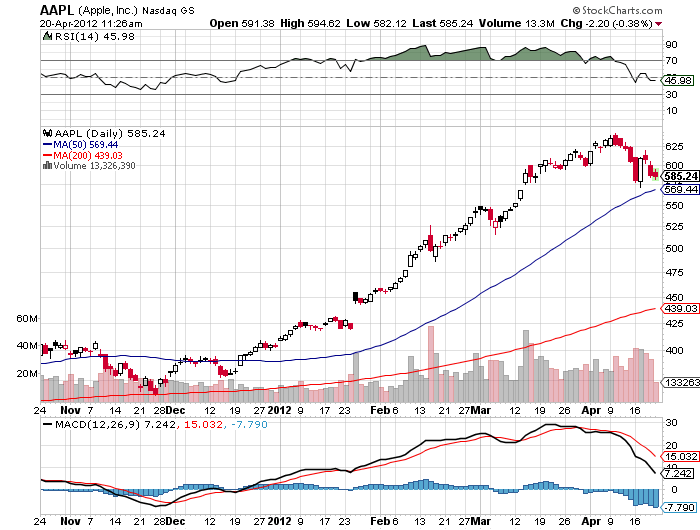

My Apple April $450-$480 call spread expired deep in the money at the close on Friday. Legally, these expire at midnight on Saturday night, so your broker won?t take these off your statement until the following Monday. The position should be zeroed out and you should receive a cash credit. You will also find that the margin requirement has disappeared.

Your net profit on this position should be $1,855, or? $1.86% for the notional $100,000 portfolio. Well done. Here is how the profit is calculated in detail:

Execution

March $450 call cost?????... $97.60

March $480 call premium earned?-$70.25

Net Cost???????.........?. $27.35

Profit Calculation at Expiration

Expiration value???????..$30.00

Purchase cost ?..??????. . $27.35

Net Profit????????.??.$2.65

Total profit = ($2.65 X 100 X 7) = $1,855 = $1.86% for the notional $100,000 portfolio.

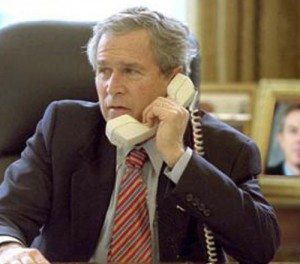

I will go back into another position like this in the future, but only after a substantial dip in the share price. I still think that Apple will continue on its march to $1,000 a share. Coming down the road we have Apple TV and the iPhone 5. Of far greater importance will be the adoption of Apple standards by corporate America, which has long avoided Steve Jobs? creations. This is going on everywhere, and is being hastened by the demise of Blackberry (RIMM). But it is a trip that will take years, not weeks or months.

Thanks, Steve

With all of the handwringing about the zero return on US equities for the last decade, I thought I'd better take a look at the long term charts. It's very clear that we have been trading in a gigantic sideways narrowing wedge for the last 18 years, defined by 14,000 on the upside and 6,000 on the downside.

The clever investors out there, like hedge funds, have been selling every big rally and buying every dip, laughing all the way to the bank and leaving your average Joe pension fund beneficiary, 401k owner, and mutual fund investor holding the malodorous bag.

What's more, I believe that this state of affairs is going to continue for another few years. You get what you deserve. This view is consistent with an economy that isn't inventing anything new, spends more than it borrows, and lets foreigners take the technological lead through sheer indolence and complacency. We aren't going to Twitter our way to prosperity.

It also fits with 80 million baby boomers withdrawing wealth from the system, downsizing their homes, and plopping everything into the Treasury market. This means that we are much closer to the end of this run in equities than the beginning.

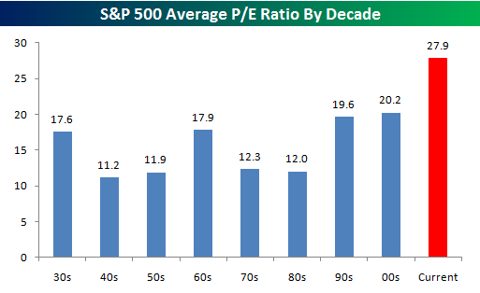

If you have any doubts, take a look at the chart below showing that stocks are more expensive now than at any time in the last nine decades. Should one of the world?s? more structurally impaired economies be commanding one of the highest PE multiples? I think not. This is why I have been using my electric cattle prod and my kangaroo skin bullwhip to herd investors to the sidelines.

