Featured Trades: (THE TRUE COST OF HIGH OIL), (OIL), (USO)

1) The True Cost of High Oil. Economists are furiously downsizing their economic growth forecasts for 2011 in the wake of the oil price spike, both for the US and for the world at large. Since last week, West Texas crude prices have soared $12 from $86 to $98. Each $1 increase in the price of oil jumps gasoline prices by 2.5 cents. Each one cent rise in the cost of gasoline takes $1 billion out of the pockets of consumers.

If oil stays at this price, it removes $30 billion from the pockets of consumers. At $110/barrel, it short changes them by $60 billion, or? 41% of GDP. If you wonder why hedge fund managers have lurched into an aggressive '?RISK OFF' mode, are throwing their babies out with the bathwater, and why the volatility index is spiking to three month highs, this is why.

-

-

-

Featured Trades: (HOW FAR WILL THE MARKETS FALL?), (VIX), (SPX), (SPY)

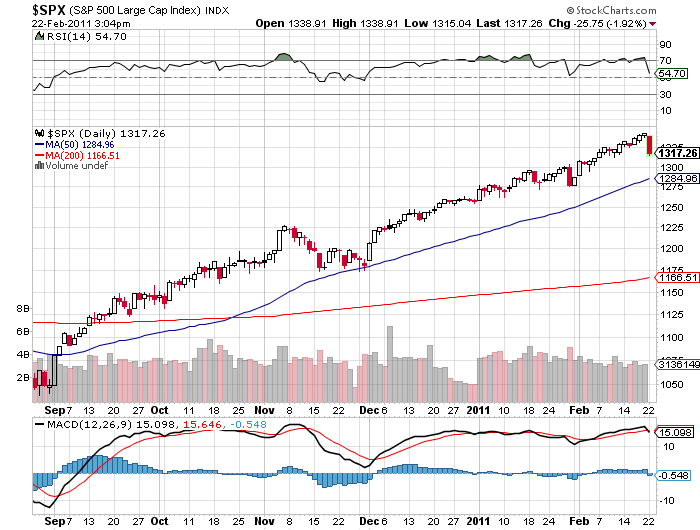

2) How Far Will the Market Fall? Now that we are solidly in 'RISK OFF' mode, traders, managers, and investors are asking how much downside we are looking at. It is safe to say that those who were piling on longs with reckless abandon are now potentially staring into the depths of a great chasm. I have included charts below showing the important Fibonacci support levels. Let's take a look at how far down is down.

*1,300 '? The first big figure. Already broken intraday, but it held the first time.

*1,286 '? The 50 day moving average, the no brainer, most bullish target. The 'buy the dip' crowd takes a first bite here.

*1,280 '? 38.2% Fibonacci support level.

*1,260 '? 50% Fibonacci support level.

*1,230 '? Broken resistance from the November high. Europe blows up again. Take your pick: Spain, Ireland, Britain, Portugal'?

*1,167 '? The 200 day moving average. It must hold for the bull market to stay intact. This is where $5/gallon takes us. Double dip recession talk reemerges. The 'buy the dip' crowd takes a second bite.

*1,117 '? The November low. The 'buy the dip' crowd throws up on its shoes and pukes out the last two 'buys'. We spike down, triggering another 'flash crash.'

*1,000 '? The next really big figure. Ben Bernanke, with the greatest reluctance, announces QE3. Bond prices soar, taking ten year yields to 2%. Homes prices collapse again, triggering a secondary banking crisis.

*666 '? The Saudi regime falls, and 12 million barrels a day disappears from the market for the indefinite future. Unemployment hits 15%. Obama is toast. Your broker turns bearish and tells you to sell everything. Welcome to the Great Depression II. It starts raining frogs.

-

-

But Will He Bounce?

Featured Trades: (S&P 500 IS CRUISING FOR A BRUISING)

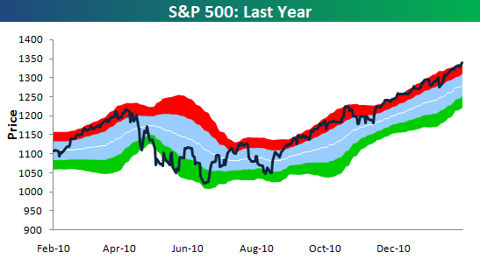

2) The S&P 500 is Cruising for a Bruising.? How overbought is the stock market? My friends at the Bespoke Investment Group produced this chart of the S&P 500 showing that it has remained in nosebleed territory for nearly six months now, except for a few fleeting months in November. This is why many hedge fund managers have been tearing their hair out, become addicted to Maalox, or are contemplating going into the restaurant business, especially if they have been playing from the short side for the past six months. It has been such a straight line move that it hasn't allowed many traders in.

