On my last trip to my lakefront estate at Lake Tahoe, I stopped off at the state capital, Sacramento, to look in on my old friend, Governor Jerry Brown. It is crucial that readers across the country, and indeed, around the world, know what Jerry is thinking. California has always been a ?pathfinder? state, and what starts here is often adopted across the country. This little chat could be a hint of what?s headed your way.

As I bounded up the steps of the marble capitol building, the first thing I noticed was the absence of the previous governor, Arnold Schwarzenegger?s, smoking tent. The governator had it erected on the lawn so he could enjoy long puffs on his stogies and not be in violation of the state ban on indoor smoking. This was in the state that invented the anti-smoking movement.

I have trod a very long path with Jerry Brown. His dad, then Governor Pat Brown, ordered teargas dropped on me from a helicopter while I was at a Berkeley anti-war march nearly half a century ago. He was Secretary of State while I attended the University of California, often going head to head against then governor Ronald Reagan.

I was in Asia during his first two terms as governor from 1975-83, when his girlfriend, Linda Ronstadt, called him the ?moonbeam governor?, a nickname he has yet to live down. Warning: don?t call him that to his face.

I ran into him at the Democratic convention in New York in 1980 when he mounted his second run for the presidency. After he retired and was considered a political has-been, I bumped into Jerry once again when he studied Zen Buddhism in Japan.

In 1999, he was elected mayor of Oakland, a mostly black Bay Area slum near bankruptcy, which many considered ungovernable. He did a spectacular job, fighting corruption, rebuilding the school system, and sparking an economic renaissance. It was like he had nothing left to lose.

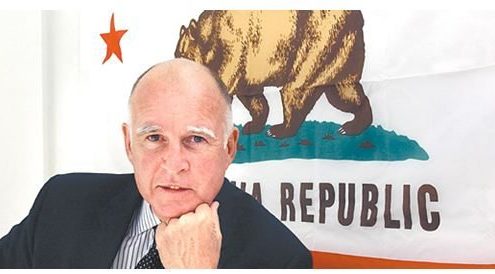

To the amazement of many, Jerry ran and won a third term as governor in 2011, taking over the wreckage left by the disastrous reign of Arnold Schwarzenegger. He has been raising eyebrows nationally ever since.

He immediately launched a crash campaign to raise taxes and cut spending. His Proposition 30 succeeded at the polls, raising sales taxes for everyone and boosting income taxes on those earning more than $500,000. The Golden State now has the highest combined federal and state taxes in the country, at 51.5%. The proceeds of the tax hike are solely dedicated to increasing $6 billion in spending on education.

State leaders learned a long time ago that people will pay a premium to live here. They pay double for housing, so why not double taxes? The sunshine has value. As I explain to guests at my strategy luncheons, high earners don?t mind paying an extra dollar in tax when it means they can make and extra $10, or $100, in profits. That has been the case with a technology industry here that has been booming almost non-stop since WWII.

Brown originally studied at a seminary school to become a catholic priest. To this day, he frequently quotes from the Bible, and he gave my Latin a real workout. Citing Luke, Chapter 12, verse 48 with regards to the sharing of the tax burden, ?to those who are given much, much is required.? The seven-year sunset provision for the new income tax also comes from the ?seven years of plenty?, found in the Old Testament.

He argues that this is only fair, since the top 1% of state earners have seen their income increase by 165% since 1980, while the bottom 80% have seen an 8% drop. The top 1% took 10% of state incomes in the seventies. Now it is 22%.

To say Jerry is iconoclastic is a disservice to the word. He is a combative 75 year old who says what he thinks at the drop of a hat, no matter whom it offends, be they friend or foe. He is a mix that is all too rare in this country, a flaming liberal on social issues, while an ironclad conservative on fiscal matters.

He is a staunch advocate for the environment. He appointed the first gay judge in the US. He is about to deliver the toughest anti-gun legislation in the country. He has been a lifelong cheerleader for the alternative energy industry.

Brown has also completed the most ambitious cuts in social spending in the state?s history, including grants for the disabled, child welfare, and Medical. Some 40,000 non-violent inmates were released from prisons into probation to save money. The University of California saw its budget cut by a massive 25%. State employment was chopped by 50,000, and some 50 redundant state boards were eliminated.