The Sidelines Are a Good Place to Be

After spending all of this year ignoring the fiscal disaster that the US is facing at the end of 2012, markets are finally taking off the blinders. That might explain why the S&P 500 has dropped 4.3% so far from its April 1 peak and why it may have more to come.

Remember the debt ceiling crisis of the summer of 2011? You know, the one that triggered a 25% collapse in US stock prices? The compromise that was struck required major progress in deficit reduction by November, or drastic measures would automatically kick in.

Well guess what? Zero progress has been made. None can be expected until after the November 6 election as long as both parties expect to win. That allows just eight weeks for the president and congress to repair some of the most serious fiscal damage ever to strike the country, three of which will be vacation weeks.

Add up the numbers and the potential impact on the economy is particularly grim. If congress takes no action by year end, a series of tax increases and spending cuts will automatically take effect that will squeeze the life out of the economy. Think Austerity with a capital ?A?. Think Spain with a capital ?S?. Even Federal Reserve Chairman, Ben Bernanke, a man normally disposed to making cautious, taciturn statements has described the problem as ?A massive fiscal cliff?.

Here is the forbidding breakdown in terms of their effect on annual GDP growth:

-0.2%? Expiration of unemployment benefits

-0.8%? Automatic spending cuts required by sequestration

-0.8%? Expiration of payroll tax cuts

-1.0%? Expiration of Bush tax cuts

-2.8%? Total

The big problem is that the economy doesn?t have much economic growth to give away. My own forecast for GDP for 2012 is still at 2%. But that is based on the assumption that corporate earnings would bring in 5% growth, down from last year?s torrid 15% growth. My calculator tells me that 2% -2.8% = recession. Danger! Danger! Current stock prices are not reflecting this reality.

It gets worse. The 15% of companies that have reported Q1, 2012 earnings so far have delivered a much more modest 1% growth, well below my own minimal expectations. That is with the earnings cycle front loaded with the most profitable companies in technology. It also reflects a lot of business pulled forward into Q1 from Q2 and Q3 by the warm winter. Yikes!

It?s hard to see how this ends happily for the stock market. The best case scenario would be for a lame duck president and congress, no longer worried about reelection, to cobble together a deal in December. Some sort of resuscitation of the ?grand bargain? that was on the table last summer, but suffocated in its crib by the Tea Party because it included tax increases, might work. Alternatively, if one party or the other sweeps the election, it could ram through something. But that outcome is unlikely. A divided country gets the dysfunctional government it deserves.

The headache for equity investors and risk investors in general is that even the mere discussion of the weighty matters triggers a huge ?RISK OFF? trade. Confidence withers, business and consumer spending slows, and the economic data takes a hit. That?s what happened last summer, when the markets discounted a full blown double dip recession that never actually happened. It?s a given that our representatives in congress don?t understand this.

Is This Our Fiscal Policy?

With gasoline prices staying stubbornly high, the number of hybrid and electric cars manufactured is soaring skyward. Toyota Motors (TM) is far and away the biggest beneficiary as the world?s largest manufacturer of hybrid cars with its Prius family that now extends to five models. Nissan Motors (NSANY) is expected to complete construction of a Tennessee plant that will produce 150,000 all-electric Leafs a year in 2014.

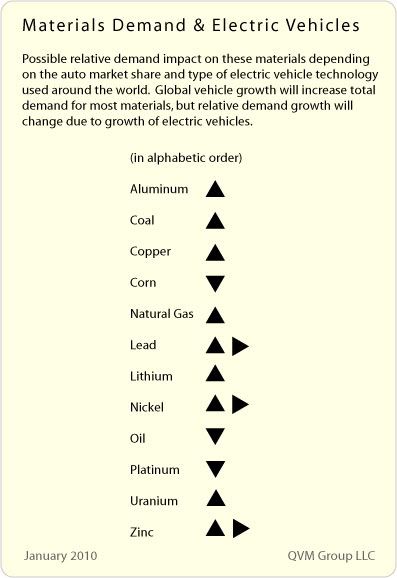

Beyond these obvious beneficiaries it gets a little more complicated. I found this interesting table from the QVM Group that listed the impact that electric cars, which will soon be produced at one million units a year, will have on the supply and demand for raw materials. Here are my comments:

Aluminum (AA): Lighter cars need more aluminum for bodies

Coal (KOL): Greater electricity needs increase demand from this cheapest of sources.

Copper (CU): Big increase in demand for copper wire from electric motors and the grid.

Corn (CORN): Kiss the pork barrel ethanol program goodbye. Demand falls.