The light blue area in the chart represents one standard deviation above or below the 50 day moving average, which yesterday was at 1,284.? The red area shows where the market is more than one standard deviation above the average, while the green is more than one standard deviation below. Not only that, each individual sector in the (SPX) is overbought, with consumer discretionary, materials, and energy the most overbought.

Just to reach the nearest oversold area, the market has to drop to 1,240, down 100 points, or 7.5% from last night's close. Just thought you'd like to know.

-

-

Featured Trades: (BUY THE DIP IN THE AGS), (DBA), (CORN), (MOS), (POT), (AGU), (ANDE), (CPO)

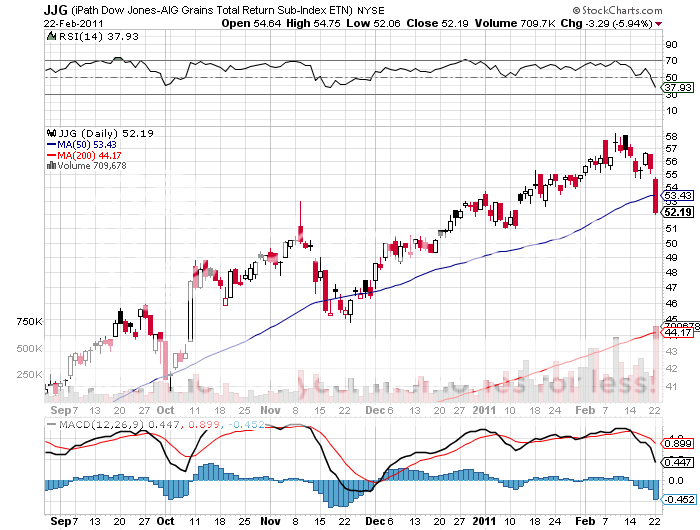

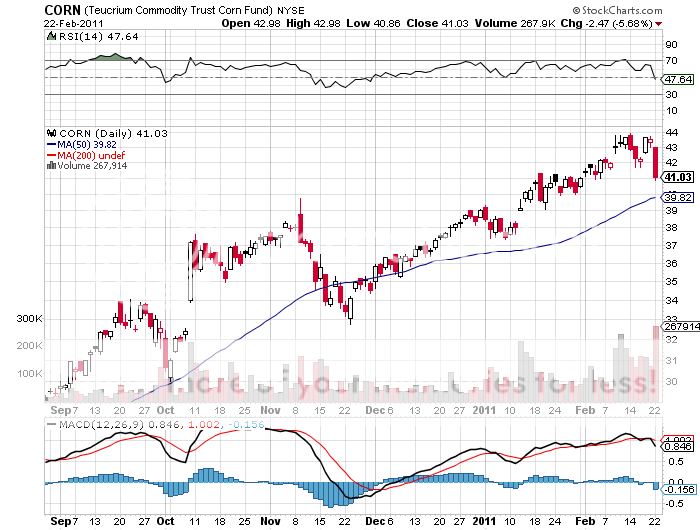

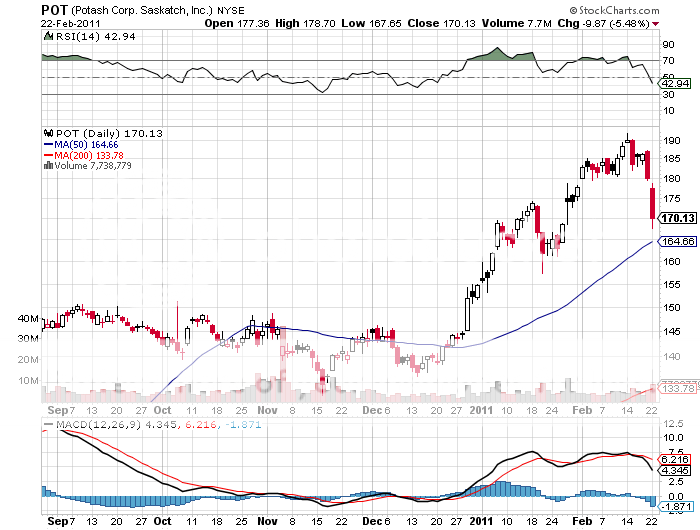

3) A Buying Opportunity is Setting Up for the Ags. In January, I wimped out of my hefty long position in the grain ETF (JJG), hoping to sidestep a potential sell off going into a dreaded US Department of Agriculture crop report, which last year triggered limit down moves. The report turned out to be benign, and I ended up sidestepping an 18% pop in the security.

