Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, April 12, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $189.

I?ll be arriving at 11:00 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a private club in downtown San Francisco near Union Square that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

The stunning and unprecedented move by the Bank of Japan last week boosted the Trade Alert Service of the Mad Hedge Fund Trader to a new all time high.

It was an incredible week, with me punching out 14 Trade Alerts to readers, burning up the fiber optic cable of the global broadband network. And I did all of this, sitting in front of the fire at my Lake Tahoe beachfront estate, drinking coffee nonstop. Some retirement!

I bet that the new governor of Japan?s central bank, my friend, Haruhiko Kuroda, would engineer a monetary easing that was so aggressive that it would collapse the country?s beleaguered currency. All those nights playing Scrabble with him have finally paid off. As a result, the 2013 profit for the Trade Alert Service soared to an incredible 35%.

The 28-month total return has punched through to a breathtaking 90%, compared to a modest 18.5% return for the Dow average during the same period. That raises the average annualized return for the Trade Alert Service to 38.6%, elevating it to the pinnacle of the hedge fund ranks.

My careful calculation that the stock markets would continue to grind up to new all time highs in the face of complete disbelief and multiple international shocks paid off big time, as I continued to run long positions in the S&P during January to March.

My substantial short volatility positions are contributing to profits daily, with the closely watched (VIX) Index plummeting at one point to a new five year low at 11%. I booked nice profits from holdings in American International Group (AIG) and copper producer, Freeport McMoRan (FCX), and the Russell 2000 (IWM).

Sensing that the stock market was getting overbought for the short term, I switched from a long only to a balanced long/short trading book at the beginning of April. That really allowed me to coin in on short positions in the S&P 500 (SPY), Bank of America (BAC), and United Continental Group (UAL).

It hasn?t entirely been a rose garden. The rapid market swoon cost me some money on my (UAL) and (BAC) call options. Apple (AAPL) has taken another bite out of me, although I will only lose money on the position if it trades and stays below $420 over the next 9 trading days. But as they taught me at my karate dojo in Tokyo during the early 1970?s, you can?t win a tournament without taking a few hits.

Trade Alerts that I wrote up, but never sent, worked too. That?s because I have been 100% invested for the entire year in long stock/short yen positions. However, followers of my biweekly strategy webinars caught my drift and benefited from the thinking, and many did these trades on their own. These included shorts in the Treasury bond market, (TLT), the Euro (FXE), (EUO), and the British pound (FXB).

Sometimes the best trades are the ones you don?t do. I have been able to dodge the bullets that have been killing off other hedge funds, including those in gold (GLD), silver, (SLV), oil (USO), and commodities (CORN), (DBA), (CU). Oh, and I didn?t have a single penny in a Cyprus bank.

All told, the last 27 out of the last 28 closing recommendations of the Trade Alert Service have been profitable, and I have another six moneymakers still on the books.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011 and 14.87% in 2012. The service includes my Trade Alert Service, daily newsletter, real-time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars. To subscribe, please go to my website at www.madhedgefundtrader.com, find the ?Global Trading Dispatch? box on the right, and click on the lime green ?SUBSCRIBE NOW? button.

How Low Can She Go?

A Triple Top or a Breakout Launch?

Life is Good

If you want to impress your friends with your vast knowledge of financial matters, then here are the Latin translations of the script on the backside of a US dollar bill.

?ANNUIT COEPTIS? means ?God has favored our undertaking.? ?NOVUS ORDO SECLORUM? translates into ?A new order has begun.? The Roman numerals at the base of the pyramid are ?1776.? The better known ?E PLURIBUS UNUM? is ?One nation from many people.?

The basic design for the cotton and linen currency with red and blue silk fibers, which has been in circulation since 1957, carries enough symbolism to drive conspiracy theorists to distraction. An all seeing eye? The darkened Western face of the pyramid? And of course, the number ?13? abounds.

Thank freemason Benjamin Franklin for these cryptic symbols, and watch Nicholas Cage?s historical adventure movie ?National Treasure.? The balanced scales in the seal are certainly wishful thinking and a bit quaint if they refer to the Federal budget. Study the buck closely, because there are soon going to be a lot more of them around.

What Did You Really Mean, Ben?

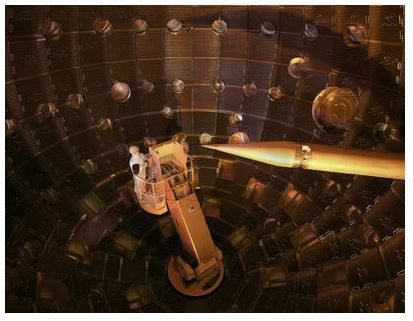

Expect to hear a lot about ignition in the next year. No, I don?t mean the rebuilt ignition for the beat up ?68 Cadillac El Dorado up on blocks in your front yard. I?m referring to the inauguration of the National Ignition Facility next door to me at Lawrence Livermore National Labs in Livermore, California.

