Following Howard Ruff for the last 35 years has always been eye opening, if not entertaining. The irascible Mormon is the publisher of Ruff Times (http://www.rufftimes.com? ), one of the oldest investment letters in the business, and one of the original worshipers of hard assets.

The great thing about the end of the world crowd is that all of their trades are going gangbusters now and we?re all still here. Talk about a win-win! He says that any investment denominated in dollars is a mistake, which is in a long term down trend, along with all paper assets. Silver (SLV) is his first choice, which will outperform gold, and eventually top $100 from the current $27. His personal target for the barbarous relic (GLD) is $2,300, but that might prove conservative.

With the Chinese building 100 nuclear power plants over the next ten years, uranium (CCJ) has great potential. Equities may never come back from their lost decade. Don?t buy ETF?s because they are just another form of paper, and may not actually own the gold or silver they claim. The government is laying the foundation for a massive inflation which will begin soon.

Howard has long been considered card carrying member of the lunatic fringe of the investment world, sticking with hard assets throughout their 20 year bear market during the eighties and nineties, and annually predicting the demise of the federal government. Maybe it?s a case of a broken clock being right twice a day, but in recent years I find myself agreeing with Howard more and more. Whether that means I?m now a lunatic too, only time will tell.

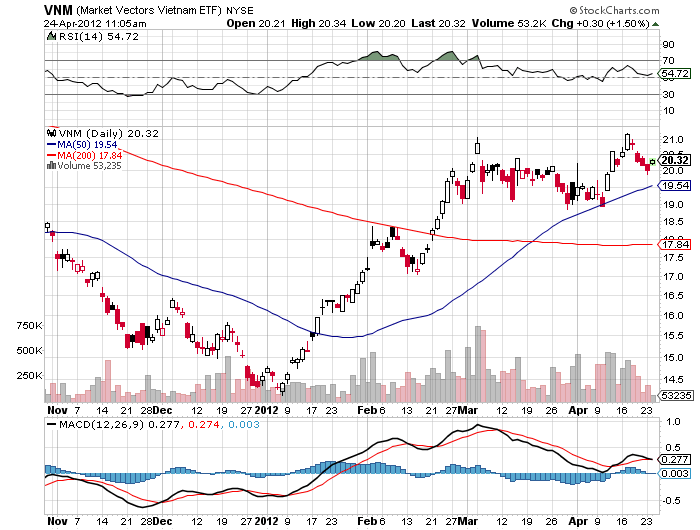

Vietnam has delivered one of the top performing stock markets so far in 2012. Take a look at the Market Vectors Vietnam ETF (VNM). The venture invests in companies that get 50% or more of their earnings from that country, with an anticipated 37% exposure in finance, and 19% in energy. This will get you easily tradable exposure in the country where China does its offshoring.

Vietnam was also one of the top performing stock markets in 2009. It was a real basket case in 2008, when zero growth and a 25% inflation rate took the main stock market index down 78%, from 1,160 to 250. This is definitely your E-ticket ride.

Vietnam is a classic emerging market play with a turbocharger. It offers lower labor costs than China, a growing middle class, and has been the target of large scale foreign direct investment. General Electric (GE) recently built a wind turbine factory there. You always want to follow the big, smart money. Its new membership in the World Trade Organization is definitely going to be a help. As my old friend, Carl Van Horn, the head of investment at JP Morgan taught me, watch direct investment, because the stock markets always follow.

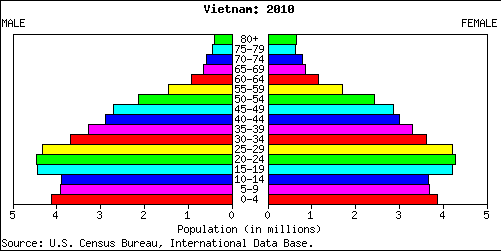

It also helps a lot that the country has one of the world?s more favorable demographic pyramids. That means it has a high percentage of young, free spending workers and relatively few older social service demanding retirees. That is partially because we killed so many off during 1960-1972.

I still set off metal detectors and my scars itch at night when the weather is turning, thanks to my last encounter with the Vietnamese, so it is with some trepidation that I revisit this enigmatic country. Throw this one into the hopper of ten year long plays you only buy on big dips, and go there on a long vacation. If we get a summer swoon in global risk assets as I expect, this would be a good name to pick up.

The green shoots are real. But watch out for the old land mines.