It is now six weeks later, and we have our limit down moves across the entire ag space. But this time it is a global '?RISK OFF' trade triggered by the calamitous events in Libya. I just received word that a close friend working there for an oil major was safely airlifted to Malta, while another reader emails me that Khadafi is dynamiting pipelines to prevent them falling into the hands of rebels. A declaration of 'force majeure' does little to calm investors. Given that the ags have been among the best performers this year, it only makes sense that a flight to safety delivers to them the worst drubbing.

If you are still holding your position in this space, don't sweat too many bullets. This is but a kink in an upward trajectory that has possibly another two years to run. The world is still making people faster than the food to feed them. Almost every major supplier around the world is facing disruption. Supplies are at multi decade lows. A hungrier, more calorie addicted middle class is still burgeoning in emerging markets. Did I mention the threat to the food supply by global warming and melting glaciers? Food driven inflation isn't going away anytime soon.

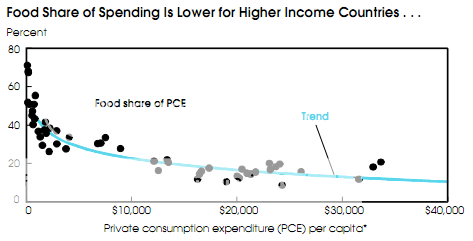

If you have any doubts, take a look at the chart below of the percentage of annual income spent on food by country. It starts with a low of 7% for Americans, and goes hyperbolic to 75% for several African countries. When you already spend 75% of your income on food, the only way to cope with a further 50% price increase is to eat less. Not easy when you are surviving on 1,000 calories a day. Expect higher prices, political instability, hoarding, and mass suffering to result.

I have been a huge bull on the ag space since I put out my watershed piece last June, a call that turned out to be immensely profitable for everyone who participated (click here for 'Going Back Into the Ags'). Use the current distress to add to your ag positions, or pick them up if you have not already done so. Look at my favorites in the space the ag ETF (DBA), the corn ETF (CORN), and equities Mosaic (MOS), Potash (POT), and Agrium (AGU). When I see a short term bottom, I'll try to shoot out a trade alert, if I am clever enough to spot it.

You might also add a couple of new names, like Andersons, Inc.? (ANDE), which is involved in crop storage and fertilizer. Also visit and Corn Products International (CPO), which is benefiting from consumer flight from record high sugar prices towards cheaper high fructose corn syrup.

-

-

-

-

Here's Where I Want to Buy the Dip

'Right now, the US is the best looking horse in the glue factory,' said Erskine Bowles, co-chair of the National Commission on Fiscal Responsibility and Reform

Featured Trades: (MORGAN STANLEY), (MS)

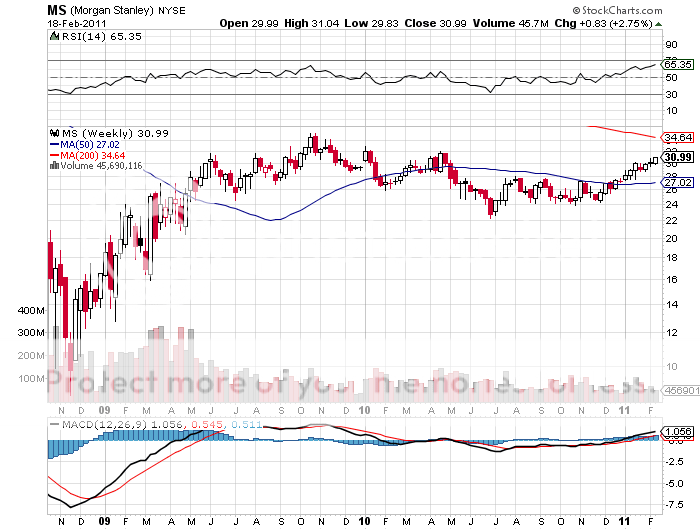

1) Reflections on Morgan Stanley's 75th Anniversary. The three elder statesmen I saw on TV ringing the opening bell at the NYSE couldn't have been more representative of the evolution of Morgan Stanley (MS) over the past three quarters of a century. When I joined just after the 35th anniversary, it was a small, white shoe private partnership with a lock on the cream of investment banking clients like IBM, AT & T, and General Motors.