Natural Gas (UNG): Some 100% of new power generation facilities are gas fueled.

Lead: Older technology batteries still use lots of lead.

Lithium (SQM): You can?t lose. If electric car demand doesn?t kick in, then fertilizer demand will.

Nickel: The same batteries use nickel

Oil (USO): Some analysts think gasoline demand could drop by 50% by 2020 because of electric cars, mileage improvements in conventional cars, and the discovery of huge new fields in the US with fracking technology.

Platinum (PPLT): Demand falls from fewer catalytic converters, but this will be offset by growing monetary demand for the white metal.

Uranium (NLR) : More power demand means more nukes everywhere.

Zinc: Battery demand again

Who Am I Helping?

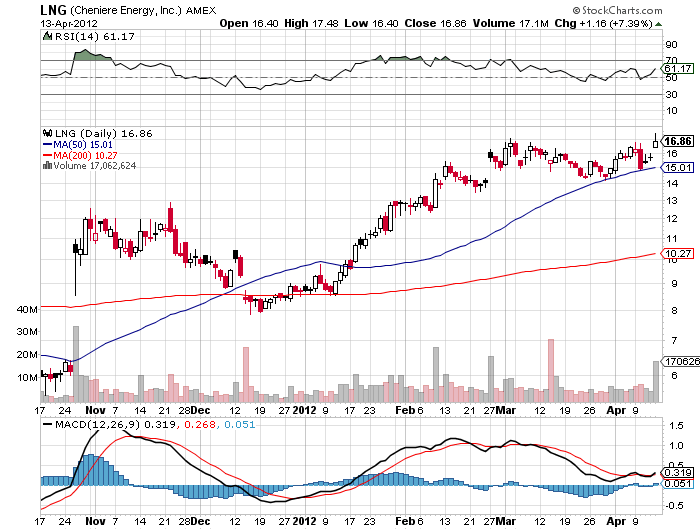

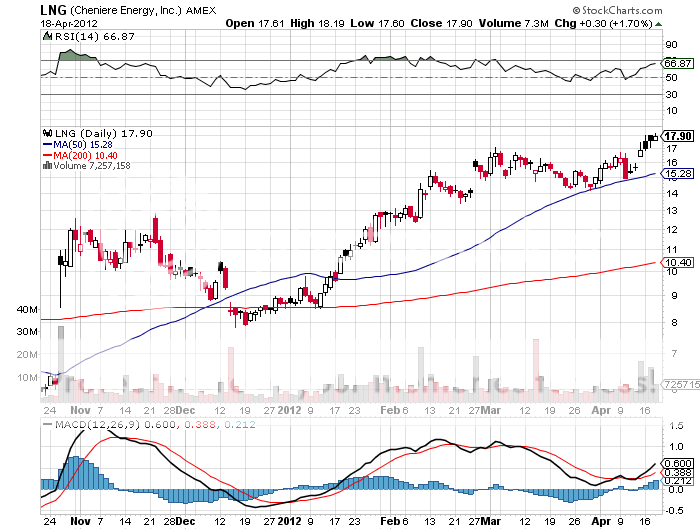

There is never any guarantee that a government agency will not do something idiotic. This time it didn?t, thankfully. The Federal Energy Regulatory Commission (FERC) granted the final license needed by Cheniere Energy (LNG) to build the first of two liquifaction plants at Sabine Pass on the Texas Louisiana border on the Gulf of Mexico. These will be the first such plants built in the US in 40 years.

FERC gave to go ahead despite vocal opposition from the Sierra Club, which claimed that fracking caused environmental damage. This, of course, is complete bunk. MIT recently published a study of 50 incidents where gas made it into local water supplies. In every case, it was shown to be the cause of subcontractor incompetence and inexperience, not because of any fundamental flaws with the technology.

The move is a crucial step towards turning the US into a major natural gas (UNG) exporter. The company has already contracted to sell 89% of the plants? planned annual output of 16 million tonnes. Buyers include BG Group of the UK, Gas Natural Fenosa of Spain, Gail of India, and Kogas of South Korea. Initial deliveries are expected to commence at the end of 2015.

The shares jumped to $18, a new high for the year, and reached as high as $19 in premarket trading. You may recall that I recommended this stock to readers back on March 7 when it was trading at $16.10 a share (click here for ?Take a Look at Cheniere Energy (LNG)?). I think it is just a matter of time before the stock surpasses its next hurdle at $20, especially if natural gas continues its collapse under $2/MM BTU.

