Those of you counting on getting your old union assembly line job back in Detroit can forget it.

The eight year forecast published by the Bureau of Labor Statistics shows that 4.19 million jobs will be gained in the US in professional and business services, followed by 4 million health care and social assistance jobs, while 1.2 million will be lost in manufacturing.

This is great news for website designers, internet entrepreneurs, registered nurses, and masseuses in California, but grim tidings for traditional metal bashers in the rust belt manufacturing states like Michigan, Indiana, and Ohio.

I?m so old now that I am no longer asked for a driver?s license to get into a nightclub. Instead, they ask for a carbon dating. The real challenge for we aged career advisors is that probably half of these new service jobs haven?t even been invented yet, and if they can be described, it is only in a cheesy science fiction paperback with a half-dressed blond on the front cover. After all, who heard of a webmaster, a cell phone contract sales person, or a blogger 40 years ago?

Where are all these jobs going? You guessed it, China, which by my calculation, has imported 25 million jobs from the US over the past decade. You can also blame other lower waged, upstream manufacturing countries like Vietnam, where the Middle Kingdom is increasingly subcontracting its own offshoring.

These forecasts may be optimistic, because they assume that Americans can continue to claw their way up the value chain in the global economy, and not get stuck along the way, as the Japanese did in the nineties. The US desperately needs no less than 27 million new jobs to soak up natural population and immigration growth and get us back to a traditional 5% unemployment rate. The only way that is going to happen is for America to invent something new and big, and fast.

Personal computers achieved this during the eighties, and the internet did the trick in the nineties. The fact that we?ve done didly squat since 2000 except create a giant paper chase of subprime loans and derivatives explains why job growth since then has been zero, real wage growth has been negative, and American standards of living are falling.

Alternative energy and biotechnology are two possible drivers for a new economy. Unfortunately, the last administration did everything it could to stymie progress in both these fields, coddling big oil so China could steal a lead in several alternative technologies, and starving stem cell researchers of federal cash, ceding the lead there to others.

While the current crop of politicians extol the virtues of education, the reality is that we are dumbing down our public education system. How do we invent the next ?new? thing, while shrinking the University of California?s budget by 20% two years in a row? If my local high school can?t afford new computers, how is it going to feed Silicon Valley with computer literate work force? The US has a ?Michael Jackson? economy. It?s still living like a rock star, but hasn?t had a hit in 20 years.

China can have all the $20 a day jobs it wants. But if it accelerates its move up the value chain, as it clearly aspires to do, then America is in for even harder times. I?ll be hoping for the best, but preparing for the worst. How do you say ?unemployment check? in Mandarin?

Global Market Comments

September 30, 2013

Fiat Lux

Featured Trade:

(NOVEMBER 1 SAN FRANCISCO STRATEGY LUNCHEON),

(HAVE CALM WATERS RETURNED FOR SHIPPING STOCKS?),

($BDI), (DRYS), (SEA), (GNK),

(RIO), (BHP), (KOL), (FXA), (EWA)

Baltic Exchange Dry Index ($BDI)

DryShips, Inc. (DRYS)

Claymore/Delta Global Shipping (SEA)

Genco Shipping & Trading Ltd. (GNK)

Rio Tinto plc (RIO)

BHP Billiton Limited (BHP)

Market Vectors Coal ETF (KOL)

CurrencyShares Australian Dollar Trust (FXA)

iShares MSCI Australia Index (EWA)

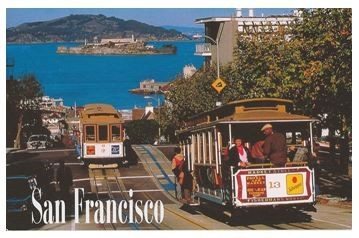

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, November 1, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $191.

