Featured Trades: (GLD), (SLV), (PPLT), (CU)

SPDR Gold Shares Trust ETF

iShares Silver Trust ETF

ETFS Physical Platinum Trust ETF

First Trust Global ISE Copper Trust ETF

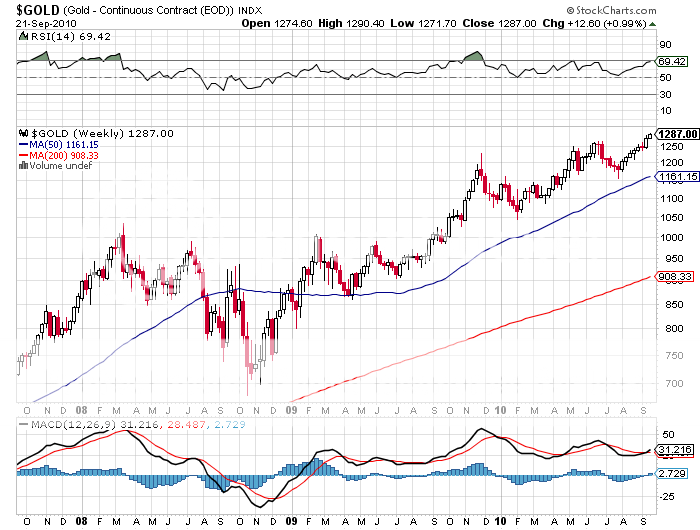

1) Peak Gold Is Upon Us. If you had any doubt about what the driver has been for gold's meteoric rise to $1,300, take a look at the chart below showing the spike right at the Fed's announcement that QEII was in the cards. With the speed of a mainframe running the latest algorithm, this bid spread to the other precious metals and commodities as well.

Last week, gold ETF's purchased a staggering 16 tonnes of the yellow metal worth $582 million. The 800 pound gorilla, the (GLD) now owns $38.5 billion of the barbarous relic, making it the sixth largest owner in the world, ahead of Switzerland and China.

These are heady inflows into such a small space. All of the gold mined in human history, from King Solomon's mines to the bars still in Swiss bank vaults bearing Nazi eagles (I've seen them) would only fill 2.5 Olympic sized swimming pools. That amounts to 5.3 billion ounces, about $6.3 trillion at today's prices. For you trivia freaks out there, that is a cube with 65.5 feet on an edge.

Peak gold may well be upon us. Production has been falling for a decade, although it popped up to 83 million ounces last year worth $108 billion. That would rank gold 17th as a Fortune 500 company, along with Wells Fargo Bank (WFC), IBM (IBM), and drug store CVS Caremark (CVS). It is also only 2.8% of global public debt markets worth $39 trillion (click here for The Economist magazine's global public debt clock).

That is not much when you have the entire world bidding for it, governments and individuals alike. Talk about getting a camel through the eye of a needle! We may well see the bull market end only when those two asset classes, government bonds and gold, see outstanding values reach parity, implying a sixfold increase in gold prices from here to $7,800 an ounce.

No wonder buying is spilling out into the other precious metals, silver (SLV), platinum (PPLT), and palladium (PALL), as well as copper (CU) and other hard assets. As much as I love the gold inlays in my teeth, and sometimes leave waitresses quarter ounce gold eagles as tips at restaurants, this is the reason I have been stampeding readers into the yellow metal for the past 18 months.

This is not a riskless trade here. Obviously, there is a lot more downside potential at $1,300 than there was at $800, or $34. So if you get involved at this late date, better to play with near money calls spreads.

World Annual Gold Production 1970-2009

Can Your Fit Through the Eye of a Needle?

