For those who wisely ignored my advice to sell the SPDR Gold Trust Shares ETF (GLD) June $160 Puts on May 3, good for you. The options are now trading at $10.50 and you have a profit of 147%, adding 14.7% to your annual return. This will no doubt be your home run trade of the year.

If you still have these, it is time to give thanks for your good fortune and head for the sidelines. You don?t get to do trades like this very often. Selling out here allows you to avoid the time decay hit as we run into expiration on June 15.

Gold has now fallen $100 since my last ill-timed sell recommendation. Tough luck if the rumor that the International Monetary Fund was going to sell its gold reserves to bail out Europe hit the wires two days later. I had heard about this from my European central banker friends a month earlier, which is why I put on such a big short position in the first place. Alas, timing is everything in this business.

The yellow metal is now approaching both a severely oversold condition and major support at $1,510, and it would be unwise to continue to run the position. The same is true for every other risk asset in the universe, including the S&P 500 (SPX), the Russell 2000 (IWM), the NASADQ (QQQQ), oil (USO), silver (SLV), copper (CU), the Euro (FXE), and the Australian dollar (FXA).

Use whatever metaphor you want; the rubber band has been stretched to the breaking point, the paddlers have all bunched up at one end of the canoe. The dollar index is up 13 consecutive days, and the Dow is down 9 out of 10. How long do you want to keep flipping a coin and relying on heads coming up every time?

In the meantime, the big ?RISK OFF? assets of Treasury bonds (TLT) and the Japanese yen (FXY) are starting to make rather shrill topping noises, giving additional signals that it is time to shrink your book.

Finally, I have my own performance to look at, with May thankfully the most profitable in the 18 month life of my Trade Alert Service. As of this morning?s marks, I am up an eye popping 22% so far this month. If the past is any guide, big numbers like these are a great ?sell? indicator. Mean reversion can be a cruel and unfeeling bitch, worse than an Internet date, so watch out.

Take profits here and you will have plenty of dry powder to resell the barbarous relic and other risk assets in any dead cat, short covering rally that may unfold into the May month end book closing and into June. Then we can position for the final low in the summer, which should be downright scary.

Sell these ETF Alternatives:

the DB Gold Short ETN (DGZ) 1X short gold

the DB Double Short Gold ETN (DZZ) 2X short gold

or buy to cover the SPDR Gold Trust Shares ETF (GLD) sold short on Margin outright

Time to Pare Back Some Risk

A major plank in my golden age scenario for the 2020?s is the collapse of the cost of energy. This won?t occur because of a single big discovery, but from a 1,000 small ones that aggregate together to create a leveraged effect. The upshot is that we may be free of OPEC in 3-5 years, and completely energy independent not long after that. The impact on financial markets and global standards of living will be huge.

To flesh out my arguments, I called Dr. Amory B. Lovins, chief scientist of the Rocky Mountain Institute, who spends a lot of time thinking about these things. He says that our current energy addiction makes us dig up about four cubic miles of primordial swamp goo to burn each year. That costs the US about $2 billion a day, and another $4 billion a day when the cost of defending unstable supplies in the Middle East is thrown in.

Some 75% of the electricity generated powers buildings, three fourths of the oil fuels transportation, and the rest goes to industry. Demand for Texas tea is already falling dramatically. Since 1975, the amount of oil needed to produce a dollar of GDP has plunged a stunning 60%. Coal production peaked in 2005 and has since lost 25% of the market for power utilities, mostly to natural gas. ?Peak oil? is becoming a reality, not in supply terms, but in demand.

This is only the beginning of a major long term trend that still has decades to run. Obama?s move to raise mileage on US made cars from 25 to 55 miles per gallon by 2025 will have a crucial impact. While in the past Detroit lawyered up and fought such policies tooth and nail, now it is reengineering to achieve this ambitious goal. GM says it will offer a hydrogen fuel cell powered subcompact in five years for $35,000. Some two thirds of fuel consumption is caused by weight, so the adoption of cheap ultra-strong carbon fiber composite technology from the aircraft industry, which offers five times the strength of steel at a tenth of the weight, will give them a major advantage. BMW, Volkswagen, and Audi all plan to bring such vehicles to the market in 2013.

