Featured Trades: (SOYB), (CORN), (WEAT)

Teucrium Agricultural Trust Corn Fund

Teucrium Agricultural Trust Soybean Fund

Teucrium Agricultural Trust Wheat Fund

2) The Grains Are On Fire. I bet I'm the only guy you know whose wedding was filmed by the KGB. My friend, the TASS correspondent, Yuri, shot the entire assembled foreign press at the event at The Foreign Correspondents Club of Japan in the seventies, undoubtedly for their files in Moscow. No wonder they lost the cold war.

We've stayed in touch through the years, through the collapse of the Soviet Union and the many wars, revolutions, booms, and busts that followed. He now advises a Russian hedge fund. What else? He called me the other day to tell me I was right on track with my recommendation to buy the grains (click here for 'Going Back Into the Ags' ), because the heat in Russia and the Ukraine this year was unbearable, and their crop was coming in at 20% below expectations. Yields were plummeting, and this would be good news not only for wheat, but corn and soybeans as well.

The country was once known as the bread basket of Europe, which is why it was invaded by Napoleon in 1812 and the Germans in 1942. They still have a sizeable impact on global prices. I have also gotten an assist from my trading partner in Canada, Mother Nature, whose torrential rains have wrecked much of the canola crop this year, helping to drag the prices of the other oil seeds northward.

Since my initial call on June 24, soybeans (SOYB) have risen by 10% to $3.00, while corn (CORN) has popped 13% to $4.10, and wheat (WEAT) has soared by a white hot 27% to $6.15. With profits like these, who needs the stock market, anyway? No doubt cash is pouring into the ags now because of the lack of attractive alternatives in stocks, bonds, currencies, commodities, and real estate. OK, my horse came in to show, but I'll take that over a loser any day. I've noticed over the decades that when one does the hard research and gets the fundamental call right, all of the accidents and surprises tend to happen in your favor. That seems to be happening here. As for my old spy friend, I advised him to fill up a bathtub with cold water and soak in it to deal with the heat. That always worked when I was starving in Tokyo and couldn't afford air conditioning, despite temperatures at 99 degrees with 99% humidity. At least it cooled me off for 15 minutes.

Featured Trades: (BP)

3) Take the Money and Run from BP. If you followed my advice to buy BP at $29 on June 17 (click here for my piece), please sell it. It peaked at $40 yesterday. Take the easy money and run. I've never seen a better opportunity to buy the rumor and sell the news. The long awaited announcement that the April 22 blowout in the Gulf of Mexico was at long last capped has sent the stock on a tear. This limits the pariah firm's liability to $50 billion max, down from estimates that ran as high as several hundred billion dollars only days ago. The final answer won't be in until hell freezes over. Sure, if you end the moratorium on offshore drilling, get it back up to its old multiple, tack on higher oil prices, and take in $20 billion in asset sales or equity capital raises, you might be able to squeeze another $20 out of the trade. But do you really want to hang around and run the market risk? Or the dilution risk? BP now has 43,000 locals working to clean up the spill. Would you want to meet that payroll? Don't be the pig that gets slaughtered. A profit of 38%, some 76% if you used margin, and over 150% if you played the options is better than a poke in the eye with a sharp stick, especially in this miserable environment.

'Many times when you listen to sell side analysts, it's garbage in, garbage out on a lot of the opinions that they have,' said stock commentator Gary Kaminsky.

Featured Trades: (BALTIC DRY INDEX), ($BDI),

(CONTAINER RATES), (US RAIL TRAFFIC)

