Global Market Comments

September 15, 2015

Fiat Lux

Featured Trade:

(OCTOBER 12 PORTLAND, OREGON GLOBAL STRATEGY LUNCHEON),

(THE COMING MARKET REACTION TO THE FED DECISION),

(SPY), (VIX),

(TAKING A BITE OUT OF STEALTH INFLATION), (SGG), (WEAT)

SPDR S&P 500 ETF (SPY)

VOLATILITY S&P 500 (^VIX)

iPath Bloomberg Sugar SubTR ETN (SGG)

Teucrium Wheat ETF (WEAT)

Up, then down, then up again.

How about that?

Will the Federal Reserve reverse their nine-year interest rate-cutting trend, or does it have another three months of life?

Is global economic weakness, or the approach of US full employment first and foremost in the mind of my friend, Federal Reserve governor Janet Yellen?

I?m sure that two days before the meeting, even the Fed itself doesn?t know the answer to these burning questions.

That has been the wellspring of the tremendous volatility we have grievously suffered for the past month that had the Volatility Index (VIX) at one point tickle a twice a decade high 53% level.

But could we be focusing on the wrong thing?

Is the Fed decision a simple matter of smoke and mirrors distracting us from the real market driver?

That would be the calendar.

After all the pundits predicted that the ?Sell in May, and go away? effect was utterly useless, backward looking, and little more than popular folklore, it then performed like a star.

I was certain this would be the case, and warned readers in the spring we would see a ?Sell in May, and go away? with a turbocharger, racing tires, and fuel injection.

This is why almost every S&P 500 Trade Alert I shot out since April was from the short side. My strategy thankfully delivered windfall profits for believing followers.

The problem is we may be trying to overthink the markets.

The May peak, and the 15% swoon that followed could be simply no more than further proof of the 60 year seasonal preference to sell stocks in the Spring and buy them back in the Fall.

Global growth fears, the China slowdown, stock market crash, and currency devaluation, the European refugee crisis, ISIS, the commodity collapse, saber rattling from Russia, and even share price valuations all could be nothing more than simple noise.

If I am right, then the Thursday Fed decision will be absolutely of no consequence. Whether they raise ?% and follow it up with ultra dovish talk will have no impact of the profitability of US companies whatsoever, except financials.

As we mathematicians like to say, ?it is close enough to zero to still be zero.?

The mere fact that the Fed decision is out of the way is the really important thing.

I have always believed that making money in the stock market is all about anticipating what is going to happen next.

What happens after a China crash? A China recovery.

European chaos? European stability.

An ISIS victory? An ISIS defeat.

A commodity collapse? A commodity bull market.

Russian saber rattling? Russian peace overtures.

Concern about share valuations? A return to momentum investing.

It all adds up to a global synchronized economic recovery sometime in 2016.

When do stocks start discounting this? How about right now!

You better pay attention to me, because I have been dead on right about how the stock market would play out after the August 24 flash crash.

That was my expectation of a narrowing triangle of higher lows and lower highs that reaches an apex exactly on Thursday, September 27 at 2:00 PM EDT.

After a false breakdown, the risk is we may get a stock melt up once the Fed announcement is out. It could kick off the six months a year we usually get seasonal strength for equities.

And this time, the follow up discussion will be far more important than the initial, algorithm driving headline.

Don?t get me wrong. We haven?t suddenly gotten a free pass on market turmoil.

Volatility is not about to plummet back to 10% and then sit there for four more years. We still have October to get through, which has a notorious reputation for ruining people?s lives and wealth.

However, my prediction for new all time high in American stock markets by the end of 2015 still stands.

Make your bets, and place your chips on the table please.

It?s Really All About the Calendar

It?s Really All About the Calendar

Global Market Comments

September 14, 2015

Fiat Lux

Featured Trade:

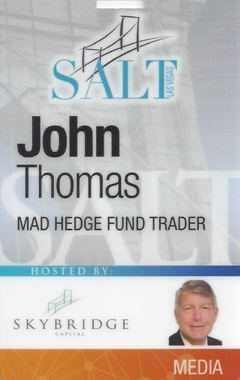

(A DAY IN THE LIFE OF THE MAD HEDGE FUND TRADER),

(SPY), (SPX), (QQQ), (AAPL), (VIX), (FSLR), (SCTY), (TLT), (TBT), (FXE), (GLD), (GDX), (USO)

SPDR S&P 500 (SPY)