Jerry told me that the state?s problems were caused by two bubbles; the Internet one in 2000, and the indiscriminate mortgage lending that followed. That created a budget deficit that ballooned to $27 billion by the time he returned to office, which cut the California?s credit rating to the lowest of the 50 states. In a short 18 months, Brown balanced the budget, and state debt is now rapidly seeing upgrades, reducing borrowing costs.

The governor says that the spending cuts have been very tough to swallow. Even the carpet in his office is falling apart, and he confesses to eating day old tuna sandwiches. On the tax front, he says that ?when you have more in the cookie jar, you have more cookies to give.?

Jerry says his goals as governor were threefold. He eliminated false accounting gimmicks, which shuffled the state?s financial problems under the carpet, where they festered. He only implemented new taxes if people voted for them. And he returned decision making to cities and counties on schools, because the entities closest to problems have best ability to solve them, a policy he calls ?realignment?. Decentralization and devolution of power to local authorities isn?t something you hear about from liberals very often.

He points out that the big growth in state spending didn?t arise from some idealistic social agenda. Three strikes law mandating extremely long sentences caused an explosive growth of the prison system, which expanded from 3% to 11.5% of the state budget since the seventies. ?An aging population is also prompting a substantial increase in medical spending. These two items alone account for the entire increase in state spending for the past 40 years on a GDP adjusted basis.

I asked Jerry what he thought about the efforts by other tax-free states, particularly Texas, to lure business away. He erupted into a tirade. He argued passionately there was absolutely no evidence that people moved to avoid taxes, which amount to only a few thousand dollars a year for millionaires.

The economy here is booming. The best and the brightest minds in the world are pouring into the most creative and innovative place on the planet. There have been 300,000 private sector jobs created during his current tenure. Exports are up 17%. The state draws 50% of global venture capital investment, and files for four times more patents than runner up New York. The one-ton truck now driving around Mars was built in Pasadena.

My obvious last question had to be ?what?s next? for the energetic governor. Might his tax raising, spending cutting habits have a national audience? ?Do I have more offices in mind? I?m not telling,? he answered, with a twinkle in his eye. That is a lot to say for someone who has already held every high office in his home state.

I got a call from my car telling me it was time to get moving if we were going to make it over Donner Pass before it iced up. I said, ?see you next time? to Jerry. There always seems to be a next time with Jerry.

?What a Long, Strange Trip It?s Been.?

Global Market Comments

February 8, 2013

Fiat Lux

Featured Trade:

(HOW THIS MARKET WILL DIE),

(SPY), (SPX), (DOW AVERAGE), (AAPL), (QQQ),

(APRIL 12 SAN FRANCISCO STRATEGY LUNCHEON),

(THE CRUEL TRUTH ABOUT GOVERNMENT STATISTICS),

(TESTIMONIAL)

SPDR S&P 500

S&P Large Cap Index

Apple

Power Shares QQQ

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, April 12, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $189.

I?ll be arriving at 11:00 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a private club in downtown San Francisco near Union Square that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store at http://madhedgefundradio.com/store and click on ?luncheons.?

There have been complaints about the quality of government data as long as there have been stock markets. The US is not much better than emerging markets, like China, where numbers are subject to huge, after the fact revisions. A broker friend of mine emailed the conversation below, which has been circulating around the street. Enjoy.

Costello: I want to talk about the unemployment rate in America.

Abbott: Good subject. Terrible times. It's 7.8%.

Costello: That many people are out of work?

Abbott: No, that's 14.7%.

Costello: You just said 7.8%.

Abbott: 7.8% unemployed.

Costello: Right 7.8% out of work.

Abbott: No, that's 14.7%.

Costello: OK, so it's 14.7% unemployed.

Abbott: No, that's 7.8%.

Costello:?Wait a minute. Is it 7.8% or 14.7%?

Abbott: 7.8% are unemployed. 14.7% are out of work.

Costello: If you are out of work, you are unemployed.

Abbott: No, Congress said you can't count the "out of work" as the unemployed.?You have to look for work to be unemployed.

Costello:?But they are out of work!!!