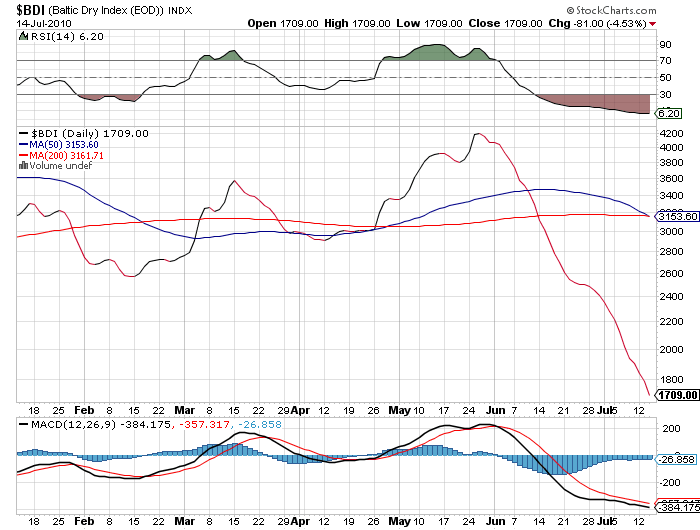

1) The Baltic Dry Index Versus Container Rates: Who to Believe? There is a ferocious debate underway among economists over which leading indicator to believe, the Baltic Dry Index, or international container shipping rates. The BDI, a measure of the cost of chartering bulk carriers for coal, iron ore, wheat, and other dry commodities, has just suffered one of its most dramatic sell offs in history, plunging some 60% since May. The downturn has been accelerated by the recent delivery of a glut of new ships that were ordered during the boom years 3-4 years ago, when getting cheap money was as easy as falling overboard. There is no doubt that this index is shouting loud and clear for a double dip in the world economy. On the other hand, and if you notice, most economists are two handed, the rates for standard 20 foot containers shipped to international destinations has gone absolutely through the roof. The Maersk Line has even gone to the extreme of diverting its fastest ships to return empty containers from the U.S. to China. The big driver here has been intra Asian trade, as well as rising imports by big US customers like Wal-Mart (WMT). This shortage has been exacerbated by the large scale cancellation of orders to build new containers during the 2008-09 crisis, and strikes at key manufacturers in China. The data points to a global economic recovery centered in Asia, and trickling down to the U.S. and Europe. Who to believe??? I'll let American rail traffic cast the tie breaking vote, which you can see in the chart below. After crashing in 2008-09, it performed a 'V' shaped recovery, and has been holding its gain's ever since, although is only at 80% of full capacity. This is my 'gull winged' chart, which you see for the prices of almost all financial assets these days. And the envelope, please! The conclusion is unequivocal. We are in for a slow, bumpy long term recovery that will deliver the long term U.S. growth rate of 2% that I have been predicting all year. Too bad the stock market doesn't know this yet.

Featured Trades: (URANIUM), (CEI:FP), (PDN:AU), (CCJ)

