Global Market Comments

March 6, 2013

Fiat Lux

Featured Trade:

(APRIL 12 SAN FRANCISCO STRATEGY LUNCHEON),

(INVESTING IN A STATE SPONSOR OF TERRORISM),

(AFK), (GAF), (EZA),

(THE LONG VIEW ON EMERGING MARKETS),

(EWZ), (RSX), (PIN), (FXI)

Market Vectors Africa Index ETF (AFK)

SPDR S&P Emerging Middle East & Africa (GAF)

iShares MSCI South Africa Index (EZA)

iShares MSCI Brazil Capped Index (EWZ)

Market Vectors Russia ETF (RSX)

PowerShares India (PIN)

iShares FTSE China 25 Index Fund (FXI)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, April 12, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $189.

I?ll be arriving at 11:00 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a private club in downtown San Francisco near Union Square that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store at www.madhedgefundtrader.com/category/luncheons/.

How about a country whose leaders have stolen $400 billion in the last decade and have seen 300 foreign workers kidnapped? Another country lost four wars in the last 40 years. Still interested? How about a country that suffers one of the world?s highest AIDs rates, endures regular insurrections where all of the Westerners get massacred, and racked up 5 million dead in a continuous civil war?

Then, Africa is the place for you, the world?s largest source of gold, diamonds, chocolate, and cobalt! The countries above are Libya, Nigeria, Egypt, and the Congo. Below the radar of the investment community since the colonial days, the Dark Continent has recently been attracting the attention of large hedge funds and private equity firms.

Goldman Sachs has set up Emerging Capital Partners, which has already invested $2 billion there. China sees the writing on the wall, and has launched a latter day colonization effort, taking a 20% equity stake in South Africa?s Standard Bank, the largest on the continent. There are now thought to be over one million Chinese agricultural workers in Africa.

The angle here is that all of the terrible headlines above are in the price, that prices are very low, and the perceived risk is much greater than actual risk.

Price earnings multiples are low single digits, cash flows are huge, and returns of capital within two years are not unheard of. These numbers remind me of those found in Japan during the fifties, right after it lost WWII.

The reality is that Africa?s 900 million have unlimited demand for almost everything, and there is scant supply, with many firms enjoying local monopolies. The big plays are your classic early emerging market targets, like banking, telecommunications, electric power, and other infrastructure.

For example, in the last decade, the number of telephones has soared from 350,000 to 10 million. It?s like the early days of investing in China in the seventies, when the adventurous only played when they could double their money in two years, because the risks were so high.

This is definitely not for day traders. If you are willing to give up a lot of short term liquidity for a high long term return, then look at the Market Vectors Africa Index ETF (AFK), which has 29% of its holdings in South Africa and 20% in Nigeria. There is also the SPDR S&P Emerging Middle East & Africa ETF (GAF). For more of a rifle shot, entertain the iShares MSCI South Africa Index Fund (EZA). Don?t rush out and buy these today. Instead, wait for emerging markets to come back in vogue. I will send you a trade alert when this is going to happen.

Meet Your New Business Partner

I managed to catch a few comments in the distinct northern accent of Jim O'Neil, the fabled analyst who invented the 'BRIC' term, and who has been kicked upstairs to the chairman's seat at Goldman Sachs International (GS) in London.

Jim thinks that it is still the early days for the space, and that these countries have another ten years of high growth ahead of them. As I have been pushing emerging markets since the inception of this letter in 2008, this is music to my ears.

By 2018 the combined GDP of the BRIC's; Brazil (EWZ), Russia (RSX), India (PIN), and China (FXI), will match that of the US. China alone will reach two thirds of the American figure for gross domestic product. All that?s required is for China to maintain a virile 8% annual growth rate for eight more years, while the US plods along at an arthritic 2% rate. China's most recent quarterly growth rate came in at a blistering 8%.

?BRIC? almost became the 'RIC' when O'Neil was formulating his strategy a decade ago. Conservative Brazilian businessmen were convinced that the new elected Luiz Ignacio Lula da Silva would wreck the country with his socialist ways. He ignored them and Brazil became the top performing market of the G-20 since 2000. An independent central bank that adopted a strategy of inflation targeting was transformative.

This is not to say that you should rush out and load up on emerging markets tomorrow. American big cap stocks are the flavor of the day, and as long as this is the case, emerging markets will continue to blend in with the wall paper. Still, with growth rates triple or quadruple of our own, they will not stay ?resting? for long.