Alternatives will also make a growing contribution. While they account for only 3% of the total US energy supply, 50% of the new capacity added since 2010 were powered by alternatives. Solar clearly is cost competitive in the Southwest, as is wind in Texas. All that is lacking are the transmission lines to bring power to the energy hungry, populous coasts.

The cost of solar has recently dropped as much as 80%, as highlighted by the Solyndra bankruptcy. Prices have fallen so fast that it may wipe out all the current equity investors before a new industry rises up to replace them. Radical change can?t happen without casualties along the way.

Don?t expect any action from a gridlocked congress to make this easy. But the marketplace is moving ahead without them. Companies are turning into world class conservationists, desperate to find new ways to reduce costs, now that labor has been cut to the bone. The big surprise here will be in building design, which can bring immediate and large savings in heating and air conditioning costs that fall straight to the bottom line.

No great sacrifices will be required to achieve this energy revolution. If existing energy savings technology were applied to lights, air conditioners, refrigerators, and TV?s, the combined energy savings would be about $1 trillion a year, enough to take 300 coal fired power plants offline.

The implications of this shift away from oil will be global. Much of the world?s developing country debt is driven by high energy bills. So the boost to global economic growth enabled by cheap oil will be enormous. Consuming countries like China, Japan, and Europe will benefit greatly at the expense of producing countries in the Middle East. With oil under $50, that volatile region of the world will shrink to irrelevance, certainly not worth defending.

This is all highly beneficial for risk assets everywhere and is the basis for my own forecast of a Dow average of 50,000 by 2030. It is also massively dollar possible as the disappearance of oil import will shrink our trade deficit dramatically and push our current account deficit into a surplus. Perhaps this is what the recent extraordinary strength of the dollar is trying to tell us. The very long term charts are suggesting that this could become a multiyear affair.

Going Out of Style?

When I heard that the managers of exchange traded funds were raking in huge fees from lending out shares in their index portfolios I thought ?That?s great, the managers are really working hard to maximize returns for their shareholders.? These shares are borrowed by hedge funds which then then sell short. Then I found out the ugly truth.

I was horrified to learn recently that the fund operators are keeping a substantial portion of the fees to be paid out in profits and bonuses for themselves. According to an investigation by the Financial Times, the largest ETF operator, Blackrock, kept, $57 million of $164 million in lending fees earned, while State Street kept 15% of the total. Others are thought to keep as much as 50%.

The problem is that the investors take all the risk in this securities lending, but reap only a portion of the benefit. Sure, the lending is fully collateralized and marked to market on a daily basis. But has anyone figured out what happens if your borrower goes bust, as hedge funds are frequently prone to do? Involvement in litigation can cost millions, and I?m pretty sure that the managers aren?t assuming their share of that liability.

By engaging in this activity, fund managers are making it easy for speculators to drive down the value of the lending fund, wiping out shareholder equity. Am I the only one who sees a conflict of interest here? It is the classic sort of ?Heads, I win, tails, you lose? type of management philosophy which has sickened me over the years and seems to be getting worse, but which has become institutionalized.

ETF operators insist that this activity is disclosed in the prospectus. But the exact share of the profit split they keep isn?t. You can always vote with your feet, and flee the funds that are withholding the most in fees. Good luck figuring out who they are. This is the kind of regulation that the industry is spending hundreds of millions of dollars in Washington to defeat. And you wonder why people are so pissed off at Wall Street.

I?ll Keep the Change

I follow a broad range of unconventional, but highly useful leading economic indicators that gives me a decisive edge when predicting the future direction of global financial markets. One of them has started flashing a warning sign.

I fund an orphanage in remote Zhanjiang, in China?s southern Guangdong province near Hainan Island called The Zhanjiang Kids Organization that catches the kids who missed out on China?s economic miracle. Lacking America?s social safety net, child abandonment in the Middle Kingdom usually leads to a cruel death through malnutrition or disease at the few primitive public institutions that exist. With China?s one child policy now 30 years old, most families prefer their sole heir to be a boy, which means that girls account for the vast majority of orphan children.

