Featured Trades:? (EMERGING MARKET DEBT), (PCY), (ELD)

PowerShares Emerging Markets Sovereign Debt Portfolio ETF

Wisdom Tree Emerging Markets Local Debt Fund ETF

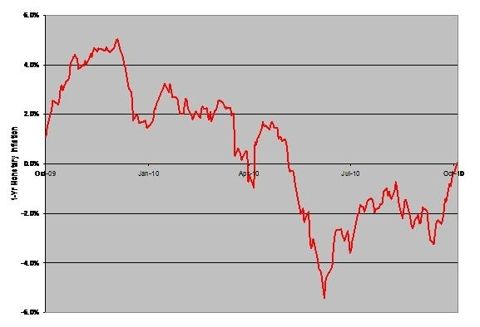

2) My Reconciliation With Emerging Market Debt. Last month, I advised readers to take profits on the emerging market debt ETF (PCY) after clocking a generous 30% total return over the previous year (click here for 'Sovereign Debt Was a Great Place to Hide'). As much as I liked the credit, the tremendous gains achieved by all fixed income instruments were starting to give me a definitely queasy feeling.

Well, Doctor Ben Bernanke rode to the rescue with a Costco sized bottle of Dramamine, and I am now feeling a million times better. Given the global surge that is going on in all asset classes, the (PCY), with its generous 5.82% yield, has to be on the menu in a yield hungry world.

One of the great ironies in the international capital markets is that emerging nation balance sheets are so healthy because the West refused to lend to them for so long. Several debt crisis during the seventies and eighties caused entire continents to be rated as junk. That forced these countries to pull themselves up with their own bootstraps, financing growth from savings instead of expensive foreign borrowing.

Now that I'm back in the game, I'll see you one ETF, and raise you another. While the (PCY) invests only in the dollar denominated debt of emerging markets, Wisdom Tree has just launched its (ELD), which gives you the local currency exposure as well, and still offers a healthy 4.8% yield. The fund invests in the bonds of Brazil, Chile, Columbia, Indonesia, Poland, Russia, South Korea, South Africa, and others, all countries you should know and love well after reading this letter. With large capital inflows expected to continue into these high growth countries for years to come, giving a steroid shot to their currencies, this is a bet that I am more than happy to make.

You get the a double play here: a continuous cycle of credit upgrades lead to lower interest rates, higher bond prices, in appreciating currencies. International capital flows are providing a tremendous wind at your back. Don't expect the de facto better quality credit to continue paying higher interest rates forever. This screaming contradiction can only be resolved through higher prices for both the (PCY) and the (ELD).

We're Getting Back Together

Featured Trades:?? (ETF RANKINGS), (SPY), (GLD), (EEM)

3) Guess Who's On Top of the ETF Rankings? I saw the latest ranking of ETF's by asset size today, and I was stunned by the results. It was no surprise to see State Street Global Advisors' SPDR S&P 500 (SPY) on top, with $78 billion in assets, long the 800 pound gorilla of ETF's. It was the second and third spots that I found the most titillating.

The World Gold Trust Services' Gold Trust ETF (GLD) came in second, now worth amazing $54 billion, and BlackRock's (BLK) iShares MSCI Emerging Market Index Fund ETF (EEM) came in third at $45 billion. It seems like only yesterday that these two ETF's were just little nippers, knee high at best.

The flood of cash out of paper assets into hard ones by investors fleeing global, competitive quantitative easing easily explains GLD's popularity. And you can't blame investors departing the US en masse for emerging markets, trading in a projected wheezing, arthritic 2% growth rate at home for sexier, more virile 6%-10% growth rates abroad.

I'm going to make a bold prediction here. GLD and EEM will occupy the top two slots on this list within two years. This will occur both because of price appreciation of the underlying and a continuing inward flood of assets. These ETF's cater to the major long term trends in the global economy, which are only just getting started, and could continue for the rest of the decade.

How Much Longer Will the SPY be the 800 Pound Gorilla?

Featured Trades: (MONETARY INFLATION)

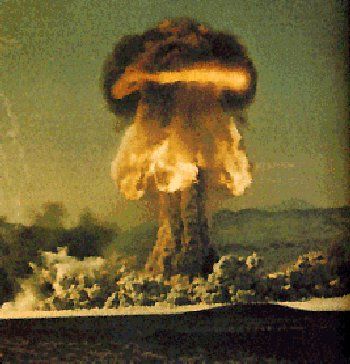

1) The Heads I Win, Tails You Lose Market. Ben Bernanke has privatized the upside of the global stock, bond, currency, commodity, energy, and precious metals markets, and socialized the downside, with his much publicized move towards quantitative easing. While former Treasury Secretary Hank Paulsen spoke about a bazooka in his pocket, Helicopter Ben is hinting that he has a 100 megaton thermo nuclear weapon.

