every need. That includes directing advertising to you, which you have a high probability of clicking on. The more you click on my ads, the higher prices I can realize for those ads. The ad campaigns you now see are unique to your own personal computer because they are tied to your IP address. My program, called ?behavioral targeting? is the next ?big thing? in online advertising. It?s all part of the brave new world.

I see you have been shopping for a new car. Check out the new Hyundai at http://www.hyundaiusa.com/ , which offers the same quality as your existing ride, at half the price. Your clicks this morning suggest you?re taking your ?significant other? out to dinner tonight. Might I suggest Gary Danko?s on Bay Street at http://www.garydanko.com/site/bio.html? The rack of lamb is to die for there. Your visits to http://www.travelocity.com/ and http://www.expedia.com/ tell me you?re planning a vacation. I bet you didn?t know you can find incredible deals in Las Vegas at http://www.visitlasvegas.com/vegas/index.jsp. Thinking about buying a condo there? They?ll even pay for the trip if you promise to check one out while you?re there.

Since we?re chatting here mano a mano, I noticed that that last pair of jeans you ordered from http://us.levi.com/home/index.jsp had a 42-inch waist, up from the 40?s in your last order. Better lay off those cheeseburgers. Pretty soon, they?ll be calling you ?tubby? or ?fatso?. Better visit http://www.weightwatchers.com/Index.aspx soon, or the legs on that chair might buckle out from under you.

Worried about privacy? Privacy, shmivacy. There hasn?t been privacy in this country since the first social security number was handed out in 1936. And don?t expect any relief from Congress. I doubt half those dummies even know how to turn on their own PC?s.

Don?t even think about trying to delete me. I?m a ?flash cookie?, an insidious little piece of code that reinstalls every time you try that. Think of me as a toenail fungus. Once you catch me, I?m almost impossible to get rid of.

I hope you don?t mind, but I?ve been passing your personal details around to some of my buddies at other websites. That?s why when you clicked on http://www.nfl.com/ you got deluged with product offers from your local team, the San Francisco 49ers. I?ve got friends at Google, Facebook, MySpace, and pretty much everywhere. Can I help it if I?m a popular guy? I bet the view from those 50 yard seats is great, isn?t it?

I noticed that your spending habits don?t exactly match with the income you reported on your last tax return. Do you think the IRS would like to know about that? I bet you didn?t know the agency offers a 10% reward for turning in tax cheats.

How did you like those triple X DVD?s you bought last week? Whoa! Hot, hot, hot! I hope your employer never finds out about those. It might not go down too well at your next performance review.

I thought it was lovely that you bought your spouse a two carat, yellow, vvs1, round cut diamond ring for $26,000 from http://www.bluenile.com/ for your 30th wedding anniversary. But who is Lolita, the Argentine firecracker, in Miami Beach? Does the old wifey know you sent her a $2,000 pair of diamond stud earrings? What?s it worth to you for me to keep mum on this? Maybe you should take a quick peak at http://www.divorcelawfirms.com/ and see what you?re in for?

Naw, I?m just pulling your leg. This is all just between friends, right? Think of it as a doctor/patient relationship. I?ll tell you what. See that leaderboard ad at the top of the page? Just click on that and we?ll call it even. Oooh that felt good! Click it again. Oh, baby! Not too many times. You?ll trigger my anti click fraud program.

Now you see that wide skyscraper add over on the right? Click on that too. Oh baby! Click it again! And there?s a little button ad at the bottom of the page. No, not that one. A little lower. What was that little cutie?s name in Miami again? Aaaaah.

Global Market Comments

May 6, 2013

Fiat Lux

Featured Trade:

(MAY 8 LAS VEGAS STRATEGY LUNCHEON),

(BEN?S NEW LEG FOR THE BULL MARKET),

(SPY), (IWM), (AAPL), (GLD), (SLV), (CU), (TLT), (YCS), (FXY)

(PLEASE USE MY FREE DATA BASE SEARCH)

SPDR S&P 500 (SPY)

iShares Russell 2000 Index (IWM)

Apple Inc. (AAPL)

SPDR Gold Shares (GLD)

iShares Silver Trust (SLV)

First Trust ISE Global Copper Index (CU)

iShares Barclays 20+ Year Treas Bond (TLT)

ProShares UltraShort Yen (YCS)

CurrencyShares Japanese Yen Trust (FXY)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Las Vegas, Nevada on Wednesday, May 8, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. I will also explain how I have been able to deliver a blowout 40% return since the November, 2012 market bottom. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $179.

I?ll be arriving at 11:00 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets. The PowerPoint presentation will be emailed to you three days before the event.

The lunch will be held at a major Las Vegas hotel on the Strip, the details will be emailed with your purchase confirmation. Please make your own hotel reservations, as business there is booming.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

The original purpose of this letter was to build a database of ideas to draw on in the management of my hedge fund. When a certain trade comes into play, I merely type in the symbol, name, currency, or commodity into the search box, and the entire fundamental argument in favor of that position pops up with a link chain to older stories.

You can do the same. Just type anything into the search box with the little magnifying glass in the upper right side of my Homepage and a cornucopia of data, charts, and opinion wills appear. Even the price of camels in India (to find out why they?re going up, click here). As of today, the database goes back to February 2008, and comprises some 2 million words, or triple the length of Tolstoy?s epic novel, War and Peace.

Watching the traffic over time, I can tell you how the database is being used, and the implications are fascinating:

1) Small hedge funds want to see what the large hedge funds are doing.

2) Large hedge funds look to see what they have missed, which is usually nothing.

3) Midwestern advisors to find out what is happening in New York and Chicago.

4) American investors to find out if there are any opportunities overseas (there are lots).

5) Foreign investors wish to find out what the hell is happening in the US (about 1,000 inquiries a day come in through Google?s translation software in a multitude of languages).

6) Specialist traders in stocks, bonds, currencies, commodities, and precious metals are looking for cross market insights which will give them a trading advantage with their own book.

7) High net worth individuals managing their own portfolios so they don?t get screwed on management fees.

8) Low net worth individuals, students, and the military looking to expand their knowledge of financial markets (lots of free online time in the Navy).

9) People at the Treasury and the Fed trying to find out what the private sector is doing.

10) Staff at the SEC and the CFTC to see if there is anything new they should be regulating.

11) More staff at the Congress and the Senate looking for new hot button issues to distort and obfuscate.

12) Yet, even more staff in Obama?s office gauging his popularity and the reception of his policies.

13) As far as I know, no justices at the Supreme Court read my letter. They?re all closet indexers.

14) Potential investors/subscribers attempting to ascertain if I have the slightest idea of what I am talking about.

15) Me trying to remember trades which I recommended, but have forgotten.

16) Me looking for trades that worked so I can say, ?I told you so.?

It?s there, it?s free, so please use it.