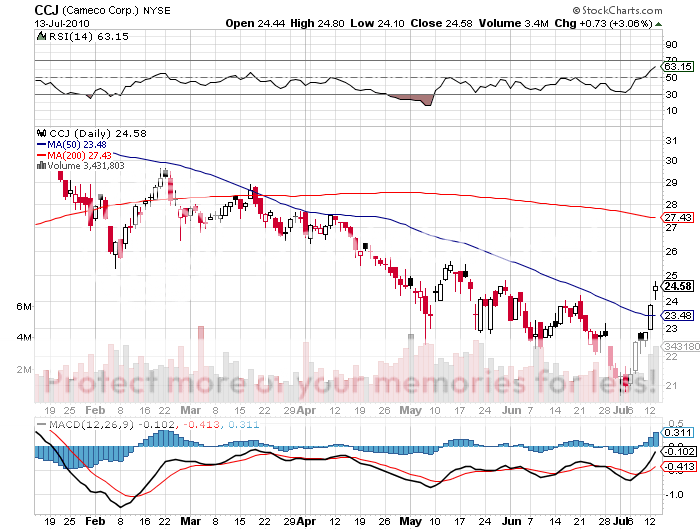

3) Serve Yourself a Piece of Yellow Cake. Uranium traders have been stunned by a sudden Chinese effort to corner the supplies in an effort to fuel the world's most ambitious nuclear program. The once moribund market now suddenly sees buyers everywhere as the Chinese ramp up their purchases to 5,000 tonnes this year, double their current consumption. The emerging nation plans to build ten new plants a year for the next decade, boosting their electricity supply up from 9.5 to a massive 85 gigawatts. That will make China the world's largest nuclear power generator. Uranium peaked at $136 a pound in 2007, and collapsed during the financial crisis to as low as $26. High prices also brought a flood of new mines, with 27 coming on line in the past decade. Last year, the total uranium market amounted to 50,572 tonnes. China will need a third of that in ten years, and India another fifth. Prices have since crawled back up to $31/pound, and some analysts are predicting a double or more in five years. Producers have seen share prices pop in the last few days. I have been a long term bull on uranium and the entire nuclear industry, predicting that it was only a matter of time before the Middle Kingdom's immense appetite for yellow cake overwhelmed supplies (click here for my piece). It may be time to add some new names to your watch list, like Paris listed Areva SA (CEI:FP), Australia's Paladin Energy Ltd. (PDN:AU), and my favorite, Cameco (CCJ). Or you can take a shot at trading the illiquid uranium futures directly on the NYMEX.

How the CIA Views China's Nuclear Program

Featured Trades: (RARE EARTHS), (AVARF.PK), (GWMGF.PK), (RAREF.PK), (LYSCF)

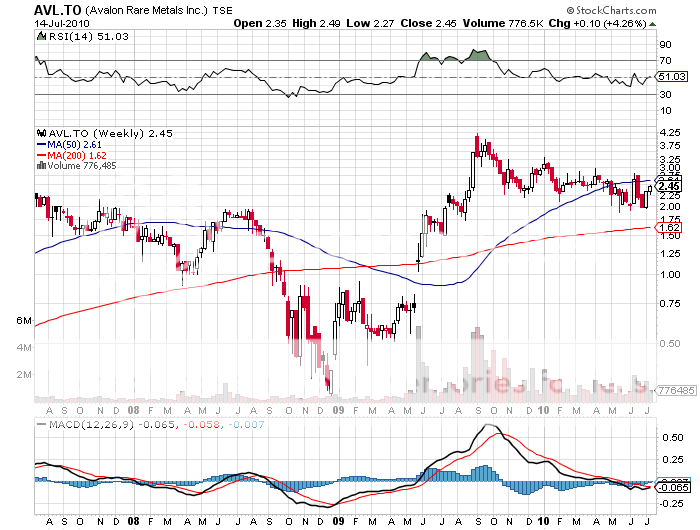

4) China Puts the Squeeze on Rare Earths. China has further tightened the screws on the world's rare earths market by announcing new export quotas that are only half of those seen last year. China's Ministry of Commerce has limited 2010 second half shipments by its 32 licensed producers to 7,976 tonnes, down from nearly 20,000 tones in the first half. Chinese authorities have also announced that they are cracking down on widespread illegal mining of rare earths, which is causing immense environmental damage. Why should you care? It turns out that you can't build a hybrid or electric car, a wind turbine, thin film solar, LED's, high performance batteries, or a cell phone without these elements. One Prius uses 25 kilograms of the stuff. You also can't fight a modern war without rare earths, being essential for radar, missile guidance systems, navigation, and night vision goggles. That's where things get interesting. The Middle Kingdom supplies 97% of the world's rare earths, and no new major western supplies are expected to come on stream for years. I think rare earths, which include esoteric elements like cerium, Ce, lanthanum, La, and neodymium, Nd, could be one of the next great hard asset plays. Please revisit Avalon Rare Metals (AVARF.PK), Great Western Minerals Group (GWMGF.PK), Rare Earth Metals (RAREF.PK), Lynas Corp (LYSCF), and Molycorp, after it goes public. You can learn more about this once obscure corner of the global commodity market by reading my earlier piece by clicking here.

'You have the watches, and we have the time,' said a Taliban prisoner to US forces.

