Occasionally the consensus is right.

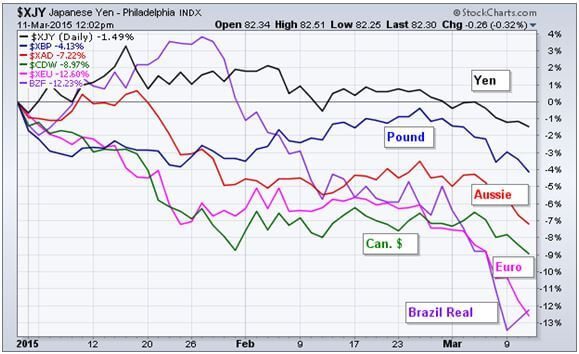

Since the start of the year, it seems that everyone and his brother, sister and cleaning lady has been selling short the euro.

As a result, the beleaguered continental currency has suffered one of the sharpest falls in the history of the foreign exchange markets.

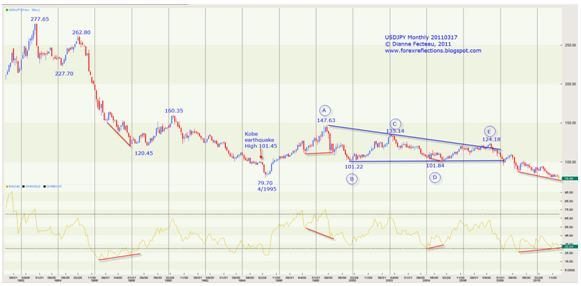

I have to think back three decades to recall something similar, when the Plaza Accord ignited a dramatic collapse in the US dollar against the Japanese yen, then trading at Y270.

Or you can recall back to January, when my friends at the Swiss National Bank engineered an overnight depreciation of the euro against the Swiss franc of 20%.

Those who followed my advice to sell short the euro last July have profited mightily. The (FXE) has plunged by 26% since then. Those who picked up the ProShares Ultra Short Euro 2X bear ETF (EUO) that I pleaded with you to buy did even better, capturing an eye popping 75% profit.

To read my prescient predictions about the imminent demise of the European currency, please click here for my 2015 Annual Asset Class Review.

With spectacular results like this, one has to ask whether we are seeing too much of a good thing, if this trade is getting rather long in the tooth, and if it is time to get while the getting is good.

The technical analysts certainly think so. The greenback is currently overbought and the euro oversold in the extreme, with RSI?s and momentum indicators off the charts.

For the statisticians out there, the euro?s move is 3.5 standard deviations away from the mean, something that is only supposed to happen every 100 years. And as we all know, mean reversion can be a real bitch.

On top of that, long-term market veterans will tell you that markets of all kinds naturally gravitate towards large round numbers. With the euro trading yesterday at the $1.03 handle, spitting distance from parity at $1.00, this is about as large of a round number that you will find anywhere.

So trying to catch the last three cents of a move from $1.40 to $1.00 is an awful trading idea, as the risk/reward is so poor.

My guess is that we will take a brief, peripatetic run at the $1.01 handle, and then develop a sudden case of acrophobia, or fear of heights. There will just be too many traders out there with enormous unrealized gains, begging to be exited.

I have not suddenly fallen in love with the euro. The pit from which its economy must extricate itself is deep, foreboding, and structural. But it is time to face facts. The only reason to add new euro positions here is to believe that it is going to 88 cents to the US dollar, and fast.

It could well do that. But the probability is much lower than we saw with the moves from $1.60 to $1.40 or from $1.40 to $1.03.

However, get me a decent price to sell at, like $1.08 or $1.10, and I?ll be back there again on the short side in a heartbeat.

You also must understand that the cure for a cheap euro is a cheap euro. Big continental exporters, like Daimler Benz, BMW and Volkswagen, are licking their chops at the prospects of booming sales, thanks to a newly devalued currency. Sooner or later, this will turn into robust economic growth.

If nothing else, you need to look at the Wisdom Tree Germany Hedged Equity Fund (DXGE), which will profit from this new business activity, and has already tacked on an impressive 24% in 2015. The Wisdom Tree International Hedged Equity Fund (HEDG) also looks pretty good.

As for me, I have already started planning my discount summer vacation in Europe in earnest.

Cappuccino, please!