Recently, there has been an upsurge of children dropped off at the orphanage and a sudden increase in the age of the kids. Twelve year old boys are being dumped because they cannot be fed. For a Chinese family to give up a boy this close to working age is truly an act of desperation. As a trader, this is all proof to me that the Chinese economy is slowing faster than people realize and that the global economy will take a deeper dip this summer. Indeed, the People?s Bank of China affirmed as much by once again easing bank reserve requirements again last night.

I usually avoid organized charities like the plague. The great majority are scams where 95% of the funds raised go to ?administrative costs? that usually end up in someone?s bank account. As we all know, the corruption in China is rampant.

The Zhanjiang Kids Organization is a rare exception. I know the organizers personally, who originally got involved by adopting a couple of girls there, and they are saints. They carefully oversee the spending of every single dollar, assuring that it gets spent for its intended purposes. Instead of doling out cash to local organizations which often gets lost, as other organizations do, they undertake physical delivery of desperately needed food, books, and medical supplies. They also organize trips for volunteer pediatricians, educators, and administrators from the US.

To learn more about The Zhanjiang Kids Organization, please visit their website by clicking here at http://www.zhanjiangkids.org/ . There, you can contribute directly through your PayPal account or credit card. If you have any further questions about this fine organization, please contact Susan Doshier directly at susandoshier@gmail.com .

Checks should be made out to the ?Zhanjiang Kids Organization? and sent to Zhanjiang Kids Organization, c/o Susan Doshier, 2 Abbey Woods Lane, Dallas TX 75248, USA. Print out a hard copy of your receipt. This organization is set up as a US 501 (3) (c), so all contributions are fully deductible on the 2012 Form 1040, schedule ?A?. There is no reason why Uncle Sam shouldn?t pick up one third of the tab.

Those who made a 40.16% return on their investment following my timely advice last year should consider chipping in a few bucks. Newer subscribers who haven?t made money yet can wait. When the big numbers arrive in coming months, you can contemplate a donation then. Do the asymmetric trade here. A $100 gift creates $10,000 worth of benefit. Act in your own self-interest. You may be working for one of these orphans someday. If you don?t, your kids will.

JP Morgan (JPM) just gave us the preview of the next financial crisis. A surprise, hidden $2 billion trading loss in esoteric foreign derivatives at on offshore branch by America?s premier bank is exactly what the markets did not want to hear right now. The London whale has beached itself. Although no one has mentioned this, these are exactly the same sort of securities that drove MF Global into bankruptcy only seven months ago. As baseball great, Yogi Berra, said, ?It?s d?j? vu all over again.?

I doubt that (JPM) will go under on this one, but others may. This is how our financial system works these days. There is never just one cockroach. With the profitability of traditional business lines now pared back to pennies, banks are desperate to reach for marginal income wherever possible to keep from turning into utilities. Bring on the downgrades! Indeed, the loss could well result in a de-rating not just for (JPM), but the entire US banking sector.

As a result, they have all turned into giant, opaque hedge funds. Some genius thinks up a trade that works out great in computer back testing. The Federal Reserve indirectly provides all the capital they need through its zero interest rate policy. It makes good money for a while. Then the word gets out, and everyone starts imitating them.

But the copycat institutions lack the sophistication, the risk control, and the experience to get it right. When too much capital pours into a single trade it ceases to work. Some little market setback gets magnified 100 fold by leverage and the wanabee trader blows up. If (JPM) lost $2 billion, you can bet someone else has lost $20 billion on a smaller capital base and the runs begin. However, we may not hear about this for another nine months, once the annual audits get underway and fail.

The scary thing is that the senior management of JP Morgan may not even know what their true position is. They are relying on sheepish presentations by some mid-level traders using model driven pricing that has utterly failed them.