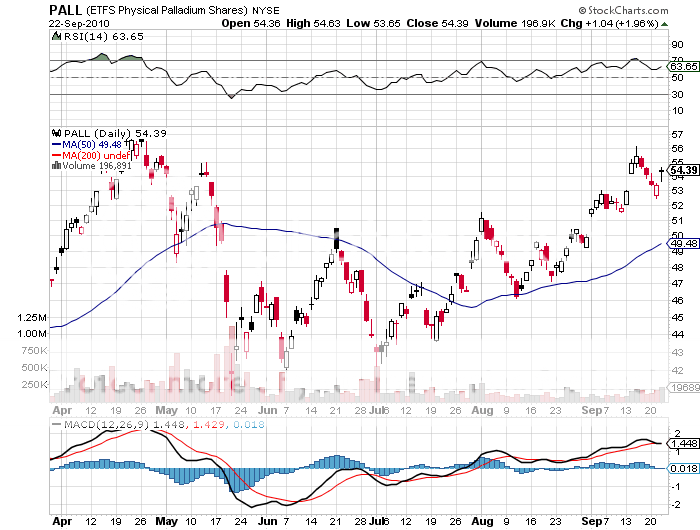

Featured Trades: (PALLADIUM), (PALL)

ETFS Physical Palladium Trust ETF

2) Palladium Explodes to the Upside. If you are thrilled about the recent performance of gold, you have to be absolutely ecstatic about the ballistic rise of palladium, which has soared by 33% in the past two months. Double dippers beware! Moves like this by industrial commodities do not occur in the face of a collapsing economy.

Palladium, named after Pallas, the Greek goddess of wisdom, has been mined in South America for over 1,000 years, was discovered as an element in 1804, and saw jewelry use start in 1939. But in 1975 it really came into its own when a nascent environmental movement got legislation passed requiring catalytic converters on all new American cars.

Toyota's USA's president, Jim Lentz, believes that the US car market will recover from the present 12 million annual units to 15 million by 2015. You can forget the drug induced haze of 20 million annual units free money brought us, returning in our lifetime. Fewer than one million of these will be hybrids or electrics. That means industry demand for catalytic converters is ramping up by 3 million units a year.

Which catalyst will the auto makers choose? Palladium at $539 an ounce or platinum at $1,642 an ounce? Hmmmm, let me think. They do have new management now, so maybe they'll figure it out. Some 80% of the world's palladium production comes from Russia and South Africa, dubious sources on the best of days. That means that a long position in this white metal gives you a free call on political instability in these two less than perfectly run countries.

Also known as the 'poor man's platinum,' demand for palladium for jewelry in China has been soaring with the growth of the middle class. On top of this, you can add $387 million of new demand from the palladium ETF (PALL) launched in January, which will soak up a hefty 10% of the world's production.

Those set up to trade the futures can play the Decembers contract, where a margin of $3,713 gets you a 100 ounce exposure worth $53,900. If you are looking for something to stash in your gun safe, bury in the backyard, or give to the grandkids on their college graduation, get physical. You can buy 100 ounce bars at $50 over spot, or Royal Canadian Mint one ounce .9995% fine palladium Maple Leaf coins at $50 over spot. And yes, you can even buy them on Amazon by clicking here.

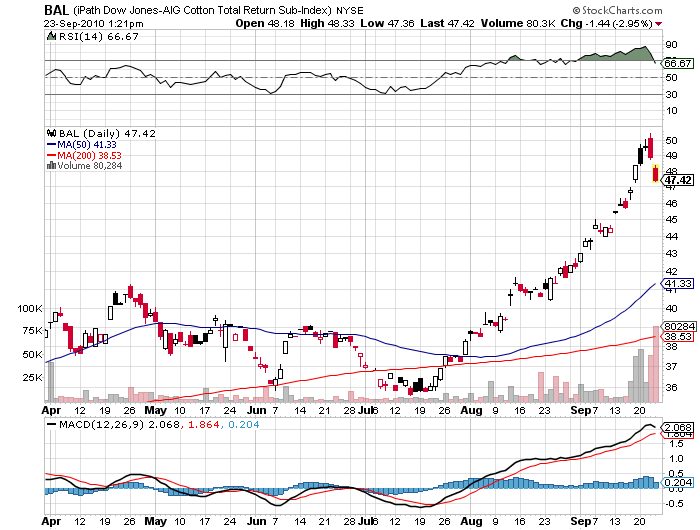

Featured Trades: (COTTON), (BAL)

