Traders and investors have grown comfortable with a steady stream of corporate earnings reports. 2011 as a whole may come in as high as $15 a share for the S&P 500. But the gravy train may end starting next week.

The number of companies reducing guidance and downshifting expectations is at a three year high. Similarly, analyst earnings forecast cuts are at a ten year high. Among the 25 companies that have already reported, only 60% beat estimates, another new low.

In my own 2012 Annual Asset Class Review I predicted that S&P earnings would slow from $15 a share to only $5, and I received a lot of abuse from the hedge fund community for being that optimistic. Morgan Stanley has since joined in with its own bucket of cold water by predicting a 7% decline in the stock market this year, blaming deceleration, disfunctionality, and deleveraging, matching my own expectation.

The announcements kick off after the Monday close when aluminum (aluminium to you Brits and Ausies) producer, Alcoa (AA), reports.? Costs have been rising, sales prices have been falling, creating a squeeze on earnings. The technical picture looks particularly dire, with a double top in place and a descending triangle formation in the works. Will this be a preview of what a second ?lost decade? will look like? Has the stock market figured this out yet? Not!

Those Q4 Earnings Aren?t Going to Be So Pretty

(Note to Newsletter only subscribers: This trade alert went out to paying customers of my Trade Alert Service last Thursday morning.) I am going to start the New Year with a 25% allocation to the double leveraged short ETF (EUO). It?s time to do the hard trade, sell on weakness, and sell the breakdown. The Euro is so weak that it just won?t give new entries a decent entry point.

The really impressive thing about the way Euro traded in the closing weeks of December is how it failed to rally when all other risk assets were doing well. That ultimate arbiter of risk appetite, the S&P 500 (SPX) saw ten days of gains, posting a healthy 5.4% increase. The European currency managed no gain whatsoever. So many hedge funds are ready to add to their Euro shorts that it isn?t able to breathe at all.

I don?t know how long it will take the Euro to fall. The big 3%-4% daily declines are well behind us, occurring back when the currency was peaking in April just short of $1.50.? Existing shorts in the Euro are at all-time highs. So what we may see from here might be more of a slow grind than a sudden crash, as existing shorts increase positions and Johnny Come Latelies and neophytes join the game for the first time.

To use American football terminology, this will be a running game, not a passing one. The bigger moves won?t come until you see a broader ?RISK OFF? trade take hold in the global financial markets, where everyone runs towards the security of the greenback. That may happen sooner than you think.

Somewhere down the road, we should get a dramatic worsening in the fiscal and monetary conditions on the continent. The disagreement now is whether Europe is in a recession, where the economy is shrinking at a 1%-2% rate, or is in a full blown depression decelerating at a 5% or more rate. When the data hits the tape it is assured to trigger more selling of Euros than buying, driving the (EUO) trade in our favor.

Of course, European Central Bank president, Mario Draghi, will fight the valiant fight to slow the Euro?s decline. But at this stage, he only has words to use as weapons. Everyone knows that he is going to cut Euro interest rates by 25 basis points at the next meeting to head off the coming deflation. That will chop the interest rate differential between the Euro and the dollar in Uncle Buck?s favor, triggering further Euro selling.

My only concern here is that Europe?s long term structural problems are extremely well known, so this is not exactly a new trade. When my cleaning lady, gardener, and masseuse are already heavily short the Euro you have to beware. The smart money has been shorting Euros for the last eight months from $1.49 down, and smacking every rally. We are probably half way through a multiyear plunge in the Euro, from $1.50 to $1.10, so the risk of a snap back short covering rally will be ever present.

This is why I have chosen the leverage ETF instead of put options on the (FXE). Without time decay we can afford to wait this one out. The cost of carry is only a couple percent a year. The reduced leverage compared to an option will soften the impact on my daily P&L. And entering the New Year with a flat book, I have cash to burn.

If the Euro hits $1.20, a reasonably conservative downside target, the (EUO) should appreciate from $20.73 to $23.5. That would add 3.25% to our annual return. If we get a first class run on this despised currency and it drops to a more aggressive $1.10, the (EUO) should make it to $26.5, creating a 7% profit.

For risk control purposes, I shall use a stop on this position of $1.34 in the underlying Euro, or $19.50 in the (EUO).

This is How We Get to $1.10

?China is not going to have a hard or soft landing. It is going to keep on flying. There is a tremendous amount of momentum in the Chinese economy. There?s a lot to be done in terms of infrastructure. At the low end there is a lot to be done in housing. And it now has the largest amount of foreign exchange reserves in the world, by far,? said Mark Mobius of the Templeton Emerging Markets Group.