Featured Trades: (ING), (TM), (LEN), (CRB), (AA),

(AGU), (IBM), (XOM), (COP), (BBY)

1) Technical Analyst Charles Nenner Shows Where to Play in a Bear Market. Yesterday, I was commiserating with my buddy, Charles Nenner, of the Charles Nenner Research Center in Amsterdam, about his team's miserable performance in the World Cup, which lost 0-1 in overtime after a dreadfully pedestrian, foul plagued, uninspiring game. No wonder Holland and Spain lost their empires! I didn't want to beat up the suffering Dutchman too much, as my hometown Los Angeles Lakers, had only recently clinched the National Basketball Association championship (whose center, ironically, is from Spain). All glory is fleeting, isn't it?

Charles was so depressed, that he said his team's feckless play reminded him of the Dow's coming plunge to 5,000. What! Come Again!! The alarm bells and distress flares went off in my head. Would he care to expand on that view? Charles thinks that we are ten days into a summer rally that will run out of steam sometime in August. Then we will resume a 3-5 year bear market, with enough 40% rallies along the way to squeeze those without conviction out of their shorts. His best historical parallel was with Japan's Nikkei, which for 20 years has seen gut wrenching sell offs followed by equally violent, and prolonged rallies. Each pop was optimistically heralded as a new bull market, only to end in tears.

So, are we supposed to sit on our hands for the next half decade until we reach the final, agonizing reckoning? Not at all. He gave me a list of ten names that had the long-term technical muscle to outperform on either a relative or an absolute basis, no matter how dire things get in the main market. The list follows below, along with my own fundamental comments:

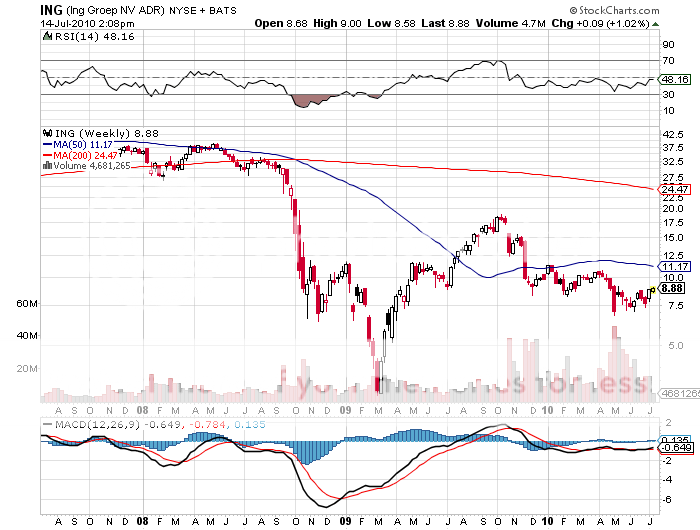

Ing Groep NV ADR (ING) '? Rigorous risk control, low leverage, a healthy balance sheet, and broad diversification will enable this financial giant to weather any storms headed its way. This company has been around, in some form, for centuries, for a reason.

Toyota Motors (TM) '? Will recover from recent quality knocks to reclaim its lead position as the world's largest and best car maker. It will leverage its nearly two decade head start and dominant market share in hybrids to generate record profits, the 'BP' of the auto industry.

Lennar (LEN) '? The residential real estate collapse continues and industry consolidation will accelerate, but this homebuilder will be one of the few survivors. Pick your entry points carefully through buying only on the melt downs.

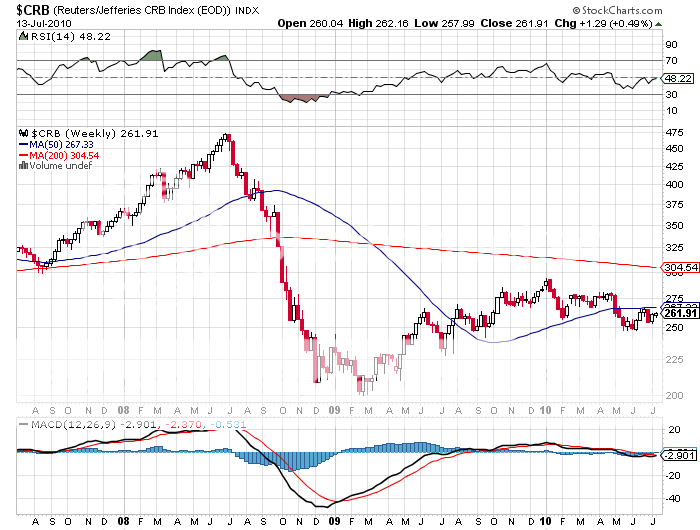

Reuters/Jeffries CRB Index- The 9 month bear market in commodities ends, as investors flee paper assets in favor of the hard stuff.