Pass Me a ?BUY? Ticket Please

As much as my real estate broker insists that the bottom is in for residential real estate, the raw and unvarnished data still does not support that belief. This morning, the February S&P 500 Case Shiller real estate index put in new lows for nine major markets, as well as for both composite indexes. Overall, prices are down 3.5% YOY. That takes us back to Q3, 2002 levels. It is now officially a lost decade for housing.

The foreclosure disaster in Atlanta continues unabated, with prices there down 2.5% MOM. It was followed by Chicago, -2.5%, and Cleveland, 1.7%. Believe it or not, prices in Detroit are still falling, down 1.3% MOM, and are below 1992 levels. Obtaining bank financing is still a major hurdle for many buyers. Unless you have a FICO score of over 700, the world doesn?t want to know you.

We received additional data today indicating that all is not well in River City. March new home sales absolutely collapsed by -7.1% in March, compared to a gain of +7.3% in February. It is obvious that good winter weather pulled forward demand at the expense of the current quarter. This has ominous implications for the broader economy. Did other industries see this as well?

I have been mercilessly beating up on the residential sector for seven years now. Telling people that their homes, their principal asset, still had farther to fall got me disinvited from the last dinner party years ago. The best case you can make is that we are bumping along a bottom, supported by the lowest interest rates and highest affordably in 50 years. But we are going to be here a long time. As long as the demographic headwinds remain at gale force strength, rent, don?t buy.

By the way, I had a fascinating dinner with Robert Shiller, the Yale economics professor who created this index from whole cloth. When I get some time, I?ll write it up.

Still Facing Gale Force Winds in the Real estate Market

It would be easy to ignore what is happening on the other side of the world, especially when they involve the French. But to do so today in this interconnected and interdependent world would be extremely hazardous to your wealth. When a butterfly flaps its wings in Brazil, the tsunami hits Japan.

That is exactly the extreme sort of weather event we are witnessing today with the French presidential election results. This is how they came out:

Socialist Fran?ois Hollande? 28%

Conservative Nicolas Sarkozy? 26%

Right wing Marine Le Pen 18%

Communist Jean-Luc M?lenchon 11%

Other parties and uncommitted? 17%

To say this is a disaster for Sarkozy is an understatement of the highest order. It is the first time in more than 50 years that a sitting president lost in the first round. The odds of the socialists winning again in two weeks have moved from 50:50 to more like 80:20. For Sarkozy to pull things out of the fire from here would require nothing less than a miracle.

The socialist economic policies will require an increase in government spending, growing budget deficits, an extended retirement age, and a far heavier reliance on sovereign borrowing by France. It makes a complete hash of the careful progress made by German chancellor, Angela Merkel, made towards steering Europe to live within its means. More debt issuance means higher interest rates, falling stock markets, and a continuation of the European crisis. Message: bombs away for risk assets.

The only way that Sarkozy could keep his job is to do some sort of a deal with the right wing National Front to create a coalition government. And what would be their price for such an arrangement? The immediate withdrawal of France from the Euro to recover national pride and sovereignty. Message: more bombs away for risk assets.

Needless to say, this is all hugely positive for the dollar (UUP), the yen (FXY), and US Treasury bonds (TLT), and very negative for US stocks (IWM), the Euro (FXE), oil (USO), copper (CU), gold (GLD), and silver (SLV). That house you think you recently bought at the bottom just fell in value by 5%. If you have been reading this letter in recent weeks, you already have all of the right positions and are sitting pretty. If you don?t, you better start reading.

As a long time analyst of the American political scene, I have to laugh at the results broken out by prefecture on the map below. The conservatives dominate the cities, while the socialists control the countryside, which is the complete opposite found in US election outcomes. Similarly, college grads vote conservative while the uneducated vote liberal, which again is the polar opposite of American results. No wonder I have such a hard time digesting frog legs.

The Next Prime Minister of France?

I ran into Minxin Pei, a scholar at the Carnegie Endowment for International Peace. Who imparted to me some iconoclastic out of consensus views on China?s position in the world today.

He thinks that power is not shifting from West to East; Asia is just lifting itself off the mat, with per capita GDP only at $5,800, compared to $48,000 in the US. We are simply moving from a unipolar to a multipolar world. China is not going to dominate the world, or even Asia, where there is a long history of regional rivalries and wars.