iPath Dow Jones-AIG Cotton Total Return Subindex ETN

3) My Big Miss in Cotton. Those lowriders you have been buying your girlfriend every Christmas are about to get a lot more expensive.? Since the Great Ag Boom of 2010 started in May, the white staple has rocketed 38% to over $1/pound, a 15 year high, and only the second time since the Civil War that it has broken the buck. The cotton ETN (BAL), is up an eye popping 60%.

Rapidly rising standards of living have encouraged demand for cotton to explode in China and India. Heavy rains in China, the world's largest producer, have caused much of this year's crop to rot, and local traders have been paying as much as $1.45/pound. Imports of cotton into the Middle Kingdom have doubled this year.

Much of the crop in Pakistan was destroyed by their recent floods, and India has imposed an export ban. Mills in the US and Europe are now hoarding bales to head off further shortages and price increases. In recent months, the futures exchanges have increased margin requirements to keep hedge funds at bay, which are believed to have doubled long positions in recent months. This has put the squeeze on producers and middlemen alike.

As much as I try, I can't catch each move in every commodity in the world all the time. Instead, I'll take the lessons home that the world economy may be stronger than we realize, and that long predicted inflation is approaching, just not from the direction that we expect.

Featured Trades: (QUANTITATIVE EASING II), (BEN BERNANKE), (TBT)

SPDR Gold Trust Shares ETF

iShares Silver Trust ETF

Market Vectors Coal ETF

1) Bring on the Conspiracy Theories! There is a wonderful conspiracy theory propagated by Tea Partiers that has been making the rounds in the financial markets for the past several months. In a desperate attempt to salvage the November election, president Obama has ordered Fed governor Ben Bernanke to flood the system with $2 trillion of liquidity. This is the QEII you have been hearing so much about. The move will give the economy a much needed shot in the arm that will enable the Democrats to retain control of both houses of Congress. Two more years of Obamanomics will then follow.

The only problem with this theory is that it is complete hogwash. For a start, Ben Bernanke is a Republican originally appointed by President Bush. Then there is Fed independence to consider. The board of governors is well stocked with enough conservatives, like Richard Fisher (click here for my chat with him), to make such a politically inspired maneuver impossible. If the Fed weren't set up this way, it would become a political football kicked back and forth with every election. Congress would order the stimulus machine to be stuck permanently in the 'ON' position.

You also have to ask the question of whether QEII will make any difference at all to the economy. With banks desperately seeking to deleverage and unwilling to lend, the level of interest rates today is truly irrelevant. The 35 million homeowners with negative equity, about 25% of the total, certainly aren't going to be refinancing anytime soon. Much of the drag on the economy springs from the sorry state of the real estate market (click here for 'Years of Pain to Come In Residential Real Estate'), so there is little the Fed can do, unless it starts buying millions of houses and burning them down.

Personally, I think the American central bank is out of bullets, and that any such gestures would amount to pushing on a string. Believe me, I have been watching the Japanese do this for 20 years, to no effect. There is one thing the Fed does understand, and that is that any QEII implemented now would be highly inflationary down the road. This fits nicely with my (TBT) recommendations.

But hey, as I learned in my journalism days, never let the truth get in the way of a good story. My late editor at The Economist, the brilliant Peter Martin, taught me that belief will trump fact every time. Facts change, opinions don't. That totally works for me, because this theory on the true motivations of the Fed is driving cash into hard assets at an unprecedented rate, commodities and companies that I have been pounding the table about for the past 18 months. I made that call because it dovetailed nicely with global macroeconomic trends which I see continuing for another decade. Most people get invited to dinners. I get invited to mines.