Alcoa (AA) '? Ditto for AA on the aluminum front.

Agrium (AGU) '? The big rally in most agricultural commodities since June may mean that the long awaited bull market in food is at hand. China returns as a huge importer of fertilizer to address its own production shortfalls.

IBM (IBM) '? One of the best companies, in one of the only US sectors that will prosper globally for decades to come. Their brilliant transmutation from a manufacturer to a service provider insured its prosperity as a world class competitor.

Exxon Mobile (XOM) '? Obama can't bring enough alternative energy supplies online in time to avoid another oil spike, possibly to $200 a barrel. The BP oil spill has suddenly revalued all onshore and foreign crude reserves. A rare chance to buy this gem at a single digit multiple, while BP is dragging down valuations for the entire sector.

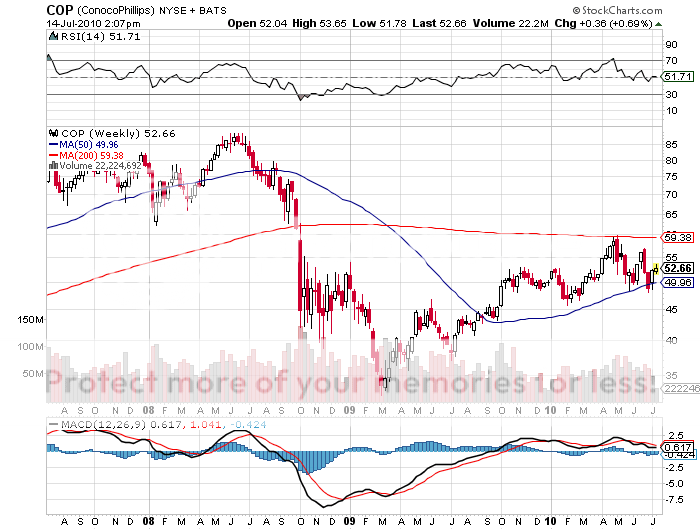

Conoco Phillips (COP)- Ditto above for COP.

Best Buy (BBY)- The ultimate predator retailer, with a great service business in the 'Geek Squad' to carry the whole enchilada.

If this all sounds like it is from another planet and you need to be convinced that Charles is not just making it all up, please visit his website at http://www.charlesnenner.com/ . And how far will the Dow plunge in the next down leg? Charles said he would fire up his computer and get me a number after more data came in. I guess you'll just have to keep reading this letter to find out what it is.

All Glory is Fleeting

Featured Trades: (FXJ), (YCS)