The problem is that once the market sniffs out a big position gone wrong, it will press it until the holder can take no more pain. That?s how a $2 billion problem becomes a $4 billion, then a $6 billion one. I remember in 1998 when Long Term Capital management was trying to get out of a gigantic short volatility position on the S&P 500 in that they sold all the way down to 9%. Buy the time the last position was unwound, volatility was trading at 40%, and it took a year to get there. Needless to say, the LTCM shareholders were entirely wiped out.

Sure, the industry shills and apologists say this is a one off, an aberration, and will never happen again. But remember how Ben Bernanke said the sub-prime crisis was contained? These things have a tendency of bubbling under the surface for a while before they explode and send investors into a panic. Have we just seen the opening salvo of the crash of 2012?

OK, maybe I?m in a bad mood today, maybe the market has beaten me up too much lately, or perhaps I am getting cynical in my old age. But I have seen this script unfold dozens of times in my 40 year career. Remember the nifty 50 of the early seventies, the first gold and silver bubbles, portfolio insurance, the 1987 crash, the Japanese stock market bubble, the Granite Capital fiasco, the dotcom bubble, the China bubble, Bear Stearns, and Lehman Brothers? I rest my case.

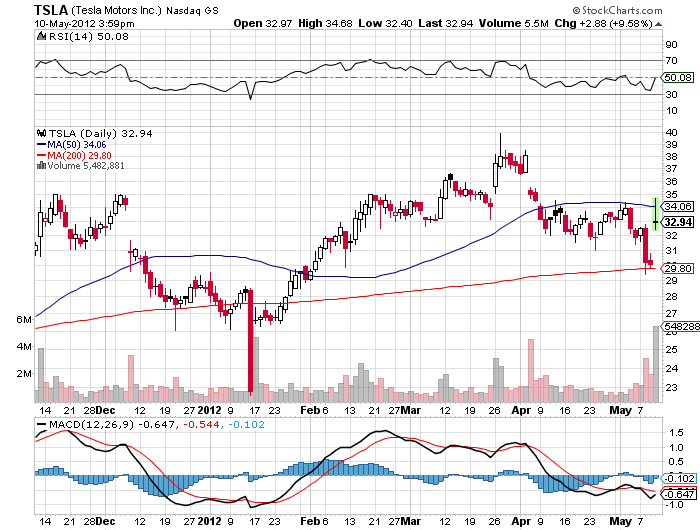

This couldn?t have come at a better time for the bears. Suddenly the glass on equity valuations has gone from half full to half empty. Take a look at the charts below and you can see they are sitting on a knife edge. We are right at terra incognito on the maps between the modest 5.8% correction that we have seen so far and breaking towards the more serious 10% or 15% the market so richly deserves. Suddenly the glass on equity valuations has gone from half full to half empty, making them far more fragile than people realize. JP Morgan and the absolute rout that we have already seen in commodities are the writing on the wall.

JP Morgan may have given the bears the firepower they need to break the current support lines. If successful, down 500 to Dow (INDU) 12,200 is in the cards, as are $75 for the Russell 200 ETF (IWM) and 1,280 for the S&P 500 (SPX).

Is JP Morgan the Tip of the Iceberg?

Readers of the Diary of a Mad Hedge Fund Trader down under are welcome to join the online ?Secure the Future? conference which I will be participating in through the miracle of the Internet. My friend, Greg Owen, created this organization to educate investors in the opportunities available in international markets by bringing in industry veterans like myself. I will be making presentations on the current state of and prospects for the global financial markets, to be followed by an extended question and answer session. No doubt I will spend a lot of time expounding on my outlook for Australian stocks, bonds, commodities, precious metals, and real estate. My schedule is below.

Sydney on Saturday, May 12 at 2:00 PM

Brisbane on Tuesday, May 15 at 2:00 PM

Perth on Thursday, May 17 at 2:00 PM

To register for the event, please click here at www.securethefuture.com.au/greg . In order to register, you will need to input your credit card information. However, you can attend as my guest, so there will be no charge made to your credit card. I look forward to hearing from you in the Q & A.

As of this week, Oregon will become the first state to complete a chain of charging stations that will enable electric cars to travel from one end of the state to the other. It completed the last of eight 440 volt fast charging stations that allow travel for the full 310 miles on the beaver state?s Interstate 5, from the Washington to the California border.