Global Market Comments

March 5, 2013

Fiat Lux

Featured Trade:

(THE GREAT YAWN OF 2013),

(INDUSTRIES THAT YOU WILL NEVER HEAR FROM ME ABOUT)

The focus of this letter is to show people how to make money through investing in fast growing, highly profitable companies which have stiff, long-term macroeconomic winds at their backs. That means I ignore a large part of the US economy whose time has passed and are headed for the dustbin of history. According to the Department of Labor's Bureau of Labor Statistics, the eight industries listed below are least likely to generate positive job growth in the next decade. As most of these stocks are already bombed out, it is way too late to short them. As an investor, you should consider this a 'no go' list. I have added my comments, not all of which should be taken seriously. 1) Realtors - Despite a halving of prices, and therefore commissions, the number of realtors is only down 10% from its 1.3 million peak in 2006. This business is dying? for a major rationalization. 2) Pharmaceuticals - With a number of blockbuster drugs seeing patents expire soon and going generic, the downsizing at the major firms has been ferocious. The survivors will merge to cut costs, sending more masses to the unemployment office. 3) Newspapers - these probably won't exist in five years, save the Wall Street Journal and the New York Times, as five decades of hurtling technological advances have already shrunk the labor force by 90%. Go online, or go away. 4) Airline employees - This is your worst nightmare of an industry, as management has no idea what interest rates, fuel costs, or the economy will do, which are the largest inputs into their business. Pilots will eventually work for minimum wage just to keep their flight hours up. 5) Big telecom - Can you hear me now? Nobody uses landlines anymore, leaving these companies with giant rusting networks that are costly to maintain. Since cell phone market penetration is 90%, survivors are slugging it out through price competition, cost cutting, and all that annoying advertising. 6) State and Local Government - With employment still at levels private industry hasn't seen since the seventies, firing state and municipal workers will be the principal method of balancing ailing budgets. Expect class sizes to soar to 80, to put out your own damn fires, and to keep the 9 mm loaded and the back door booby-trapped for home protection. 7) Installation, Maintenance, and Repair - I have explained to my mechanic that the electric motor in my new Tesla S-1has only five moving parts, compared to 300 in my old clunker, and this won't be good for business. But he just doesn't get it. The winding down of our wars in the Middle East is about to dump a million more applicants into this sector. The last refuge of the trained blue-collar worker is about to get cleaned out. 8) Bank Tellers - Since the ATM made its debut in 1968, this profession has been on a long downhill slide. Banks have lost so much money in the financial crisis, they can't afford to hire humans any more. It hasn't helped that 283 banks have closed during the recession, with many survivors merging to cut costs (read fire more people). Your next bank teller may be a Terminator.

Out With the Old

And in With the New

Global Market Comments

March 4, 2013

Fiat Lux

Featured Trade:

(MARCH 6 GLOBAL STRATEGY WEBINAR),

(THE DEATH OF GOLD, PART II),

(GLD), (GDX), (GDM), (FXE), (UUP), (FXB), (GBB), (USO), (CU),

(THE REAL ESTATE MARKET IN 2030),

(TESTIMONIAL)

SPDR Gold Shares (GLD)

Market Vectors Gold Miners ETF (GDX)

GOLD MINERS INDEX (GDM)

CurrencyShares Euro Trust (FXE)

PowerShares DB US Dollar Index Bullish (UUP)

CurrencyShares British Pound Sterling Tr (FXB)

iPath GBP/USD Exchange Rate ETN (GBB)

United States Oil (USO)

First Trust ISE Global Copper Index (CU)

A number of analysts, and even some of those in the real estate industry, are finally coming around to the depressing conclusion that there will never be a recovery in residential real estate. Long time readers of this letter know too well that I have been hugely negative on the sector since late 2005, when I unloaded all of my holdings. However, I believe that 'forever' may be on the extreme side. Personally, I believe there will be great opportunities in real estate starting in 2030.

Let's back up for a second and review where the great bull market of 1950-2007 came from. That's when a mere 50 million members of the 'greatest generation', those born from 1920 to 1945, were chased by 80 million baby boomers born from 1946-1962. There was a chronic shortage of housing, with the extra 30 million never hesitating to borrow more to pay higher prices. When my parents got married in 1949, they were only able to land a dingy apartment in a crummy Los Angeles neighborhood because he was an ex-Marine. This is where our suburbs came from.