China can?t even control China, where recessions lead to revolutions, and 30% of the country, Tibet and the Uighurs, want to secede. All of Asia?s progress to date has been built on selling to the US market. Take us out, and they?re nowhere. With enormous resource, environmental, and demographic challenges constraining growth, Asia is not replacing the US anytime soon.

There is no miracle form of Asian capitalism; impoverished, younger populations are simply forced to save more because there is no social safety net. Try filing a Chinese individual tax return, where a maximum rate of 40% kicks in at an income of $35,000 a year, with no deductions, and there is no social security or Medicare in return. Ever heard of a Chinese unemployment office or jobs program?

Nor are benevolent dictatorships the answer, with the despots in Burma, Cambodia, North Korea, and Laos thoroughly trashing their countries. The press often touts the 600,000 engineers that China graduates, joined by 350,000 in India. In fact, 90% of these are only educated to a trade school standard. Asia has just one world class school, the University of Tokyo.

As much as we Americans despise ourselves and wallow in our failures, Asians see us as a bright, shining example for the world. After all, it was our open trade policies and innovation that lifted them out of poverty and destitution. Walk the streets of China, as I have done for nearly four decades, and you feel this vibrating from everything around you. I?ll consider what Minxin Pei said next time I contemplate going back into the (FXI) and (EEM).

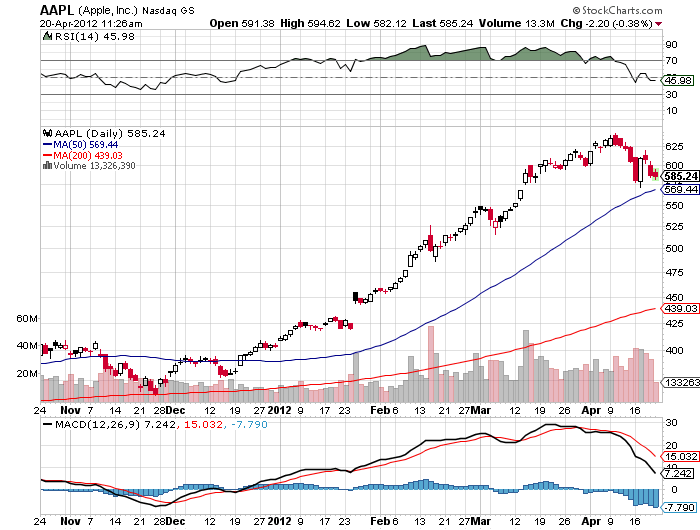

My Apple April $450-$480 call spread expired deep in the money at the close on Friday. Legally, these expire at midnight on Saturday night, so your broker won?t take these off your statement until the following Monday. The position should be zeroed out and you should receive a cash credit. You will also find that the margin requirement has disappeared.

Your net profit on this position should be $1,855, or? $1.86% for the notional $100,000 portfolio. Well done. Here is how the profit is calculated in detail:

Execution

March $450 call cost?????... $97.60

March $480 call premium earned?-$70.25

Net Cost???????.........?. $27.35

Profit Calculation at Expiration

Expiration value???????..$30.00

Purchase cost ?..??????. . $27.35

Net Profit????????.??.$2.65

Total profit = ($2.65 X 100 X 7) = $1,855 = $1.86% for the notional $100,000 portfolio.

I will go back into another position like this in the future, but only after a substantial dip in the share price. I still think that Apple will continue on its march to $1,000 a share. Coming down the road we have Apple TV and the iPhone 5. Of far greater importance will be the adoption of Apple standards by corporate America, which has long avoided Steve Jobs? creations. This is going on everywhere, and is being hastened by the demise of Blackberry (RIMM). But it is a trip that will take years, not weeks or months.

Thanks, Steve

With all of the handwringing about the zero return on US equities for the last decade, I thought I'd better take a look at the long term charts. It's very clear that we have been trading in a gigantic sideways narrowing wedge for the last 18 years, defined by 14,000 on the upside and 6,000 on the downside.

The clever investors out there, like hedge funds, have been selling every big rally and buying every dip, laughing all the way to the bank and leaving your average Joe pension fund beneficiary, 401k owner, and mutual fund investor holding the malodorous bag.

What's more, I believe that this state of affairs is going to continue for another few years. You get what you deserve. This view is consistent with an economy that isn't inventing anything new, spends more than it borrows, and lets foreigners take the technological lead through sheer indolence and complacency. We aren't going to Twitter our way to prosperity.