I?ll be arriving at 11:00 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a private club in downtown San Francisco near Union Square that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

Global Market Comments

September 27, 2013

Fiat Lux

Featured Trade:

(GOING BACK INTO JAPAN),

(DXJ), ($NIKK), (FXY), (YCS),

(BE CAREFUL, YOUR PC IS WATCHING)

WisdomTree Japan Hedged Equity (DXJ)

Nikkei Index ($NIKK)

CurrencyShares Japanese Yen Trust (FXY)

ProShares UltraShort Yen (YCS)

Hey! You there, staring at this monitor. This is your PC talking to you. No, not you over there standing in the background. I?m talking to the guy sitting in front of me poking at my keys. Ouch! That one hurt!

So you thought no one was watching, did you? Let me set you straight. About a month ago you clicked on a certain website, and I installed myself as a cookie on your computer, which is an innocuous little text file that you can?t see. Since then, I have been tracking your every move, recording websites you clicked on, the pages you visited, and the stuff you ordered. I then used this handy little algorithm to build a profile of exactly who you are. I now know you better than your own mother. In fact, I know you better than you know yourself.

For example, I am aware that you make more than $250,000 a year, live in a posh zip code in San Francisco, belong to a fancy country club, and drive a Mercedes. You donate to Republican political causes, send your kids to a prestigious private school, and bill it all to an American Express Platinum Card. Did I leave anything out?

Because I know every detail of your life, down to your inside leg measurement, I am able to harness the power of this machine to more precisely service your every need. That includes directing advertising to you, which you have a high probability of clicking on. The more you click on my ads, the higher prices I can realize for those ads. The ad campaigns you now see are unique to your own personal computer because they are tied to your IP address. My program, called ?behavioral targeting? is the next ?big thing? in online advertising. It?s all part of the brave new world.

I see you have been shopping for a new car. Check out the new Hyundai athttp://www.hyundaiusa.com/, which offers the same quality as your existing ride, at half the price. Your clicks this morning suggest you?re taking your ?significant other? out to dinner tonight. Might I suggest Gary Danko?s on Bay Street athttp://www.garydanko.com/site/bio.html?? The rack of lamb is to die for there.

Your visits to Travelocity and Expedia tell me you?re planning a vacation. I bet you didn?t know you can find incredible deals in Las Vegas athttp://www.visitlasvegas.com/vegas/index.jsp?. Thinking about buying a condo there? They?ll even pay for the trip if you promise to check one out while you?re there.

Since we?re chatting here?mano a mano, I noticed that that last pair of jeans you ordered from?http://us.levi.com/home/index.jsp?had a 42-inch waist, up from the 40?s in your last order. Better lay off those cheeseburgers. Pretty soon, they?ll be calling you ?tubby? or ?fatso?. Better visit?http://www.weightwatchers.com/Index.aspx?soon, or the legs on that chair might buckle out from under you.

Worried about privacy? Privacy, shmivacy. There hasn?t been privacy in this country since the first social security number was handed out in 1936. And don?t expect any relief from Congress. I doubt half those dummies even know how to turn on their own PC?s.

Don?t even think about trying to delete me. I?m a ?flash cookie?, an insidious little piece of code that reinstalls every time you try that. Think of me as a toenail fungus. Once you catch me, I?m almost impossible to get rid of.

I hope you don?t mind, but I?ve been passing your personal details around to some of my buddies at other websites. That?s why when you clicked on?http://www.nfl.com/?you got deluged with product offers from your local team, the San Francisco 49ers. I?ve got friends at Google, Facebook, MySpace, and pretty much everywhere. Can I help it if I?m a popular guy? I bet the view from those 50-yard seats is great, isn?t it?

I noticed that your spending habits don?t exactly match with the income you reported on your last tax return. Do you think the IRS would like to know about that? I bet you didn?t know the agency offers a 10% reward for turning in tax cheats.

How about those triple XXX DVD?s you bought last week? Whoa! Hot, hot, hot! I hope your employer never finds out about those. It might not go down too well at your next performance review.

