At the Orlando Money Show in February I recorded three videos, which readers can watch for educational purposes. I cover the coming disaster in Japan, the current state of technology in electric cars, and the long term opportunities in India. They are only about five minutes in duration each. If you want to see how this newsletter has visibly aged me, have a look. At least I am wearing better suits these days. I have included the links below.

One Country at the Tipping Point

http://www.moneyshow.com/video/video.asp?wid=7956&t=3&scode=027351

Going Electric

http://www.moneyshow.com/video/video.asp?wid=7934&t=3&scode=027351

India's The Best Bet

http://www.moneyshow.com/video/video.asp?wid=7955&t=3&scode=027351

I tell people at my strategy luncheons that living in the San Francisco Bay area is like living in the future. There is an explosion of high tech innovation going on here, and we locals often find ourselves the guinea pigs for the latest hot products. However, sometimes the future is not such a great place to be.

I learned this the other day when I received a parking ticket in the mail. I didn?t recall finding a notice of violation tucked under my windshield wiper in the recent past, so I looked into it. To my chagrin, I learned that the city is now outfitting its busses with video cameras pointing forward and sideways. The digital recordings are then transmitted to parking control officers sitting behind computers for review.? They issue tickets which are mailed to the registered owner of the vehicles.

San Francisco suffers from one of the worst parking nightmares in the country. The streets were never planned, they just sort of happened on their own during the frenzy of the 1849 gold rush. They were built to handle the traffic of horses and carriages, and later cable cars, not the crush of traffic we get today.

Sky high real estate prices have driven millions into the suburbs across the bridges over which they must commute. So parking has always been in short supply and it is very expensive. When I drive into the city for a Saturday night dinner, sometimes the parking tab is more expensive than the meal.

Newly minted millionaires from tech IPO?s are now buying vintage Victorian homes, and then retrofitting garages underneath them. Every time this is done, it eliminates another parking spot on the street to make room for the driveway. So while the traffic is increasing, the number of parking spots is actually declining.

The city originally installed the cameras to catch offenders driving in bus lanes during rush hour. When they discovered that the cameras also captured the license plates of illegally parked cars they expanded the program. Last year 3,000 such tickets were issued.

The program has been so successful that the cash strapped city will greatly expand it this year. And with a great San Francisco track record to point to, the firm selling the system is planning on going nationwide. Soon it will come to a city near you. Like I said, sometimes the future is not such a great place to be.

Parking in San Francisco Can be Tight

Boeing Aircraft (BA) is one of the great icons of American manufacturing, and also one of the country?s largest exporters. I was given a private, sneak preview of the new Dreamliner at the Everett plant days before the official launch with the public, and I can tell you that this engineering marvel is a quantitative leap forward in technology. No surprise that the company has amassed one of the greatest back order books in history.

I can also tell you that my family has a very long history with Boeing (BA). During WWII, my dad got down on his knees and kissed the runway when the B-17 bomber in which he served as tail gunner (two probables) made it back, despite the many holes. It was only after the war that he learned that the job had one of the highest fatality rates in the in the services.

Some 40 years later, I got down on my knees and kissed the runway when a tired and rickety Boeing 707 held together with spit and bailing wire, which was first delivered as Dwight Eisenhower?s Air Force One in 1955, flew me and the rest of Reagan?s White House Press Corp to Tokyo in 1983 and made it there in one piece.

I even tried to buy my own personal B-17 bomber in the nineties for a nonprofit air show I was planning, but was outbid by Paul Allen on behalf of his new aviation museum. Note to self: never try to outbid Paul Allen, a cofounder of Microsoft, on anything.

So it is with the greatest difficulty that I examine this company in the cold hard light of a stock analyst. There is nothing fundamentally wrong with the company. But its major customers around the world are suffering from some unprecedented stress.

US airlines are getting hammered by the high cost of fuel. Delta even resorted to the unprecedented move of buying its own refinery to assure fuel supplies. Europe, where Boeing competes fiercely against its archenemy, Airbus, is clearly in recession. Government owned airlines there are in ferocious cost cutting mode.