It also fits with 80 million baby boomers withdrawing wealth from the system, downsizing their homes, and plopping everything into the Treasury market. This means that we are much closer to the end of this run in equities than the beginning.

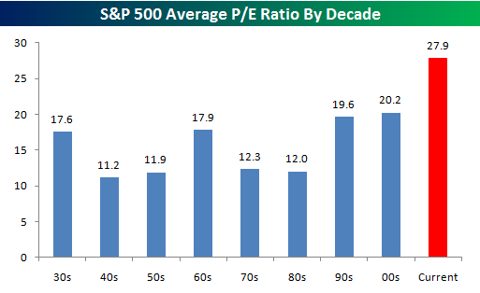

If you have any doubts, take a look at the chart below showing that stocks are more expensive now than at any time in the last nine decades. Should one of the world?s? more structurally impaired economies be commanding one of the highest PE multiples? I think not. This is why I have been using my electric cattle prod and my kangaroo skin bullwhip to herd investors to the sidelines.

The Sidelines Are a Good Place to Be

After spending all of this year ignoring the fiscal disaster that the US is facing at the end of 2012, markets are finally taking off the blinders. That might explain why the S&P 500 has dropped 4.3% so far from its April 1 peak and why it may have more to come.

Remember the debt ceiling crisis of the summer of 2011? You know, the one that triggered a 25% collapse in US stock prices? The compromise that was struck required major progress in deficit reduction by November, or drastic measures would automatically kick in.

Well guess what? Zero progress has been made. None can be expected until after the November 6 election as long as both parties expect to win. That allows just eight weeks for the president and congress to repair some of the most serious fiscal damage ever to strike the country, three of which will be vacation weeks.

Add up the numbers and the potential impact on the economy is particularly grim. If congress takes no action by year end, a series of tax increases and spending cuts will automatically take effect that will squeeze the life out of the economy. Think Austerity with a capital ?A?. Think Spain with a capital ?S?. Even Federal Reserve Chairman, Ben Bernanke, a man normally disposed to making cautious, taciturn statements has described the problem as ?A massive fiscal cliff?.

Here is the forbidding breakdown in terms of their effect on annual GDP growth:

-0.2%? Expiration of unemployment benefits

-0.8%? Automatic spending cuts required by sequestration

-0.8%? Expiration of payroll tax cuts

-1.0%? Expiration of Bush tax cuts

-2.8%? Total

The big problem is that the economy doesn?t have much economic growth to give away. My own forecast for GDP for 2012 is still at 2%. But that is based on the assumption that corporate earnings would bring in 5% growth, down from last year?s torrid 15% growth. My calculator tells me that 2% -2.8% = recession. Danger! Danger! Current stock prices are not reflecting this reality.

It gets worse. The 15% of companies that have reported Q1, 2012 earnings so far have delivered a much more modest 1% growth, well below my own minimal expectations. That is with the earnings cycle front loaded with the most profitable companies in technology. It also reflects a lot of business pulled forward into Q1 from Q2 and Q3 by the warm winter. Yikes!

It?s hard to see how this ends happily for the stock market. The best case scenario would be for a lame duck president and congress, no longer worried about reelection, to cobble together a deal in December. Some sort of resuscitation of the ?grand bargain? that was on the table last summer, but suffocated in its crib by the Tea Party because it included tax increases, might work. Alternatively, if one party or the other sweeps the election, it could ram through something. But that outcome is unlikely. A divided country gets the dysfunctional government it deserves.

The headache for equity investors and risk investors in general is that even the mere discussion of the weighty matters triggers a huge ?RISK OFF? trade. Confidence withers, business and consumer spending slows, and the economic data takes a hit. That?s what happened last summer, when the markets discounted a full blown double dip recession that never actually happened. It?s a given that our representatives in congress don?t understand this.

Is This Our Fiscal Policy?

With gasoline prices staying stubbornly high, the number of hybrid and electric cars manufactured is soaring skyward. Toyota Motors (TM) is far and away the biggest beneficiary as the world?s largest manufacturer of hybrid cars with its Prius family that now extends to five models. Nissan Motors (NSANY) is expected to complete construction of a Tennessee plant that will produce 150,000 all-electric Leafs a year in 2014.