Ready for Export

At the Orlando Money Show in February I recorded three videos, which readers can watch for educational purposes. I cover the coming disaster in Japan, the current state of technology in electric cars, and the long term opportunities in India. They are only about five minutes in duration each. If you want to see how this newsletter has visibly aged me, have a look. At least I am wearing better suits these days. I have included the links below.

One Country at the Tipping Point

http://www.moneyshow.com/video/video.asp?wid=7956&t=3&scode=027351

Going Electric

http://www.moneyshow.com/video/video.asp?wid=7934&t=3&scode=027351

India's The Best Bet

http://www.moneyshow.com/video/video.asp?wid=7955&t=3&scode=027351

I tell people at my strategy luncheons that living in the San Francisco Bay area is like living in the future. There is an explosion of high tech innovation going on here, and we locals often find ourselves the guinea pigs for the latest hot products. However, sometimes the future is not such a great place to be.

I learned this the other day when I received a parking ticket in the mail. I didn?t recall finding a notice of violation tucked under my windshield wiper in the recent past, so I looked into it. To my chagrin, I learned that the city is now outfitting its busses with video cameras pointing forward and sideways. The digital recordings are then transmitted to parking control officers sitting behind computers for review.? They issue tickets which are mailed to the registered owner of the vehicles.

San Francisco suffers from one of the worst parking nightmares in the country. The streets were never planned, they just sort of happened on their own during the frenzy of the 1849 gold rush. They were built to handle the traffic of horses and carriages, and later cable cars, not the crush of traffic we get today.

Sky high real estate prices have driven millions into the suburbs across the bridges over which they must commute. So parking has always been in short supply and it is very expensive. When I drive into the city for a Saturday night dinner, sometimes the parking tab is more expensive than the meal.

Newly minted millionaires from tech IPO?s are now buying vintage Victorian homes, and then retrofitting garages underneath them. Every time this is done, it eliminates another parking spot on the street to make room for the driveway. So while the traffic is increasing, the number of parking spots is actually declining.

The city originally installed the cameras to catch offenders driving in bus lanes during rush hour. When they discovered that the cameras also captured the license plates of illegally parked cars they expanded the program. Last year 3,000 such tickets were issued.

The program has been so successful that the cash strapped city will greatly expand it this year. And with a great San Francisco track record to point to, the firm selling the system is planning on going nationwide. Soon it will come to a city near you. Like I said, sometimes the future is not such a great place to be.

Parking in San Francisco Can be Tight

Boeing Aircraft (BA) is one of the great icons of American manufacturing, and also one of the country?s largest exporters. I was given a private, sneak preview of the new Dreamliner at the Everett plant days before the official launch with the public, and I can tell you that this engineering marvel is a quantitative leap forward in technology. No surprise that the company has amassed one of the greatest back order books in history.

I can also tell you that my family has a very long history with Boeing (BA). During WWII, my dad got down on his knees and kissed the runway when the B-17 bomber in which he served as tail gunner (two probables) made it back, despite the many holes. It was only after the war that he learned that the job had one of the highest fatality rates in the in the services.

Some 40 years later, I got down on my knees and kissed the runway when a tired and rickety Boeing 707 held together with spit and bailing wire, which was first delivered as Dwight Eisenhower?s Air Force One in 1955, flew me and the rest of Reagan?s White House Press Corp to Tokyo in 1983 and made it there in one piece.

I even tried to buy my own personal B-17 bomber in the nineties for a nonprofit air show I was planning, but was outbid by Paul Allen on behalf of his new aviation museum. Note to self: never try to outbid Paul Allen, a cofounder of Microsoft, on anything.

So it is with the greatest difficulty that I examine this company in the cold hard light of a stock analyst. There is nothing fundamentally wrong with the company. But its major customers around the world are suffering from some unprecedented stress.

US airlines are getting hammered by the high cost of fuel. Delta even resorted to the unprecedented move of buying its own refinery to assure fuel supplies. Europe, where Boeing competes fiercely against its archenemy, Airbus, is clearly in recession. Government owned airlines there are in ferocious cost cutting mode.

China, another one of Boeing?s largest customers, is also slowing down. As for Japan, the economy there is going from bad to worse. All Nippon Airways was awarded the first Dreamliner for delivery because it is such a large customer. It is just a matter of time before this harsh reality starts to put a dent in the company?s impressive earnings growth.