If you recall, I predicted a six month bull market in global equities on September 1, inviting much abuse at the time (click here for 'My Equity Scenario for the Rest of 2010'). My logic then was that once the market spent six months sucking in bears into expanding their positions, it would quickly reverse and race to the upside. The triggers would be better than expected corporate earnings, and the removal of the midterm elections as an unknown. What I did not expect was the Bernanke assist. After spreading gasoline everywhere with zero interest rates, Ben has now slyly produced a book of matches.

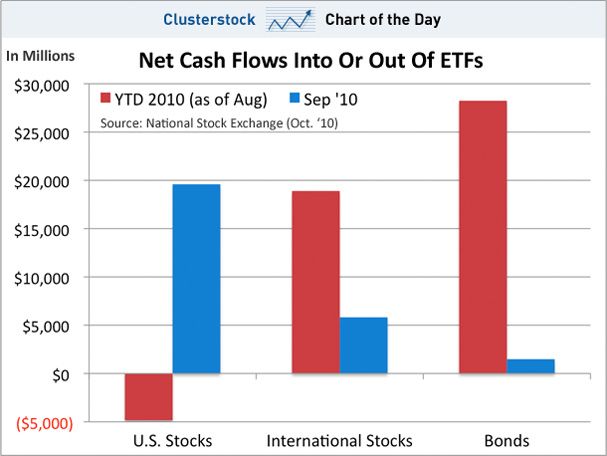

As you can see from the chart below, the stimulative impact of his strategy began to work almost immediately. Monetary inflation took off like a rocket in September and is about to punch through the threshold to positive numbers. Emboldened 'double dippers' were pooh poohing this prospect only four weeks ago. Those few of us long enough in the tooth to remember real price hikes can tell you that monetary inflation is the certain precursor of the real kind, where the prices of actual goods and services go up.

The net of all of this is that we may see the broad based rally in the prices of everything continue far longer than we realize. It makes the 1220 target for the S&P 500 I put out only a few weeks ago look conservative (click here for 'Bring on the Bernanke Put'). We may get some profit taking and a dip going into the midterm elections. If we do, get on board the money train for a year end ride.

This Didn't Work

So We'll Try This

Yes, I Remember Inflation Well

Featured Trades: (SOLAR ENERGY), (FSLR), (YGE), (STP)

3) The Double Play in First Solar. There is another angle to the solar play, which I bet you haven't thought of. I have been arguing that companies like First Solar (FSLR) are great proxy for oil, as any price rise in crude raises the breakeven point that alternative power generators must meet to be competitive on a non subsidized basis (click here for 'Solar Energy is Poised to Achieve Cost Parity').

I bet you didn't know that it is a currency play as well. First Solar's primary competitors are Chinese firms, like Suntech Power (STP) and Yingli Green Energy (YGE), whose costs are based in the Yuan. That was not a problem as long as the Yuan was fixed and the global recession caused polysilicon prices to collapse. Those days are now coming to a close. Any appreciation of the Chinese currency feeds directly into their overhead cost. Even just a 5% per year appreciation, the maximum rate which the Chinese government is thought to tolerate, could wipe out the razor thin margins these companies subsist on.

A cheap, long dated call on both oil and the Yuan? Given that I believe that we are in a long term bull market for both, I think you better be accumulating this company on dips. The upside surprises could be explosive.

Setting Up for the Double Play in Solar

Featured Trades: (THAILAND), (TF)

4) Wow! Have You Seen Thailand? You first heard about Thailand from me in my Hedge Fund Radio interview with Vivian Lewis of Global Investing, back when her pick, the Thai Capital Fund (TF) was trading at $10.75 (click here for the show). Last night it hit an all time high of $15.44, a gain of 44% in less than four months.

Part of the gain can be attributed to an 8% appreciation of the Thai baht against the dollar, which has risen along with most other emerging market currencies (click here for 'Emerging Market Currencies are On Fire'). All they had to do was stop rioting for 15 minutes and it was off to the races, and this was before they even had a chance to rebuild the stock exchange, which they burned down. Maybe the sellers can't find the market's new location?