China, another one of Boeing?s largest customers, is also slowing down. As for Japan, the economy there is going from bad to worse. All Nippon Airways was awarded the first Dreamliner for delivery because it is such a large customer. It is just a matter of time before this harsh reality starts to put a dent in the company?s impressive earnings growth.

Take a look at the chart below and you?ll see what I mean. Despite having a tailwind of one of the strongest bull markets in history, (BA) shares have continuously bumped up against an invisible ceiling at $76/share. Now that we have some general market weakness, I think the stock is ripe for probing some serious downside.

If the selloff continues for another week or two, we could take a run at the 200 day moving average at $68.75. Break that, and the next support is at $60. Touch $60, and the August, 2012 $70 puts that I picked up for $3.45 could hit $9. Even half of that move would produce a great trade. But you may have to suffer some turbulence to get there. This is not for the weak of heart.

They Build Those Boeings to Last

Reformed oil man, repenting sinner, and borne again environmentalist T. Boone Pickens says that ?When we turn the US green, it will have the best economy ever.? I met the spry, homespun billionaire at San Francisco?s Mark Hopkins on a leg of his self-financed national campaign to get America to kick its dangerous dependence on foreign oil imports.

For the past 30 years, the US has had no energy policy because ?no one wanted to kick a sleeping dog? while oil was cheap. Production at Mexico?s main Cantarell field is collapsing, and will force that country to become a net importer in five years. Venezuela will be shifting exports of its sulfur laden crude to China for political reasons, once refineries in the Middle Kingdom are completed to handle it.

Unfortunately, unstable energy prices and the disappearance of credit have put alternative energy development on a back burner. If the US doesn?t make the right investments now, our energy dependence will simply shift from one self-interested foreign supplier (Saudi Arabia) to another (China).

Wind and solar alone won?t work on still nights, and can?t power an 18 wheeler. Don?t count on the help of the big oil companies, because they get 81% of their earnings from selling imported oil, and don?t want to kill the goose that laid the golden egg. The answer is a diverse blend of multiple alternative energy supplies from American only sources.

Although Boone now has Obama?s ear, it?s a long learning process. Boone has donated $700 million to charity, and says the 20,000 trees he has planted should offset the carbon footprint of his Gulfstream V private jet.

I worked with Boone to organize financing for a Mesa Petroleum Pac Man oil company takeover in the early eighties, when it was cheaper to drill for oil on the floor of the New York Stock Exchange than in the field. Now 82, he has not slowed down a nanosecond.

82 and Still Sharp as a Tack

I received another one of those scratchy, barely audible cell phone calls from my buddy at the Barnet Shale in Texas this morning.

Cheniere Energy (LNG) is has obtained three of the four permits it needs to begin construction of a gas liquifaction plant in Louisiana. This will enable the company to export natural gas (UNG) to Asia, where it is selling for prices eight times higher that here in the US. The project will be a major step towards dealing with the enormous glut of natural gas dumped on the market by the new ?fracking? process that has taken prices down to under $2/MM BTU?s, a new 12 year low.

Today we learned that (LNG) made it on to the calendar for a Federal Energy Commission (FERC) hearing on April 19 to consider this last license. That news alone was enough to drive the share up 7% today to a new high for the year. There the company will be opposed by the usual anti carbon alliance of environmentalists.

You may recall that I recommended this stock to readers back March 7 when it was trading at $16.10 a share (click here for ?Take a Look at Cheniere Energy (LNG)?). Today, the stock hit a high of $17.48, a gain of 8.6% since then. If Cheniere get the permit, as it is likely to do, the shares are likely to double. If it doesn?t, it will halve. I?ll leave it up to you to decide how best to play this.

From my mountain top aerie in the Oakland Hills I had a front row seat to the spectacular lightning storm that hit San Francisco last week. I saw both towers of the Golden Gate Bridge get hit simultaneously. I just thought I would pass on some of the more amazing pictures. It is all part of life?s rich tapestry. Enjoy.