I Remember it like it was Yesterday

I Remember it like it was Yesterday

The Cheap Euro Works for Me

The Cheap Euro Works for Me

Global Market Comments

March 12, 2015

Fiat Lux

Featured Trade:

(MAD DAY TRADER JIM PARKER IS UP 39% IN 2015),

(ZIOP), (THRX), (ZTS), (DXJ), (USO), (SPY), (IWM),

(FRIDAY, MAY 15 SAN FRANCISCO STRATEGY LUNCHEON)

(DIAMONDS ARE STILL AN INVESTOR?S BEST FRIEND)

ZIOPHARM Oncology, Inc. (ZIOP)

Theravance Inc. (THRX)

Zoetis Inc. (ZTS)

WisdomTree Japan Hedged Equity ETF (DXJ)

United States Oil ETF (USO)

SPDR S&P 500 ETF (SPY)

iShares Russell 2000 (IWM)

Mad Day Trader Jim Parker has been absolutely knocking the cover off the ball this year, delivering a blistering 39% profit so far for followers.

He was in and out of the Apple (AAPL) melt up twice. He was early and big in the biotechnology sector, trading around ZIOPHARM Oncology (ZIOP), Therevance (THRX), and Zoetis (ZTS).

He played the Japanese economic recovery through the Wisdom Tree Japan Hedged Equity ETF (DXJ). And for good measure, he was playing oil (USO) from the short side.

The current rapid ?RISK ON/RISK OFF? environment is tailor made for Jim?s disciplined, quantitative approach to the markets. In other words, Jim thrives on volatility.

And the best is yet to come. Jim is expecting the rest of 2015 to offer plenty of volatility and loads of great trading opportunities. He thinks the scariest moves may be yet to come.

He sees a massive rotation out of large caps (SPY) into small caps (IWM), as investors flee the adverse effects of the euro collapse on American corporate profits. That is bringing the (SPY) 200 day moving average at $199. Key support for all equity markets will be found when the NASDAQ hits 4,265.

Sector leadership could change daily, with a brutal rotation, depending on whether the price of oil is up, down, or sideways.

The market is paying the price of having pulled forward too much performance from 2015 back into the final month of 2014, when we all watched the December melt up slack jawed.

Jim is a 40-year veteran of the financial markets and has long made a living as an independent trader in the pits at the Chicago Mercantile Exchange. He worked his way up from a junior floor runner to advisor to some of the world?s largest hedge funds.

We are lucky to have him on our team and gain access to his experience, knowledge and expertise.

Jim uses a dozen proprietary short-term technical and momentum indicators to generate buy and sell signals.

If you are not already getting Jim?s dynamite Mad Day Trader service, please get yourself the unfair advantage you deserve. Just email Nancy in customer support at support@madhedgefundtrader.com and ask for the $1,500 a year upgrade to your existing Global Trading Dispatch service.

Global Market Comments

March 11, 2015

Fiat Lux

Featured Trade:

(WHAT ALMONDS SAY ABOUT THE GLOBAL ECONOMY),

(BE CAREFUL WHO YOU SNITCH ON),

(COULD YOU QUALIFY TO BECOME A US CITIZEN?)

Yes, that?s right, you read it correctly, almonds.

By now, many of you have figured out that I like calling my paid subscribers to find out how they find the service. I always ask for suggestion for improvements. Then I ask what they do besides trade the markets.

I get an amazing array of answers. One reader flew helicopters in Alaska to inspect oil pipelines, executing trades on his cell phone in between flights. Another ran a Russian hedge fund in Moscow.

The sheep farmer in Australia relied on me as his connection with the rest of the world. The family office in Spain valued my American view of the world.

Then I called Brad in Modesto, California, who said he was in the Almond business. My interest piqued, I proceeded to grill him. And with that, I obtained a fascinating insight into an obscure corner of the global economy.

If you thought marijuana, estimated by the DEA at $6 billion a year, was California?s largest cash crop, you?d be wrong. Grapes used to be our largest legal crop, at $5 billion a year. But almonds will beat all this year, possibly reaching as high at $8 billion.

You can blame the California drought, now in its fourth year. It has only rained once in the Golden State so far in 2015. This has driven the price of almonds from $1/pound a few years ago to as much as $4/pound today.

The price spike has ignited fierce water wars across the state, with increasingly desperate farmers battling over an ever-diminishing commodity. Those located in the eastern half of the Central Valley (which you will remember from your freshman English class in The Grapes of Wrath) are sitting pretty.

