Global Market Comments

April 25, 2014

Fiat Lux

Featured Trade:

(LAS VEGAS WEDNESDAY, MAY 14 GLOBAL STRAGEGY LUNCHEON),

(STOCKS TO BUY AT THE BOTTOM),

(LNG), (GOOGL), (AAPL), (IBB), (BRKA), (AMZN), (DIS), (FB), (YHOO),

(SSO), (XLV), (QQQ),

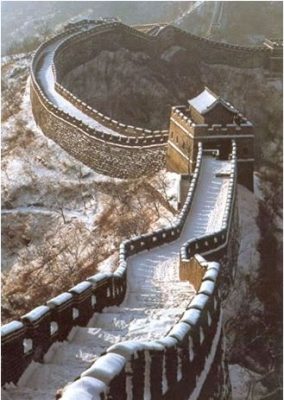

(THE CHINA VIEW FROM 30,000 FEET)

(FXI), (DBC), (DYY), (DBA), (PHO)

Cheniere Energy, Inc. (LNG)

Google Inc. (GOOGL)

Apple Inc. (AAPL)

iShares Nasdaq Biotechnology (IBB)

Berkshire Hathaway Inc. (BRK-A)

Amazon.com Inc. (AMZN)

The Walt Disney Company (DIS)

Facebook, Inc. (FB)

Yahoo! Inc. (YHOO)

ProShares Ultra S&P500 (SSO)

Health Care Select Sector SPDR (XLV)

PowerShares QQQ (QQQ)

iShares China Large-Cap (FXI)

PowerShares DB Commodity Index Tracking (DBC)

PowerShares DB Commodity Dble Long ETN (DYY)

PowerShares DB Agriculture (DBA)

PowerShares Water Resources (PHO)

I have long sat beside the table of McKinsey & Co., the best management consulting company in Asia, hoping to catch some crumbs of wisdom (click here for their home page). So, I jumped at the chance to have breakfast with Shanghai based Worldwide Managing Director, Dominic Barton, when he passed through San Francisco visiting clients.

These are usually sedentary affairs, but Dominic spit out fascinating statistics so fast I had to write furiously to keep up. Sadly, my bacon and eggs grew cold and congealed. Asia has accounted for 50% of world GDP for most of human history. It dipped down to only 10% over the last two centuries, but is now on the way back up. That implies that China?s GDP will triple relative to our own from current levels.

A $500 billion infrastructure oriented stimulus package enabled the Middle Kingdom to recover faster from the Great Recession than the West, and if this didn?t work, they had another $500 billion package sitting on the shelf. But with GDP of only $6.5 trillion today, don?t count on China bailing out our $16.5 trillion economy.

China is trying to free itself from an overdependence on exports by creating a domestic demand driven economy. The result will be 900 million Asians joining the global middle class who are all going to want cell phones, PC?s, and to live in big cities. Asia has a huge edge over the West with a very pro-growth demographic pyramid. China needs to spend a further $2 trillion in infrastructure spending, and a new 75-story skyscraper is going up there every three hours!

Some 1,000 years ago, the Silk Road was the world?s major trade route, and today intra-Asian trade exceeds trade with the West. The commodity boom will accelerate as China withdraws supplies from the market for its own consumption, as it has already done with the rare earths.

Climate change is going to become a contentious political issue, with per capita carbon emission at 19 tons in the US, compared to only 4.6 tons in China, but with all of the new growth coming from the latter. Protectionism, pandemics, huge food and water shortages, and rising income inequality are other threats to growth.

To me, this all adds up to buying on the next substantial dip big core longs in China (FXI), commodities (DBC) and the 2X (DYY), food (DBA), and water (PHO). A quick Egg McMuffin next door filled my other needs.

Global Market Comments

April 24, 2014

Fiat Lux

Featured Trade:

(ORLANDO FLORIDA SATURDAY, MAY 17 GLOBAL STRAGEGY LUNCHEON),

(APPLE BLOWS OUT Q2), (AAPL),

(ANOTHER NAIL IN THE NUCLEAR COFFIN),

(NLR), (CCJ)

Apple Inc. (AAPL)

Market Vectors Uranium+Nuclear Enrgy ETF (NLR)

Cameco Corporation (CCJ)

Global Market Comments

April 23, 2014

Fiat Lux

Featured Trade:

(JUNE 17 NEW YORK STRATEGY LUNCHEON)

(APRIL 23 GLOBAL STRATEGY WEBINAR),

(COME TO THE JUNE 13-14 INVEST LIKE A MONSTER LAS VEGAS CONFERENCE)

Please come to hear me, Mad Hedge Fund Trader John Thomas, as the keynote speaker at the Invest Like a Monster Las Vegas Conference on June 13-14.

I will be joined by many old friends from across the investment spectrum. Jon and Pete Najarian will teach you the tricks of the trade for navigating the ever complex options markets.

Fellow former combat pilot, Chuck Hughes, will go into depth on his own highly successful approach to trading the market. To listen to my in depth interview with him on Hedge Fund Radio, please click here.

Well known market commentator Guy Adami, the Prince of New Jersey, will be there to give his trading insights. So will former hedge fund manager and Yahoo Finance guru Jeff Macke.