S&P 500 Index (SPX)

PowerShares QQQ (QQQ)

Apple Inc. (AAPL)

VOLATILITY S&P 500 (^VIX)

First Solar, Inc. (FSLR)

SolarCity Corporation (SCTY)

iShares 20+ Year Treasury Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

CurrencyShares Euro Trust (FXE)

SPDR Gold Shares (GLD)

Market Vectors Gold Miners ETF (GDX)

United States Oil (USO)

Global Market Comments

September 11, 2015

Fiat Lux

Featured Trade:

(FRIDAY, OCTOBER 30 SAN FRANCISCO STRATEGY LUNCHEON)

(CATCHING UP WITH DAVID TEPPER)

?Flat stocks is not a bad place to be right now,? said my friend, hedge fund legend David Tepper of Appaloosa Management LP.

Those of a certain age will remember a TV commercial that instructed us that ?When EF Hutton talks, people listen.

Today, they should be listening to Tepper.

David argues that river of liquidity that has been a tailwind for stocks for the past 17 years may be about to end, or it may not.

Until David figures out this conundrum, he?ll feel safer watching the equity markets from the sidelines. Tepper is presently carrying an unusual amount of cash on his books right now.

So am I.

The S&P 500 peaked at an earnings multiple of 18 earlier this year when it tickled $2,014, bang on his forecast.

It now trades at 16 multiple. If you assume that (SPX) earnings will come in at $118 a share, that puts a fair value for the index of $1,888, or spitting distance from the current level.

If you take that 16 multiple into next year, and figure in a (SPX) earnings figure of $125/share, that takes the index up to 2,000. Not much, but better than a poke in the eye with a sharp stick.

The problem is with the earnings numbers. As we approach the 4% handle for the headline unemployment rate, wages have to rise. That will cut corporate margins, which are currently peaking.

This means we currently have one of the greatest stock picking markets of all time. Some stocks are clearly overvalued, while others are OK.

That is were I come in. I have found that focusing the half dozen winners is the perfect way to play these tempestuous markets.

The problem is that there is a lot of risk in the markets now, a point I have been vociferously arguing for the past four months. Almost every Trade Alert I have send out since April on the (SPY) has been from the short side.

Stocks here are either fairly valued, or slightly expensive. But there is no safety cushion. If the mass refugee problem causes Europe to blow up, or if China is worse than we think, then there could be trouble.

The earnings multiple could drop to 14-15 in a heartbeat, knocking another 10% off of stocks.

It is clearly not ?bet the ranch? time for equities.

Even long-term investors should be raising a little bit of cash here, paring their most expensive, highest beta holdings. That said, stockowners with a four-year time horizon will be alright.

While all eyes are on the Federal Reserve decision next week, 25 basis points are neither here nor there for the almighty US economy. The larger impact of the Fed move will be felt in the foreign exchange markets.

The ?river? David is talking about is the accumulation of assets by international entities on multiple fronts.

Chinese and other emerging market reserves rocketed. Saudi oil profits ballooned. US companies managed to sock away $2 trillion in foreign profits.

Quantitative easing by the US, Japan, Europe, and China added fuel to the fire. All told, some $11 trillion in cash was created. In these circumstances, you buy every dip in risk assets, which David has been doing for nearly two decades.

This initial move for most of these assets was into the global bond markets, which is why interest have been falling for 30 years to absurdly low levels.

Now a chink is appearing in this argument, with the end of QE in the US and the de facto tightening it has brought.

Suddenly, the flow of money in this river has changed from one-way to mixed. This uncertainty and confusion is giving us our current round of volatility. In this environment, you buy every dip in volatility and sell every rally.

I have been doing the same through the Velocity Shares Daily Inverse VIX Short Term ETN (XIV) and the ProShares Short VIX Short Term Futures ETN (SVXY).

Tepper is the best trader our generation, bar none. If you gave him $1 million when he started Appaloosa Management LP in 1993, it would be worth a staggering $149 million today.

Managing $20 billion in assets with a staff of only 33, David earned a personal paycheck of $3.5 billion last year, one of the largest in history. He was worth every penny.

His rise from a gritty inner city high school in Pittsburgh is now part of Wall Street lore. It is a classic American bootstrap story. He moved on to University of Pittsburgh and Carnegie Mellon University for graduate school.

He spent two years battling to keep a dying Republic Steel alive with innovative refinancings, even though he was hit with a 10% pay cut six weeks into the job.