Currency Shares Japanese Yen Trust ETF

ProSharesUltraShort Yen ETF

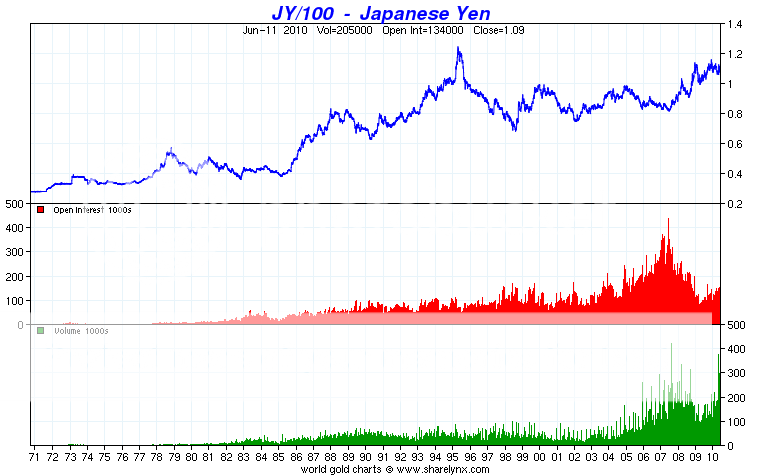

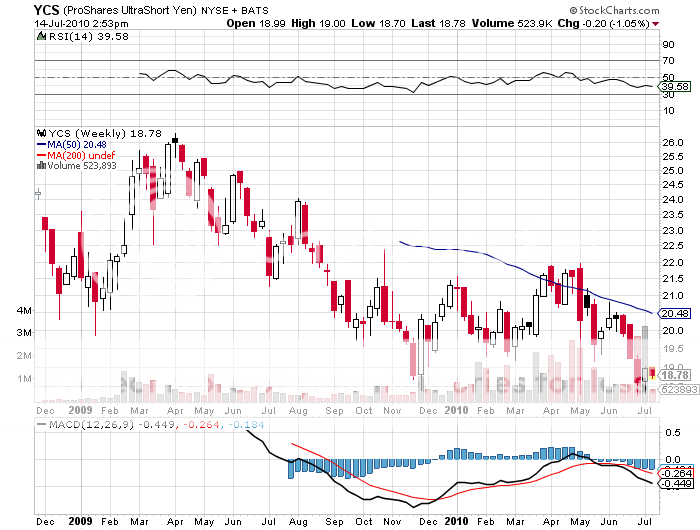

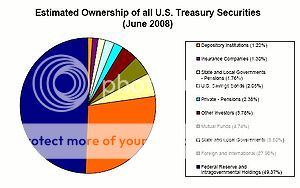

2) Why the World's Worst Economy Has the Strongest Currency. Global currency traders remain puzzled by the continuing strength of the yen (FXY), (YCS), which broke out of a ?90- ?95 range a few weeks ago and insists on levitating around the ?87-?89 area. Looking at the fundamentals, you would not pick Japan to possess one of the world's most virile currencies. It runs one of the planet's largest and most rapidly climbing budget deficits, suffers a demographic nightmare of epic proportions, and lives in the shadow of China, which surpassed it in GDP this year to become number two. It produces a tenth of the Middle Kingdom's new per capita GDP. And the ruling Democratic Party of Japan (DPJ), which promised to weaken the yen, just took an absolute pasting at the polls. The reason is simple: the fundamentals are so poor, that no one owns the yen, and therefore, can't sell it. Central bank holdings of the Japanese currency have been plummeting for years, and are now thought to be around 10% of the total. Japan's 15 year old zero interest rate policy made it unattractive when the others were yielding 5%-6%. Now that all the major currencies yield close to nothing, the playing field is level. While the government has been a massive issuer of debt, thanks to the country's high savings rate some 95% is held domestically, unlike the US, where more than 28% is owned by foreigners. You don't hear rumors of China threatening to dump its JGB holdings, because they own virtually none. Japan's notoriously anemic long term growth rate of a minuscule% hasn't exactly seduced managers to pack their portfolio with yen assets. Risk reducing hedge funds buying yen to unwind carry trades has been another dynamic at work (click here for an explanation). But it doesn't look so bad if you think that the US growth rate is about to double dip into negative numbers. Yen bulls, and yes, there are such people out there, are hoping for a run to the 1996 high of ?85, and even an overshoot to the all time high of ?79.5. If that happens, you can kiss the Nikkei goodbye, and watch 10 year Japanese bond yield touch 0.45% once again. This is one slugfest that I prefer to watch from the sidelines. I think the long term trend of the Japanese currency is down from here, and won't own it here on pain of death.

'America has become a second rate power. It's fiscal and trade deficits are at nightmare proportions. In the days of the free market when our country was a top industrial power, there was accountability to the stockholder. The Carnegies, the Mellons, and the men who built this great empire made sure of it because it was their money at stake,' said Gordon Gecko in the classic 1987 film,Wall Street. Wow! I should hire writer and director, Oliver Stone, as a research analyst.