Anne Barnhardt was the CEO of a money manager who was forced to shut down her firm in the wake of the MF Global collapse. She is calling for a boycott of the financial markets and JP Morgan (JPM) specifically. To listen to her blistering attack in full in an interview with by Buddy, Peter Schiff, please click here. I excerpt below:

?Thank you for speaking up and calling it like it is. My father joined the Chicago Board of Trade in 1979. I joined the CBOT in 2009. We are customers of MF Global. The day they told me my money had been frozen I declared the futures industry completely dead. I grew up in the industry. I knew there were always thieves, mobsters even, in the business and I saw it from day one on the trading floor. But the depth of deceit has reached new lows.

MF Global and the CME violated the only principle that mattered in futures and anyone watching the farmers and ranchers testify yesterday should've seen that something has been broken beyond repair for them: TRUST! If the hedgers like you and your customers won't use the market then what are the speculators like me supposed to do? Well, I believe we're seeing it. The big specs have completely captured the trading venue through High Frequency Trading and are using it to fleece as many people as foolishly remain in the game where no bona fide hedgers operate anymore. The inmates not only run the asylum, they've set fire to it.?

The Inmates are Now Running the Asylum

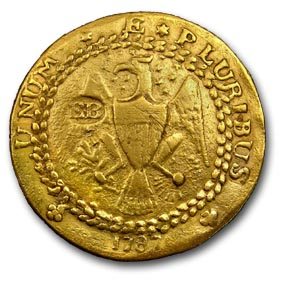

I?ll never forgot when my friend, Don Kagin, one of the world?s top dealers in rare coins, walked into the gym one day and announced that he made $1 million that morning.? I enquired ?How is that, pray tell??

He told me that he was an investor and technical consultant to a venture hoping to discover the long lost USS Central America, which sunk in a storm off the Atlantic Coast in 1857, heavily laden with gold from the California mines (click here for the full story). He just received an excited call that the wreck had been found in deep water off the US east coast.

I learned the other day that Don had scored another bonanza in the rare coins business. He had sold his 1787 Brasher Doubloon for $7.4 million. The price was slightly short of the $7.6 million that a 1933 American $20 gold eagle sold for in 2002.

The Brasher $15 doubloon has long been considered the rarest coin in the United States. Ephraim Brasher, a New York City neighbor of George Washington, was hired to mint the first dollar denominated coins issued by the new republic.

Treasury secretary Alexander Hamilton was so impressed with his work that he appointed Brasher as the official American assayer. The coin is now so famous that it is featured in a Raymond Chandler novel where the tough private detective, Phillip Marlowe, attempts to recover the stolen coin. The book was made into a 1947 movie, ?The Brasher Doubloon,? starring George Montgomery.

This is not the first time that Don has had a profitable experience with this numismatic treasure. He originally bought it in 1989 for under $1 million, and has made several round trips since then. The real mystery is who bought it last? Don wouldn?t say, only hinting that it was a big New York hedge fund manager who adores the barbarous relic. He hopes the coin will eventually be placed in a public museum. Who says the rich aren?t getting richer?

?All of Germany is a Tea Party, and that is going to be a problem for the Euro, said Yra Harris of Praxis Trading.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

If there was ever a year when you wanted a former combat pilot with a current aerobatic license giving you financial advice, it was the one we just completed. After enough loops, spins, barrel rolls, and whip stalls to induce air sickness in the most seasoned of veterans, the major indexes ended almost exactly where they started for the second year in a row. Even the much vaunted barbarous relic gave up a blistering 40% return at its high, to close up at a still decent 14%.

Looking back on my own trade history, I can assure you that I committed plenty of blunders, misjudgments, miscalculations, and fundamental misreadings of human nature. But as I like to tell my passengers, I crash better than anyone I know. That?s important, since they don?t let you practice crashing in flight school. Any landing that you walk, or run away from, is a good one, and the insurance company can always buy you a new plane. From an investment point of view, this means that my winners outnumbered my losers by better than five to one.

I started 2011 with a big splash, correctly believing that the recently announced QE2 and tax compromise would give the markets ample liquidity for me to carry longs over the holidays. So I entered 2011 with positions in the S&P 500 (SSO), the short Treasury ETF (TBT), the grains (JJG), Cisco (CSCO), and Bank of America (BAC), all of which proved profitable.

That allowed my trading book to leap 4.73% on January 3, the first trading day of the year. As the month wore on, I took profits, usually too early. But I always like to leave the last 10% of a move to the next guy. I ended January up 20.6% on the year, a peak I would not match for another ten weeks.