I'm at the second strike from the left!

In case you missed it, the second hand animal market has crashed. Forced to slash budgets by cash starved municipalities, the nation?s public zoos have been paring back their collections of living exhibits.

The Washington Zoo is trying to offload a 7,000 pound hippopotamus; while the San Francisco Zoo is short some tigers after one ate a visitor and had to be shot. The Portland Zoo was able to liquidate a portfolio of lemurs only because of the popularity of the recent DreamWorks? ?Madagascar 2? animated film.

When zoos are forced to economize, they downsize the big eaters first to save on feed costs; hence, the absence of elephants in San Francisco (Could this be a political gesture?). In fact, zoo staff were recently busted for illegally harvesting acacia on private property, a favorite food of giraffes, which grows wild here after its introduction a century ago. The hardest to move? Baltimore has been trying to sell its snake collection for two years now. Talk about an illiquid market. Maybe they should try AIG. Snake derivatives anyone?

Pink Slips for Tony?

I couldn?t for the life of me figure out why New York?s former governor and federal prosecutor, Elliot Spitzer, wanted to invite me to dinner. He wasn?t flogging a book or promoting a movie, and he certainly wasn?t running for office again. But I went anyway, thinking perhaps the notorious ?Client No.9? might let me peek at his famous black book.

Elliot, who showed up wearing a classic New York blue pin stripped suit that seems oddly out of place in San Francisco, is currently running his family?s commercial real estate business. He told me that the advantages that the US enjoyed over the rest of the world in 1945, such as a monopoly in skilled labor, are now long gone. The driver of the world economy has switched from America to Asia in the nineties.

As a result, income distribution here has morphed from a bell shaped curve to a barbell, with both the wealthy and the poor increasing in numbers, squeezing the middle class. The financial crisis compressed 30 years of change into two, taking us from libertarian Ayn Rand to pay czar Ken Feinberg in one giant leap.

Having cut his teeth prosecuting the Gambino crime family in the eighties, Elliot had some views on the need for more regulation. We only need to enforce the laws on the books, not pass new ones. The ?white collarization? of organized crime has been a secular trend since the sixties. He said the ethical lapses in the run up to the crash were best characterized by a quote from Merrill Lynch?s Jack Robins; ?What used to be a conflict of interest is now a synergy.?

AIG getting 100 cents on the dollar was the greatest scam in history. The US did not extract a high enough price from highly paid executives and shareholders of financial institutions for failure, and should have let more firms go under. As for his own scandal last year, Elliot admitted that he failed, that his flaws were made publicly apparent, and that other politicians should be smarter than he was.

Although Elliot had some good ideas, I was still puzzled over what this was all about as I ploughed through my creme brulee. Perhaps the governor has a pathological need to be in front of the spotlight, even at the risk of flaming out. And no luck with the black book.

Note to self. Don't do your midnight pee next to the bear box. They're called that for a reason. And I'm sorry that my shouting at the hungry, six foot tall black bear standing in front of me, no doubt attracted by my Cheetos, hot dogs, and marshmallows, woke up the campers at the 57 surrounding sites.

Of course it was too dark to find my bear spray. My ursine challenger eventually saw the merit of my logic that the neighbor's bacon stuffed ice chest was more appealing than me, and lumbered off into the darkness. Such was the conclusion of my camping trip on the California coast last weekend.

I am now dealing with a bear of a different sort, the financial kind. Never have I seen such a disconnect between the markets and the real economy. We have a 4% GDP stock market and a 2% GDP real economy.

All of a sudden the world has gotten expensive. Stock prices have been levitated by vapor in a faith based rally. Cost cutting, not sales growth, has artificially boosted earnings above subterranean forecasts. Commodity prices are now rolling over because of soured speculation and stockpiling and a dearth of real end consumption. This year?s rise has been entirely driven by multiple expansion, from 11 to 14 times earnings. Will this multiple expand further when earnings disappoint, as Alcoa just did with a 69% YOY drop in profits?