A fleet of Tesla Roadsters, Nissan Leafs, Fisker Karmas, and Mitsubishi iMiEVs celebrated the event by traveling in convoy from one end of the state to the other. It is all part of the Electric Highway Project, which has the final goal of building an all-electric corridor from Canada to Mexico.

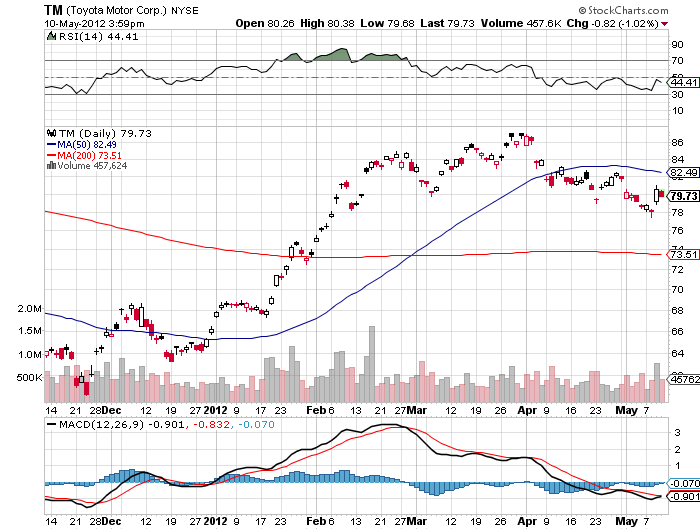

The development understates how rapidly electric cars are going mainstream. Once the domain of the wealthy who bought Tesla?s $100,000 two seat roadster, prices are now falling to the level of high end luxury cars. Tesla?s own Model S1 Sedan, which carries a 300 mile range, will be available for $58,000. Toyota announced that its electric Rav4 SUV will cost $49,800 and will include a Tesla built drive train. My own 100 mile range Nissan Leaf cost me $38,000, and after a year has delivered me 12,000 miles of pleasant driving with zero fuel and maintenance costs. Also on the drawing board is a Tesla driven Mercedes ?A? class Smart car for even less.

Toyota invested $60 million in founder Elon Musk?s fledgling car company to assure timely deliveries. Elon wisely used the cash to buy the abandoned General Motors Prizm plant in Fremont, California for pennies on the dollar with some generous US government subsidies thrown in, where Model S1 production is underway.

Yesterday, Tesla announced it was moving the delivers up a month to June this year, causing a one day 10% pop in the stock, despite announcing a $98 million quarterly loss the day before. No doubt, the 10,000 on the waiting list for the S1are thrilled. Their $5,000 deposits have provided the company with $50 million in free financing for two years.

When I first bought my Leaf, finding a charging station away from home required some advanced planning and guerrilla tactics. I still feel bad about depriving a parking lot attendant of his coffee maker outlet for three hours while I enjoyed the opera, but he didn?t mind the $20 tip. That was back when there were only 25 charging stations in the entire San Francisco Bay area. Today there are nearly 400, with 20 new ones joining the ranks each week. Soon, every Walgreens, Whole Foods, and Best buy will have one, as will every major hotel in the city. Not a bad deal, given that none of these stations has yet to charge a penny for a single electron.

Tesla is moving ahead to build its own network of 440 volt ?supercharging stations? which can get you an 80% top up in 45 minutes. One is being built at Harris Ranch, half way between San Francisco and Los Angles, with a second in Sacramento, midpoint for a trip to Lake Tahoe. I can foresee a life of plugging in my car, going into Starbucks with an Economist, a Wall Street Journal, and a New York Times, and then zooming away 45 minutes later.

Although the Tesla plug won?t be compatible with my Leaf, the stations will carry adapters for all cars. I won?t need an adapter for my Tesla Model X SUV. I am one of 1,000 on the waiting list for that futuristic, 300 mile range vehicle, which should be parked in my garage in 2 years.