If the market wants to run the prices of my assets up for the wrong reasons, I say bring it on! The dollars I am making as a result are just as good at the bar.

This is What a Chart Should Look Like

Great News for Hard Assets

Featured Trades: (COFFEE), (JO), (COCOA), (SBUX)

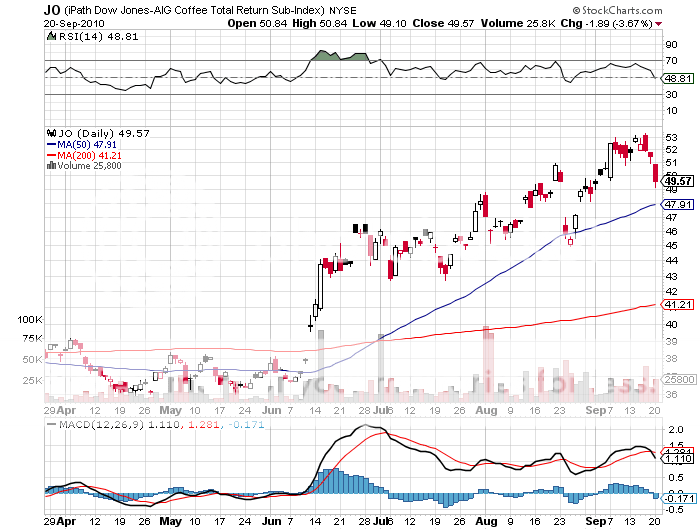

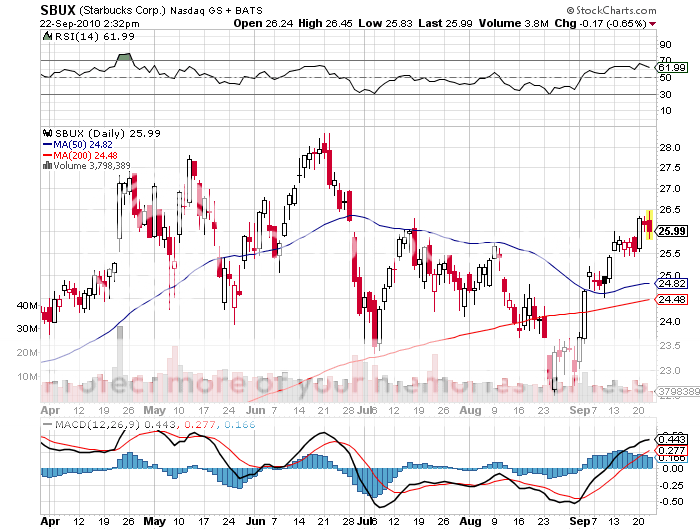

2) The Markets Develop a Caffeine Habit. Since my last piece on coffee two months ago (click here), the ETF for aromatic commodity (JO) has tacked on 23%, and 42% since I put out my watershed call (click here for 'Going Back Into the Ags').

But this may just be the down payment. Weather in primary producer, Latin America, has been poor. US coffee stockpiles are now at 10 year lows. Major producer Vietnam is threatening to cease exports and start hoarding, as Russia has already done with wheat. Although prices are now at 13 year highs, we may get even more of a jolt out of this trade.

Has anyone thought about shorting Starbucks (SBUX) on this news? They can't keep passing prices on to consumers forever in this deflationary world.? What is the one agricultural commodity that has gone down this summer? Ironically, it is cocoa, where a single hedge fund attempted to corner and create a short squeeze, unsuccessfully, it would appear (click here for 'Hedge Fund Corners the Cocoa Market' ).? Better start stocking up on those 50 pound bags of coffee beans at Costco.