February saw the beginning of a trade drought that lasted nearly three months. I correctly believed that markets were topping, but were too soon to short, and started adding long volatility plays, astutely buying the (VIX) whenever it dropped below $15. I also shorted the yen, which would eventually come to grief.

My big out-of consensus call in March was that Treasury bonds would rise into the end of QE2 on June 30, not crash, as most of the hedge fund community was expecting. I reasoned that the end of $75 billion a month of Federal Reserve asset purchases would trigger a flight to safety move that would send investors piling into government paper. My short sale of deep out of the money puts on Treasuries added 4.53% to my total return.

The first black swan of the year came with the Japanese tsunami on March 11, which caused the Nikkei Index to collapse and the currency to soar. That quickly stopped me out of my short Yen position in the (YCS), causing my first substantial loss of the year of -1.62%.

By the spring, I was receiving daily complaints about the paucity of recent Trade Alerts. That came to an abrupt end on April 28 when I called the top of multiple asset classes at once and started pumping out alerts as fast as a Gatling gun. Out went Trade Alerts to sell Oil (USO), the Euro (FXE), the S&P 500 (SPY), and to buy the dollar (UUP). It was ?sell in May and go away? with a vengeance. By May 23, my performance soared to 38%, another interim peak.

July was a total pig of a month as I totally misunderstood the consequences of the acrimonious debt ceiling negotiations in congress. I made the right call that a deal would be cut at the eleventh hour of the last day. However, instead of triggering a surge of liquidity into assets, the exact opposite happened. Investors viewed the whole sorry affair as proof of how deeply dysfunctional our government has become and ran for the hills.

The hits I took on my premature longs were painful indeed. I violated my own rules and failed to stop out of the (TBT), which would drop for another tortuous four months and end up costing me 7.02%, my biggest loss of the year. But coming from an older generation, and cutting my teeth on the double digit interest rates of the early 1980?s, it is hard for me to believe the ten year yields of 1.80% I see on my screen today.

It took me a couple of days to figure out the new game. But once I did, it was like shooting fish in a barrel, with a string of 22 profitable trades ensuing. In quick succession, I sold short the (SPY), the Russell 2000 (IWM), the Euro, and gold (GLD) several times. I hit a home run shorting the Swiss franc the weekend before the central bank devalued it and tied it to a falling Euro, adding 9.07% to the year. During August I was writing Trade Alerts so fast, up to three a day that I practically wore my fingertips down to their nubs.

By October, the pickings were getting thin. I covered my remaining shorts at the absolute bottom on October 4, but failed to go long. My last really good trade of the year was executed on October 28, when I shorted the Euro one more time for a 5.36% profit. It was enough to take me to my third performance peak of the year of 46.75%.

In October, over confidence, complacency, and a run for a 50% return on the year enticed me to reach for the trade too far. Collapsing volatility in November and December meant that I lost money on my Jeffries (JEF) calls, even though I got the stock right. In the ultimate act of idiocy, I bought silver calls (SLV) on top of an $8 move, hoping the momentum would carry onward for another couple of bucks. It was not to be. That little hickey cost me 4.29%, stopping out the day before the precious metals collapse began in earnest.

After that, I was ready to cash in for the year, locking in a total return of 40.18%, putting me in the top one tenth of one percent of all hedge fund managers. I expected December to be a tedious, low volume affair with declining volatility, offering no great trading opportunities. And nothing beats the ease of a yearend audit of only a single number that is 100% in cash. It leaves one with barrels of dry powder with which to start the New Year. As for my final grade, I?m afraid that I?ll have to give myself an A+ with numbers like this.

We live in an industry where you?re only as good as your last trade. I look at the blank slate in front of me bursting with optimism about the opportunities presented by the coming year. But I also begin humbled, chastened, and wiser from last year?s errors. I never lost money on a trade that I didn?t learn from. That is as true today as it was 48 years ago when I first joined this game.

I have always believed that if you don?t have a sense of humor, then you better get the hell out of this business. Below is a link to a YouTube video entitled ?All I Want To Do is Retire? which covers the decline of the brokerage industry over the last 20 years. The video is currently going viral and sent to me by a subscriber. Watch this during your next coffee break. The run time is five minutes. Sometimes the truth can be hard to swallow. Click here.

If you really want to get a read on how ?the 1%? are faring these days, take a ski vacation to the tony hamlet of Incline Village on the pristine shores of Nevada?s Lake Tahoe.