Tesla Model S Sedan

Tesla Model X SUV

My Leaf

I immediately recognized Robert Mueller as the kind of no nonsense, fellow ex-Marine, Vietnam Vet that he was, the kind of officer who used to rip your guts out for disobeying a direct order, which in my case was frequently.

President Obama thought this was the man you want for your Director of the FBI, which is why Mueller survived as one of the few holdovers from the previous Bush administration. Mueller has been following in the tradition of the legendary G-Man J. Edgar Hoover for 11 years now.

Mueller believes that the Internet is not just a conduit for commerce, but also for crime and terrorism, and the bad guys are checking your doorknobs every day. Information is power, and fiber optic cable is a weapon. Terrorists, in particular, love the new Google Earth application.

Recently, Mueller busted an American-Egyptian phishing ring, arresting 50, which looted 5,000 US accounts. We all must take ownership of the cyber security problem through the vigilant use of antivirus software, firewalls, sophisticated and frequently changed passwords, and constant patches. Tracing a 75-cent accounting discrepancy at UC Berkeley led to the smashing of a German industrial espionage ring that was tapping into university computers.

Teenaged kids, like the Canadian who launched the biggest ?denial of service? attack against E-Trade and E-Bay, are to be feared. Be careful what you post on your Facebook page because it may kill a job prospect years down the road.

The FBI is now embedding agents in police departments in Eastern Europe and China to take the fight global. The last time a visited FBI headquarters in Washington, I was amazed to learn that Chinese anti-hacking specialists kept their own office there.

When I got home, I immediately backed up all my files, reset my passwords, and bought my fourth antivirus program. I also installed bars on my windows and set booby traps on the front lawn for good measure. Maybe Apple products, usually immune to these sorts of problems, are not so bad after all?

Yale professor, Robert Shiller, is the kind of imp like, peripatetic college professor you might expect to find in a Disney movie. Highly animated and jumping from one radical idea to the next it is hard to keep up with his stream of consciousness torrent of economic innovations. After a two-hour barrage, I was so intellectually exhausted that all I could do when I returned home was to plop down on the sofa with a Jack on the rocks and watch Fox News.

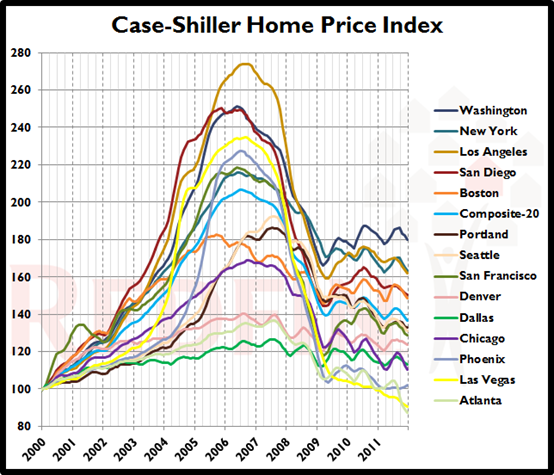

You know Robert Shiller as the creator of the Case Shiller Real Estate Index, which tracks 20 major residential housing markets around the US. His data was originally the domain of a handful of real estate brokers with a theoretical bent or securitizing investment bankers. But when the real estate collapse began to accelerate in 2007, it suddenly became the data point du jour for every property investor, business news network, and hedge fund manager.

Shiller is a devout non believer of the efficient market theory espoused by Eugene Fama of the University of Chicago. He thinks that financial markets are so emotional that they are beyond rational analysis. The systemic vulnerability of financial markets was a major cause of the 2008 crash and is still not well understood. He argues that people should have a 100 year time horizon when making investments, because that?s how long today?s children will live. Does anyone have the trading call for the Spring of 2112? (no typo!).

He says that teaching finance today is about as popular as being the university Reserve Officer Training Corps (ROTC) instructor during the Vietnam War. People are angry at bankers, as the Occupy Wall Street crowd has so amply shown, which Shiller sees as our own ?Arab Spring?. Since 1990, the top 1% of the wealthy have seen their net worth soar by 60%, while it has fallen for the other 99%.