Abbott: No, you miss his point.

Costello: What point?

Abbott: Someone who doesn't look for work can't be counted with those who look for work. It wouldn't be fair.

Costello: To whom?

Abbott: The unemployed.

Costello: But?all?of them are out of work.

Abbott: No, the unemployed are actively looking for work. Those who are out of work gave up looking and if you give up, you are no longer in the ranks of the unemployed.

Costello: So if you're off the unemployment roles, that would count as less unemployment?

Abbott: Unemployment would go down. Absolutely!

Costello: The unemployment just goes down because you don't look for work?

Abbott: Absolutely it goes down. That's how they get it to 7.8%. Otherwise it would be 14.7%. Our government doesn't want you to read about 14.7% unemployment.

Costello: That would be tough on those running for reelection.

Abbott: Absolutely.

Costello: Wait, I got a question for you. That means there are two ways to bring down the unemployment number?

Abbott: Two ways is correct.

Costello: Unemployment can go down if someone gets a job?

Abbott: Correct.

Costello: And unemployment can also go down if you stop looking for a job?

Abbott: Bingo.

Costello: So there are two ways to bring unemployment down, and the easier of the two is to have people stop looking for work.

Abbott: Now you're thinking like an economist.

Costello: I don't even know what the hell I just said!

Abbott: Now you're thinking like Congress.

So, Who?s on First?

Global Market Comments

February 7, 2013

Fiat Lux

Featured Trade:

(HOW MUCH TO GO WITH PALLADIUM), (PALL),

(HANGING OUT WITH WOZ), (AAPL),

(THANK GOODNESS I DON?T LIVE IN SWEDEN), (EWD)

ETFS Physical Palladium Shares (PALL)

Apple Inc. (APPL)

iShares MSCI Sweden Index (EWD)

Global Market Comments

February 6, 2013

Fiat Lux

Featured Trade:

(WHY YOU SHOULD CARE ABOUT THE IRANIAN RIAL COLLAPSE),

(WHEN YOUR OPTIONS ARE EXERCISED)

The Iranian Rial (IRR) has just suffered one of the most cataclysmic crashes in the history of the foreign exchange markets. It is off a mind numbing 75% since the beginning of 2011. One dollar now buys 12,200 Rials. Watch out Zimbabwe!

When communications between intelligence agencies suddenly spike, as has recently been the case, I sit up and take note. Hey, do you think I talk to all of those generals because I like their snappy uniforms, do you?

The word is that the despotic, authoritarian regime in Syria is on the verge of collapse, and is unlikely to survive more than a few more months. The body count is mounting, and the only question now is whether Bashar al-Assad will flee to an undisclosed African country or get dragged out of a storm drain to take a bullet in his head a la Gaddafi. It couldn?t happen to a nicer guy.

The geopolitical implications for the US are enormous.? With Syria gone, Iran will be the last rogue state hostile to the US in the Middle East, and it is teetering. The next and final domino of the Arab spring falls squarely at the gates of Tehran.

Remember that the first real revolution in the region was the street uprising there in 2009. That revolt was successfully suppressed with an iron fist by fanatical and pitiless Revolutionary Guards. The true death toll will never be known, but is thought to be in the thousands. The anti-government sentiments that provided the spark never went away and they continue to percolate just under the surface.

At the end of the day, the majority of the Persian population wants to join the tide of globalization. They want to buy IPods and blue jeans, communicate freely through their Facebook pages and Twitter accounts, and have the jobs to pay for it all. Since 1979, when the Shah was deposed, a succession of extremist, ultraconservative governments ruled by a religious minority, have failed to cater to these desires.

When Syria collapses, the Iranian ?street? will figure out that if they spill enough of their own blood that regime change is possible and the revolution there will reignite. The Obama administration is now pulling out all the stops to accelerate the process. The new Secretary of State, John Kerry, will stiffened his rhetoric and work tirelessly behind the scenes to bring about the collapse of the Iranian economy.

The oil embargo is steadily tightening the noose, with heating oil and gasoline becoming hard to obtain in this oil producing country. Yes, Russia and China are doing what they can to slow the process, but conducting international trade through the back door is expensive, and prices are rocketing. The unemployment rate is 25%.