That led to a gig as a junk bond analyst at Keystone Mutual Funds (now part of Evergreen Funds), and finally a coveted job at Goldman Sachs.

A mere six months after joining the firm, he was promoted head of convertible bond trading. He quickly became known as an iconoclast and innovator, gaining a loyal following of fans, first inside Goldman, and then throughout the industry at large.

I was one of those early acolytes, trading against him from the convertible bond desk at Morgan Stanley.

Tepper dispelled a myth that he named his firm ?Appaloosa? because he liked to eat horsemeat.

In those primordial days, brokerage research was distributed by fax machines. Firms starting with the letter ?A? got the news up to 20 minutes earlier than competitors.

Hey, anything to get an edge.

David suffered three 20% drawdowns during his career, once during the Russian debt default in 1998 and again in the 2008 crash. Each one was a sobering and humbling experience.

Today has returned profits to his clients that are double their original investment.

That means they are now playing with the ?house?s money.? This has lifted a great psychological burden from David?s shoulders, cleared his mind and given him freedom. It is now impossible for his customers to lose money.

Tepper currently turns new money away and has closed some of his peripheral funds to concentrate his focus. He keeps working not to collect more assets, but for the love of the game.

David isn?t just sitting on his cash, he is giving great chunks of it away. In 2003, he gave $55 million to his alma mater, now called the Carnegie Mellon David A. Tepper School of Business.

Last year, he wrote another check to the school for $67 million. He has been active in Paul Tudor Jones? Robin Hood Foundation.

When the super storm Hurricane Sandy devastated the east coast in 2012, he topped up many New Jersey charities that had been drained by the financial crisis.

Since then, Tepper has been able to deliver his best performance ever. Does he believe in karma? David pointed to himself with both hands in a big, bold flourish and said, ?This is karma!?

Asked if he had any advice for aspiring young hedge funds traders, he furrowed his brow and thought for a moment. ?The worse things are, the better they will get. When they are awful, it is a great time to buy.?

So true, so true.

Good for you, David Tepper.

Global Market Comments

September 10, 2015

Fiat Lux

Featured Trade:

(FRIDAY, OCTOBER 23 INCLINE VILLAGE, NEVADA STRATEGY LUNCHEON)

(PLEASE USE MY FREE DATA BASE SEARCH),

(IS THIS THE BIG TRADE OF 2016?),

(JJC), (DBA), (CORN), (CU), (USO), (KOL),

(TESTIMONIAL)

iPath DJ-UBS Copper SubTR ETN (JJC)

PowerShares DB Agriculture ETF (DBA)

Teucrium Corn ETF (CORN)

First Trust ISE Global Copper ETF (CU)

United States Oil ETF (USO)

Market Vectors Coal ETF (KOL)

Watching the entire commodity complex collapse in unison this year was nothing less than amazing, with many down 30% or more. And I mean the broader definition of commodity.

It includes the base metals like copper (JJC), (CU), agricultural products (CORN), (SOYB), (DBA), precious metals (GLD), (SLV), and even energy (USO), (KOL).

If you look carefully, you can find commonality in many, but not all, of these.

A slowing China meant that global consumption of bulk commodities would recede to a low ebb. The Chinese stock market crash threw gasoline on the fire.

A bull market in US stocks produced a world clamoring for paper assets at the expense of hard ones.

And of course, the high prices seen in all of these nearly four years ago cured high prices, drawing in new production from untold corners of the earth.

This is how bubbles always end.

What leaves many scratching heads is how widespread the route became. Those clever people who used one commodity to hedge another were left with portfolios of ashes, as everything plunged in lockstep.

The big talk now among my global strategist friends is this: will this year?s dogs become next year?s Cinderellas?

It is easy to imagine how this could happen. For a start, the higher paper stocks rise, the cheaper commodities look. They are now starting to appear like great laggard/diversification plays.

Here is another conundrum.

The world is on track for a global synchronized recovery, with the US. China, Japan and Europe all going ?pedal to the metal? to spur economic growth.

So how is it supposed to do this without using more commodities?

Yes, you can argue, there are big stockpiles to eat through before we see any real price appreciation. But stores can be exhausted in mere months.

This is why I am starting to get interested in the entire commodity space. I have already executed a couple of profitable trades in Freeport McMoRan (FCX) this year-- one of the world?s largest copper producers.

And if my old friend, Carl Icahn, is interested, should I be?

I look forward to more visits to the trough.

