Come join John Thomas for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Amsterdam, The Netherlands, on Friday, July 12, 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $229.

The lunch will be held at a downtown Amsterdam hotel near Nieumarkt that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

I spent an evening with Lester Brown, president of the Earth Policy Institute and a winner of the coveted MacArthur Prize, for some long-term thinking about the environment and its investment implications.

Global warming is causing the melting of ice sheets in Greenland and Antarctica, glaciers in the Himalayas, and the Sierra snowpack. Water tables are falling and fossil aquifers are depleting. In the coming decades this will cause severe shortages of fresh water that could lead to crop failures in India and China, where one billion people depend on mountain runoff to irrigate crops, and even California, which delivers 80% of America?s vegetables.

The fresh water inputs in one person?s food and materials consumption works out to some 2,000 liters a day. That is no typo. As a result, all food prices will rise. To head off the greatest threat to the global food supply in human history, we need to cut carbon emissions by 80% before 2020, not 2050, as is being discussed in Copenhagen.

This can only be accomplished by redefining food and the environment as national security issue and launching a wartime mobilization. These difficult goals are achievable. Enough sunlight hits the earth in a day to power the global economy for a year. Texas alone has more than 20 gigawatts of wind power operating, under construction, or planned, enough to take 5% of our 250 coal fired power plants offline. Electricity demand could be cut by 90% purely through greater efficiencies, like switching from incandescent bulbs to LED?s.

Europe could get its entire 300 gigawatt power supply from solar plants in North Africa at current market prices. Cars powered by wind generated electricity would bring fuel costs down to an equivalent 75 cents a gallon, as electric motors are three times more efficient than internal combustion engines.

While Brown?s predictions are a little extreme for many, they mesh perfectly with my long term bullish cases for food and water plays. Take another look at the food sector ETF?s, (DBA) and (MOO), and the water space ETF?s (PHO) and (FIW).

All of the high-grade paper used by the US Treasury to print money is bought by one firm, Crane & Co., which has been in the same family for seven generations.

Last year, the Feds printed 38 million banknotes worth $639 million. Although they have seen the recession cause the velocity of money to decline, recent reflationary efforts have spurred a big increase in demand for paper for $100 dollar bills. The US first issued paper money in 1861 to finance the Civil War, and Crane has been supplying them since 1879.

The average life of a dollar bill is 21 months. Who said no one was doing well in this economic slowdown? M1, or notes and coins in circulation, is already exploding. Is this a warning of an imminent jump in inflation? In the meantime, check out the new 3D $100 bill. It includes the latest anti-counterfeiting techniques, like a new blue security strip, tiny liberty bells that morph into the number 100, and ?United States of America? micro printed on Franklin?s jacket collar. The new bills should start entering circulation in September.

It?s ironic that the balanced scales, a symbolic reference to the founding fathers? commitment to maintaining a balanced budget, are still on the new Benjamin. Old Ben must be turning over in his grave.

Out With the Old

Out With the Old

In With the New

In With the New

Global Market Comments

June 14, 2013

Fiat Lux

Featured Trade:

(UPDATED 2013 SUMMER STRATEGY LUNCHEON SCHEDULE),

(THE YEN CARRY TRADE BLOW UP),

(FXY), (YCS), (DXJ), (SNE), (HMC), (TM),

(THE SERVICE JOB IN YOUR FUTURE), (MCD)

CurrencyShares Japanese Yen Trust (FXY)

ProShares UltraShort Yen (YCS)

WisdomTree Japan Hedged Equity (DXJ)

Sony Corporation (SNE)

Honda Motor Co., Ltd. (HMC)

Toyota Motor Corporation (TM)

McDonald's Corp. (MCD)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Updates, which I will be conducting throughout Europe during the summer of 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store at http://madhedgefundradio.com/ and click on ?STRATEGY LUNCHEONS?.

New York City - July 2

London, England - July 8

Amsterdam, Netherlands - July 12

Berlin, Germany - July 16

Frankfurt, Germany - July 19

Portofino, Italy - July 25

Mykonos, Greece - August 1

Zermatt, Switzerland - August 9

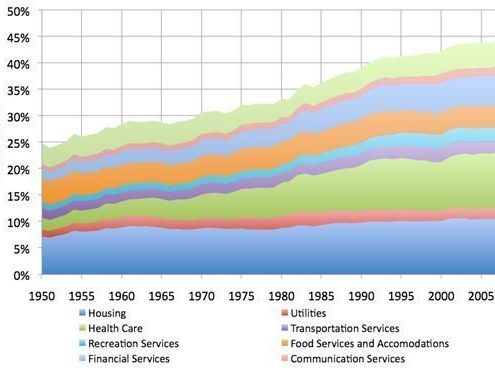

Anyone wondering about the long term future of the US economy should take a look at the chart below. It shows the unrelenting growth of services? share of American GDP growing from 25% to 45% over the last sixty years.

Far and away the fastest growth area has been in health care, and with the first Obamacare programs starting in September, that growth is set to accelerate. Financial services have also been a serious growth creator, for better or for worse. You can turn the chart upside down and the shrinkage in our manufacturing base is equally illustrated.

This is not necessarily a bad thing. Would you rather be mining coal or designing a website? These statistics make us the envy of the world, as services are where the future lies. By creating so many key technologies, our country has been the most successful in climbing up the global value chain.

Services largely comprise pure intellectual content, require no raw materials, and the end product can be transmitted over the Internet. There is a reason why nearly a million foreign students have flocked to the US for an education. Emerging nations like China and South Korea, which only see services generating 10%-15% of their GDP, are wracking their brains trying to figure out how to play catch up.