Iranian banks have been kicked out of the SWIFT international settlements system, a death blow to their trade. That is what the Standard Chartered money laundering scandal last year was all about. Sure, you can sell oil one truckload at a time for cash. Try doing that with 3 million barrels a day of which should fetch $270 million. That?s a lot of Benjamins. Forget the fives and tens.

Let?s see how docile these people remain when the air conditioning quits running because of power shortages. With their currency now worthless, it has become impossible to import anything. This is causing severe shortages of everything under the sun, especially foodstuffs, which in some cases have more than doubled in price in months.

What does the government in Tehran say about all of this? Blame it on the speculators. Sound familiar?

Iran is a rotten piece of fruit ready to fall of its own accord and go splat. The Obama administration is doing everything it can to shake the tree. No military action of any kind is required on America?s part. Think of it as victory on the cheap.

The geopolitical payoff of such an event for the US would be almost incalculable. A successful Iranian revolution will almost certainly produce a secular, pro-Western regime whose first priority will be to rejoin the international community and use its oil wealth to rebuild an economy now in tatters.

Oil will lose its risk premium, now believed by the oil industry to be $30 a barrel. A looming oversupply could cause prices to drop to as low as $30 a barrel. This would amount to a gigantic $1.66 trillion tax cut for not just the US, but the entire global economy as well (87 million barrels a day X 365 days a year X $100 dollars a barrel X 50%).

Almost all funding of terrorist organizations will immediately dry up. I might point out here that this has always been the oil industry?s worst nightmare. Commercial office space in Houston may not do so well either, as imports account for 80% of the oil majors? profits.

At that point, the US will be without enemies, save for North Korea, and even the Hermit Kingdom could change with a new leader in place. A long Pax Americana will settle over the planet.

The implications for the financial markets will be enormous. The US will reap a peace dividend as large, or larger, than the one we enjoyed after the fall of the Soviet Union in 1992. As you may recall, that black swan caused the Dow Average to soar from 2,000 to 10,000 in less than eight years, also partly fueled by the technology boom.

A collapse in oil imports will cause the US dollar to rocket.? An immediate halving of our defense spending to $400 billion or less and burgeoning new tax revenues would cause the budget deficit to collapse. With the US government gone as a major new borrower, interest rates across the yield curve will fall further.

A peace dividend will also cause US GDP growth to reaccelerate from a tepid 2% rate to a more robust 4%. Risk assets of every description will soar to multiples of their current levels, including stocks, junk bonds, commodities, precious metals, and food. The Dow will soar to 30,000, the Euro collapses to parity, gold rockets to $3,000 an ounce, silver flies to $100 an ounce, copper leaps to $6 a pound, and corn recovers $8 a bushel. The 60-year bull market in bonds ends in a crash.

Some 1 million of the armed forces will get dumped on the job market as our manpower requirements shrink to peacetime levels. But a strong economy should be able to soak right up these well-trained and motivated. We will enter a new Golden Age, not just at home, but for civilization as a whole.

Wait, you ask, what if Iran develops an atomic bomb and holds the US at bay? Don?t worry. There is no Iranian nuclear device. There is no real Iranian nuclear program. The entire concept is an invention of Israeli and American intelligence agencies as a means to put pressure on the regime and boost their own budget allocations. The head of the miniscule effort they have was assassinated by Israeli intelligence last year (a magnetic bomb, placed on a moving car, by a team on a motorcycle, nice!). What nuclear infrastructure they have is being decimated by computer viruses as I write this.

If Iran had anything substantial in the works, the Israeli planes would have taken off a long time ago. There is no plan to close the Straits of Hormuz, either. The training exercises in small rubber boats we have seen are done for CNN?s benefit, and comprise no credible threat.

I am a firm believer in the wisdom of markets, and that the marketplace becomes aware of major history changing events well before we mere individual mortals do. The Dow began a 25-year bull market the day after American forces defeated the Japanese in the Battle of Midway in May of 1942, even though the true outcome of that confrontation was kept top secret for years.

If the collapse of Iran was going to lead to a global multi decade economic boom and the end of history, how would the stock markets behave now? They would rise virtually every day, offering no substantial pullbacks for latecomers to get in. That is exactly what they have been doing since mid-November.