I am using the big up days to buy short dated out-of- the-money puts, which if I get things right should double in value. That's because I keep my favorite quote from John Maynard Keynes pasted to my monitor, ?Markets can remain irrational longer than you can remain liquid.? Sure we're going down more, but zero interest rates won't let us crash. Date your short positions, don?t marry them. This is not the big one. For that, you?ll have to wait until next year.

Date, Don?t Marry Those Short Positions

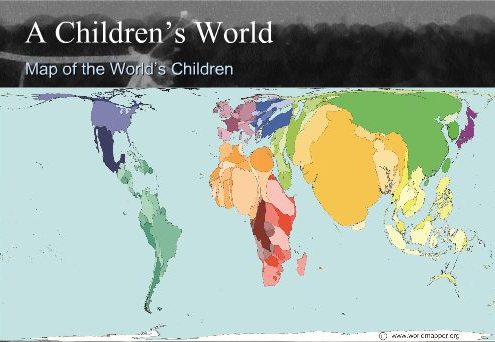

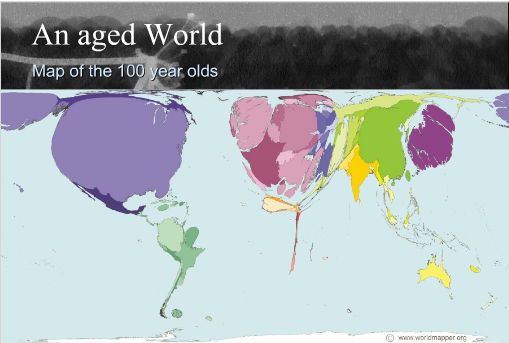

You can never underestimate the importance of demographics in shaping long term investment trends, so I thought I?d pass on these two highly instructive maps.

The first shows a map of the world drawn in terms of the population of children, while the second illustrates the globe in terms of its 100 year olds. Notice that China and India dominate the children?s map. Kids turn into consumers in 20 years, stay healthy for a long time, and power economic growth. The US, Japan, and Europe shrink to a fraction of their actual size on the children?s map, so economic growth is in a long term secular downtrend there.

There is more bad news for the developed world on the centenarian?s map, which show these countries ballooning in size to grotesque, unnatural proportions. This means higher social security and medical costs, plunging productivity, and falling GDP growth.

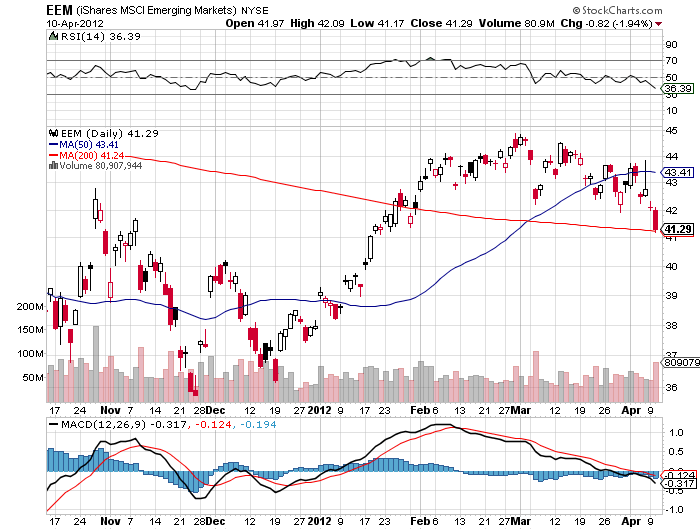

The bottom line is that you want to own equities and local currencies of emerging market countries, and avoid developed countries like the plague. This is why we saw tenfold returns from SOME emerging markets (EEM) over the past ten, and why there is an irresistible force pushing their currencies upward (CYB). Use any major melt downs this year to increase your exposure to emerging markets, as I will.

Would You Rather Own Them?

Or Them?