Global Market Comments

June 13, 2013

Fiat Lux

Featured Trade:

(JULY 16 BERLIN STRATEGY LUNCHEON),

(ANOTHER NAIL IN THE NUCLEAR COFFIN),

(SCE-PF), (NLR), (CCJ)

(THE CHINA VIEW FROM 30,000 FEET)

(FXI), (DBC), (DYY), (DBA), (PHO)

Southern California Edison Trus (SCE-PF)

Market Vectors Uranium+Nuclear Enrgy ETF (NLR)

Cameco Corporation (CCJ)

iShares FTSE China 25 Index Fund (FXI)

PowerShares DB Commodity Index Tracking (DBC)

PowerShares DB Commodity Dble Long ETN (DYY)

PowerShares DB Agriculture (DBA)

PowerShares Water Resources (PHO)

Come join John Thomas for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Berlin, Germany, at 12:00 noon on Tuesday, July 16, 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $219.

The lunch will be held at a downtown Berlin hotel within sight of the Brandenburg Gate, the details of which will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

Southern California Edison (SCE/PF) has announced that it is permanently closing its controversial nuclear power plant at San Onofre. The move is only the latest in a series of closures implemented by utilities around the country, and could well spell the end of this flagging industry. This is further dismal news for holders of ETF?s in the sector, like the Market Vector Uranium + Nuclear Energy ETF (NLR) and Cameco (CCJ).

SCE?s problems started in July, 2012 when a faulty steam generator tube released a small amount of radioactive steam and the plant was immediately shut down. An inspection revealed that 3,000 additional tubes were showing excessive wear, possible due to a design flaw, or perhaps their exposure to 45 years of high intensity radiation.

Supplier, Westinghouse, owned by Japan?s Toshiba Group, rushed in with a replacement generator, which failed within a month. That prompted the Nuclear Regulator Commission to demand a full license reapplication, which promised to be a contentious and expensive multiyear slugfest. That was all SCE needed to throw in the towel and move for permanent closure. About 1,100 workers will be laid off.

San Onofre has been a continuous target of environmentalist litigation since it was opened in 1968. You could have found a better place to build a nuclear power plant than the birthplace of the environmental movement. After the Fukushima nuclear disaster in 2010, another Westinghouse plant, Senator Barbara Boxer was not too happy about it either. It turns out there was no practical evacuation plan in the event of an emergency. Some 25 million people live within 100 miles of the facility, and there is no way you move these numbers anywhere in a hurry. The region is totally gridlocked even in a normal rush hour. That prompted Boxer to lead a series of congressional hearings, not just about San Onofre, but the entire aging nuclear industry nationwide.

The development means that Southern California Edison will have to write off the $2.1 billion in capital investment and upgrades that it has carried out over the last 20 years. Decommissioning will cost another $2 billion. These are the most expensive and toxic demolitions on the planet. Stored nuclear waste will remain on sight until a national solution is found. The costs will be entirely passed on to the region?s long-suffering electric power consumers.

I know the San Onofre plant well, as it is right on the border of the Marine Corps. base at Camp Pendleton. My dad was stationed there during WWII and was followed by a long succession of descendants. I used it as a landmark for inbound VFR flights to the base. I also practiced amphibious assaults on the beach, with traditional landing craft, light armored reconnaissance vehicles (LAR), and advanced hovercraft (LCAC). I also had to swim once. On R&R, San Onofre offered one of the best surfing beaches on the coast.

I am not holding my breath for the nuclear industry. For more depth on the topic, please see my earlier piece, ?New Nuclear Demolished by New Natural Gas? by clicking here.

Not Exactly a Crowd Pleaser

Not Exactly a Crowd Pleaser

A Navy Assault LCAC

A Navy Assault LCAC

I have long sat beside the table of McKinsey & Co., the best management consulting company in Asia, hoping to catch some crumbs of wisdom. So, I jumped at the chance to have breakfast with Shanghai based Worldwide Managing Director, Dominic Barton, when he passed through San Francisco visiting clients.

These are usually sedentary affairs, but Dominic spit out fascinating statistics so fast I had to write furiously to keep up. Sadly, my bacon and eggs grew cold and congealed. Asia has accounted for 50% of world GDP for most of human history. It dipped down to only 10% over the last two centuries, but is now on the way back up. That implies that China?s GDP will triple relative to our own from current levels.

A $500 billion infrastructure oriented stimulus package enabled the Middle Kingdom to recover faster from the Great Recession than the West, and if this didn?t work, they had another $500 billion package sitting on the shelf. But with GDP of only $5.5 trillion today, don?t count on China bailing out our $15.5 trillion economy.

China is trying to free itself from an overdependence on exports by creating a domestic demand driven economy. The result will be 900 million Asians joining the global middle class who are all going to want cell phones, PC?s, and to live in big cities. Asia has a huge edge over the West with a very pro-growth demographic pyramid. China needs to spend a further $2 trillion in infrastructure spending, and a new 75-story skyscraper is going up there every three hours!

Some 1,000 years ago, the Silk Road was the world?s major trade route, and today intra-Asian trade exceeds trade with the West. The commodity boom will accelerate as China withdraws supplies from the market for its own consumption, as it has already done with the rare earths.

Climate change is going to become a contentious political issue, with per capita carbon emission at 19 tons in the US, compared to only 4.6 tons in China, but with all of the new growth coming from the later. Protectionism, pandemics, huge food and water shortages, and rising income inequality are other threats to growth.

To me, this all adds up to buying on the next substantial dip big core longs in China (FXI), commodities (DBC) and the 2X (DYY), food (DBA), and water (PHO). A quick Egg McMuffin next door filled my other needs.