I received a few emails from readers whose option holdings have been exercised against them, and have asked me for advice on how best to proceed. So, here we go.

The options traded on US exchanges are American style, meaning that they can be exercised at any time by the owner. This is opposed to European style options, which can only be exercised on the expiration day.

The call option spreads that I have been recommending for the past year are composed of a deep out-of-the-money long strike price and a short portion at a near money strike price. ?When stocks have high dividends, there is a chance that the near money option you are short gets exercised against you. This requires you to deliver the stock equivalent of the option you are short, plus any quarterly dividends that are due.

You get notice of this assignment in an email after the close. You then need to email or call your broker back informing him that you want to exercise your remaining long option position to meet your assigned short position. This should completely close out your position. This is not an automatic process and requires action on your part.

Assignments are made on a random basis by an exchange computer, and can happen any day. Exercise means the owner completely loses the premium on his at-the-money call. Dividends have to be pretty high to make such a move economic, usually at least over 3% on an annual rate. But these days, markets are so efficient that traders, or their machines, will exercise options for as single penny profit.

Assignments create a risk for option spread owners in a couple of ways. If you don?t check your email every day, you might not be aware that you have been assigned. Alternatively, emails sometimes get lost, or hung up in local servers, which occasionally happens to readers of my own letter. Then, you are left with the long side deep out-of-the-money call alone, which will have a substantially higher margin requirement.

If you don?t have the cash in your account to cover this, you could get a margin call. If you ignore this call as well, your broker will close out your position at market without your permission. You shouldn?t lose much, if any, money in this event, as your long and short options positions perfectly hedge each other. But it could produce some disconcerting communications from your broker. Brokers generally hate issuing margin calls, and could well close your account if it is too small to bother with, as they create regulatory issues.

It order to get belt and braces coverage on this issue, it is best to call your brokers and find out exactly what their assignment policies and procedures are. Believe it or not, some are still in the Stone Age, and have yet to automate the assignment process or give notice my email.

The readers I have heard from still had a profit in the positions after an assignment, albeit a smaller one. Consider it a cost of doing business, or a frictional cost. In-the-money options are still a great strategy. But you should be aware of all the potential costs and risks to get the most benefit.

John Thomas

Global Market Comments

February 5, 2013

Fiat Lux

Featured Trade:

(FEBRUARY IS THE CRUELEST MONTH), (SPX), (SPY),

(WHY GOLD IS DEAD), (GLD), (GDX),

(TESTIMONIAL), (OXY), (BYDDF)

Actually, it is the second cruelest month. September is the worst, as indicated by the table below, put together by my friends at Stockcarts.com.

I think you have to get some sort of pullback between now and March 15, like of the 2%-4% range. It?s not that we are without fundamental reasons to do so. Don?t forget, we have a sequestration deadline looming on March 1, when the world as we know it is supposed to end. However, what is more likely is that Wall Street calls Washington?s bluff, since the last several Armageddon?s have failed to materialize.

Another possibility is that it grinds sideways in a narrowing range with diminishing volatility, because there are still so many investors trying to get in. If you believe, as I do, that markets will do whatever they have to do to screw the most people, then this is your scenario.

The only choices are down, or sideways. Trees don?t go to the sky, and markets don?t go up forever. I think long side plays in equities from here on will be a story of diminishing returns.

This is why I started selling short out of the money calls and call spreads on the S&P 500 (SPY), (SPX) first thing Monday morning. In either scenario these expire at their maximum point of profitability on March 15. These will help hedge, and lower the average breakeven points of my remaining long side plays in the market.

The move we have seen in stocks this year has been one of the most extended in 18 years, since back when the Dow was trading at about 3,000. These positions will partially hedge the remaining long positions that currently bulk up our portfolio. There is absolutely no way that we will repeat the January performance in February.

Yes, this is a short position. Warning: I have issued so many Trade Alerts for call spreads in the past two months, about 60, that readers forgot what bearish trades looked like. When I issued my Trade Alert on bear put spreads this morning, some readers went ahead and bought the call spread anyway.

Advice: for these alerts to work, you have to read them first.

Looks Like Another No Show