Come join me for the Mad Hedge Fund Trader?s Global Strategy Seminar, which I will be conducting high in the Alps in Zermatt, Switzerland at 2:00 PM on Friday, August 9, 2012. A PowerPoint presentation will be followed by an open discussion on the crucial issues facing investors today. Coffee, tea, and schnapps will be made available, along with light snacks.

You are welcome to attend in your mountain climbing gear, but you will have to leave your boots at the door. Last year, someone came down from the Matterhorn summit straight to the seminar, sunburned and tired, but happy.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $189, down from last year, thanks to the dramatic and welcome, as well as predicted depreciation of the Swiss franc against the US dollar.

I?ll be arriving early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The event will be held at a central Zermatt hotel with a great Matterhorn view, operated by one of the village?s oldest families and long time friends of mine. The details will be emailed directly to you with your confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

?I have to admit that it was with some trepidation that I joined Supreme Court Justice, Sonia Sotomayor, for lunch in San Francisco. I have friends in the New York federal prosecutor?s office who warned me that she was tough as nails and a complete bitch, first as a prosecutor herself, and later as a judge.

I confided this observation to her, and she agreed completely. Growing up as a poor Hispanic girl in the South Bronx, with a single parent family, demanded more than toughness. Her father died young from chronic alcoholism.

As a kid, she beat up a lot of others, but was thrashed often herself. It was certainly no place for weaklings, or those who stuck to establishment rules. Her family nicknamed her ?ahi?, Puerto Rican for ?hot chili pepper.?

Interviewing Supreme Court justices is a tough game, as I learned when I met Sandra Day O?Connor a few months ago, the first woman ever appointed. But at least we had some common ground, both growing up on ranches in the baking Southwest before air conditioning was invented. The great insight with her was that on her first day at work there was no woman?s bathroom at the Supreme Court. Sonia Sotomayor would be a different kettle of fish.

Justices are not permitted to comment on any cases in the recent past, present, or those that may appear in front of them in the future. And by recent, I mean in the past 12 years. You really have to go back to Andrew Jackson for them to feel totally comfortable.

Back then, my own family took a case to the court on the interpretation of the India Removals Act of 1830. We won. (The government was not allowed to banish a white woman married to an Indian chief west of the Mississippi). So the best that you can do is try and get the measure of the person, their character and their motivations, and distill down their essence. Then you have to extrapolate forward as to how this may influence their future decisions.

You might ask what this piece is doing in an investment newsletter. But the Supreme Court is playing a growing role in the lives of traders. The decision in favor of Obamacare totally upended the entire health care industry, which accounts for no less than 12% of our GDP, and will soon rise to 18% (You sold the HMO?s and bought the drug companies).

The Citizens United decision permitting unlimited anonymous corporate political donations was a boon for the media and the Washington DC commercial property market, as tens of thousands of new lobbyists were hired. Bush v Gore, which decided the 2000 presidential election, turned out to be the greatest windfall in history for the oil and defense industries. Investors ignore the Supreme Court at their peril.

Justice Sotomayor frankly admitted to me that she was an early beneficiary of affirmative action. But she ran like thoroughbred, once the bit was between her teeth. She was one of the first women admitted to Princeton, which proved to be a totally alien environment. There she heard a Southern accent for the first time. The looking glass metaphors in Lewis Carol?s Alice in Wonderland were unknown to her. It was not part of Hispanic culture.

When invited to join Phi Beta Kappa for her academic excellence, she thought it was a scam. They asked for money for a lousy symbolic key, so she threw it in the trash. Sonia rarely slept, graduated Summa cum Laude in 1976, and moved on to Yale Law School.

Racial slurs, sexism, and discrimination, feature large in her life. When she worked as a corporate litigator, a senior partner complained that he didn?t know why the firm was hiring all these minorities, only to dismiss them for incompetence a few years later. I hope this guy isn?t planning on pleading any cases in front of the Supreme Court in the near future. In fact, Sotomayor will have to rule on a reverse discrimination case brought by a white college student some time this year.

