Expect to hear a lot about ignition in the next year. No, I don?t mean the rebuilt ignition for the beat up ?68 Cadillac El Dorado up on blocks in your front yard. I?m referring to the inauguration of the National Ignition Facility next door to me at Lawrence Livermore National Labs in Livermore, California.

Mention California to most people, and images of love beads, tie died T-shirts, and Birkenstocks come to mind. But it is also the home of the hydrogen bomb, which was originally designed amid the vineyards and cow pastures of this bucolic suburb. The thinking at the time was that if someone accidently flipped the wrong switch, it wouldn?t blow up San Francisco, or more importantly, Berkeley.

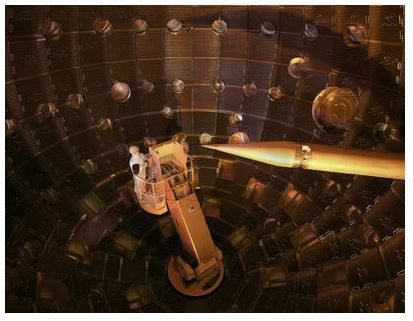

The $5 billion project aims 192 lasers at a BB sized piece of frozen hydrogen, using fusion to convert it to helium and unlimited amounts of clean energy. The heat released by this process reaches 100 million degrees, hotter than the core of the sun, and will be used to fuel conventional steam electric power plants. There is no need for a four foot thick reinforced concrete containment structure that accounts for half the construction cost of conventional nuclear plants. The entire facility is housed in a large warehouse.

The raw material is seawater, and a byproduct is liquid hydrogen, which can be used to fuel cars, trucks, and aircraft. If this all sounds like it is out of Star Trek, you?d be right. I worked with these guys in the early seventies, back when math was used to make things, and before it was used to game financial markets, and I can tell you, there is not a smarter and more dedicated bunch of people on the planet.

If it works, we will get unlimited amounts of clean energy for low cost in about 20 years. Oil will only be used to make plastics and fertilizer, taking the price down to $10 for domestic production only. The crude left in the Middle East will become worthless. Lumps of coal will only be found in museums, or in jewelry, its original use. If it doesn?t work, it will melt the adjacent Mt. Diablo and take me with it. If you don?t get your newsletter tomorrow, you?ll know what happened. Now what is this switch for?

Global Market Comments

April 5, 2013

Fiat Lux

Featured Trade:

(NEW BOJ GOVERNOR CRUSHES THE YEN),

(FXY), (YCS), (DXJ),

(SIGN UP NOW FOR TEXT MESSAGING OF TRADE ALERTS),

(THERE ARE NO GURUS),

(WATCH OUT FOR THE MILLENNIAL VOTER)

CurrencyShares Japanese Yen Trust (FXY)

ProShares UltraShort Yen (YCS)

WisdomTree Japan Hedged Equity (DXJ)

I have been banging the table for years now about the importance of demographic trends for the economy, the financial markets, and the housing market. Well, politics is no different.

According to recent surveys, Millennials, who are now aged 21-32 (I have three of them) are suspicious of government, have a strong anti-business bias, are opposed to new regulation, are highly conscious of environmental issues, and give the president his highest marks. They are also overwhelmingly in favor of same sex marriage, even in the red states.

They also happen to care the least about health care, and put a high value on ethics. We also have learned that they don't bother to vote in midterm elections. This is important because the Millennium Generation surpassed in size the 80 million strong baby boomer generation last year.

No wonder the last election focused so much energy on online campaigning and social media. Is the outcome of future elections to be determined by clicks and bandwidth? The data effectively means that the population of liberals is growing, while that for conservatives is shrinking. Politician planners and makers of campaign tchotchke take note.

Deciding the Next Election

Deciding the Next Election

Global Market Comments

April 4, 2013

Fiat Lux

Featured Trade:

(JULY 8 LONDON STRATEGY LUNCHEON)

(ANOTHER DINNER WITH ROBERT REICH),

(TESTIMONIAL),

(CONNECTING UP AMERICA)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in London on Monday, July 8, 2012. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $249.