I thought it was lovely that you bought your spouse a two carat, yellow, vvs1, round cut diamond ring for $26,000 from?http://www.bluenile.com/?for your 30th?wedding anniversary. But who is Lolita, the Argentine firecracker, in Miami Beach? Does the old wifey know you sent her a $2,000 pair of diamond stud earrings? What?s it worth to you for me to keep mum on this? Maybe you should take a quick peak at? 3StepDivorce.com at?http://www.3stepdivorce.com? and see what you?re in for?

Naw, I?m just pulling your leg. This is all just between friends, right? Think of it as a doctor/patient relationship. I?ll tell you what. See that leaderboard ad at the top of the page? Just click on that and we?ll call it even. Oooh that felt good! Click it again. Oh, baby! Not too many times. You?ll trigger my anti click fraud program.

Now you see that wide skyscraper add over on the right? Click on that too. Oh baby! Click it again! And there?s a little button ad at the bottom of the page. No, not that one. A little lower. What was that little cutie?s name in Miami again? Aaaaah.

Global Market Comments

September 26, 2013

Fiat Lux

Featured Trade:

(THE GOVERNMENT THAT CRIED WOLF),

(BREAKFAST WITH BOONE PICKENS)

Reformed oil man, repenting sinner, and borne again environmentalist, T. Boone Pickens, Jr. says that ?When we turn the US green, it will have the best economy ever.?

I met the spry, homespun billionaire at San Francisco?s Mark Hopkins on a leg of his self-financed national campaign to get America to kick its dangerous dependence on foreign oil imports. For the past 30 years, the US has had no energy policy because ?no one wanted to kick a sleeping dog.?

Production at Mexico?s main Cantarell field is collapsing, and will force that country to become a net importer in five years. Venezuela is shifting its exports of its sulfur-laden crude to China for political reasons, once refineries in the Middle Kingdom are completed to handle it.

Unfortunately, stable energy prices have put urgent alternative energy development on a back burner, with his preferred natural gas (UNG) taking the biggest hit. If the US doesn?t make the right investments now, our energy dependence will simply shift from one self-interested foreign supplier (Saudi Arabia) to another (China).

Wind and solar alone won?t work on still nights, and can?t power an 18-wheeler. Don?t count on the help of the big oil companies because they get 81% of their earnings from selling imported oil. The answer is in a diverse blend of multiple alternative energy supplies from American only sources.? Although Boone now has Obama?s ear, it?s a long learning process.

Boone says he has donated $700 million to charity, and argues that the 20,000 trees he has planted should offset the carbon footprint of his Gulfstream V private jet.

I worked with Boone to organize financing for a Mesa Petroleum Pac Man oil company takeover in the early eighties, when it was cheaper to drill for oil on the floor of the New York Stock Exchange than in the field. Now 85, he has not slowed down a nanosecond.

As Boone walked out the door, I shook hands with him and said ?I want to be like you when I grow up.? He smiled. When you meet a friend who is 85, you never know if you are going to see him again.

Global Market Comments

September 25, 2013

Fiat Lux

Featured Trade:

(MAD HEDGE FUND TRADER HITS THREE YEAR 100% GAIN),

(JOIN THE INVEST LIKE A MONSTER SAN FRANCISCO TRADING CONFERENCE),

(WHY I?M BUYING THE TREASURY BOND MARKET),

(TLT), (TBT)

iShares Barclays 20+ Year Treas Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

I am pleased to announce that I will be participating in the Invest Like a Monster Trading Conference in San Francisco during October 25-26. The two-day event brings together experts from across the financial landscape who will improve your understanding of markets by a quantum leap and measurably boost your own personal trading performance.

Tickets are available for a bargain $399. If you buy the premium $499 package you will be invited to the Friday 6:00 pm VIP cocktail reception, where you will meet luminaries from the trading world, such as Trademonster?s Jon and Pete Najarian, Guy Adami, Jeff Mackey, and of course, myself, John Thomas, the Mad Hedge Fund Trader. All in all, it is great value for the money, and I?ll personally throw in a ride on the City by the Bay?s storied cable cars for free.