A great nephew of the original JP Morgan still worked there, was his spitting image, and was trotted out to impress admiring clients. Neatly framed on the wall in the chairman's office was US Steel (X) share certificate No.1, signed by Andrew Carnegie himself, which the firm's antecedents midwifed into existence. One of the first deals I worked on was the breaking up of Ma Bell into the baby bells.

Parker Gilbert was chairman, the son of one of a handful of men who rebuilt the firm from the wreckage of the Great Crash and the passage of the Glass Steagle Act. I knew him well as one of the blue bloods who ran the firm, a genteel, polished, Ivy Leaguer, who exuded fine breeding and confidence. I once spent an afternoon with him in the back of a Daimler limousine driving around London, shopping for thousands of dollars' worth of high end fishing gear, so he could accept an invitation to a Scottish private estate perfectly appointed. If Parker hadn't landed the top job at MS, he probably would have been running another exclusive gentleman's club, like the Jockey Club or the New York Yacht Club.

John Mack was one of a new generation of brash, street fighting, in your face, bare knuckled traders who forced the firm, kicking and screaming all the way, to make a fortune in proprietary trading. Mack, known internally as 'Mack the Knife', was of Lebanese origin, and could not have been more at odds with Morgan Stanley's elitist origins. He once lured a star trader away from Solomon Brothers, and then fired him on the first day. The few female employees we had then cried in his mercurial presence. But there is no doubt that the profits Mack reeled in saved the firm from a takeover down the road, rescuing it from the fate of Solomon Brothers, Kidder Peabody, Dillon Read, and Drexel Burnham, assuring its place in the big league today.

I was one of the few who bridged the two generations, comfortable from my journalism days with moving in Olympian circles, but coming from humble, rural origins. We took the 1987 crash in stride, but during the dark days of the financial crisis, when the share price plunged below $6, it seemed the firm was out for the count. Mack saved the firm a second time, successfully demanding a huge equity infusion from the Mitsubishi Group in Japan (great move, John!), while simultaneously holding at bay the wolves from Wall Street and Washington. What better year to have a junkyard dog as CEO than 2008?

James Gorman joined well after I left, and appears to be a modern day 'suit'. A professional and talented manager to be sure, but lacking the flash, the panache, and the balls of earlier generations. He is symbolic of the class of professional administrators who have been brought on board to run what has essentially become a gigantic utility.

I have seen MS grow from 1,000 to 60,000 employees. The dividend today is more than the total market capitalization of the company back then. Parker summed it up all nicely when he said his 'mind was blown' by the present size of the firm and how far it has gone. I have no doubt Morgan Stanley will be around for another 75 years. And if you believe in the continued existence of Wall Street, as I do, as I do, this would be a great stock to own for your grandkids' 529 educational investment plans.

-

Featured Trades: (LEARNING TO LOVE HEDGE FUNDS)

3) Learning to Love Hedge Funds. The Wall Street Journal has put together the best history of hedge funds I have found so far. They start with the legendary Fortune Magazine editor, Winslow Jones, who created the first fund out of a shabby office on Broadway in 1948, and generated monster returns over the next 20 years. I learned for the first time that the industry standard 20% performance bonus was borrowed from ancient Phoenician sea captains who kept a fifth of the profits from successful voyages. Jones must have had an historical bent.

They cover the second generation titans, George Soros, Julian Robertson, and Michael Steinhardt, who made their debut in the sixties. I count myself among the third generation along with Paul Tudor Jones and Louis Bacon, who launched funds in the late eighties, when there were still fewer than 200 funds and $25 million was still considered a lot of money. The really big money showed up in the nineties when the pension funds found them.

The Journal then navigates us through the big crisis that followed, including Long Term Capital, Amaranth, and Lehman Brothers. It also correctly points out that the industry's avoidance of ratings agencies kept most funds out of hot water during the financial crisis. Today there are over 10,000 hedge funds, thought to manage some $2.9 trillion which dominate all financial markets. To read the well researched article in full, please click here.