Stockpiling for That Caffeine Habit

Featured Trades: (COPPER), (FCX), (GLD), (KOL), (BHP), (ECH)

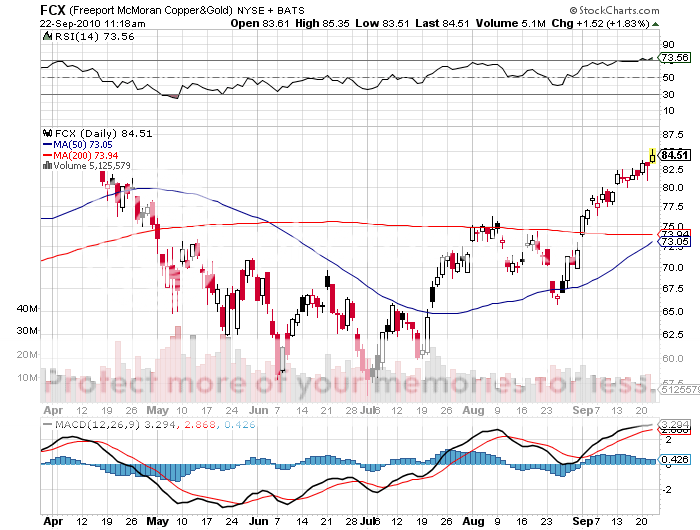

3) Upgrading Copper. They say that imitation is the sincerest form of flattery, so I felt like puffing out my chest yesterday when Goldman Sachs (GS) announced an upgrade of Freeport McMoran (FCX), posting a six month target of $96/share. (FCX) is one of the world's largest copper producers, and has a nice little gold business on the side, as the two are often found together. The Vampire Squid said that demand from China was unrelenting, would continue into the foreseeable future, and that it was not all about stockpiling.

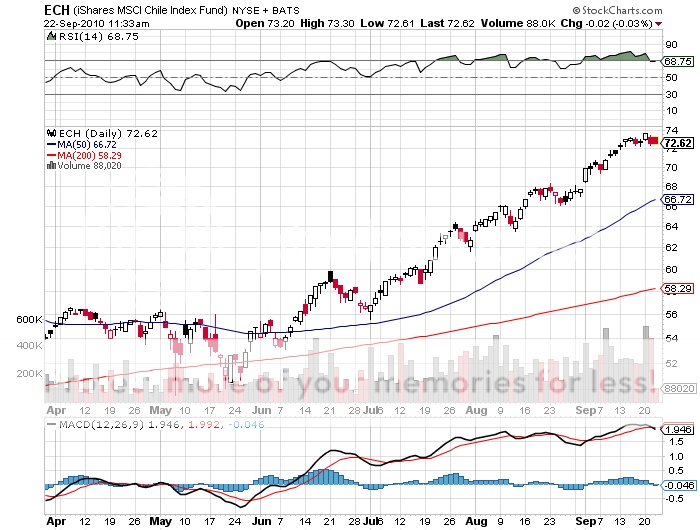

I always welcome more investors joining the bandwagon after I have established a position much lower down. Their report adds confirmation to my recent piece on the red metal (click here for 'Is Copper the New Red Gold'). It also bodes well for my call on Chile (ECH) (click here for 'Chile is Looking Hot'). Long time readers know that I have been bullish on copper all year, listing it in my 2010 Annual Asset Review as one of the commodities that will outperform for the next decade (click here for that report).

Like all other hard assets, copper is a direct beneficiary of the QE II rumors now sweeping the financial markets (see above). In the old days, such a move by the Fed ritually delivered strong bond prices and a weak dollar. In the 'new normal' it also triggers a tidal wave of buying things that hurt if you drop them on your foot, like precious metals (GLD), (SLV) industrial metals, coal (KOL), and iron ore (BHP).

These are the 'new dollars' with the unique attributes that they can't be made with a printing press, aren't being made anymore, and the number of potential consumers is growing by 175,000 a day. If you don't believe me, then check out the World Population Clock by clicking here.