My inner trader says to take profits after a meteoric pop like this. But people I know on the ground in the Land of Smiles tell me this market is still fundamentally cheap. The multiple is only 11.7, cheaper than surrounding Asian stock markets, despite a 30% rise in corporate earnings in the first half of this year. Exports account for 65% of Thai GDP, which have been on a tear all year. Several big multinationals, like Ford Motors, have announced large new direct investments which I always love to follow.

This is not a riskless trade. The political problems that lead to eight weeks of rioting earlier this year are still simmering below the surface. The government has threatened capital controls, which if imposed, would kill the stock market. A Supreme Court ruling in an anti corruption case later this month could lead to the dissolution of the ruling Democratic Party and reignite the unrest. Maybe the game here is to sell the peace and buy the riots?

Let me Know When You're Going to Riot Again

The ?Friday-Monday Effect? Exposed

Dennis Gartman of the ever interesting The Gartman Letter published an interesting study of the well known ?Monday-Friday? effect. The analysis was done by Andrew Greely of Acorn Derivatives in White Plains, NY. If you bought every Friday close this year and sold the Monday close, your return so far would be 14.20%, versus a 0.42% return on the S&P 500. Virtually all the gains would accrue at the Monday morning gap opening.

If you did the reverse, bought the Monday close and sold the Friday close, then your YTD loss would be 11.00%. Apparently, the market is paying a huge premium for traders willing to run the weekend risk, which during the financial crisis, is when all the disasters occurred. I know of several desks that have been working this trade all year long, with much success. On paper you could have made 25.20% on a non leveraged basis, and less once you take execution and other frictional costs out.

The longer this works, the more who will pile into it, until it blows up, as all of these purely quantitative approaches always do. This is symptomatic of a market dominated by short terms traders, arbs, and hedge fund where the end investor has fled. Expect things to get worse before they get better. By the way, don?t try Googling the word ?exposed?. You?d be shocked, shocked.

To see the data, charts, and graphs that support this research piece, as well as more iconoclastic and out-of-consensus analysis, please visit me at www.madhedgefundtrader.com . There, you will find the conventional wisdom mercilessly flailed and tortured daily, and my last two years of research reports available for free. You can also listen to me on Hedge Fund Radio by clicking on ?This Week on Hedge Fund Radio? in the upper right corner of my home page.

(SPECIAL FIXED INCOME ISSUE)

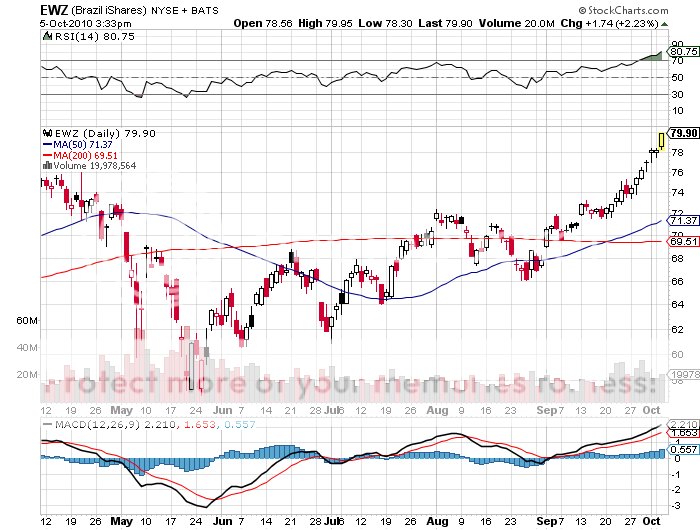

Featured Trades: (BRAZILIAN BONDS), (EWZ)

2) The Seductive Allure of Brazilian Bonds. OK, let's say that if you don't own bonds, but someone is holding a gun to your head, dangling you by your ankles outside a window on a high floor, or threatening to cut you off their Christmas card list, if you don't buy some. Or worse, you offended you boss's wife at the last office party, and as a result have been put in charge of running the firm's bond fund. What do you do?

There is only one place on the planet I would consider owning bonds right now, and that is in Brazil. Local government one year debt, denominated in the Brazilian currency, the real, is yielding 11.3% . The real is appreciating against the dollar, offering investors a double leveraged effect that will deliver returns above and beyond the coupon. The one year maturity eliminates your duration risk. Inflation is under control at 4.7%. With GDP forecast to grow at 7% a year, the country has a long and merry series of credit upgrades to look forward to.