Sotomayor is one of those rare individuals who walk a fine line between both political parties. She was appointed a federal judge by George H.W. Bush. She was moved up to the Appeals Court by Bill Clinton. Obama named her as his second Supreme Court appointment, and only the third woman in history.

I think the majority of observers missed the most important outcome of the 2012 presidential election. If a conservative justice dies or retires before 2016, and another liberal replaces Justice Ruth Bader Ginsburg, the impact on history will be huge. Then, the court swings from a 5-4 conservative vote, where it has been for the past 40 years, to 5-4 liberal for the next 40 years.?

Sotomayor is a crucial part of this plan, and is so far following the script. In her first case, during which she confesses she was ?terrified?, she dissented on the above-mentioned Citizens United case. She has voted with left leaning Justices Ginsburg and Stephen Breyer 90?percent of the time, one of the highest agreement rates on the Court. She was in the 5?3 majority in Arizona v. United States that struck down several aspects of the state?s anti-illegal immigration law. She was also in the 5-4 majority that ruled in favor of Obamacare.

The US Supreme Court is a world stage, as its decisions are closely followed by the judiciaries of many other countries. It is a non-stop conversation in which she walked at mid point. Sonia says most people would find her job boring, as it is very contemplative. The court only hears 60-80 cases a year, and allocates just an hour to hear arguments for each case. The rest of her time is spent reading, writing, editing, and arguing with other justices.

The reality that there is no higher court than her own places an additional burden on her decisions. It is all humbling, as every case produces someone who, in the end, believes an injustice has been done. You can?t play God. Sotomayor is the only member of the court who has worked as a judge.

Sonia revealed to me that her inspiration to go into law came from the Nancy Drew children?s mystery novels and the Perry Mason TV series. Chronic type 2 diabetes prevented her from working in the field. For her, being a lawyer enabled her to work as a detective while in the confines of an office.

On January 21, Sotomayor administered the oath of office to Vice President, Joseph Biden. Not bad for someone who claims her main accomplishment in life was throwing the opening pitch at a New York Yankees game in her hometown Bronx.

As our lunch broke up, she invited me to Washington to tour the Supreme Court and meet the other justices. I said I might just take her up on that.

Global Market Comments

July 25, 2013

Fiat Lux

Featured Trade:

(AUGUST 9 ZERMATT, SWITZERLAND STRATEGY SEMINAR),

(REPORT FROM THE ORIENT EXPRESS),

(SO WHAT IS YOUR ?INFLUENCER? SCORE)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Seminar, which I will be conducting high in the Alps in Zermatt, Switzerland at 2:00 PM on Friday, August 9, 2012. A PowerPoint presentation will be followed by an open discussion on the crucial issues facing investors today. Coffee, tea, and schnapps will be made available, along with light snacks.

You are welcome to attend in your mountain climbing gear, but you will have to leave your boots at the door. Last year, someone came down from the Matterhorn summit straight to the seminar, sunburned and tired, but happy.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $189, down from last year, thanks to the dramatic and welcome, as well as predicted depreciation of the Swiss franc against the US dollar.

I?ll be arriving early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The event will be held at a central Zermatt hotel with a great Matterhorn view, operated by one of the village?s oldest families and long time friends of mine. The details will be emailed directly to you with your confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the Strategy Seminar, please go to my online store.

Global Market Comments

July 24, 2013

Fiat Lux

Featured Trade:

(CATCHING UP WITH DOWNTON ABBEY),

(REPORT FROM LONDON)

(TESTIMONIAL)

Global Market Comments

July 23, 2013

Fiat Lux

Featured Trade:

(JULY 25 PORTOFINO, ITALY STRATEGY LUNCHEON),

(MY SOLUTION FOR EUROPE), (FXE), (EUO)

CurrencyShares Euro Trust (FXE)

ProShares UltraShort Euro (EUO)