Jon Najarian is the founder of OptionMonster, which offers clients a series of custom crafted computer algorithms that give a crucial edge when trading the market. Called Heat Seeker ?, it monitors no less than 180,000 trades a second to give an early warning of large trades that are about to hit the stock, options, and futures markets.

To give you an idea of how much data this is, think of downloading the entire contents of the Library of Congress, about 20 terabytes of data, every 30 minutes. His firm maintains a 10 gigabyte per second conduit that transfers data at 6,000 times the speed of a T-1 line, the fastest such pipe in the civilian world. Jon?s team then distills this ocean of data on his website into the top movers of the day. ?As with the NFL,? says Jon, ?you can?t defend against speed.?

The system catches big hedge funds, pension funds, and mutual funds shifting large positions, giving subscribers a peek at the bullish or bearish tilt of the market. It also offers accurate predictions of imminent moves in single stock and index volatility.

Jon started his career as a linebacker for the Chicago Bears, and I can personally attest that he still has a handshake that?s like a steel vice grip. Maybe it was his brute strength that enabled him to work as a pit trader on the Chicago Board of Options Exchange for 22 years, where he was known by his floor call letters of ?DRJ.? He formed Mercury Trading in 1989 and then sold it to the mega hedge fund, Citadel, in 2004.

Jon developed his patented algorithms for Heat Seeker? with his brother Pete, another NFL player (Tampa Bay Buccaneers and the Minnesota Vikings), who like Jon, is a regular face in the financial media.

In order to register for the conference, please click here. There you will find the conference agenda, bios of the speakers, and a picture of my own ugly mug. I look forward to seeing you there.

Cling! Cling!

Jon Najarian

Jon Najarian

The Trade Alert service of the Mad Hedge Fund Trader has posted a year-to-date gain of 43.24%, a new all time high. Performance since inception 33 months ago soared to 98.29%. This pegs the average annualized return at 35.7%, putting me in the absolute top tier of all hedge fund managers.

These numbers come off the back of a blistering September month to date of up +5.66%. Some 72% of all Trade Alerts since the beginning have been profitable. Carving out the closed 2013 trades alone, 42 out of 51 have made money, a success rate of 82%. In addition, we are carrying six open trades, which are profitable. It is a track record that most big hedge funds would kill for.

This performance was only made possible by correctly calling the near term direction of stocks, bonds, foreign currencies, energy, precious metals and the agricultural products. This may sound easy, until you try it. Some retirement!

My big win this month has been my major short position in the Japanese yen (FXY), (YCS), which is probing new lows against the dollar as we speak. The Japan win on hosting the 2020 Olympics gave the beleaguered Japanese currency some extra downside momentum. The yen has already collapsed in the crosses, and a further major breakdown against the dollar is imminent.

We really coined it on a short position in the Euro (FXE), coming out near the bottom. A new position in copper producer, Freeport McMoRan (FCX), become immediately profitable, jumping some 5% after the Trade Alert went out. I jumped at the $60 selloff in Apple shares in the wake of their latest product launch, instantly, moving into the green with this holding as well. The same is true for my long in the Australian dollar (FXA).

Only my oil short left me with a hickey, which I stopped out of, thanks to the Syria gas attack. Still, if I had held it for only two more hours it would have made money when the Russian peace initiative for Syria was announced. Risk control is paramount if you want to swing for the fences. Welcome to show business.

The coming autumn promises to deliver a harvest of new trading opportunities. On the menu are the taper, a new Fed governor, a debt ceiling crisis, a possible war with Syria, and the death of the bull market in bonds. The Trade Alerts should be coming hot and heavy.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011 and 14.87% in 2012. The service includes my Trade Alert Service and my daily newsletter, the Diary of a Mad Hedge Fund Trader. You also get a real-time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars, Global Trading Dispatch PRO adds Jim Parker?s Mad Day Trader service to the mix.

To subscribe, please go to my website: ?www.madhedgefundtrader.com, find the ?Global Trading Dispatch? box on the right, and click on the lime green ?SUBSCRIBE NOW? button.