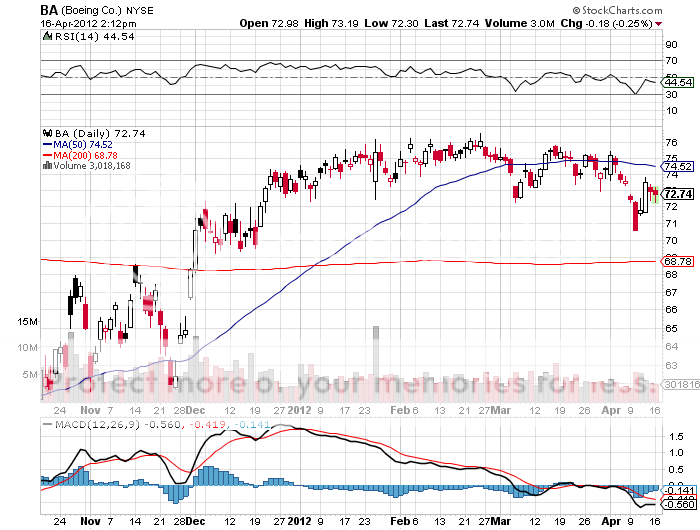

Take a look at the chart below and you?ll see what I mean. Despite having a tailwind of one of the strongest bull markets in history, (BA) shares have continuously bumped up against an invisible ceiling at $76/share. Now that we have some general market weakness, I think the stock is ripe for probing some serious downside.

If the selloff continues for another week or two, we could take a run at the 200 day moving average at $68.75. Break that, and the next support is at $60. Touch $60, and the August, 2012 $70 puts that I picked up for $3.45 could hit $9. Even half of that move would produce a great trade. But you may have to suffer some turbulence to get there. This is not for the weak of heart.

They Build Those Boeings to Last

Reformed oil man, repenting sinner, and borne again environmentalist T. Boone Pickens says that ?When we turn the US green, it will have the best economy ever.? I met the spry, homespun billionaire at San Francisco?s Mark Hopkins on a leg of his self-financed national campaign to get America to kick its dangerous dependence on foreign oil imports.

For the past 30 years, the US has had no energy policy because ?no one wanted to kick a sleeping dog? while oil was cheap. Production at Mexico?s main Cantarell field is collapsing, and will force that country to become a net importer in five years. Venezuela will be shifting exports of its sulfur laden crude to China for political reasons, once refineries in the Middle Kingdom are completed to handle it.

Unfortunately, unstable energy prices and the disappearance of credit have put alternative energy development on a back burner. If the US doesn?t make the right investments now, our energy dependence will simply shift from one self-interested foreign supplier (Saudi Arabia) to another (China).

Wind and solar alone won?t work on still nights, and can?t power an 18 wheeler. Don?t count on the help of the big oil companies, because they get 81% of their earnings from selling imported oil, and don?t want to kill the goose that laid the golden egg. The answer is a diverse blend of multiple alternative energy supplies from American only sources.

Although Boone now has Obama?s ear, it?s a long learning process. Boone has donated $700 million to charity, and says the 20,000 trees he has planted should offset the carbon footprint of his Gulfstream V private jet.

I worked with Boone to organize financing for a Mesa Petroleum Pac Man oil company takeover in the early eighties, when it was cheaper to drill for oil on the floor of the New York Stock Exchange than in the field. Now 82, he has not slowed down a nanosecond.

82 and Still Sharp as a Tack

I received another one of those scratchy, barely audible cell phone calls from my buddy at the Barnet Shale in Texas this morning.

Cheniere Energy (LNG) is has obtained three of the four permits it needs to begin construction of a gas liquifaction plant in Louisiana. This will enable the company to export natural gas (UNG) to Asia, where it is selling for prices eight times higher that here in the US. The project will be a major step towards dealing with the enormous glut of natural gas dumped on the market by the new ?fracking? process that has taken prices down to under $2/MM BTU?s, a new 12 year low.

Today we learned that (LNG) made it on to the calendar for a Federal Energy Commission (FERC) hearing on April 19 to consider this last license. That news alone was enough to drive the share up 7% today to a new high for the year. There the company will be opposed by the usual anti carbon alliance of environmentalists.

You may recall that I recommended this stock to readers back March 7 when it was trading at $16.10 a share (click here for ?Take a Look at Cheniere Energy (LNG)?). Today, the stock hit a high of $17.48, a gain of 8.6% since then. If Cheniere get the permit, as it is likely to do, the shares are likely to double. If it doesn?t, it will halve. I?ll leave it up to you to decide how best to play this.