Gotta Love Those Hard Assets

Featured Trades: (EMERGING MARKET CURRECIES), (FXC), (FXA)

Currency Shares Canadian Dollar Trust ETF

Currency Shares Australian Dollar Trust ETF

4) Emerging Market Currencies Are on Fire. If you think that emerging stock markets have been hot this year, take a look at their currencies, which are all blasting through to new all time highs. The Malaysian ringgit is up 11.1% against the buck this year, the Thai baht has appreciated by 8.9%, and the Singapore dollar has jumped by 6.8%.

The central banks of these countries have tried to stem the inflows to maintain export competitiveness, as Japan has done, to no avail. The ocean of money pouring in from the big hedge funds has just been too great. Friends who are using 5X leverage modest for the foreign exchange market are reporting windfall returns.

For me, this move was a no brainer to see coming, as internationally strong economies are the basis, not only for bull markets in equities, but virile currencies as well (click here for 'Time to Play the Minor Asian Currencies'). Unfortunately, there are no dedicated currency ETF's for these relatively illiquid currencies, as there thankfully are for the Canadian (FXC) and Australian (FXA) dollars. At least not yet, anyway.

The great thing for the investors in these countries, like Singapore (EWS) (click here for 'Singapore Sizzles' ), and Thailand (TF) (click here for that call) is that this creates a double leveraged effect on profits. Rising foreign shares are worth even more when their currencies are increasing in value too.

Even the Chinese Yuan (renminbi) has been strong, with the People's Bank of China kicking and screaming all the way. Concerns about a generalized dollar collapse have driven the ETF (CYB) up 2% this month. Like everything else in the emerging world, these currencies are overbought for the short term, but should continue to power on for another decade.

Hey Baby, Can You Spare a Baht?

Featured Trades: (MY Q3 PERFORMANCE),

(CORN), (DBB), (SSG),

(GLD), (SLV), (PPLT), (PALL),

(ECH), (TF), (IDX), (TUR), (EPOL), (EWY), (EWS),

(FXJ), (TBT)

1) My Q3 Performance. Today is the autumnal equinox, the day when the sun crosses the equator and heads southward to the Tropic of Capricorn at the 20th parallel. The moon is full, and night becomes longer than day. This is when pagan civilizations sacrificed virgins to assure the return of the sun in the spring.

As my days get longer and the sun sets earlier I find myself completing my daily hike down Mount Diablo late, my contemplations about the market interrupted by packs of howling coyotes, hoping I don't step on a Western rattlesnake in the darkness, yet again. Sometimes I have to skip adding the 30 pound log or rock I use to keep my shoulders and quads in shape. After all, the next forced march in Iraq or Afghanistan is only a phone call away. Until then, the High Sierras will have to suffice as a motivator.

I was expecting a boring summer and got a sizzler instead. Corn (CORN), wheat (DBB), soybeans, sugar (SSG), gold (GLD), silver (SLV), platinum (PPLT), and palladium (PALL), the subjects of years of painstaking research, all paid off big time by going ballistic. Emerging markets in Chile (ECH), Thailand (TF), Indonesia (IDX), Turkey (TUR), Poland (EPOL), Singapore (EWS), and South Korea (EWY) also made generous contributions. I wanted to short the yen (FXJ) and Treasury bonds (TBT), but took a nap instead, sparing myself much grief.

This equinox marked the passing of long time friends, like CNN correspondent John Lewis (click here for the obit) and Murray Sayle (click here for his piece).

It also heralds the onset of the most treacherous time of year for stock investors. There should be some substantial selling to beat imagined increases in capital gains tax rates from 15% to 20%, once the November election is out of the way. There will also be sacrifices of a different sort, as unfortunate managers playing catch up desperately reach for performance. That may be what's powering the current low volume rally in stocks.

I have heard of too many advisors who panicked and sold their clients out, close to the 2009 bottom, chased the market back in front of the 2010 Q2 top, taking yet another hickey. Thus, I expect the bloodletting to be fierce and unforgiving when they are fired in December, such is the cruel and heartless nature of our business.