Mention California to most people, and images of love beads, tie died T-shirts, and Birkenstocks come to mind. But it is also the home of the hydrogen bomb, which was originally designed amid the vineyards and cow pastures of this bucolic suburb. The thinking at the time was that if someone accidently flipped the wrong switch, it wouldn?t blow up San Francisco, or more importantly, Berkeley.

The $5 billion project aims 192 lasers at a BB sized piece of frozen hydrogen, using fusion to convert it to helium and unlimited amounts of clean energy. The heat released by this process reaches 100 million degrees, hotter than the core of the sun, and will be used to fuel conventional steam electric power plants. There is no need for a four foot thick reinforced concrete containment structure that accounts for half the construction cost of conventional nuclear plants. The entire facility is housed in a large warehouse.

The raw material is seawater, and a byproduct is liquid hydrogen, which can be used to fuel cars, trucks, and aircraft. If this all sounds like it is out of Star Trek, you?d be right. I worked with these guys in the early seventies, back when math was used to make things, and before it was used to game financial markets, and I can tell you, there is not a smarter and more dedicated bunch of people on the planet.

If it works, we will get unlimited amounts of clean energy for low cost in about 20 years. Oil will only be used to make plastics and fertilizer, taking the price down to $10 for domestic production only. The crude left in the Middle East will become worthless. Lumps of coal will only be found in museums, or in jewelry, its original use. If it doesn?t work, it will melt the adjacent Mt. Diablo and take me with it. If you don?t get your newsletter tomorrow, you?ll know what happened. Now what is this switch for?

Global Market Comments

April 5, 2013

Fiat Lux

Featured Trade:

(NEW BOJ GOVERNOR CRUSHES THE YEN),

(FXY), (YCS), (DXJ),

(SIGN UP NOW FOR TEXT MESSAGING OF TRADE ALERTS),

(THERE ARE NO GURUS),

(WATCH OUT FOR THE MILLENNIAL VOTER)

CurrencyShares Japanese Yen Trust (FXY)

ProShares UltraShort Yen (YCS)

WisdomTree Japan Hedged Equity (DXJ)

I have been banging the table for years now about the importance of demographic trends for the economy, the financial markets, and the housing market. Well, politics is no different.

According to recent surveys, Millennials, who are now aged 21-32 (I have three of them) are suspicious of government, have a strong anti-business bias, are opposed to new regulation, are highly conscious of environmental issues, and give the president his highest marks. They are also overwhelmingly in favor of same sex marriage, even in the red states.

They also happen to care the least about health care, and put a high value on ethics. We also have learned that they don't bother to vote in midterm elections. This is important because the Millennium Generation surpassed in size the 80 million strong baby boomer generation last year.

No wonder the last election focused so much energy on online campaigning and social media. Is the outcome of future elections to be determined by clicks and bandwidth? The data effectively means that the population of liberals is growing, while that for conservatives is shrinking. Politician planners and makers of campaign tchotchke take note.

Deciding the Next Election

Deciding the Next Election

Global Market Comments

April 4, 2013

Fiat Lux

Featured Trade:

(JULY 8 LONDON STRATEGY LUNCHEON)

(ANOTHER DINNER WITH ROBERT REICH),

(TESTIMONIAL),

(CONNECTING UP AMERICA)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in London on Monday, July 8, 2012. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $249.

I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a private club on St. James Street, the details of which will be emailed to you with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

Until now, the country?s power grid has been divided into three unconnected, noncompetitive kingdoms (in the spirit of Game of Thrones), making transnational transmission impossible, leading to huge regional mispricing. While California and New York suffered from periodic brown outs and sky high prices, electricity was given away virtually for free in Texas.

A group of power companies is now proposing to build the $1 billion Tres Amigas superstation in Clovis, New Mexico that would connect all three grids. The plant would use advanced superconducting technology that will send five gigawatts of power down cables cooled at 300 degrees below zero. Construction is expected to reach completion in 2014.

The facility would solve a major headache of alternative energy planners, and will no doubt accelerate development. It would allow the enormous wind farms in the Lone Star State to ship energy to the power hungry coasts. Ditto for the mega solar projects proposed in the Southwest deserts, and the big geothermal plants being built in Nevada. With the Department of Energy having already sent tidal waves of government cash towards the sector, the timing couldn?t be better.

Global Market Comments

April 3, 2013

Fiat Lux

Featured Trade:

(APRIL 19 CHICAGO STRATEGY LUNCHEON),

(PULLING THE RIPCORD ON UNITED), (UAL),

(EASTER AT INCLINE VILLAGE)

United Continental Holdings, Inc. (UAL)