They have long term contracts to buy water from federal public works projects at subsidized prices that date back to the Great Depression. These rights can make or break the value of a farm, and are passed down from one generation to the next.

The Western half of the valley is another story. When construction of Interstate 5 was completed in 1979, most of it was still barren desert, a rain shadow effect of the state?s coastal mountain range.

Only the oil industry was there in force, especially around the Elk Hills oil find (watch the Daniel Day Lewis movie, There Will Be Blood). I know because my grandfather worked there for Standard Oil during the 1920?s.

So when large scale farming developed there during the eighties, they had to buy water on the spot market. The problem is that during a draught, there is very little water for sale. So parched farmers have turned to drilling to irrigate their fields.

This has lead to an even bigger headache. In the 19th century, you could drill 100 feet and find all the water you wanted. Today, they have to go as deep as 1,200 feet, and even these ancient deep aquifers are drying up. And that?s assuming you have the $1 million it costs to drill such a well.

Indeed, the elevation of the Central Valley has fallen by ten feet over the past century because of the underground water that has been withdrawn so far. Destruction of rural buildings through catastrophic subsidence is becoming widespread.

The only alternative is to let your crops die. You see this in abundance while making the drive from San Francisco to Las Angeles, withered trees frozen in tortured, grotesque death throes. Also plentiful are irate billboards attacking the government for depriving local farmers of their cheap water.

Even if you have plenty of water, it is still not smooth sailing in the almond business these days. China is the world?s largest buyer of almonds. The demand there has been so great that the Chinese have become major buyers of almond farms throughout the state, at premium prices.

However, the Middle Kingdom?s recent anti corruption campaign is starting to take a big bite out of sales.

In years past, individuals would buy dozens of boxes of almond cookies to pass out to friends, customers, employers, government officials and regulators during the Lunar New Year celebrations. Not so today. The difference has lead to the cancellation of a few shiploads of the prized nuts.

Brad kindly invited me to tour his roasting and packaging facilities the next time I was in the neighborhood.

I was left thinking, this really is a global economy that is so integrated that, when a butterfly flaps its wings in Brazil, it causes a typhoon in Japan. It is also a great example of how information about one asset class can provide insights about all the others.

With that, I opened a fresh can of Blue Diamond almonds that I picked up at Costco and grabbed a handful.

Another Batch for China

Another Batch for China

Global Market Comments

March 10, 2015

Fiat Lux

Featured Trade:

(WHY I WENT TO 100% CASH),

(HEDJ), (SPY), (FXE), (GLD), (TLT)

(THE SOLAR ROAD REVISTED),

(AAPL), (GOOG), (TESLA), (FB), (TWTR)

WisdomTree Europe Hedged Equity ETF (HEDJ)

SPDR S&P 500 ETF (SPY)

CurrencyShares Euro ETF (FXE)

SPDR Gold Shares (GLD)

iShares 20+ Year Treasury Bond (TLT)

Apple Inc. (AAPL)

Google Inc. (GOOG)

Tesla Motors, Inc. (TSLA)

Facebook, Inc. (FB)

Twitter, Inc. (TWTR)

I am sitting here in the balcony seats at the Napa City Winery. Somehow, my peripatetic social life has dragged me down here to listen to a Hispanic rap group. That?s right, you heard it correctly. A Hispanic rap group.

It is midnight.

The sound is so loud that it is vibrating through my chest. So I have withdrawn into my own inner silence to contemplate what the hell happened in the financial markets on Friday.

Most modern hedge funds are constructed using a series of complex correlations between asset classes which are back tested years, if not decades.

When stocks go up (SPY), bonds (TLT) are supposed to go down, as corporate America profits from the lower cost of money. When stocks go down, gold (GLD) is supposed to rally, as traders flee from risk. When bonds collapse, the dollar is weak, as foreign investors repatriate the proceeds of their sales.

And so on, and so on.

Except on Friday, none of this worked. Everything went down in unison. Only the dollar rose. It was that simple. You could hear the models blowing up like fireworks on the Fourth of July (or Guy Fawkes Day, whatever your persuasion).

To see the market trade this badly on such great news as the blockbuster February nonfarm payroll of 395,000 was really quite amazing. It makes no sense, but it is there, and therefore, I am gone.

Whenever I don?t understand what is going on, I get out. You should too.

I was never one to argue with Mr. Market. So I have moved to a 100% cash position, a circumstance, which for me, is as rare as a dodo bird.