Hedge Funds Do Have Their Advantages

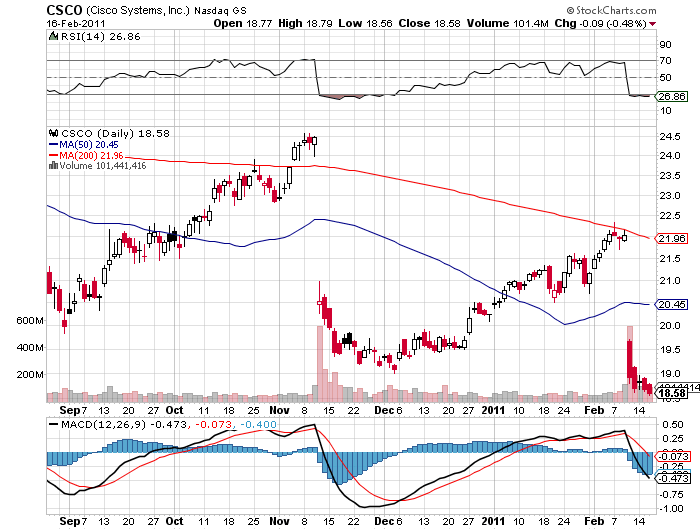

Featured Trades: (MY NEAR MISS WITH CISCO)

2) My Near Miss With Cisco. My predatory instinct as a scavenger and bottom feeder is coming to the fore once again. After building up expectations for a blowout quarter, Cisco Systems disappointed once again, prompting traders to trash the stock by 15% in one day. Call me greedy, but my risk averse nature prompted me to take the double that I had on by March $20-$22 bull call spread three weeks earlier. If you wonder why I am still cautious in one of the most Teflon resistant bull markets of all time, this is a good reason.

All of which sets up the exact same trade again. It was actually a decent report, as earnings came in near expectations. But in this unforgiving world analysts saw only the glass half empty and couldn't head for the door fast enough.

This is still one of the world's preeminent technology companies, and is one of the few American ones that makes stuff that people still want to buy. Some 70% of its global sales are to foreigners. Ownership of the router market is nothing to sneeze about, especially when the planet is making the leap to streaming video, causing demand for the company's products to soar tenfold in coming years.

I know CEO John Chambers personally and frequently bump into him at high end charity functions in San Francisco, and a better manager there never was. With a forward price earnings multiple of only 7, it is not often that you get to buy a growth company at a value price, and a Dow stock at that! An announcement of a new 1%-2% dividend is thought to be imminent. They will automatically suck in an entire new class of pension fund investors.

The way to play this is to wait for another haymaker to pop the stock on the nose. That could come in the form of a long awaiting market correction, which could take the broader index down 5%, and (CSCO) down more. Below that, the company's well publicized stock buyback program kicks in. Not only does Cisco benefit from a Bernanke put, it offers investors own free put as well.

I am not the only genius that has figured this out. None other than hedge fund managers George Soros, Eddie Lampert, and Whitney Tilson are similarly accumulating their own long positions in this stock. Watch this space, and I'll pop out a quick trade alert when I see a window open to get in.

-

A Near Miss is Better Than No Miss At All

Featured Trades: (THE PETE NAJARIAN/JOHN THOMAS SMACKDOWN)

1) Global Strategy Review With OptionMonster's Pete Najarian. Please join John Thomas, The Mad Hedge Fund Trader, and OptionMonster's Pete Najarian for a free live webinar on Thursday, February 17 at 12:00 noon EST. It will be a no holds barred, mano a mano, smack down where we will debate the future of every major global asset class.

Is the stock market rally coming to an end, or is there more to go? Should we be buying dips or selling rallies in gold and precious metals? Is the commodities boom a yearlong or decade long phenomenon? Which sectors on the international landscape will be the winners or losers? Are the agricultural plays getting tired, or is it time for a second helping?? Will the collapse of the bond market or a spike in oil prices bring the party to an end?

Pete Najarian is a former linebacker for Tampa Bay Buccaneers and the Minnesota Vikings who graduated to the pits of Chicago's volatile, and occasionally dangerous, commodity trading pits. With his brother, Jon, he developed a proprietary computer program called Heat Seeker? which monitors no less than 180,000 trades a second to give him an early warning of moves that are about to hit the stock, options, and futures markets.

To give you an idea of how much data this is, think of downloading the entire contents of the Library of Congress, about 20 terabytes, every 33 minutes. His firm maintains a 10 gigabyte per second conduit that transfers data at 6,000 times the speed of a T-1 line, the fastest such pipe in the civilian world. Pete then distills this ocean of data into the top movers of the day, which he puts up for free on his website, and offers much more detailed analysis through a premium subscription product. 'As with the NFL,' says Pete, 'you can't defend against speed.'

The system catches big hedge funds, pension funds, and mutual funds shifting large positions, giving subscribers a peak at the bullish or bearish tilt of the market. It also offers accurate predictions of imminent moves in single stock and index volatility.