Looking for Fresh Meat

Featured Trades: (COAL), (BTU), (MEE), (JOYG), (BNR)

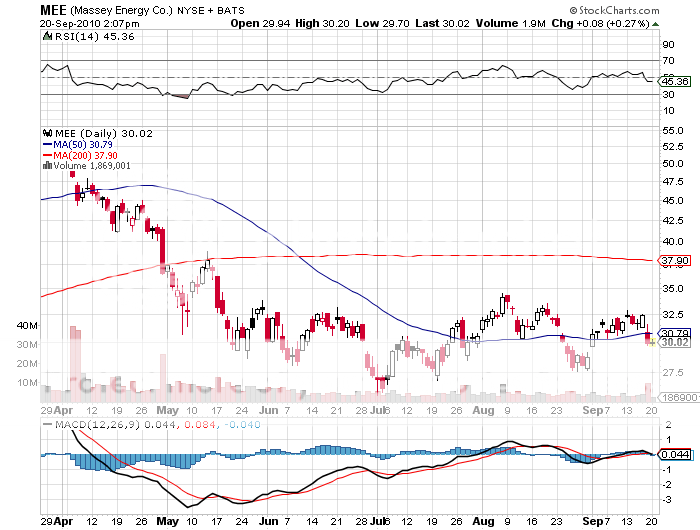

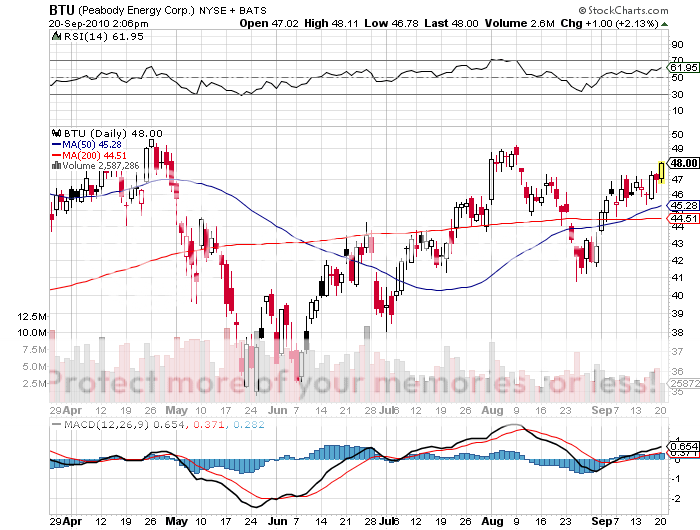

1) Is Coal the New Black Gold? After the halting and starting three week rally we have seen in stocks, I would be negligent to recommend equity plays here. But there is one sector you should add to your 'buy on meltdowns' list and that is King Coal.

Demand from emerging markets, especially metallurgical coal needed to make steel, is absolutely exploding. Industry experts say a major super cycle of buying from China, South Korea, Japan, and Taiwan that is creating a long term structural shortage for the black stuff. One of the reasons Warren Buffet's Berkshire Hathaway acquired the Burlington Northern Railway (BNR), was that it obtains 75% of its earnings from transporting coal to west coast ports for shipment to Asia.

The US currently derives 50% of its power generation from burning coal, and that dependence isn't changing any time soon. The only potential drag is the subterranean price of natural gas, to which many coal burning utilities may switch, if prices fall further. Not only do power companies have the environmental incentive to switch to relatively clean burning CH4, it is also cheaper on a dollar per BTU basis. However, this only affects the domestic demand for coal, not the foreign markets.

If the Republicans win the November elections, a regulatory back off will deliver a sudden boost to profitability, and you can count on perceptions to front run that. The new cost of recent regulations brought in by the Obama administration has already been priced in to these stocks. Some of the premier names to look at here include Peabody Energy (BTU), Massey Energy (MEE), and Joy Global (JOYG).

Is It Time to Look Into Coal?