Did the world go mad when I wasn?t looking?

Which leaves us to contemplate what the markets are trying to tell us deaf traders.

When you see illogical, irrational, unpredictable market behavior like this, it is evidence that the market is changing. But in which way? Let us consider five possibilities.

1) The Fed is Raising Rates in June. It is amazing how much complacency there is out there about the coming hike in interest rates, the first in a decade. The talking heads will tell you that it is well telegraphed, fully discounted, and in the market. But when the momentous event actually occurs, just watch. Traders will run around like chicks with their heads cut off.

It is not in the market.

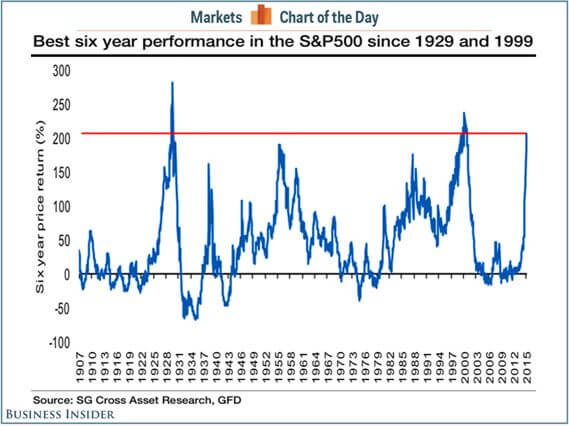

2) The market is topping out. This is the most frightening prospect for most investors, as the memories of the Great Crash are so recent. Unfortunately, it has also been predicted annually for the last seven years. If anything, the global economy is getting stronger, not weaker, now that Euro QE is finally kicking in.

This new virility will enable Europe, China, and Japan to rejoin the global economy after a prolonged period of absence. US economic growth should catapult from 2.5% to 3% this year. That?s what Friday?s 5.5% headline unemployment rate was shouting at us, the closest to full employment that we have been since 2005.

3) Money is Shifting Out of the US and into Europe. It is only natural that investors want to reallocate capital out of markets where QE is ending, like the US, and into markets where it is beginning, such as Europe. Those who have been mercilessly beaten for diversifying internationally for the last seven years, are now, at long last, getting rewarded. Suddenly, learning all those exotic foreign languages and strange customs is getting you more than a nice table at an ethnic restaurant.

The markets certainly believe this, with the Wisdom Tree International Hedged Equity ETF (HEDJ) up an impressive 20% in 2015, compared to a feeble 0% for the S&P 500 (SPY). Nothing persuades like performance.

4) The Seasonal Period of Equity Strength is Ending. Remember ?Sell in May, and go away?? That looming deadline is only two months off. Some four of the six months of seasonal equity strength is behind us.

5) The Strong Dollar is Finally Starting to Hurt. After a 34% depreciation of the Euro against the US dollar over the past seven years, the deflationary impacts are finally taking their toll. Global multinationals are feeling the heat the most, mid caps less so. At last, I can afford my extravagant European vacations!

If the dollar is the driver, can we expect any respite? Only if the Federal Reserve cancels all interest rate hikes for the foreseeable future. In other words, fat chance.

Parity against the Euro, here we come!

All of this inspires me to exercise greater than usual amounts of self-discipline and risk control. With any luck, I?ll be all cash going into the next meltdown. That is worth paying a premium for in terms of opportunity cost.

Hey, even a broken clock is right twice a day, occasionally a blind squirrel finds an acorn and if you fire buckshot long enough, eventually you are going to hit a barn.

Well, the band has just completed its grand finale, wading into the middle of the crowd for a giant selfy. My ears will be ringing for days.

Now, for my next newsletter?

Global Market Comments

March 9, 2015

Fiat Lux

Featured Trade:

(WATCH OUT FOR APPLE IN THE DOW),

(AAPL), (T), (MSFT), (CSCO), (INTC),

(A COW BASED ECONOMICS LESSON)

Apple Inc. (AAPL)

AT&T, Inc. (T)

Microsoft Corporation (MSFT)

Cisco Systems, Inc. (CSCO)

Intel Corporation (INTC)

?No one is line dancing over the fact that the market is at 1,940. No one feels good about it. The market likes to climb a wall of worry, and the stonemason has been hard at work. So I think we continue to grind higher,? said Jason Trennert, chief investment strategist at Strategas Research Partners.