Capital is pouring in to take advantage of these lofty, double digit yields, with foreign investors snapping up over $5 billion of the $900 billion market this year. These bonds have become especially popular with investors in low yield countries, like Japan, where ten year bonds pay a parsimonious 0.90% a year (that's no typo), and increasingly in the US.

Why are yields so high?? Brazil is still laboring under the weight of its own history, when many of these issuing entities defaulted during troubled times in the seventies and eighties. It turns out that Latin American generals aren't very good at running countries or economies. There is also some concern that growth will become so white hot, that the government would be forced to raise rates to cool inflation, burning bond investors.

If you are a major hedge fund with a 24-hour trading desk in Rio de Janeiro, you will have no trouble picking up a position here, if you haven't already done so. If not, you may have a problem finding paper, as these securities are not to be found in your standard online trading account. If anyone knows better, please let me know.

The only easy way in is through an international bond fund, like the (PCY), which I have been recommending for over a year, with stellar results (click here for the call). The problem here is that Brazil never accounts for more than 10% of these funds, and your gains are diluted by other positions you would rather not have, such as in Greece and Portugal. You could also learn the salsa, become fluent in Portuguese, and pick up a Brazilian girlfriend to get access to the local market. That strategy might offer other advantages as well.

Check Out Those Double Digit Yields in Brazil

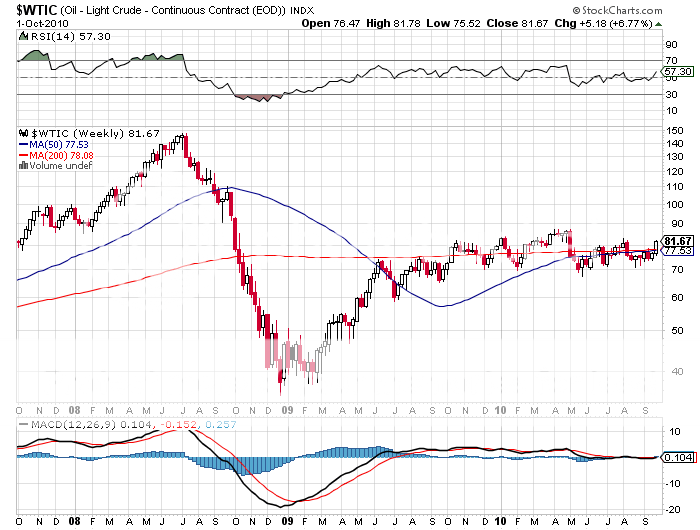

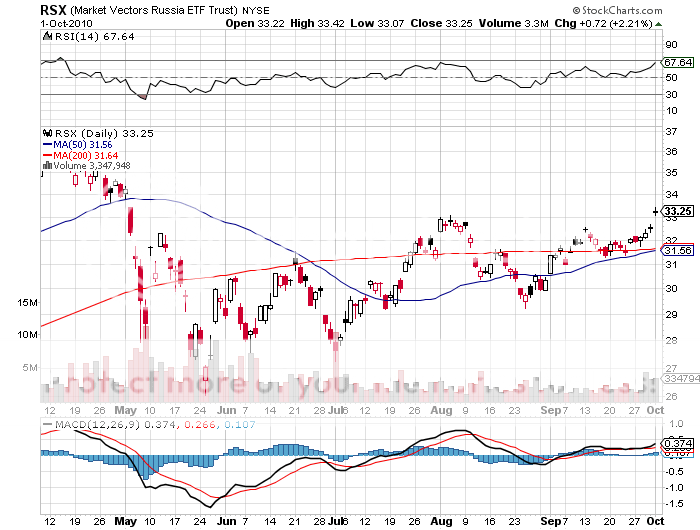

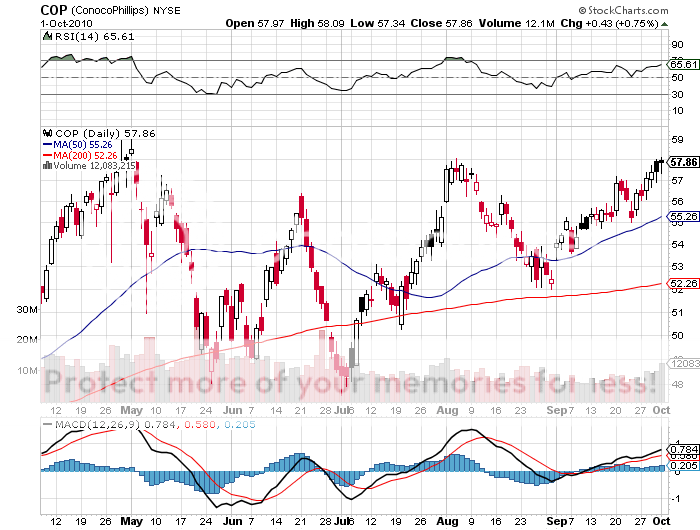

Featured Trades: (OIL), (XOM), (CVX), (OXY), (COP), (RSX)

1) Contemplations on Oil.? After a tumultuous 2009, oil has been one of the least volatile assets of 2010, confined to a tortuous $68-$88 range, frustrating momentum players to no end. How many city morgues are packed with the bodies of those who sold every dip and bought every rally, vainly hoping for a break out? By Friday, crude was down 3% on the year, virtually, the only hard asset showing a negative number this year.

Oil traded like it was on Ambien because it spent most of the year discounting a double dip recession. Bloated inventories encouraged hedge funds to build up substantial short positions. Some traders were targeting prices as low as $40.