I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a private club on St. James Street, the details of which will be emailed to you with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

Until now, the country?s power grid has been divided into three unconnected, noncompetitive kingdoms (in the spirit of Game of Thrones), making transnational transmission impossible, leading to huge regional mispricing. While California and New York suffered from periodic brown outs and sky high prices, electricity was given away virtually for free in Texas.

A group of power companies is now proposing to build the $1 billion Tres Amigas superstation in Clovis, New Mexico that would connect all three grids. The plant would use advanced superconducting technology that will send five gigawatts of power down cables cooled at 300 degrees below zero. Construction is expected to reach completion in 2014.

The facility would solve a major headache of alternative energy planners, and will no doubt accelerate development. It would allow the enormous wind farms in the Lone Star State to ship energy to the power hungry coasts. Ditto for the mega solar projects proposed in the Southwest deserts, and the big geothermal plants being built in Nevada. With the Department of Energy having already sent tidal waves of government cash towards the sector, the timing couldn?t be better.

Global Market Comments

April 3, 2013

Fiat Lux

Featured Trade:

(APRIL 19 CHICAGO STRATEGY LUNCHEON),

(PULLING THE RIPCORD ON UNITED), (UAL),

(EASTER AT INCLINE VILLAGE)

United Continental Holdings, Inc. (UAL)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Chicago on Friday, April 19. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $199.

I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a downtown Chicago venue on Monroe Street that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

It has definitely been a tough year for ski bums, massage therapists, and black jack dealers at Incline Village, Nevada. After getting a prodigious eight feet of snow over one weekend at Christmas, there has been nary a flake since then. Hats off to the Diamond Peak ski resort for trucking down enough snow from the higher elevations to keep the bunny slope running.

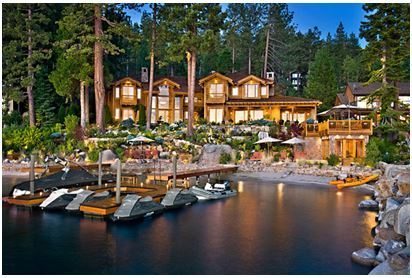

However, the real estate business is another kettle of fish. After a six-year hiatus, business is now booming in the High Sierras, as it is throughout the West. Until December, my real estate agent had only sold one house since 2007, and that to me, a nice little foreclosure deal where I picked up a beachfront estate for pennies on the dollar. Since then she has sold six residences, half to Chinese buyers for cash, and has another three in escrow. I guess when it rains, it pours.

I was surprised to learn that my neighbor, Oracle mogul, Larry Ellison, has placed on the market his nearby Glenbrook compound for $28.5 million. The property includes a six bedroom, eight bathroom 9,242 square foot main house on 2.6 acres, with 230 feet of frontage on the east shore of Lake Tahoe (click here for the listing).

I guess his existing 7.6 acre estate with 420 feet of beachfront next door is enough. Larry has been accumulating ultra high-end properties all over the world for the past two decades, more than he could ever possibly live in. Who knew these were investments, and not conspicuous consumption? This is the first time I have ever seen Larry sell anything. Is this a tell?

You can?t swing a dead cat in Incline Village without hitting a billionaire, so the public events are incredibly well funded. Junk bond king, Michael Milliken, pays for the Fourth of July fireworks, as the celebration falls on his birthday. On Sunday, the ski slopes were amply planted with plastic eggs, some containing candy, others, free lift tickets. Even the pet hospital here is better equipped than most public hospitals.

So I knew the Easter egg hunt would not disappoint. Perhaps, the eggs contained real gold coins. I have to tell you that it was a total blast wading through 500 hyped up children. Click here for the video of the event and hit the ?PLAY? arrow, if for no other reason than to admire the spectacular Lake Tahoe scenery.

This Can Be Yours for $28.5 Million

Global Market Comments

April 2, 2013

Fiat Lux

Featured Trade:

(APRIL 12 SAN FRANCISCO STRATEGY LUNCHEON),

(THE US DOMINANCE IN HIGHER EDUCATION),

(AN EVENING WITH JAMES BAKER III),

(THE CORN CRASH CONTINUES),

(CORN), (WEAT), (SOYB), (DBA)

Teucrium Corn (CORN)

Teucrium Wheat (WEAT)

Teucrium Soybean (SOYB)

PowerShares DB Agriculture (DBA)