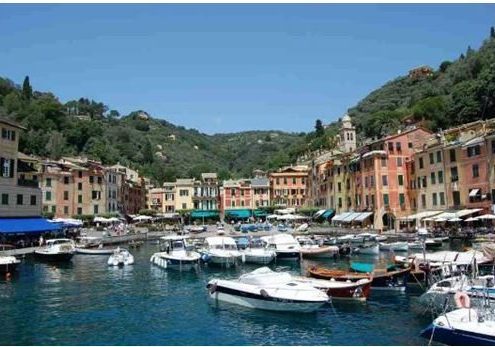

Come join John Thomas for lunch at the Mad Hedge Fund Trader's Global Strategy Update, which I will be conducting near Portofino, Italy on the Italian Riviera, on Thursday, July 25, 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I'll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I'll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $205.

The lunch will be held at major hotel on the beach in the village of Santa Margherita Ligure, the details of which will be emailed with your purchase confirmation. The town is easily accessible by train from Genoa, and the hotel is about a ten-minute walk from the train station.

Bring your broad brimmed hat, sunglasses, and suntan lotion. You will need them. The dress is casual. Accompanying spouses will be free to use the beach below and bill drinks to the luncheon. Together we will plot the future of western civilization.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

Taking the express train from Paris to Frankfurt, I was playing around with Google Maps on my iPhone 5s. It was really cool watching the blue dot marking my location zip across the map at 200 miles per hour.

When I zoomed in on my location, I realized that I recognized many of the names. Soissons, Chateau, Thierry, and Belleau Wood were all citations that I recalled from reading my grandfather?s US Army discharge papers from WWI. That?s where he suffered a mustard gas attack that inflicted total blindness for 5 years and put him in a bad mood for the next 50. The train was traveling along the trenches of the Western Front.

I wondered what my grandfather would say to me today, 45 years after his passing. His parents sent him from his native Sicily to New York City to avoid the Italian draft, which then needed recruits to expand its empire in Libya and Ethiopia. But when 1917 came, he joined the American army?s famed Rainbow Division to gain US citizenship and quickly found himself in the trenches.

I am sure he would be amazed by the technology that emerged nearly 100 years into the future; bullet trains, cell phones, and laptop computers that give immediate access to all knowledge. He was a true renaissance man, spoke five languages, and was well versed in the classics, so he would have appreciated the utility of such devices.

However, he would have been horrified that I was traveling to Germany to speak with the hated ?Bosch?, who were accused of committing atrocities against Belgian children, whose submarines sank unarmed civilian ships, and who were no better than lowly ?Huns?. That, however, is precisely where I was going, to advise the German government, the CEO?s of top corporations, and officials from the Bundesbank on how to extricate themselves from their current financial and political predicaments.

Check Out My Frankfurt Digs

Check Out My Frankfurt Digs

When I arrived at Frankfurt station, my origins as a German blue-collar factory worker made themselves abundantly clear. I headed straight for a fast food stand and ordered a bratwurst mit brutchen und kartofelsalat mit eine grosse bier. When I was 16, I spent a summer working at the Sarotti chocolate factory in West Berlin, and the dietary preferences I picked up live with me today. Some of my co-workers had been Russian POW?s in Siberia released only a few years before, and the stories they told me were bone chilling.

When the list of those who wished to hear my views became impossibly long, I finally said to one friend, ?Why don?t we just get everyone together and have one big party.? And that?s exactly what he did. Crammed into the top floor of one of Frankfurt?s highest skyscrapers were 100 of the cream of the German establishment who came to hear my thoughts on the world at large.

I told them that Europe has two choices: it can move backward or forward. If it returns to the past, the European Community and its currency will break up, forcing each country to compete individually against the US and China. This would cut GDP growth by half and lead to a permanent decline in standards of living. Germany would lose all of its banks as they go under en masse from the burden of bad European debts. Eventually, you would end up with a Germany that is angry, broke, and nuclear, and nobody wants that.