Higher prices for commodities in 2016 may not turn out to be a fairy tale after all.

A Commodity Recovery in 2016 is No Fairy Tale

A Commodity Recovery in 2016 is No Fairy Tale

Global Market Comments

September 9, 2015

Fiat Lux

Featured Trade:

(OCTOBER 12 PORTLAND, OREGON GLOBAL STRATEGY LUNCHEON),

(THE BIPOLAR ECONOMY),

(AAPL), (IBM), (INTC), (ORCL), (CAT),

(HANGING OUT WITH THE WOZ), (AAPL),

(TESTIMONIAL)

Apple Inc. (AAPL)

International Business Machines Corporation (IBM)

Intel Corporation (INTC)

Oracle Corporation (ORCL)

Caterpillar Inc. (CAT)

Global Market Comments

September 8, 2015

Fiat Lux

Featured Trade:

(SEPTEMBER 9 GLOBAL STRATEGY WEBINAR),

(THE MAD HEDGE FUND TRADER LOSES MONEY!),

(SPY), (XIV), (VIX), (HD), (UHAL),

(TESTIMONIAL)

SPDR S&P 500 ETF Trust (SPY)

VelocityShares Daily Inverse VIX ST ETN (XIV)

VOLATILITY S&P 500 (^VIX)

The Home Depot, Inc. (HD)

AMERCO (UHAL)

The month of August is now behind us, and it is all over but the crying.

After a heroic effort, I traded the month to a near draw, posting a -0.90% loss, my first red ink of the year.

Never mind that I would have turned positive if August had lasted a single day longer. Never mind that most investors would have given their right arm to be down only -0.90% last month.

You can?t eat relative performance!

Red is red!

As penance, I have begun wearing a hair shirt, am waking up two hours earlier every morning to get ahead of the market, am spending long hours on the phone late at night finding out what really is happening in China, and will not shave my beard until I move back into the green.

So far, I am off to a great start for September, posting a 3.25% return for the first four days of the month.

Dodging and weaving, I sold short the Volatility Index (VIX) through the Velocity Shares Daily Inverse VIX Short Term ETN (XIV) when it briefly stuck its head above $32 on Tuesday, and covered it during the vol collapse to $23 two days later.

The real icing on the cake was then pushing out my umpteenth short in the (SPY) of the last four months right at the Thursday market highs.

It helped a lot that I completely nailed the August nonfarm payroll report, which came in at a feeble 173,000, the lowest in months.

Headline unemployment hit an astounding decade low of 5.1%, and is within spitting distance of hitting the 5% forecast I boldly made all the way back in January (click here for my ?2015 Annual Asset Class Review? ).

What?s more, the JOLTS (the Bureau of Labor Statistics Job Openings and Labor Turnover Survey) shows there are 5 million unfilled jobs across the country going begging right now.

Here in California, labor shortages are cropping up almost everywhere. Schools can?t hire teachers. Contractors can?t hire laborers.

The mob of illegals that used to huddle in front of Home Depot (HD) and U-Haul Trailers (UHAL) are gone. They have all found full time jobs with their fake California drivers licenses.

Everyone in my neighborhood is rushing to repair their roofs before the biggest El Nino in history hits in October. But guess what? There is a one-month wait, if a roofer will return your phone call.

And these are the people who were all collecting unemployment four years ago.

I have my guys working weekends to finish my rain harvest system on time so I can tell my local water utility, East Bay MUD, to go screw themselves.

If the Fed doesn?t raise interest rates soon, then we will be looking at a 4% handle for unemployment, and zero interest rates at the same time.

Unbelievable!

August is a particularly squirrelly month to call the nonfarm. It is prone to a very weak initial report, followed by huge upward revisions.

It is those revisions that will trigger a ferocious short covering rally in the fall that will lead the market to new all time highs by yearend.

My friend, legendary technician, Charles Nenner, is calling for a final bottom this month for this nervous breakdown of $1760 in the S&P 500 (SPX).

This calls into question my position in the September $174-$179 vertical bull call spread. But that expires in only eight trading days, and even if Charles turns out to be right, it isn?t going to happen by September 15.

In the meantime, expect volatility to continue, especially at market openings and closes, that to the new bane of our existence, Risk Parity traders (click here for ?Blame it All on the Risk parity Traders?).

That will leave our lives, dull, mean, and brutish for the rest of this month.

But hey, it was you who wanted to be in show business!

Toughen up!