The first day will be devoted to three educational sessions that get into the nitty gritty of trading options. The day winds up with a cocktail party with the Najarian Brothers and me.

I will kick off the Saturday session with and extended presentation on the long-term future of the financial markets, to be followed by an extensive question and answer session. I will be followed by an impressive lineup of market veterans.

The event will be held at the Bellagio Hotel on the Strip, my favorite Las Vegas haunt, best known for its spectacular water fountains out front. You may recognize it in the hit movies The Hangover and Ocean?s Eleven.

General admission costs $499 for the two full days. You can buy a VIP ticket for $699, which includes social events with the high and the mighty. It is all great value for the money, given the quality and quantity of the information you will obtain. Just click here: http://www.optionmonster.com/events/?refId=186 to buy tickets.

Trademonster?s proprietary program, called Heat Seeker ?, monitors no less than 180,000 trades a second to give an early warning of large trades that are about to hit the stock, options, and futures markets. To give you an idea of how much data this is, think of downloading the entire contents of the Library of Congress, about 20 terabytes, every 33 minutes.

The firm maintains a 10 gigabyte per second conduit that transfers data at 6,000 times the speed of a T-1 line, the fastest such pipe in the civilian world. The firm then distills this ocean of data into the top movers of the day, which is put up for free on its website, and offers much more detailed analysis through a premium subscription product.

?As with the NFL,? says Jon, ?you can?t defend against speed.?

The system catches big hedge funds, pension funds, and mutual funds shifting large positions, giving subscribers a peak at the bullish or bearish tilt of the market. It also offers accurate predictions of imminent moves in single stock and index volatility.

Jon started his career as a linebacker for the Chicago Bears, and I can personally attest that he still has a handshake that?s like a steel vice grip. Maybe it was his brute strength that enabled him to work as pit trader on the Chicago Board of Options Exchange for 22 years, where he was known by his floor call letters of ?DRJ.? He formed Mercury Trading in 1989 and then sold it to the mega hedge fund, Citadel, in 2004.

Jon developed his patented algorithms for Heat Seeker? with his brother Pete, another NFL player (Tampa Bay Buccaneers and the Minnesota Vikings), who like Jon, is a regular face in the financial media.

June is a great time to visit Sin City, as the crowds are largely gone and the sun is wonderfully baking hot. You can ride the neck-breaking roller coaster at the New York New York Hotel, catch one of eight Cirque du Soleil shows, and ride a gondola at the Venetian Hotel.

Or you can try to get a great deal on a luxury item from my buddy, Rick Harrison, at the famous Gold and Silver Pawn, of Pawn Stars fame (good luck with that!).

Just be sure to bring extra sun tan lotion!

Global Market Comments

April 22, 2014

Fiat Lux

ANOTHER SPECIAL TESLA ISSUE

Featured Trade:

(LAST CHANCE TO ATTEND THE APRIL 25 SAN FRANCISCO STRATEGY LUNCHEON),

(CRASH TESTING THE TESLA), (TSLA)

Tesla Motors, Inc. (TSLA)

Global Market Comments

April 21, 2014

Fiat Lux

Featured Trade:

(JULY 11 SARDINIA, ITALY STRATEGY LUNCHEON)

(THE 1% AND THE BOND MARKET),

(TLT), (TBT), (MUB), (LQD), (ELD), (JNK),

(MAKE YOUR NEXT KILLING IN AFRICA),

(AFK), (GAF)

iShares 20+ Year Treasury Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

iShares National AMT-Free Muni Bond (MUB)

iShares iBoxx $ Invst Grade Crp Bond (LQD)

WisdomTree Emerging Markets Local Debt (ELD)

SPDR Barclays High Yield Bond (JNK)

Vectors Africa Index ETF (AFK)

SPDR S&P Emerging Middle East & Africa (GAF)

Global Market Comments

April 17, 2014

Fiat Lux

Featured Trade:

(LAS VEGAS WEDNESDAY, MAY 14 GLOBAL STRAGEGY LUNCHEON),

(THE MARKETS ARE NOT RIGGED)

Global Market Comments

April 16, 2014

Fiat Lux

Featured Trade:

(CHICAGO FRIDAY, MAY 23 GLOBAL STRAGEGY LUNCHEON),

(BUY SOLAR STOCKS ON THE DIP),

(FSLR), (SPWR), (SCTY), (TAN), (USO), (UNG), (XLU),

(THE ONE SAFE PLACE IN REAL ESTATE)

First Solar, Inc. (FSLR)

SunPower Corporation (SPWR)

SolarCity Corporation (SCTY)

Guggenheim Solar (TAN)

United States Oil (USO)

United States Natural Gas (UNG)

Utilities Select Sector SPDR (XLU)

Global Market Comments

April 15, 2014

Fiat Lux

Featured Trade:

(FRIDAY APRIL 25 SAN FRANCISCO STRATEGY LUNCHEON),

(HOW LONG WILL THE RUN IN MASTER LIMITED PARTNERSHIPS CONTINUE?),

(LINE), (BWP), (USO), (UNG),

(PILING ON THE SHORTS AGAIN), (SPY)

Linn Energy, LLC (LINE)

Boardwalk Pipeline Partners, LP (BWP)

United States Oil (USO)

United States Natural Gas (UNG)

SPDR S&P 500 (SPY)