Featured Trades: (JUNK BONDS), (JNK), (HYG), (PHB)

SPDR Lehman High Yield Bond Fund ETF

iShares iBoxx High Yield Corporate Bond Fund ETF

PowerShares High Yield Bond Fund Portfolio ETF

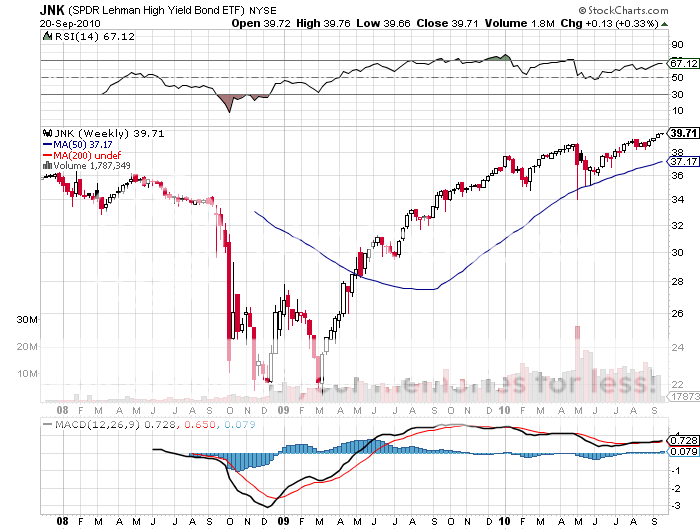

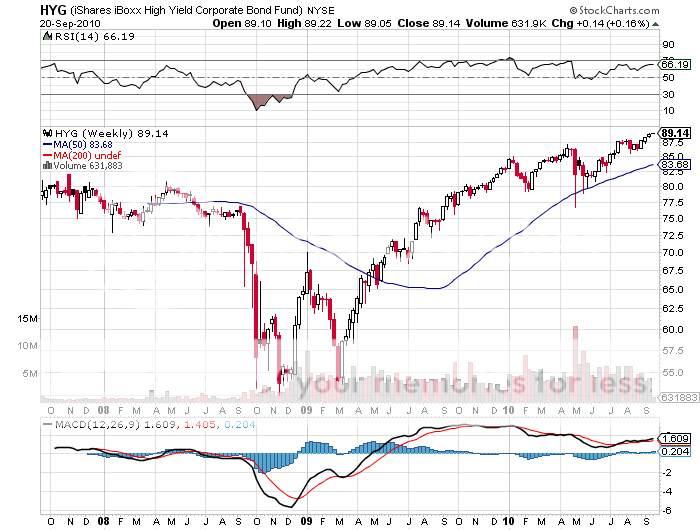

2) Are Junk Bond Investors Paying Rolls Royce Prices for Jalopy Securities? One of my more prescient calls of the past two years has been to move readers into the junk bond arena (click here for my '2009 Annual Asset Class Review'). My argument then was that the market was discounting a default rate of 14%, but that the realized default rate would be a tiny fraction of that.

This turned out to be true, prompting the (JNK) ETF to deliver a parabolic 80% return, not bad for a bond fund. Similar gains were seen in the other junk ETF's, like (HYG), and (PHB). However, it looks like this market is returning to the bad old days that we saw at the last top of this market in 2007. Inferior credits are now flooding the market with dubious conditions, lax covenants, but premium terms, taking new issuance up to an unbelievable $172 billion during the first nine months of 2010. Banks may not be willing to lend, but investors of every stripe are more than happy to. Investors are once again paying Rolls Royce terms for jalopy credits. Apparently the reach for yield knows no bounds.

If you haven't started to sell off your position in this area, I would begin to do so. What seemed like a riskless yield with (JNK) at 18% last year doesn't seem like such a bargain now at 10.8%. Use the current strength in the equity market to take profits at these very rich prices. When credit quality once again becomes an issue, these will be the first securities to drive into the ditch.

Rolls Royce Prices for Jalopy Securities