Since 2005, the tables have turned. There are now 80 million baby boomers attempting to unload dwellings on 65 million generation Xer's who earn less than their parents, marking down prices as fast as they can. As a result, the Federal Reserve thinks that 35% of American homeowners either have negative equity, or less than 10% equity, which amounts to nearly zero after you take out sales commissions and closing costs. That comes to 42 million homes. Don't count on selling your house to your kids, especially if they are still living rent free in the basement.

The good news is that the next bull market in housing starts in 20 years. That's when 85 million Millennials, those born from 1988 to yesterday, start competing to buy homes from only 65 million gen Xer's. By then, house prices will be a lot cheaper than they are today in real terms. The next interest rate spike will probably knock another 25% off real estate prices. Think 1982 again.

Fannie Mae and Freddie Mac will be long gone, meaning that the 30 year conventional mortgage will cease to exist. All future home purchases will be financed with adjustable rate mortgages, forcing homebuyers to assume interest rate risk, as they already do in most of the developed world. With the US budget deficit problems persisting beyond the horizon, the home mortgage interest deduction is an endangered species, and its demise will chop another 10% off home values.

For you millennials just graduating from college now, this is a best case scenario. It gives you 15 years to save up the substantial down payment banks will require by then. You can then swoop in to cherry pick the best neighborhoods at the bottom of a 25-year bear market. People will no doubt tell you that you are crazy, that renting is the only safe thing to do, and that home ownership is for suckers. That's what people told me when I bought my first New York co-op in 1982 at one tenth its current market price.

Just remember to sell by 2060, because that's when the next intergenerational residential real estate collapse is expected to ensue. That will leave the next, yet to be named generation, holding the bag, as your grandparents are now.

Global Market Comments

March 1, 2013

Fiat Lux

Featured Trade:

(TRADE ALERT SERVICE CLOCKS 26% GAIN IN 2013)

(A CONVERSATION WITH THE BOOTS ON THE GROUND),

(DINNER WITH NOBEL PRIZE WINNER JOSEPH STIGLITZ)

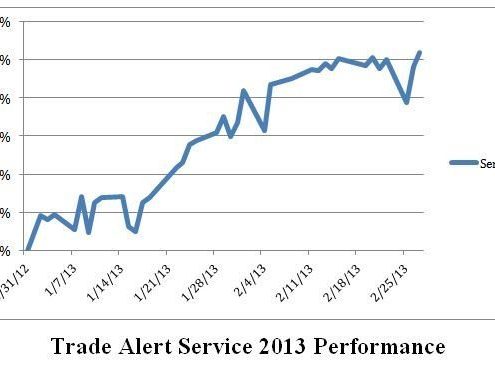

The Trade Alert Service of the Mad Hedge Fund Trader has posted a 26.01% profit year to date, taking it to another new all time high. The 26-month total return has punched through to an awesome 81.06%, compared to a miserable 15% return for the Dow average during the same period. That raises the average annualized return for the service to 36%, elevating it to the pinnacle of hedge fund ranks.

My bet that the stock markets would move sideways to up small during the month of February has paid off big time, as I continued to run sizeable long positions in the S&P 500 and the Russell 2000 (IWM). In the end, the Dow gained only 80 points for the month, an increase of only 57 basis points. My substantial short volatility positions are contributing to profits daily. I booked nice profits from holdings in American International Group (AIG) and copper producer, Freeport McMoRan (FCX). I also prudently doubled up my short positions in the Japanese yen.

It has truly been a month where everything is working. Even my short positions in deep out of the money calls on the (SPY) are substantially contributing to my P&L. While the (SPY) has been going up, it has not been appreciating fast enough to hurt the position. In the meantime, I have been able to dodge the bullets that have been killing off other hedge funds, including those in gold (GLD), oil (USO), and commodities (CORN), (CU).

All told, the last 18 consecutive recommendations of the Trade Alert Service have been profitable. I have eight trades to go to beat this record. Watch this space.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011 and 14.87% in 2012. The service includes my Trade Alert Service, daily newsletter, real-time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars. To subscribe, please go to my website at www.madhedgefundtrader.com, find the ?Global Trading Dispatch? box on the right, and click on the lime green ?SUBSCRIBE NOW? button.