When Occupiers discovered that their movement could cause governments to fall, it rapidly spilled beyond its Madrid, Spain origins. But the financial industry is not all bad. Witness the miracle in emerging markets which has been made possible through new capital provided by western investment bankers.

Robert titillated me with some highly creative innovations which we may see adopted in coming years. I?ll give you the highlights.

*Options on individual real estate markets, now five years old, will go mainstream and finally become liquid as individuals seek to protect their home equity during economic downturns. This will become a major area of new profits for Wall Street.

*?Continuous mortgages? should be created whereby the debt is never paid off, but is assumed from one owner to the next in exchange for a higher interest rate. If you package many of these together and securitize them, it would be a major step towards clearing out the massive inventory of unsold homes.

*The government already issues plenty of bonds and next should sell equity in itself in one trillionth increments. That puts the value of the government?s share price today at about $15.50. If the economy grows, the share price should go up.

*Tax rates for the wealthy should rise with inequality. The more wealth that is concentrated with the 1%, the higher the maximum tax rate should go. Remember, the maximum rate was 90% at the time of the Roosevelt administration during the Great Depression, nearly triple today?s 35% rate.

*The actual impact of high frequency traders, who he refers to as ?millisecond traders?, is vastly exaggerated.

*Although the new ?crowd funding? bill just signed by president Obama has been described as the ?Boiler Room Full Employment Act?, it will provide a valuable source of venture capital for micro startups. Those earning only $40,000 a year are limited to an $800 bet, with the maximum legal investment set at $10,000.

*Some 14% of the total economic activity of the US involves security. Just having people watching people is an enormous waste of resources.

*For profit nonprofits, called benefit corporations, should proliferate to advance specific social goals. These should work well as they pay little in wages and enjoy community support. They are already legal in eight states.

If you would like to attend one of Shiller?s classes for free and expose yourself to more out of the box economic thinking, you can do so through regular offerings of his online courses. To sign up for Open Yale University, which Time magazine lists as one of the top websites, please click here at http://oyc.yale.edu/economics .

And what about real estate? Robert told me that his data show that there is not the slightest sign of any long term recovery in prices. Real estate brokers insisting that the final bottom has been reached are best to be ignored. Rent, don?t buy.

With Treasury Secretary, Tim Geithner, in Beijing last week kowtowing to the largest foreign owner of our national debt, the prospect of the dollar?s demise as a reserve currency has once again reared its ugly head.

Will people pleeease stop incessantly nattering about the possibility of China dropping the dollar as a reserve currency? What else are they going to use? Monopoly money? Taiwanese dollars? Collectable postage stamps?

At $3.6 trillion and rising fast, the Middle Kingdom?s reserves are so enormous that no other currency in the world could accommodate the switch, and no other security offers the necessary depth and liquidity but US Treasuries. China only needs to breathe on any other market for it to skyrocket, we have seen in the relatively Lilliputian commodity markets in recent years.

And really, how likely is it that China embarks on radical new monetary policies that suddenly halves the earnings of its exporters, as well as its 30 year hoard of accumulated savings? The demise of the dollar has been predicted more often than the ditching of Microsoft?s Windows as the global PC operating system, and is just as likely. Hate the greenback as much as you like, but there just isn?t any other alternative.

I have been hearing these arguments ever since the US went off the gold standard in 1971. First there was a perennial Arab threat to price crude in a basket of currencies. Gee, they never seem to complain when the buck is going up. Then there was the speculated emergence of the ?Yen Block?, in the eighties, back when Japan was dominating international trade and the yen was bumping up against ?75 to the dollar. Remember the book ?Japan as Number One? What a laugh.

Next we got all that European whining after the launch of the euro, when the weak dollar was every trader?s free lunch. Let?s face it, Europeans hate using someone else?s currency as their primary reserve instrument. Before the dollar, sterling was the de facto international currency, and was equally despised. So rather than waste time discussing this issue anymore, let?s talk about something more important, like who is going to win the World Series this year. I?m wearing my Yankees hat.

Our New Reserve Currency?