After last week's sudden burst, it now appears that this crucial commodity is stretching its muscles, limbering up, and getting ready for a serious move. The short position started to go badly wrong in early September. Forecast hurricanes failed to show. Wells in Nigeria, America's third largest foreign supplier, started to explode again. Word has slowly been seeping out that the net effect of the BP oil spill, and the industry curbs that followed, will be a cut of one million barrels a day of Gulf production fairly soon. That is about 5% of the country's total consumption.

Then, Ben Bernanke threatened to launch a hoard of helicopters dumping money on the economy reminiscent of a scene from the classic Vietnam War flick Apocalypse Now, smothering any prospective double dips in the crib. All it took was a surprise plunge in inventories last week, and the short covering was off to the races.

A serious run on the dollar has added fuel to the fire. After running up virtually every hard asset to unimaginable heights in such a short time, investors desperate for returns in a zero return world are now rotating into Texas tea as a laggard. Until Ben Bernanke figures out how to make a barrel of oil with a printing press, money should pour into oil, as it has already into precious metals, industrial commodities, rare earths, and food.

I have always viewed any weakness in oil as temporary, and urged readers to accumulate positions on the cheap on many occasions. This extends to longs in the Russian ETF (RSX), the world largest oil producer and a major exporter (click here for 'Buy Russia When Oil is Cheap').

I must confess that I am an out-of-the-closet, card carrying 'peak oiler', and believe that it is just a matter of time before we punch through the 2008 $150/barrel all time high (click here for 'The Price of Oil is Going Up').

Avoid the ETF here (USO) because the tracking error is so huge. You would be better off buying my picks in the industry on any dips, including Chevron (CVX), ExxonMobile (XOM) (click here for 'Pick up Big Oil While it is Still Cheap'), Occidential Petroleum (OXY) (click here for 'Looking for Value at Occidental Petroleum'), and ConocoPhillips (COP) (click here for ConocoPhillips Looks Like a Steal'.

Pass the Wrench Please, Will You?

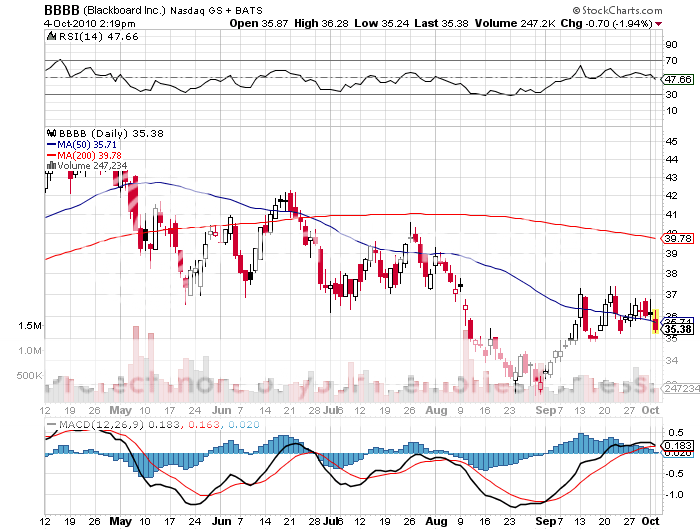

Featured Trades: (ONLINE EDUCATION), (BBBB)