Each morning, I trekked to Starbucks, one of the few local sources for the Wall Street Journal and the New York Times. There, trophy wives line up to buy their chai tea lattes, all tall, thin, and blonde, wearing designer sunglasses and snow boots, as if produced from a Gucci cookie cutter. The parking lot is jammed with Range Rovers and Cadillac Escalades.

Keeping up with the Jones?s here on fabled Lakeshore Drive can be quite a task, especially when they are populated by such names as Oracle?s Larry Ellison, casino mogul, Steve Wynn, and Saudi arms dealer, Adnan Kashoggi. Ellison alone is thought to have poured $200 million into his mountain retreat. Some of these compounds offer private beach lodgings for bodyguards and dog groomers. Junk bond king, Michael Milken, springs for the cost of the town?s annual Fourth of July fireworks display as it coincides with his birthday.

In the ultimate feat of hubris one upsmanship, one billionaire is converting the profits from his check cashing business to build a $150 million, 36,000 square foot residence that looks like a convention center. He has ruffled the feathers of locals by chopping down every ancient pine and cedar tree on the property to max out the square footage, violating multiple town ordinances. Who knew that cashing checks was so profitable?

In fact, lakefront Incline boasts one of the few neighborhoods in the US that has held up reasonably well during the real estate crash, with six properties changing hands at $1,000 a square foot in the last year. I guess they?re just not making beachfront property any more. Current listings include a 3 bedroom, 2 bath bungalow for $49.9 million and a 8,694 square foot palace for $43 million. If you are looking for a real bargain, check out the five bedroom French castle at www.inclinecastle.com for $22.85 million. As with the large diamond shortage I have written about previously, this is further evidence that the rich are getting richer at an accelerating rate.

The land here was originally owned by one of the Comstock silver barons of the 1860?s. You may recall it as the location of the TV series ?Bonanza? and I?m sure that every female reader will remember ?Little Joe?. A development company subdivided the land during the 1950?s with the intention of creating a Palm Springs in the mountains, spurred on by the completion of Interstate 80 as part of the infrastructure demanded by the 1960 winter Olympics at nearby Squaw Valley.

Devoid by edict of the down market fast food chains that afflict most of America, Incline boasts two municipal golf courses, where at 6,300 feet, the air is so thin that your drive travels an extra 50 yards. If you want a Big Mac, you have to travel down the road to California-- if the road isn't blocked by snow.

Incline is also a Mecca for libertarian millionaires drawn by the absence of a state income tax. Unfortunately, they also possessed the financial sophistication to buy gorgeous mountainside homes, extract cash-out refi's all the way up, invest the proceeds in the stock market, and lose it all in the subsequent crash.

The result has been a meltdown of Biblical proportions in the housing market. Of the 8,000 homes in the village, 400 are for sale at distressed prices and another 400 or more discouraged sellers hang over the market. Brokers report a brisk business in bank owned short sales, foreclosures, and sales on the Washoe County Court House steps for homes worth less than $800,000 at prices down 60%-70% from the 2006 peak.

Jumbo financing is now an extinct species, unless you're happy to pay a 200 basis point premium over conventional loans. So the middle market, where homes are priced from $1 million to $4 million, has ceased to exist. Only cold, hard cash talks here. But high net worth individuals hate tying up capital in an illiquid asset when more attractive options abound. Precious metal coins are especially popular in the Silver State.

I am sad to report that antidepressant addiction among realtors in Incline Village is at epidemic proportions, since they don?t have anything to sell to the 1%. Some of their properties have been on the market so long that snow drifts have collapsed balconies, the local wildlife have moved in, and prospective buyers are scared away by offensive odors. Break-ins by black bears have become a serious problem, leaving basketball sized poops on the living room floor.

Abandoned homes see their pipes freeze and burst, causing irreparable damage. In Las Vegas, foreclosed homes can be easily spotted from the air by their dead lawns and green swimming pools. In Incline the 'tells' are the ten foot high mountains of frozen snow dumped there by snow plows, blocking entry. I guess all real estate markets really are local.

Owners used to be able to cover half their annual carrying costs by renting out their properties during Christmas and New Year's, and for a few weeks in the summer. Unfortunately, that market has collapsed also. There are not a lot of high rollers willing to fork out $10,000 a week for a vacation rental in a recession.

If you are one of the 99%, I?d think again before buying a vacation home any time soon. The only consolation is that conditions are much worse in Las Vegas. The optimists concede that prices could stay down for another decade. The pessimists can already be found at the bottom of the lake with the Godfather's Fredo Corleone, another former resident of Incline Village.