Inventory is Not Flying Off the Shelf in Europe

Inventory is Not Flying Off the Shelf in Europe

The only choice, then, is to move forward. Europe is really half a country, or a pretend country. It has a common currency, but not the institutions to ensure its survival, like a US style Treasury Department and a dual mandate central bank with teeth. The present system as it stands is guaranteed to fail. But it took a Herculean effort to get this far 14 years ago, with every party expending their last centime of political capital. So here we stand. After a long hiatus, it is now time to move forward.

It?s up to Germany to bail out the weaker economies of Southern Europe. For a start, they have the money to do so. Much of this was earned exporting German products there. Last year exports exceeded $1 trillion, or about 20% of GDP. Complain all you want about Mediterranean borrowing, but a very large part of it was used to buy Mercedes, Volkswagen?s, BMW?s, and Audi?s. That?s a lot of money to put at risk by allowing their economies to implode.

Research Can Be So Tedious

Research Can Be So Tedious

But bailouts don?t come free, and the quid pro quo for riding to the rescue would be to give Germany control of European monetary policy. The president of the ECB doesn?t even need to be a German. A Belgian would do, as long as he pursues German style anti-inflationary policies.

There are plenty of historical precedents for such arrangements. The US put up the money for the creation of the United Nations in 1945, and kept for itself a permanent seat on the Security Council. The US funded World Bank is always run by an American. The originally US financed International Monetary Fund has traditionally been managed by a European. The current president is former French Finance minister Christine Lagarde. But its headquarters are in Washington DC.

Pulling this off isn?t going to be easy. When the United States wrenched these concessions out of 13 states in 1787, only 5% of the population was allowed to vote?white, property owning males. Good luck trying to achieve that in a loose confederation of 27 states, with 17 in the monetary union that backs the Euro. Some politicians may have to actually earn their pay for a change. I expect this to be a five-year work out, at the very least.

The net net for all of this is that the Euro (FXE), (EUO) will get a lot cheaper before we hear the end of this. Parity against the greenback by next year is within reach, and a revisit to the old low of 88 cents is not impossible. Such a bargain currency would give Europe a huge economic advantage on the world stage and might even provide the grease to make an ultimate solution possible. Then we will have a real United States of Europe to be admired, but also feared as a real competitor.

With that, I headed off to a late dinner near the grand Frankfurt Opera House with several of the more senior guests. My host explained that the impressive baroque building was symbolic in Germany in many ways. While it looks ancient and imposing, it in fact was new, rebuilt with modern reinforced steel and concrete on the rubble of WWII.

Powered by beer, Rhine wine, and ultimately schnapps, I made it until midnight and then caught a taxi back to my palace, wondering if I had missed anything that evening. I also wondered if my grandfather would have been proud of me.

Global Market Comments

July 22, 2013

Fiat Lux

Featured Trade:

(AUGUST 1 MYKONOS, GREECE STRATEGY LUNCHEON),

(MID ATLANTIC THOUGHTS ABOARD THE QUEEN MARY 2, PART III),

(AMERICA?S NATIVE AMERICAN ECONOMY)

Come join John Thomas for lunch at the Mad Hedge Fund Trader's Global Strategy Update, which I will be conducting on the Greek island of Mykonos in the Aegean Sea on Thursday, August 1, 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I'll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I'll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $259.

The lunch will be held at major resort hotel on the south shore of the island, which can be found by steering a course of 120 degrees 99 nautical miles from the port of Piraeus. Just make sure you don't run aground on the island of Andros on the way, as the tides can be treacherous. The pirates on Mykonos have already been dealt with. Moorings can be made available for private visiting yachts offshore. I will email more details with your purchase confirmation.

Bring your broad brimmed hat, sunglasses, and plenty of SPF 50 suntan lotion. You will need them. The Greek islands are cooking hot this time of the year. The dress is casual. Those not wishing to view the clothing optional beach can have a chair with its back to the sea. Accompanying spouses and significant others will be free to bill drinks to my personal account as my guest. Together we will plot the future of western civilization.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.