2) Say Goodbye to Your Favorite Teacher. Don't bother taking an apple to school to give your favorite teacher, unless you want to leave it in front of a machine. The school teacher is about to join the sorry ranks of the service station attendant, the elevator operator, and the telephone operators whose professions have been rendered useless by technology. The next big social trend in this country will be to replace teachers with computers. It is being forced by the financial crisis afflicting states and municipalities, which are facing red ink as far as the eye can see. From a fiscal point of view, of the 50 US states, we really have 30 Portugals, 10 Italys, 10 Irelands, 5 Greeces, and 5 Spains.

The painful cost cutting, layoffs, and downsizing that has swept the corporate area for the past 30 years is now being jammed down the throat of the public sector, the last refuge of slothful management and indifferent employees. Some 60% of high school students are already exposed to online educational programs, which enable teachers to handle far larger class sizes than the 40 students now common in California. It makes it far easier to impose pay for productivity incentives on teachers, like linking teacher pay to student test scores, as a performance review is only a few mouse clicks away. These programs also qualify for government funding programs, like 'Race to the Top.'? Costly textbooks can be dispensed with.

Blackboard (BBBB) is active in the area, selling its wares to beleaguered school districts as student/teacher productivity software. The company has recently been rumored as a takeover target of big technology and publishing companies eager to get into the space.

The alternative is to bump classroom sizes up to 80, or close down schools altogether. State deficits are so enormous that I can see public schools shutting down, privatizing their sports programs, and sending everyone home with a laptop. The cost savings would be enormous. No more pep rallies, prom nights, or hanging around your girlfriend's locker. Of course, our kids may turn out a little different, but they appear to be at the bottom of our current list of priorities.

The Old School Marm Will Be Sorely Missed

Featured Trades: (CORN), (WHEAT)

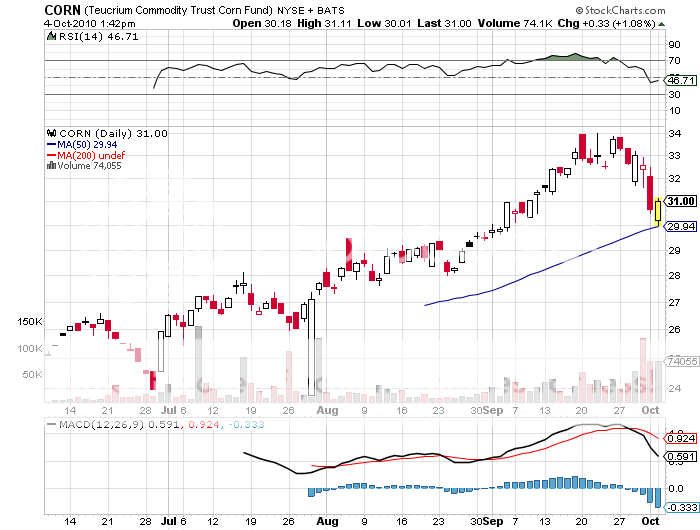

3) Welcome to the Limit Down Move. Those who are new to trading the agricultural commodity area, the dilettantes, the neophytes, and the wanabees, who have watched in awe as prices trended skyward for the past four months, may not be familiar with how they behave on the downside.

They got a harsh lesson in reality last week, when corn (CORN) posted a limit down move, the first since January. In my last piece on the ag space, I warned that prices were getting superheated, and that we were only one rainstorm away anywhere in the world from a limit down move (click here for 'Wheat Melt Up Warning'). I therefore advised traders to switch from corn to hard red winter wheat, which had already spent a few months consolidating. That is exactly what we got in Russia a few days later, as one piddling little rain storm provided some respite to the hellish conditions there.

The move proved astute, as corn has recently dropped by 12%, while hard red wheat backtracked only 6%. I often remind readers that this is the market where prices take the stairs up, but the elevator down, and sometimes the window. You only need to work in the industry for 15 minutes before you meet a hapless trader who lost everything he had on one trade, because he didn't exercise such caution.

I still believe that this is just the down payment on a major long term bull market for food (click here for my 'Special Food Issue'). However, you always, always keep stop losses in place to protect yourself from the volatility.

You're Only a Rain Storm Away From a Limit Down Move