Pete still has a handshake that's like a steel vice grip, and I am still undergoing physical therapy for the last time I did so six months ago.

To participate in the webinar, please click here. For those who miss the live show, I'll try to post an MP3 file for replay on Hedge Fund Radio later in the day. To learn more about OptionMonster, please visit their site by clicking here at http://www.optionmonster.com/ .

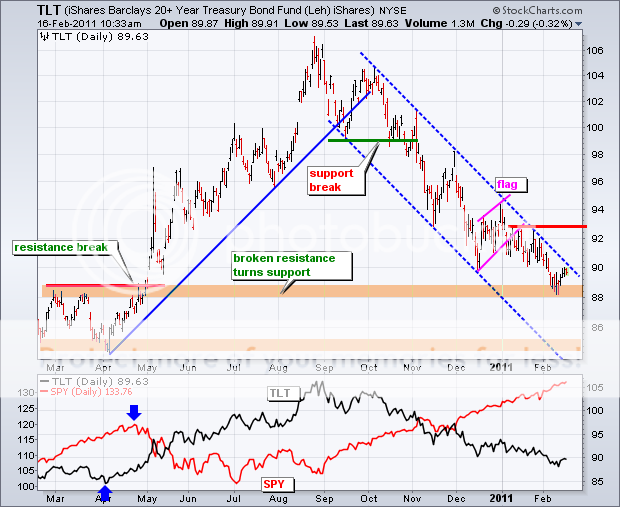

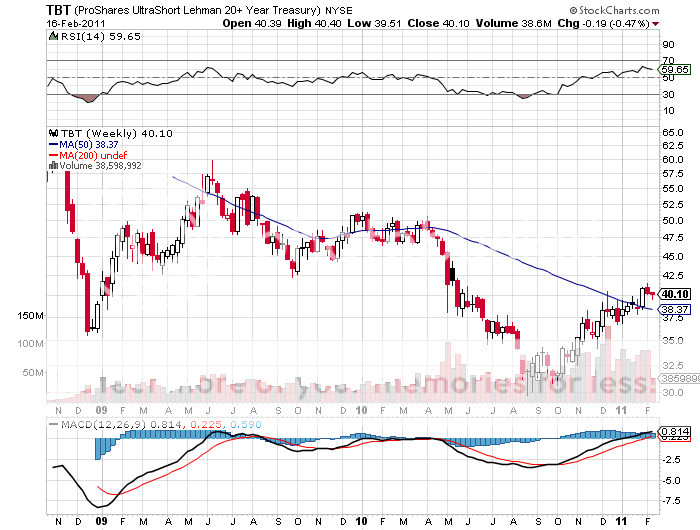

Featured Trades: (THE TREASURY BOND SELL OFF), (TBT), (TLT)

2) A Rest for the Treasury Bond Sell Off. The Great Treasury Bond Sell Off, which has been running now for nearly six months, may be about to take a rest. Take a look at the chart below put out by my friends at StockCharts.com. It shows that the iShares Barclays 20+ Year Treasury Bond ETF (TLT), the single leveraged long ETF, is bouncing off the old resistance line that we saw on the upside last April.

One of the oldest and dustiest rules in any technical analyst's handbook is that old resistance usually becomes new support. You can't see the inverse on a chart of the double short bond ETF, the (TBT), because of the distorting effects of the heavy cost of carry has on the price, nearly 1% a month.

The other interesting thing about this chart is that it shows the perfect inverse correlation between stocks and bonds that has persisted for the past year. This is important because any near term support for bonds could also signal a top for stocks and an ensuing sell off.

There are a few other canaries in the coal mine that I am carefully monitoring. The imminent break in the yen could be signaling a broader change in the global markets. A weakening yen and a strong dollar might well trigger a flight to safety that could deliver broader selling across all asset classes. In this complex and interrelated world, the blow off tops we are seeing in the cotton and sugar markets may be substituting for similar moves we say in stocks in years past.

This is why my short term trading book is the lightest that it has been in a year. I am nursing small, but so far modestly losing shorts in the S&P 500, the yen, the euro against a long position in the volatility index (VIX). The slightest weakness in stocks, and this entire book lurches into the green, big time.

It is all part of the three dimensional chess game we call 'global macro', the great 10,000 piece jigsaw puzzle. Since I have been at this for 40 years, and spent considerable time working in every major securities and commodities market on the planet, I tend to see these sea changes earlier than most. I just thought you'd like to know.

-

-

It's Your Move, Mr. Market