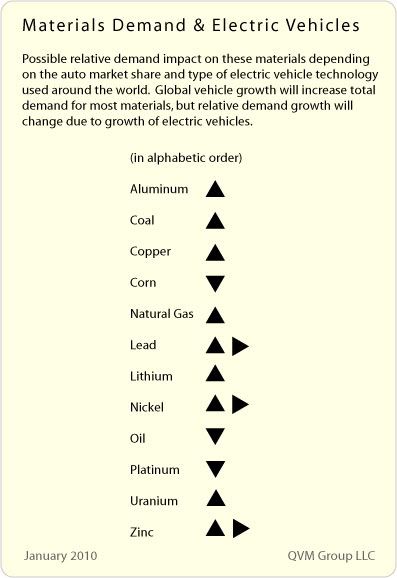

Beyond these obvious beneficiaries it gets a little more complicated. I found this interesting table from the QVM Group that listed the impact that electric cars, which will soon be produced at one million units a year, will have on the supply and demand for raw materials. Here are my comments:

Aluminum (AA): Lighter cars need more aluminum for bodies

Coal (KOL): Greater electricity needs increase demand from this cheapest of sources.

Copper (CU): Big increase in demand for copper wire from electric motors and the grid.

Corn (CORN): Kiss the pork barrel ethanol program goodbye. Demand falls.

Natural Gas (UNG): Some 100% of new power generation facilities are gas fueled.

Lead: Older technology batteries still use lots of lead.

Lithium (SQM): You can?t lose. If electric car demand doesn?t kick in, then fertilizer demand will.

Nickel: The same batteries use nickel

Oil (USO): Some analysts think gasoline demand could drop by 50% by 2020 because of electric cars, mileage improvements in conventional cars, and the discovery of huge new fields in the US with fracking technology.

Platinum (PPLT): Demand falls from fewer catalytic converters, but this will be offset by growing monetary demand for the white metal.

Uranium (NLR) : More power demand means more nukes everywhere.

Zinc: Battery demand again

Who Am I Helping?

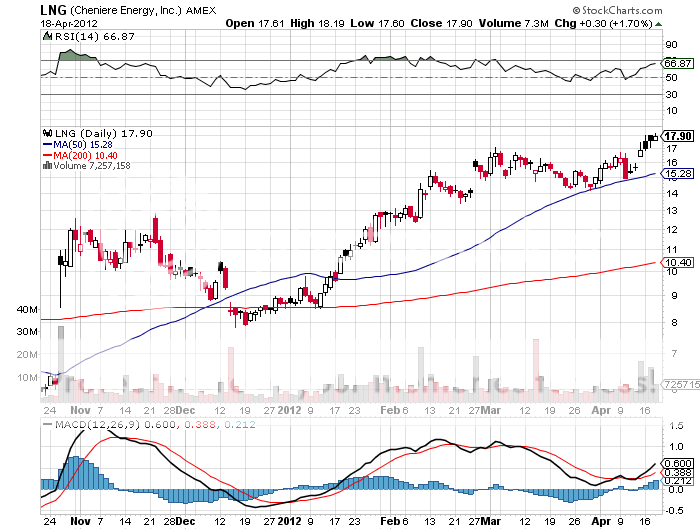

There is never any guarantee that a government agency will not do something idiotic. This time it didn?t, thankfully. The Federal Energy Regulatory Commission (FERC) granted the final license needed by Cheniere Energy (LNG) to build the first of two liquifaction plants at Sabine Pass on the Texas Louisiana border on the Gulf of Mexico. These will be the first such plants built in the US in 40 years.

FERC gave to go ahead despite vocal opposition from the Sierra Club, which claimed that fracking caused environmental damage. This, of course, is complete bunk. MIT recently published a study of 50 incidents where gas made it into local water supplies. In every case, it was shown to be the cause of subcontractor incompetence and inexperience, not because of any fundamental flaws with the technology.

The move is a crucial step towards turning the US into a major natural gas (UNG) exporter. The company has already contracted to sell 89% of the plants? planned annual output of 16 million tonnes. Buyers include BG Group of the UK, Gas Natural Fenosa of Spain, Gail of India, and Kogas of South Korea. Initial deliveries are expected to commence at the end of 2015.

The shares jumped to $18, a new high for the year, and reached as high as $19 in premarket trading. You may recall that I recommended this stock to readers back on March 7 when it was trading at $16.10 a share (click here for ?Take a Look at Cheniere Energy (LNG)?). I think it is just a matter of time before the stock surpasses its next hurdle at $20, especially if natural gas continues its collapse under $2/MM BTU.

Ready for Export